Facing the possibility of long-term care is one of the toughest conversations a family can have. It’s not just the emotional weight of a loved one needing help; it’s the crushing financial reality that follows. Many Texas families watch a lifetime of hard work and careful saving vanish under the staggering weight of nursing home bills. This experience can be overwhelming, especially when you are also grieving the loss of a loved one’s independence.

The question we hear most often is, “How do we protect our assets?” The answer isn’t about hiding money or finding loopholes. It’s about proactive planning—using the right legal tools and understanding Texas Medicaid rules before a crisis hits. This guide will provide step-by-step guidance in plain English, giving you the clarity and reassurance you need to make informed decisions for your family.

The Reality of Long-Term Care Costs in Texas

Thinking about a loved one entering a nursing home is hard enough. But the financial strain can be just as devastating, threatening to unravel decades of financial planning. For many Texas families, this isn’t a distant worry; it’s a very real fear that a family’s entire net worth could be wiped out in just a few years.

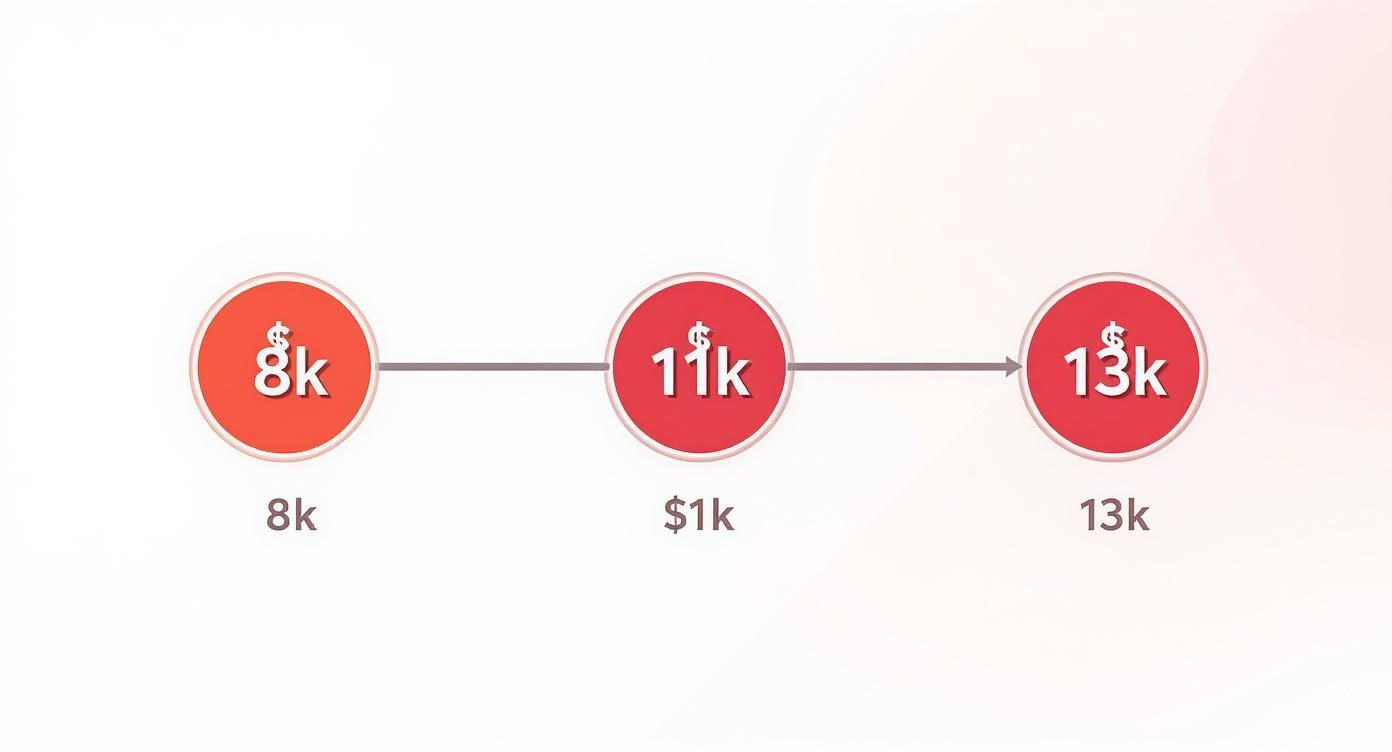

This isn’t an exaggeration. While costs vary across Texas, the trend is clear and alarming. It’s not uncommon to see monthly bills soar past $8,000 to $13,000, pushing the annual expense toward $150,000. This rapid growth has made it nearly impossible for most seniors to cover care without completely draining their life savings.

Without a solid plan, families are often forced to sell off everything—investments, retirement accounts, even the family home—just to get their loved one qualified for Medicaid. You can find more details on these rising costs in this helpful resource on long-term care expenses.

Why Proactive Planning Is Essential

Waiting until a health crisis strikes is the single biggest mistake a family can make. By the time a loved one urgently needs care, your options for protecting their assets have narrowed dramatically.

Proactive estate planning isn’t about cheating the system. It’s about strategically structuring your assets in full compliance with the law to accomplish two critical goals:

- Ensuring Eligibility for Care: Positioning your loved one to qualify for programs like Medicaid that can help cover these enormous costs.

- Preserving a Family Legacy: Protecting the assets you’ve worked a lifetime to build, so they can be passed down to your children and grandchildren as you intended.

This process involves navigating complex legal instruments and timelines, particularly those laid out in the Texas Estates Code. It demands a careful, personalized look at your family’s unique financial situation and what you hope to achieve for the future.

Takeaway

Effective asset protection is not a last-minute fix. It’s a thoughtful process that should begin years before care is needed, using legal tools like Wills & Trusts to safeguard your legacy while securing access to quality long-term care. By taking these steps now, you can gain real peace of mind, knowing your family’s financial future is secure. This guide will walk you through these strategies in plain English, giving you the power to make informed decisions for the people you love most.

Navigating the Texas Medicaid Look-Back Period

When it comes to long-term care planning, the five-year Medicaid look-back period is one of the most critical—and misunderstood—rules out there. This isn’t just a quick glance at your finances. It’s a deep dive. In simple terms, when you apply for Medicaid to cover nursing home costs, the Texas Health and Human Services Commission will scrutinize every single financial transaction you’ve made for the past 60 months.

The whole point of this review is to see if you’ve transferred assets for less than they were worth. That could be anything from giving cash to your kids, selling the family home to a relative at a steep discount, or even just adding someone’s name to your bank account. These are all considered “uncompensated transfers,” and they come with serious consequences.

Understanding the Penalty Period

If the state finds you made these kinds of transfers during the look-back period, it doesn’t just deny your application. Instead, it imposes a penalty period. This is a specific amount of time during which you are flat-out ineligible for Medicaid benefits.

What does that mean for your family? It means you’re stuck paying for the nursing home out of your own pocket until that penalty period is over.

The state calculates the length of the penalty with a simple formula: the total value of the improper transfers divided by the average daily cost of private nursing home care in Texas. This “penalty divisor” number is updated periodically, so the math can change.

Realistic Scenario: The Cost of an Uninformed Gift

Let’s walk through an example. Say a father, Robert, gifted $120,000 to his son about two years before he needed nursing home care. If the daily private pay rate in Texas is around $200, the penalty would be calculated like this:

$120,000 ÷ $200 = 600 days

This means Robert would be ineligible for any Medicaid help for 600 days—that’s nearly two years—starting from the day he otherwise would have been approved. His family would be responsible for paying the nursing home bill out-of-pocket during this entire time, a cost that could exceed $120,000 and deplete their remaining savings.

As you can see, a penalty that delays coverage can easily drain tens of thousands of dollars from a family’s savings.

Why Timing Is Everything

The look-back rule is exactly why you can’t afford to wait. Any strategy you use to protect your assets has to be put in place well before you need care. That five-year window is strict and completely unforgiving.

For a lot of Texas families, this creates a real mess. A well-intentioned gift made years ago can suddenly become a massive financial roadblock. The state enforces this rule on all asset transfers before an application is submitted, and any gifts inside that window can trigger penalties that delay vital care.

This is why legal tools like irrevocable trusts must be established at least five years before nursing home care is on the horizon to be effective.

Takeaway

The Medicaid look-back period doesn’t mean you can never qualify for help; it just delays your eligibility. The secret is to make sure any asset protection plan is in place before that five-year clock even starts ticking. Getting a handle on the look-back period is the first step in any successful asset protection strategy. It shows just how risky informal or DIY planning can be and why professional guidance is so important. Our firm can help you navigate these complex rules, and for a deeper dive, you can check out our guide on how to protect assets from Medicaid.

By making smart, informed decisions now, you can avoid devastating financial penalties down the road and make sure your loved one gets the care they need without bankrupting the family.

Using Trusts To Safeguard Your Family’s Legacy

When Texans talk about protecting their life’s work, trusts often top the list. A revocable living trust is a familiar choice—ideal for steering clear of the public Texas probate process and keeping things private. Yet, despite its benefits, this kind of trust offers zero protection against sky-high nursing home bills.

Because you retain full control—able to change, withdraw, or dissolve the trust at will—Medicaid counts those assets as yours. That means if long-term care is on your horizon, a revocable trust alone won’t shield your nest egg.

The Power Of An Irrevocable Medicaid Asset Protection Trust

Enter the Irrevocable Medicaid Asset Protection Trust (MAPT), the tool designed specifically to lock assets away from Medicaid’s reach. The moment you fund it—with your home, savings, or portfolio—you relinquish legal ownership. In plain English, this means you can no longer take the assets back for yourself.

That may sound daunting, but you don’t disappear from the picture:

- Appoint a trusted person (often an adult child) as trustee to manage the assets.

- Continue to receive any income the trust generates, like dividends, interest, or rent.

- Maintain a lifetime right to live in your home if you place it in the trust.

By handing over control, those assets fall outside Medicaid’s countable resources. Just remember: the five-year look-back starts the day you transfer property into the trust. Timing is critical.

Real-World Scenario: A Texas Family’s Story

Think of David and Sarah, retirees in a Houston suburb. Their home is valued at $400,000, and they’ve accumulated about $250,000 in investments and savings. After seeing neighbors exhaust their life savings—nursing home costs in Texas can be around $85,000 per year—they reached out to an estate planning attorney for guidance.

Here is the step-by-step process they followed:

- They created an Irrevocable Medicaid Asset Protection Trust (MAPT).

- They named their daughter Emily as trustee, trusting her to manage the assets according to the trust’s terms.

- They transferred the deed to their house and $150,000 of their investments into the MAPT.

Fast-forward six years: David needs skilled nursing care. When Sarah applies for Medicaid, those trust assets don’t count because the five-year look-back period has passed. The result? Medicaid covers David’s nursing home expenses, and Sarah keeps their home—and a substantial portion of their savings—safe for their children.

Key Differences Between Trust Types

Understanding what sets revocable and irrevocable trusts apart is essential for any comprehensive estate plan. Both avoid probate, but only one stands up to the challenges of long-term care.

Revocable Trust vs Irrevocable MAP Trust

Here’s a clear side-by-side look at why many Texans combine these two instruments:

| Feature | Revocable Living Trust | Irrevocable Medicaid Asset Protection Trust (MAPT) |

|---|---|---|

| Asset Control | You keep full control—amend or revoke anytime | Control shifts to a trustee once funded |

| Flexibility | Highly flexible, no penalties | Very limited modifications after funding |

| Probate Avoidance | Yes—assets bypass probate court | Yes—assets bypass probate court |

| Medicaid Protection | No—all assets count against eligibility | Yes, after the 5-year look-back |

| Primary Goal | Manage assets during life and avoid probate at death | Preserve assets from long-term care expenses |

For a deeper dive into how these tools fit into a larger strategy, explore why you should set up a trust.

Beyond domestic options, you might also consider the role of a trust company in asset safeguarding to see how professional fiduciary services operate on a global scale.

Takeaway

A revocable trust lets you steer clear of probate and keep your affairs private. An irrevocable Medicaid trust is the only way to shield assets from nursing home spend-down. Combining both—along with other planning tools like those found in our Wills & Trusts services—gives your legacy the protection it deserves.

Protecting the Spouse Who Stays at Home

One of the deepest fears couples face when long-term care becomes a reality is that one spouse’s health crisis will financially devastate the other. The thought of the healthy partner, often called the “community spouse,” being left penniless is a heartbreaking but very real concern.

Thankfully, both federal and Texas Medicaid laws have specific safeguards to prevent this from happening. These rules, known as spousal impoverishment provisions, are designed to make sure the at-home spouse has enough money and assets to live on without being forced into poverty. Understanding these protections is a cornerstone of any effective asset protection plan.

The Community Spouse Resource Allowance Explained

The most powerful protection available is the Community Spouse Resource Allowance (CSRA). This rule allows the community spouse to keep a specific amount of the couple’s combined “countable” assets—things like savings accounts, stocks, or a vacation cabin—without disqualifying the other spouse from receiving Medicaid benefits.

For married couples, the at-home spouse can generally keep up to half of the couple’s total countable assets, within a certain range. For 2025, the minimum a community spouse can keep is $31,584, and the maximum is $157,920. This creates a critical financial floor, ensuring they aren’t left destitute.

This framework is the safety net that allows the institutionalized spouse to get the care they need while the community spouse maintains a dignified standard of living at home.

What About Exempt Assets?

On top of the CSRA, some of your most important assets are considered “exempt” and aren’t counted toward Medicaid’s limits at all. This is a huge relief for many Texas families, as it protects core family property from being sold off.

Key exempt assets in Texas usually include:

- The Primary Residence: Your family home is typically exempt, as long as the community spouse still lives there. The equity limit for this exemption in Texas is substantial, often protecting a family’s single most valuable asset.

- One Vehicle: The family’s primary car or truck is not counted.

- Personal Belongings: This covers all the things that make a house a home—furniture, household goods, and personal items like wedding rings.

- Pre-Paid Funeral Plans: Irrevocable pre-paid funeral and burial contracts for both spouses are also excluded from the asset calculation.

These exemptions are fundamental. They ensure that a spouse doesn’t have to sell their home or car just to get their loved one the medical care they desperately need.

A Real-World Texas Scenario

Let’s look at Mark and Susan, a retired couple from San Antonio. Mark has advanced Alzheimer’s and needs to move into a full-time nursing facility. Their countable assets total $200,000 in savings and investments. They also own their home (valued at $350,000) and one car.

Under the CSRA rules, Susan, the community spouse, can keep the 2025 maximum of $157,920. The remaining $42,080 would need to be “spent down” before Mark can qualify for Medicaid.

But here’s the good news: their home and car are completely exempt assets. Susan can continue living in their home, and its value won’t affect Mark’s eligibility. After spending down the excess funds on legitimate expenses—like paying off medical bills or making necessary home repairs—Mark can qualify for Medicaid, and Susan’s financial future remains secure.

This scenario also highlights why it’s so important to understand spousal rights in Texas probate as part of a complete, forward-thinking estate plan.

Takeaway

Spousal protections under Medicaid are not automatic. You have to properly structure your assets and provide meticulous documentation to the Texas Health and Human Services Commission. One small error or oversight can lead to devastating delays or even a denial of benefits. Professional guidance is essential to ensure every step is taken correctly.

Your Proactive Asset Protection Checklist

It’s easy to feel swamped by all the details of asset protection. The real challenge is channeling that information into clear, purposeful steps you can actually follow. This checklist breaks down the essentials into a step-by-step process. Follow it at your own pace and you’ll soon see a roadmap unfold—one that strengthens your family’s financial security and delivers lasting peace of mind.

Initial Steps To Take Today

Getting organized from the outset sets the tone for everything that follows. These actions will make your next conversation with an attorney far more focused and efficient.

- Gather Financial Documents

Pull together bank statements, investment summaries, property deeds, life insurance policies, and retirement account information. A complete snapshot of your finances is the foundation for any plan. - List All Assets and Debts

Create a simple inventory of what you own and what you owe. This exercise clarifies which assets count toward Medicaid and which may qualify as exempt. - Review Existing Estate Planning Documents

Dig up any current wills & trusts, powers of attorney, or advance directives. These papers provide a starting point and often need tweaks to align with long-term care strategies.

Critical Questions To Ask

Organization only goes so far. Thinking through key decisions now will help you craft a strategy tailored to your goals.

- Who Will Be Your Power of Attorney?

Name someone you trust to handle financial and medical choices if you’re unable to speak for yourself. - Who Will Manage the Trust?

Choosing a reliable, detail-oriented trustee is crucial—this person will oversee assets on your behalf. - What Are Your Long-Term Care Preferences?

Do you want to stay at home as long as possible? Would you consider assisted living? Your vision shapes the legal tools you’ll need.

Takeaway

The best time to protect your assets is before you need long-term care. Proactive planning unlocks the widest range of options to shield your savings from nursing home costs. You don’t have to navigate this alone. About 70 percent of Americans turning 65 today will require some form of long-term care, so safeguarding your nest egg is a vital part of retirement planning. Learn more about protecting your parents’ assets from nursing home costs. An experienced Texas attorney can guide you through state-specific rules and make sure your plan stands up under scrutiny.

Common Questions We Hear About Asset Protection

Even with the best roadmap, families always have specific questions once they start digging into the details. It’s a complex process, and it’s natural to feel a bit overwhelmed. Let’s tackle some of the most common concerns we hear from Texas families to clear up any confusion and help you move forward with confidence.

Can I Just Give My House and Money To My Kids?

This is easily the most common question—and one of the biggest mistakes families make. In plain English, just handing over assets is a surefire way to trigger major Medicaid penalties.

Remember that five-year look-back period we talked about? Any gifts you make within that window will create a penalty, leaving you ineligible for benefits for months or even years. You’ll be stuck paying for care out of your own pocket until that penalty period is over. A far safer and smarter route is using a properly structured Irrevocable Trust, which legally moves assets out of your name without the harsh consequences of outright gifting.

What’s the Difference Between Medicare and Medicaid, Really?

It’s critical to understand this distinction because it’s the entire reason this planning is necessary. People use the terms interchangeably, but they are worlds apart when it comes to long-term care.

- Medicare is the federal health insurance you get at age 65. It’s fantastic for hospital stays and doctor visits. It will even cover short-term, rehabilitative care in a nursing facility for up to 100 days—think physical therapy after a hip replacement. But that’s where it stops. It does not pay for long-term custodial care.

- Medicaid is the joint federal and state program that does cover the massive costs of long-term nursing home care. But it’s a needs-based program, which is why you must meet its strict financial rules to qualify. This entire guide is about legally and ethically positioning your assets to meet those rules.

Is It Too Late to Start Planning If Mom Is Already in a Nursing Home?

While the best time to plan is always at least five years before you need care, it is never too late to get professional advice. Don’t just assume all is lost.

Even if a loved one is on the verge of entering a facility or is already there, an experienced elder law attorney can use what we call “crisis planning” strategies. These last-minute legal maneuvers can still protect a significant chunk of the remaining assets. You absolutely have options, so don’t write it off. At a time when your family is under immense stress, having a professional guide you can provide immense reassurance.

Sometimes, a comprehensive plan also means seeking a Guardianship if a loved one has lost the ability to make financial or medical decisions for themselves. This is a court process, but it ensures your loved one is protected. Our firm also handles Probate Litigation if disputes arise during these difficult times.

Takeaway

Asset protection isn’t just about saving money for heirs. It’s about making sure your loved one gets the quality care they need without bankrupting the entire family in the process. Every situation is different, and a cookie-cutter approach just won’t work. The rules are complex, but with compassionate and knowledgeable guidance, you can create a plan that provides security and peace of mind for everyone involved.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.