Losing a loved one is one of life’s most difficult experiences. When you discover they passed away without a will, it can add a layer of legal confusion right when you’re most vulnerable. We understand how overwhelming this can be. In Texas, there’s a practical tool designed for this exact situation: the Affidavit of Heirship. It’s a crucial legal document that helps families establish who the legal heirs are and transfer property—especially the family home—without getting tangled up in a formal court process.

Think of it as a recognized, streamlined alternative to traditional probate, designed to bring clarity during a difficult time.

Navigating Loss Without a Will in Texas

When someone in Texas dies without a will, the law calls this dying “intestate.” In plain English, it means the state’s laws, not your loved one, will decide how their property is distributed. This is a common scenario that leaves many families wondering how to handle their loved one’s property. Fortunately, the Texas Estates Code provides a clear path forward, and an Affidavit of Heirship is often the most straightforward solution.

Understanding Your Options

Instead of jumping into a lengthy and often expensive court proceeding, this affidavit allows heirs to formally and publicly declare who inherits the decedent’s property. It is essentially a sworn statement, filed in the county’s public records, that lays out the deceased’s family history and identifies their rightful heirs according to Texas law. This approach is particularly useful for estates where the main asset is real estate.

For families searching for clarity during this challenging time, understanding the rules for navigating an estate without a will is the first step toward peace of mind. Our goal here is to give you compassionate, straightforward information to help you understand your options and bring some clarity to this difficult transition.

What Exactly Is an Affidavit of Heirship?

Imagine trying to tell a complete, legally recognized family story to prove who should inherit a piece of property. That’s essentially what an Affidavit of Heirship does. It’s not a court order, but a sworn, factual statement that maps out a deceased person’s family history, identifies their rightful heirs under Texas law, and gets filed in the county’s public records.

Its main job is to create a clean “chain of title” for assets—most often real estate—when the owner dies without a will. This document is the bridge that allows property to pass from the decedent to their heirs, telling the world, “Here are the new, rightful owners.”

So, How Does It Actually Work?

This legal tool is a lifesaver when someone dies ‘intestate,’ the legal term for dying without a will. It’s a more common scenario than you might think. In fact, a staggering 60% of Americans don’t have a will or any kind of estate plan in place. This statistic, highlighted by legal experts on the topic, underscores why affidavits of heirship are so crucial. They offer a practical way to transfer property without getting bogged down in a full probate process, which can be expensive and drag on for months.

The affidavit establishes a public record of who the heirs are. Title companies, banks, and other institutions can then rely on this document to transfer ownership. It’s a straightforward solution for many Texas families.

To get a clearer picture, let’s break down the key parts of an Affidavit of Heirship.

Affidavit of Heirship at a Glance

This table simplifies the core components of the affidavit into plain English, as outlined in the Texas Estates Code.

| Component | Plain-English Explanation |

|---|---|

| Decedent Information | Details about the person who died, like their name, date of death, and last known address. |

| Family History | A complete family tree, including marriages, divorces, children, and other relatives. |

| Heir Identification | A clear statement identifying every legal heir based on Texas intestacy laws. |

| Real Property Description | The legal description of the property being transferred (e.g., house, land). |

| Debts and Liens | A declaration of any known debts owed by the deceased’s estate. |

| Disinterested Witnesses | Sworn statements from two people who knew the deceased but will not inherit anything. |

| Notarization | The document must be signed by the heirs and witnesses in front of a notary public. |

This structure ensures the affidavit is thorough, credible, and legally sound for establishing a clear line of ownership.

The entire document hinges on the testimony of witnesses who knew the decedent personally but have no financial stake in the estate. These disinterested witnesses are the key to the affidavit’s credibility, as their unbiased statements confirm the family’s claims. By understanding the basics of affidavits for transfers without probate, families can see how this tool provides a powerful alternative to court-supervised administration, helping secure property rights with clarity and efficiency.

Key Requirements for a Valid Texas Affidavit

For an Affidavit of Heirship to hold up legally, it has to follow the rules in the Texas Estates Code, specifically Title 2, Chapter 203, to the letter. Think of it as a legal checklist where every single box must be ticked perfectly. One misstep can cause title companies to reject the document, bringing the entire process to a grinding halt.

The absolute cornerstone of a valid affidavit is the testimony of two disinterested witnesses. This isn’t just a suggestion; it’s a non-negotiable requirement that gives the document its legal power.

Who Qualifies as a Disinterested Witness?

So, what exactly is a “disinterested witness”? It’s someone who knew the deceased and their family history but has no financial stake in the estate. In simple terms, they can’t be an heir and stand to inherit any property.

Good examples of disinterested witnesses are often people who were part of the deceased’s life for a long time, like:

- A long-time friend of the family

- A neighbor who knew the deceased for years

- A colleague or fellow church member with firsthand knowledge of the family’s situation

These individuals must swear under oath to the facts about the decedent’s family—their marriages, children, and other relatives. The entire integrity of the affidavit rests on their unbiased confirmation. For anyone navigating this, understanding the critical role of these witnesses is paramount. To see how this fits into the bigger picture, you can learn more about the different types of proofs in Texas probate affidavits and witnesses.

Essential Components of the Affidavit

Beyond getting the right witnesses, the affidavit itself has to be prepared with meticulous care. It’s not just a simple form; it’s a sworn statement of fact that must include several key pieces of information:

- A complete list of all heirs: This means their full names, their relationship to the person who passed away, and their current addresses.

- Detailed family history: The document needs to clearly map out the family tree, including marriages, divorces, children (even those who may have passed away), and parents.

- Sworn and notarized signatures: Every heir (or their legal guardian) and both disinterested witnesses have to sign the affidavit in front of a notary public. This is what makes it a legally sworn statement.

- Filing in the public record: The final step is to file the notarized document in the real property records of the county where the decedent owned property. This makes it part of the official public record.

The scrutiny for these documents is high because they are a powerful tool for transferring property without formal court oversight. In fact, these affidavits accounted for around 5% of all real estate transfers in Texas in 2022, a statistic that really highlights their importance in the system. Getting every detail right ensures the document does its job by creating a clear and legally recognized chain of title.

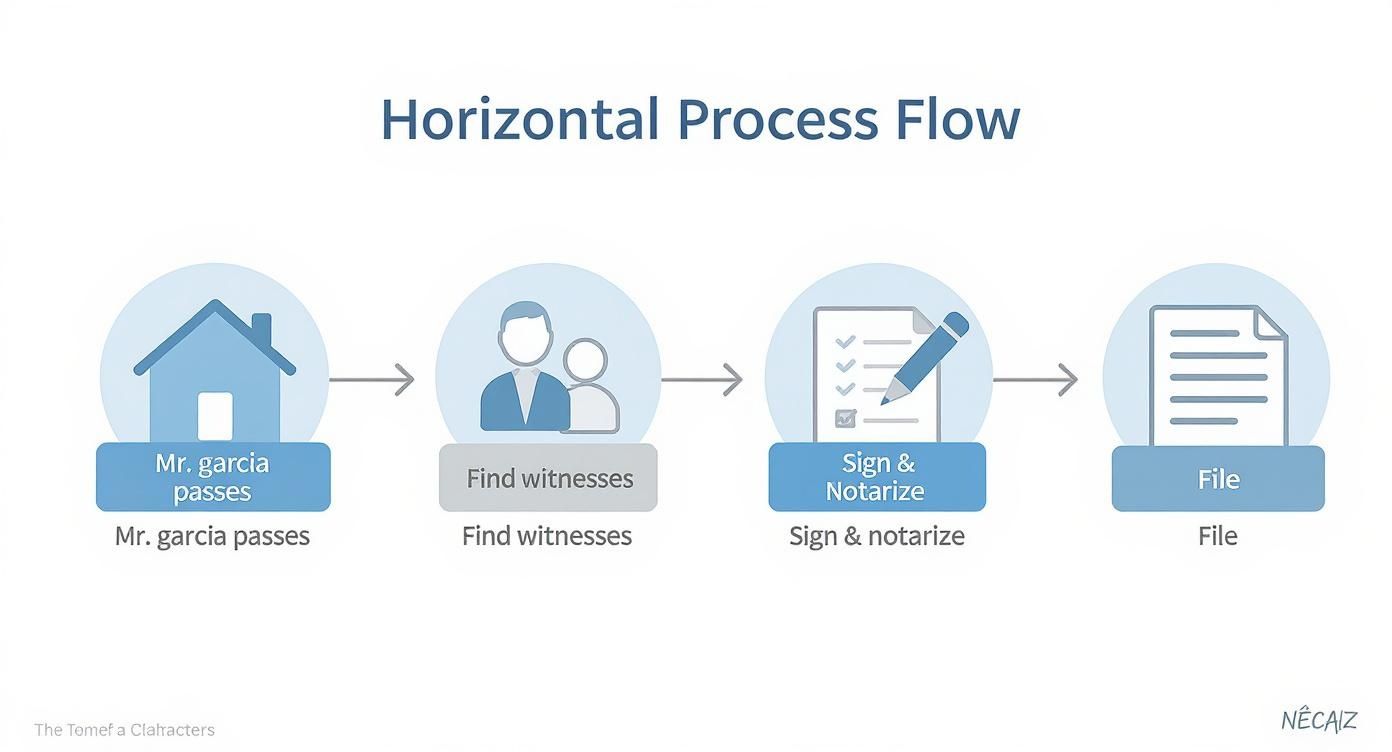

A Realistic Scenario: The Garcia Family’s Story

When Mr. Garcia passed away unexpectedly in Houston, his two adult children, Maria and Carlos, felt both grief and uncertainty. He had always been the one to handle family matters, but he never got around to creating a will. They feared the Texas Probate Process would be long, costly, and stressful, especially while they were grieving. Fortunately, their attorney explained a more straightforward path: an Affidavit of Heirship.

Step 1: Finding Witnesses

Maria and Carlos first located two disinterested witnesses: a neighbor who had known their father for thirty years and a close family friend who watched them grow up. Because neither witness stood to inherit anything, their testimony would be seen as credible and unbiased.

Step 2: Gathering Information

Next, the family gathered key documents:

- Their parents’ marriage certificate

- Their own birth certificates

- Statements confirming they were the only children and there were no other heirs

Step 3: Drafting and Signing

With these documents, their attorney drafted the affidavit, carefully detailing the family history as required by the Texas Estates Code. In a single afternoon, the witnesses, Maria, and Carlos signed the paperwork before a notary public—no courtroom appearance required.

Step 4: Filing the Document

The final step was filing the signed affidavit with the Harris County clerk. That simple move established a public record, officially identifying Maria and Carlos as the home’s new legal owners. They even used an AI Real Estate Title Document Reviewer to verify the title was clear of any surprises.

Within weeks, county records reflected the change, and the Garcia children had avoided the time and expense of formal probate. Suddenly, decisions about what to do with their childhood home felt like a family conversation, not a legal battle.

When to Use an Affidavit of Heirship

So, when is an Affidavit of Heirship the right tool for the job? Think of it as a specialized instrument, perfect for certain situations but not a one-size-fits-all solution. It shines in straightforward cases where the main asset is a piece of property, all the heirs are on the same page, and everyone agrees on how to move forward. For these families, it offers a clear and much cheaper path than formal court proceedings.

But it has its limits. If the estate gets complicated with things like stocks, bonds, or large bank accounts, you’ll likely need to go through a formal probate administration. The same goes for situations where the person who passed away had significant debts or if there’s even a hint of disagreement among family members. An affidavit just isn’t built to handle disputes, which might require Probate Litigation to resolve.

It’s also worth noting that while Texas title companies are very familiar with these affidavits for real estate transfers, some banks and financial institutions might push back, insisting on official court documents to release funds from an account.

Finding the Right Path for Your Family

Deciding between an affidavit and formal probate really boils down to the unique details of your family’s situation. This is where getting professional guidance can save you a world of trouble. A compassionate probate attorney can help you weigh the pros and cons, making sure you pick the most efficient and legally sound option.

The infographic below walks you through the streamlined process of using an affidavit to transfer a home, just like we saw with the Garcia family’s story.

As you can see, when the steps are clear and the heirs are in agreement, transferring property can be a surprisingly manageable process without ever setting foot in a courtroom. To help you visualize the decision-making process, here’s a quick comparison.

Choosing the Right Path: Affidavit of Heirship vs. Probate

Every family’s circumstances are different, so it’s crucial to understand the key distinctions between these two legal avenues. This table breaks down the main factors to consider when deciding what’s best for your loved one’s estate.

| Factor | Affidavit of Heirship | Formal Probate Administration |

|---|---|---|

| Best For | Simple estates with real estate as the primary asset. | Complex estates with diverse assets (stocks, bonds, businesses). |

| Heir Agreement | Requires 100% agreement among all heirs. | Can resolve disputes and disagreements through court supervision. |

| Cost | Generally much lower; avoids most court and attorney fees. | More expensive due to court costs, legal fees, and administrative expenses. |

| Speed | Faster; can be completed in weeks once all information is gathered. | Slower; typically takes months or even years to finalize. |

| Court Involvement | No court supervision required; filed in public records. | A court-supervised process from start to finish. |

| Handling Debts | Not designed for estates with significant or complex debts. | Provides a formal process for notifying creditors and settling all debts. |

Ultimately, choosing the right path depends on weighing these factors against your specific needs. An affidavit offers a simple, fast, and cost-effective solution for uncomplicated situations, while formal probate provides the structure and authority needed to handle more complex or contentious estates.

Finally, keep in mind that while the affidavit is a practical tool here in Texas, its usefulness can vary wildly in other states or countries. International property laws and administrative rules are often completely different. These global variations just go to show that what works seamlessly in Texas might not be recognized elsewhere. You can learn more about how heirship affidavits are used in other markets on pandadoc.com.

Your Next Steps and Key Takeaway

So, what’s the bottom line here? Think of an Affidavit of Heirship as a specific key for a specific lock. For many Texas families navigating an estate without a will, it’s the perfect tool—a compassionate, efficient, and far more affordable path than full probate. It can unlock property and bring legal clarity during an incredibly stressful time.

But just like any key, it only works if it’s cut perfectly. Its success completely depends on getting every single detail right and, most importantly, making sure it’s the right solution for your family’s unique situation.

Key Takeaway

If you take only one thing away from this guide, let it be this: talk to an experienced probate attorney. This is the single most important step you can take. An attorney can quickly confirm if an affidavit is the right choice for you and ensure every line of it meets the strict standards of the Texas Estates Code. This isn’t just about filling out a form; it’s about gaining peace of mind. Professional guidance helps you sidestep potential roadblocks and protects your family’s interests, securing your loved one’s legacy the way it was intended.

If the situation turns out to be more complex, we can also walk you through the full Texas Probate Process or help you plan ahead with Wills & Trusts. For those concerned about a loved one’s ability to manage their affairs, we also provide guidance on Guardianship.

Answering Your Questions About Heirship Affidavits

When you’re dealing with an estate, it’s natural to have questions. An Affidavit of Heirship can feel like a complex legal tool, but understanding the practical side of it can make all the difference. We’ve pulled together some straightforward answers to the questions Texas families ask us most often.

How Long Does This Process Take in Texas?

Compared to formal probate, an Affidavit of Heirship is typically much faster. The main variable is how quickly you can track down the family history and get the required signatures from witnesses. This part usually takes a few weeks.

Once the affidavit is complete and filed in the county’s public property records, it’s effective immediately for clearing up the chain of title. Just keep in mind that some title companies might impose their own short waiting period before they’ll issue a new insurance policy on the property.

Can an Affidavit of Heirship Be Contested?

Yes, it absolutely can be. If an heir was accidentally left off the affidavit or a creditor shows up with a legitimate claim against the estate, they have the right to challenge it in court.

This is where professional preparation is so important. A well-drafted affidavit, backed by credible and disinterested witnesses, is far less likely to be successfully contested. Getting legal guidance isn’t just about filling out a form; it’s about protecting your family’s interests from future challenges.

What Happens If a Bank or Title Company Won’t Accept It?

While Texas law makes Affidavits of Heirship a standard tool for transferring real estate, not every institution has to accept it for other assets. Some banks or financial institutions might still insist on seeing formal Letters Testamentary from a probate court before they’ll release funds.

If you hit this kind of roadblock, you’ll need to pivot to another legal path. Depending on the specifics of the estate, this could mean filing a suit to determine heirship or, if the estate is small enough, using a small estate administration process to get the authority you need.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.