When you're grieving a loss, the last thing your family needs is a complicated and expensive legal battle. For many Texans, a Small Estate Affidavit (SEA) offers a simpler, faster way to settle a loved one's affairs without the time and cost of traditional probate. This legal tool, established under the Texas Estates Code, is specifically designed for straightforward situations where the estate's value is modest.

This guide will walk you through what the SEA is, who qualifies, and the step-by-step process of using this form to honor your loved one’s legacy with dignity and peace of mind.

When a Small Estate Affidavit Can Help Your Family

After losing a loved one, you are often thrown into a world of unfamiliar legal terms. One of the first questions we hear from families is whether they must go through the formal Texas probate process. For many, the answer is no—if the estate qualifies for a Small Estate Affidavit. It’s a court procedure designed to be less complex and costly, giving families some relief during a difficult time.

The main rule, as outlined in Texas Estates Code Chapter 205, is this: the estate’s assets, not counting the primary home (homestead) and other exempt property, must be valued at $75,000 or less. This detail about the homestead is critical. It means that even if your loved one owned a valuable house, their estate might still qualify for this simplified process.

Understanding the $75,000 Limit: A Realistic Scenario

The law was written with real Texas families in mind. Let’s walk through a common scenario to see how this plays out.

Imagine your father passed away in Texas without a will. He owned his home, where he lived for decades, which is now worth around $300,000. He also had a checking account with $20,000, a used car valued at $15,000, and some personal belongings worth about $5,000. His only significant debt was a small credit card balance.

At first glance, that $300,000 house seems to blow past the limit. But the law says we exclude the homestead's value from the calculation. So, we only add up the other assets:

- Checking Account: $20,000

- Car: $15,000

- Personal Belongings: $5,000

- Total Non-Exempt Assets: $40,000

Because $40,000 is well under the $75,000 threshold, his estate is eligible for the Small Estate Affidavit procedure. This allows his heirs to transfer title to the home and access his bank account without getting bogged down in full probate.

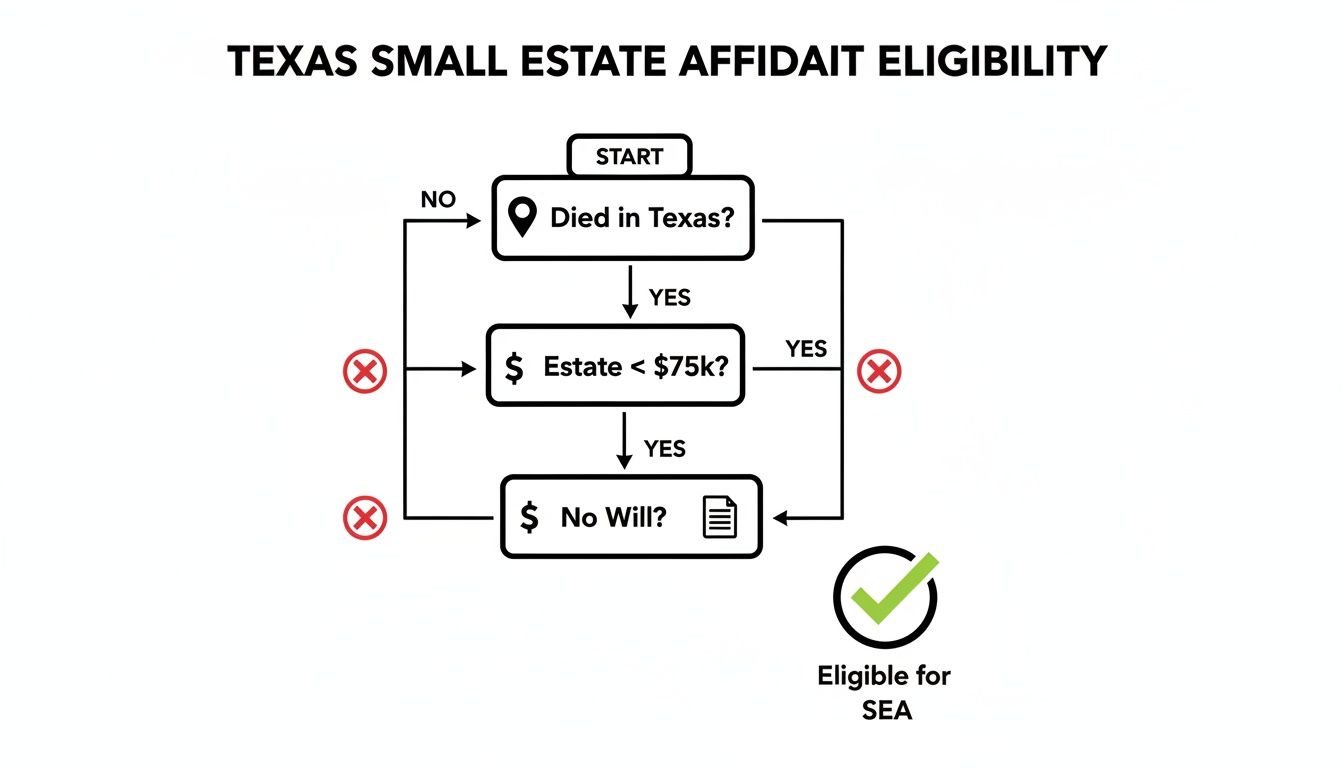

This decision tree helps visualize the basic checkpoints for using a Texas Small Estate Affidavit.

As the flowchart shows, the path to using an SEA starts with a few simple questions about where the person passed away, the estate's value, and whether a will exists. To help you see if this might be an option, here’s a quick checklist.

Quick Eligibility Checklist for a Small Estate Affidavit

Use this table to quickly see if you might be eligible to use an SEA based on key criteria from the Texas Estates Code.

| Requirement | Plain-English Explanation | Does Your Situation Match? |

|---|---|---|

| Died Without a Will | The person passed away intestate (no valid will). | Yes / No |

| Estate Value Cap | The total value of the estate (not including the homestead and other exempt property) is $75,000 or less. | Yes / No |

| Assets Exceed Debts | The value of the assets is more than the total debts owed (again, not counting the mortgage on the homestead). | Yes / No |

| Texas Resident/Property | The person was a Texas resident or owned real estate in Texas. | Yes / No |

| No Other Probate | No one else has already started a formal probate administration for the estate. | Yes / No |

If you answered "Yes" to these questions, a Small Estate Affidavit might be the right path forward for your family.

The Texas Small Estate Affidavit is a compassionate legal tool. It recognizes that not every estate needs the full-blown complexity of formal administration. By understanding if your situation fits these specific criteria, you can take the first step toward settling your loved one's affairs with clarity and peace of mind. To learn more about how this applies to your unique situation, you can read our guide to small estate probate in Texas.

Preparing to Fill Out the Affidavit Form

The Small Estate Affidavit is meant to be a simpler path, but "simpler" does not mean easy. Its success hinges entirely on careful, thorough preparation before you even look at the form. Gathering the right documents and information upfront is the single most important step you can take. This isn't just about being organized; it's about preventing frustrating delays and potential rejection from the court.

This preparation phase is about creating an accurate snapshot of your loved one's financial life at the moment they passed away.

Your Document and Information Checklist

To successfully complete a Texas Small Estate Affidavit form, you need to assemble a detailed file. Having these items ready before you start will save you countless hours.

- Certified Copy of the Death Certificate: This is your official starting point. You can get certified copies from the county clerk where the death occurred. We recommend getting several, as banks and other institutions will each require an original.

- A Complete List of All Assets: You must identify every single asset in the estate, except for the homestead. This means finding bank account numbers with their exact balances on the date of death, Vehicle Identification Numbers (VINs) for cars, and the fair market value for all personal property.

- A Full Tally of All Debts: The affidavit requires a list of all known liabilities. This means gathering recent credit card statements, medical bills, and any outstanding loans. You must be precise, as the estate's assets must exceed its debts for the affidavit to be valid.

- Names and Addresses of All Heirs: You need to identify every legal heir according to Texas's intestacy laws—the rules that determine who inherits when there is no will. This includes their full legal names, current addresses, and their exact relationship to the person who passed away.

Understanding the Role of Disinterested Witnesses

One of the most critical—and frequently misunderstood—requirements is the need for two disinterested witnesses. This isn't just a formality; it's a legal safeguard to ensure the information you present to the court is true. A plain-English explanation of a disinterested witness is someone who:

- Has personal knowledge of the deceased's family history and heirs.

- Will not inherit a single dollar or piece of property from the estate.

This could be a close family friend, a long-time neighbor, or a colleague who knew the family well. Anyone listed as an heir—a child, sibling, or any other relative set to receive property—is automatically disqualified. Their "interest" in the outcome makes them legally partial.

The Importance of a Complete Family History

Finally, you must provide the court with a crystal-clear picture of the decedent's family tree to determine the legal heirs. This often means outlining marriages, divorces, children (including any who may have passed away), and other relatives as Texas law dictates.

For example, if your mother passed away and she had three children, but one of your siblings died before her, then that sibling's children (your nieces or nephews) might also be considered heirs. A clear, accurate family history ensures every single person legally entitled to a share of the estate is identified. For more complex situations, understanding Wills & Trusts can provide helpful context, even when a will is missing.

How to Accurately Fill Out the Texas SEA Form

Staring at a blank Texas small estate affidavit form can be daunting. It is a formal legal document, and the pressure to get it right for your family is real. However, the best approach is to break it down section by section, focusing on precision and honesty with every answer.

Think of the form as a sworn statement to the court that paints a complete financial picture of your loved one's estate. Each field you complete is a piece of a puzzle that, when assembled correctly, gives the judge a clear snapshot proving the estate qualifies for this simplified process.

Step 1: Detailing Assets with Precision

The inventory of assets is one of the most critical parts of the affidavit. You must list every single piece of non-exempt property—basically, everything other than the primary home—along with its fair market value on the day your loved one died. Vague descriptions or "guesstimates" are a fast track to getting your form rejected.

For instance, don’t just write "Mom's car." You need to be specific:

- "2018 Toyota Camry, VIN [Insert VIN here], approximate market value $16,500."

The same goes for bank accounts. "Savings account" isn't enough. Instead, provide:

- "Wells Fargo Savings Account ending in #1234, balance on date of death: $8,241.57."

This level of detail proves to the court you have done your due diligence and provides a transparent accounting that confirms the estate’s value is under the $75,000 limit.

Common Mistake to Avoid: Valuing the Homestead

A frequent error we see is filers accidentally including the value of the homestead in their asset total. To be clear: under Texas Estates Code Chapter 205, the decedent's primary residence is exempt property. Its value does not count toward the $75,000 cap. This single mistake can make a perfectly eligible estate look too large on paper, leading to an unnecessary rejection from the court.

Step 2: Accounting for All Debts

Just as you list assets with precision, you must also provide a complete and honest list of all known debts and liabilities. This means everything from credit card balances and medical bills to personal loans. The court needs to see that the estate's assets can cover its debts.

It might feel tempting to overlook a small credit card bill, but omitting any known liability can invalidate the entire affidavit. The law requires a full financial picture. For example:

- Capital One Credit Card, Account #…: $1,250.33

- St. David's Medical Center, Invoice #…: $4,800.00

Step 3: Identifying Heirs According to Texas Law

This is the section that often causes the most confusion. You must list every single legal heir as determined by Texas intestacy laws—the rules that dictate who inherits property when there is no will. This is not about who your loved one wanted to inherit; it's about who the law says must inherit.

Scenario: A Grieving Spouse Navigates Heirship

Imagine Maria's husband, David, passed away without a will. They had two children together. However, David also had a son from a previous marriage he hadn't spoken to in years.

Maria might logically assume that only she and her two children are the heirs. But under Texas law, David's son from his prior marriage is also a legal heir. If Maria files the Small Estate Affidavit listing only herself and their two children, the court will reject it as incomplete. She must include David's other son, his full name, and his last known address.

Step 4: Completing the Signatures

Finally, every heir must sign the affidavit in front of a notary public, swearing that the information is true. On top of that, you’ll need two disinterested witnesses—people who knew the decedent but will not inherit anything from the estate. They must also sign a sworn statement, verifying the family history you've provided.

By carefully and accurately completing each section of the Texas Small Estate Affidavit form, you give the court a trustworthy document that meets its strict standards. This attention to detail is the best way to honor your loved one and settle their affairs efficiently.

Getting the Affidavit Filed and Navigating the Court System

You’ve done the hard work of gathering documents, filling out the Texas small estate affidavit form, and collecting signatures from all heirs and witnesses. Now, you must file it with the court to make it a legally effective tool. This part of the process is straightforward but requires patience as you navigate the court system.

Where and How to Get the Affidavit on File

You must file the affidavit in the probate court of the county where your loved one resided at the time of their death. For example, if they lived in Harris County, you will file with the Harris County Probate Court.

Each county clerk's office has its own specific procedures. It is always wise to check the local county clerk's website or call them to confirm filing fees and any local rules. When you file, you will need the original, signed affidavit and a certified copy of the death certificate. The clerk will accept your documents, assign a case number, and collect the filing fee, which is typically a few hundred dollars—far less than the cost of a full probate administration.

What to Expect After You File: The Approval Process

Once filed, the affidavit does not get approved instantly. Here is the step-by-step process of what to expect:

- Clerk's Initial Review: The court clerk will perform an initial review to ensure the form is complete, all attachments are present, and it meets basic requirements.

- Judge's Review: The affidavit is then passed to a probate judge, who will carefully examine it to ensure the estate qualifies under Texas Estates Code Chapter 205. The judge verifies that the asset value is $75,000 or less (excluding the homestead) and confirms that the listed heirs are correct under Texas law.

- Approval and Court Order: If everything is in order, the judge will sign an order approving the affidavit. This order is the official court validation that gives the document its legal power. The timing for approval can take several weeks, depending on the court's caseload.

You can discover insights on how the SEA helps Texas families on wthompsonlaw.com for more information on its practical benefits.

Real-World Example: After the Filing

Let's see how this works for a family:

Sarah’s mother passed away in Austin, so she files a completed Small Estate Affidavit with the Travis County Probate Court. After paying the filing fee, she gets a case number. Three weeks later, she checks the court's online records and sees that a judge has signed the order approving her affidavit. The clerk’s office issues her several "certified copies" of the affidavit and the judge's order. With these official documents, Sarah goes to her mother’s bank, which is now legally required to close the account and release the funds to the heirs.

The court's approval empowers you to close accounts, transfer car titles, and finally settle your loved one's estate with legal authority.

When a Small Estate Affidavit Isn't the Right Move

While the Small Estate Affidavit is an excellent tool for many Texas families, it is not a one-size-fits-all solution. Knowing when an SEA isn't the right fit is just as crucial as knowing when it is. Attempting to use it in the wrong situation can lead to court rejection, wasted time, and added stress.

The Decedent Left a Valid Will

This is the most straightforward reason an SEA won't work. A Small Estate Affidavit can only be used for an "intestate" estate—the legal term for when someone dies without a Will. If your loved one left a valid Will, the law requires a different process to honor their wishes, even if the estate is small. In this case, a simplified probate process called Muniment of Title might be a suitable alternative.

The Estate’s Value Exceeds the $75,000 Limit

The core requirement for an SEA is that the non-exempt assets are valued at $75,000 or less. If your calculation of bank accounts, vehicles, and other personal property exceeds this amount, the estate is automatically disqualified. This limit is absolute, making an accurate valuation of every asset critical.

The Estate Includes Real Estate Beyond the Homestead

An SEA is effective for transferring the title of the decedent's primary residence (their homestead) to the legal heirs. However, if the estate includes any other real property—like a vacation cabin, a rental property, or even an empty lot—you cannot use a Small Estate Affidavit. The legal steps for transferring title to other real estate are more complex and require the authority granted through formal probate administration.

There Are Disagreements Among the Heirs

Family harmony is an unspoken requirement for the SEA to work. Every legal heir must sign the affidavit and agree on the facts presented. If there's a dispute over who the heirs are, what assets are in the estate, or how property should be divided, the process will fail. In cases of family conflict, a formal administration—or even Probate Litigation—may be the only way to resolve disputes under a judge's supervision. You can learn more by reading our guide to an affidavit of transfer without probate to understand the basics and its limitations.

Small Estate Affidavit vs. Other Texas Probate Alternatives

It can be tough to know which path is right. This table breaks down the key differences between the Small Estate Affidavit and other common probate alternatives in Texas.

| Procedure | Best For… | Key Limitation | Typical Timeframe |

|---|---|---|---|

| Small Estate Affidavit | Simple, intestate estates under $75,000 with only a homestead as real property. | Cannot be used if there is a Will, other real estate, or disagreements among heirs. | 30-90 days |

| Muniment of Title | Estates with a valid Will but no debts (other than a secured mortgage). | Does not work if there are significant unpaid creditors. Cannot be used without a Will. | 2-4 months |

| Independent Administration | Larger estates with a valid Will and cooperative beneficiaries. Often the standard probate process. | Requires either a provision in the Will or unanimous consent of all heirs. | 6-12 months |

| Dependent Administration | Complex or contested estates where court supervision from a Guardianship or administrator is needed for every step. | More expensive and time-consuming due to constant court oversight. | 1-2+ years |

Choosing the right process from the start saves time, money, and stress. If you are unsure, it is a good sign that it is time to speak with an attorney.

Your Top Questions About the Texas SEA Answered

When you're dealing with a loved one's estate, questions are bound to come up. Here are plain-English answers to the questions we hear most often about the Texas small estate affidavit form.

What Happens If I Discover Another Asset After Filing?

It happens. If you discover a new asset after filing and it keeps the total non-exempt estate value under the $75,000 limit, you can typically file an amended affidavit with the court.

However, if this new asset pushes the estate’s value over the $75,000 threshold, the Small Estate Affidavit becomes invalid. At that point, you will need to transition to a more formal process, like a full Texas probate administration, to correctly handle the larger estate.

Can I Use an SEA to Sell My Loved One's House?

This is a critical point. A Small Estate Affidavit's main job concerning a homestead is to transfer the title of the property to the legal heirs. It officially puts the house in the heirs' names.

The affidavit itself does not give you the authority to sell the property to a third party. Selling the home is a separate transaction that requires additional legal steps after the title has been transferred to all the heirs, usually involving a new deed signed by everyone.

Is There a Waiting Period to File the Form?

Yes, there is a mandatory waiting period. Under Texas law, you must wait at least 30 days from the date of your loved one's death before you can file the Small Estate Affidavit. This period allows time for final bills to arrive and for a clear picture of the estate's financial situation to emerge before you swear to its contents in court.

Part of this process often involves figuring out what to do with personal belongings. If you find yourself responsible for valuables, it's a good idea to understand the market for selling inherited jewelry.

Key Takeaway

The Texas Small Estate Affidavit is a powerful tool designed to provide a compassionate, efficient, and affordable alternative to formal probate for uncomplicated estates. Its success depends entirely on meeting the strict legal requirements outlined in the Texas Estates Code, including the $75,000 asset limit (excluding the homestead), the absence of a will, and the full agreement of all legal heirs. While it simplifies the process, accuracy is paramount. One small error can lead to rejection, underscoring the value of careful preparation and professional guidance to ensure your family's peace of mind.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.