To terminate a power of attorney in Texas, you must create a formal written document called a “Revocation of Power of Attorney.” This document needs to be signed in front of a notary public. Afterward, you must deliver copies to your former agent and any institutions, like banks or hospitals, that have the original Power of Attorney (POA) on file.

This legal process, known as revocation, is the only official way to cancel an agent’s authority. Simply telling the person they are no longer your agent is not legally sufficient and won’t protect you or your assets.

Your Right to Cancel a Power of Attorney

Granting someone a Power of Attorney (POA) is a significant act of trust. You are giving another person—your “agent”—the legal authority to manage your personal, financial, or medical affairs. Equally important is your absolute right to take that authority back.

In Texas, as long as you have the mental capacity to make your own decisions, you have complete control over who acts on your behalf. This right is fundamental to protecting your independence and your assets.

Life is unpredictable. A trusted relationship might break down, you could lose confidence in your agent’s judgment, or the original reason for creating the POA may no longer exist. Whatever your reason, you are never permanently locked into your choice of agent.

Common Reasons for Revoking a POA

Families in Texas decide to terminate a Power of Attorney for many personal and practical reasons. Some of the most common scenarios we encounter include:

- Relationship Breakdowns: A divorce, a serious family disagreement, or a simple breakdown in communication can make it necessary to appoint a new agent.

- Loss of Trust: If you suspect your agent is not acting in your best interest, mismanaging your finances, or making poor decisions, revoking their power immediately is critical to protect yourself.

- A Change of Heart: You might simply decide someone else, like another child, a trusted friend, or a professional fiduciary, is now a better fit for the role.

- The Agent Can No Longer Serve: Your chosen agent may pass away, become incapacitated themselves, or move far away, making it impractical for them to fulfill their duties properly.

Understanding the responsibilities a POA grants is the first step. You can learn more about what a power of attorney is and the significant authority it grants in our detailed guide. Knowing what’s at stake makes it clear why understanding how to terminate one is so vital for your security.

The Importance of a Formal Revocation

Verbally telling your agent their authority is canceled is not enough to hold up in court. Without a formal, written revocation, third parties like banks, hospitals, and financial advisors can—and likely will—continue to honor the original document. This leaves you vulnerable to unauthorized transactions or decisions made against your wishes.

A realistic scenario makes this clear. Imagine Sarah appointed her brother, David, as her agent years ago. After a bitter disagreement, she tells him over the phone, “You can’t be my agent anymore.” But she never puts it in writing. The next week, David, who still has the original POA document, walks into Sarah’s bank and withdraws $10,000. The bank, completely unaware of the phone call, acts in good faith based on the valid legal document it has on file. Sarah is now facing a long and expensive court battle to get her money back.

The Texas Estates Code provides a clear legal framework for revocation. By following these official steps, you reassert control over your financial and personal life, giving yourself both peace of mind and legal certainty.

The Official Process for Revoking a POA in Texas

Ending a Power of Attorney (POA) in Texas requires more than a simple conversation. To legally protect yourself and make the termination official, you must follow a formal, documented process. This involves creating a specific legal document, having it notarized, and ensuring everyone who needs to know is properly informed.

The entire process begins with one critical step: creating a written Revocation of Power of Attorney. This is the formal legal document that serves as the official notice that you are canceling the agent’s authority. It doesn’t need to be complex, but Texas law requires it to be clear and contain specific information to be valid.

Drafting the Revocation Document

Think of this document as your official declaration. It must clearly state your intention to revoke the previous POA. While having an attorney draft this for you is the safest way to ensure it is legally sound, the core components are straightforward.

Your revocation document must include:

- Your full legal name (as the principal).

- The full legal name of your agent whose authority is being revoked.

- The date the original Power of Attorney was signed. This helps clearly identify which document you are canceling.

- An unambiguous statement of revocation. This is the most critical part. Language such as, “I, [Your Name], hereby revoke any and all authority granted to [Agent’s Name] in the Power of Attorney document signed on [Date of Original POA],” is direct and leaves no room for misinterpretation.

Once drafted, the document isn’t complete. The next step is what gives it legal authority in Texas.

Signing and Notarization: The Keys to Validity

For a revocation to be legally binding in Texas, it must be signed and notarized. You will need to sign the document in the presence of a notary public, who will then verify your identity, witness your signature, and affix their official seal.

This step is non-negotiable. Notarization transforms your written intention into a legally enforceable act, preventing anyone from later claiming the document is fraudulent. To better understand the critical function of notaries in these matters, you can learn more about the role of notaries in Texas legal procedures.

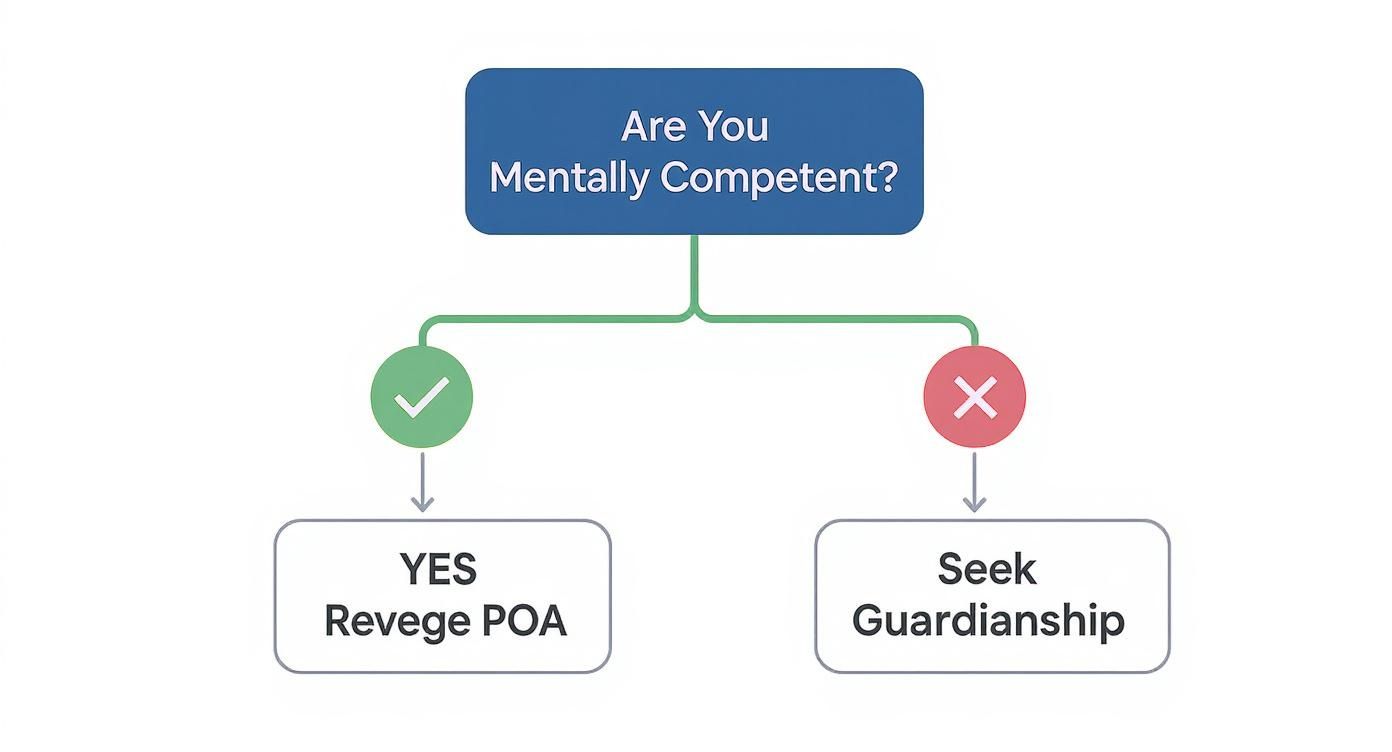

Of course, the first step in canceling a POA is determining if you have the legal standing to do so, as this visual guide explains.

This decision tree shows that your mental competency is the critical factor. If you are competent, you can revoke the POA yourself. If not, your family may need to explore other options.

Notifying Your Agent and Third Parties

A notarized revocation is powerful, but only if the right people see it. Your next responsibility is to deliver a copy of the signed and notarized document to your former agent. This formal notification prevents them from claiming they were unaware their authority had been terminated.

We strongly recommend sending the revocation via certified mail with a return receipt requested. This provides you with documented proof that the former agent received the notice, which can be invaluable if a dispute ever arises.

Equally important is notifying any third parties who have a copy of the original POA or have been acting on your agent’s instructions. This includes places like:

- Banks and credit unions

- Financial advisors or brokerage firms

- Doctors, hospitals, and other healthcare providers

- Insurance companies

- Government agencies like the Social Security Administration or the IRS

Failing to notify third parties is one of the most dangerous mistakes you can make. An institution that acts in “good faith” on an old POA is generally protected from liability, meaning any financial loss would fall on you.

To make sure you’ve covered all your bases, here’s a quick checklist to guide you.

Essential Checklist for Notifying Parties of a POA Revocation

This checklist outlines who you must notify after revoking a Power of Attorney to ensure the termination is effective and legally recognized.

| Party to Notify | Method of Notification | Reason for Notification |

|---|---|---|

| Former Agent | Certified Mail with Return Receipt | Provides legal proof of delivery and prevents claims of ignorance. |

| Banks & Credit Unions | In-person delivery or certified mail | Prevents unauthorized transactions or account access. |

| Financial Advisors | Email followed by certified mail | Stops trades, transfers, or other financial decisions. |

| Healthcare Providers | In-person delivery or secure patient portal | Revokes authority to make medical decisions on your behalf. |

| County Clerk’s Office | In-person recording (if POA involved real estate) | Creates a public record and prevents property transactions. |

Following this checklist helps ensure that your revocation is not just a piece of paper but a legally effective action that protects your assets and your decisions.

This isn’t just a theoretical risk; it has devastating real-world consequences. A 2019 case saw an 88-year-old woman formally revoke her agent’s POA but fail to notify her bank. The former agent continued to make withdrawals, draining her account to just $15.07. Because the bank was never informed, they continued to honor the old document.

As part of the official process for revoking a Power of Attorney, you may need to send formal notification documents to various parties. If faxing is a required or preferred method for these legal documents, you can learn how to send official documents via fax online.

Handling POAs Involving Real Estate

There is one final, crucial step if your original Power of Attorney granted your agent authority over real property. If the POA was recorded in the county land records, you must also record the Revocation of Power of Attorney in the very same county clerk’s office.

This action creates a public record of the termination, known as “constructive notice.” It effectively stops the former agent from trying to sell, mortgage, or transfer your property. Failing to record the revocation can lead to a clouded title and significant legal headaches down the road. This step ensures that your property rights remain fully protected.

When You Can No Longer Revoke a POA Yourself

The right to revoke a Power of Attorney belongs to you, but it depends entirely on your ability to make and communicate your own decisions. We have seen heartbreaking situations where a person, due to a sudden illness or a progressive condition like dementia, loses that ability. This leaves them vulnerable, especially if the agent holding their POA is no longer trustworthy or acting in their best interest.

In Texas law, this is known as losing legal capacity. It means you can no longer understand the nature and consequences of your actions or make sound decisions about your own well-being. Once that line is crossed, you can no longer legally sign a revocation document. This is often when concerned family members need to step in to protect their loved one.

Seeking Guardianship to Protect a Loved One

When someone is incapacitated and cannot act for themselves, the primary legal remedy in Texas is to petition a court for a Guardianship. A guardianship is a formal legal process where a judge appoints a responsible person (the guardian) to make decisions for an incapacitated individual (the ward).

Think of it as a critical safeguard. It provides a court-supervised path for a family to intervene when they see red flags—like an agent misusing funds, neglecting care, or isolating their loved one. You can get a deeper understanding of this protective measure in our detailed guide on how to get legal guardianship of a parent.

During the guardianship proceeding, a judge will carefully evaluate evidence of the person’s incapacity and scrutinize the agent’s conduct. If the court finds the agent has failed in their duties or that the principal is truly incapacitated, the judge has the power to suspend or completely terminate the agent’s authority under the POA.

A Real-World Scenario: Protecting an Incapacitated Parent

Let’s walk through a common scenario. An elderly mother, Maria, signed a POA years ago naming her son, Alex, as her agent. Unfortunately, Maria now has advanced dementia and is completely reliant on others. Her daughter, Sofia, starts noticing that Alex is using their mother’s money for his own personal expenses—vacations, a new car, things that have nothing to do with Maria’s care.

Because Maria lacks the capacity to revoke the POA herself, Sofia feels helpless. Her next move is to petition the probate court to establish a guardianship over her mother.

In court, Sofia’s attorney would present a strong case, including:

- Medical evidence from Maria’s doctor confirming her dementia diagnosis and inability to manage her finances.

- Financial records, like bank statements, that clearly show Alex’s questionable transactions.

- Testimony from family, friends, or caregivers who have witnessed Alex’s neglect or financial exploitation.

A judge reviewing this evidence would likely find that Alex has violated his duties as an agent. The court could then terminate Alex’s authority under the POA and appoint Sofia or another suitable person as Maria’s legal guardian, putting a stop to the abuse and ensuring her finances are protected.

The Agent’s Fiduciary Duty Under Texas Law

This entire legal framework is built on a cornerstone concept: fiduciary duty. Under the Texas Estates Code, anyone acting as an agent under a POA has a strict, non-negotiable obligation to act in the principal’s best interest. This duty demands loyalty, honesty, and care in every single transaction.

When an agent misuses funds, makes self-serving decisions, or neglects the principal’s needs, they are breaching that duty. A breach of fiduciary duty is one of the strongest grounds for a court to step in, remove an agent, and terminate a Power of Attorney.

The need for this kind of oversight is a growing concern. A report from England and Wales revealed a stunning 55% increase in court applications to remove or censure attorneys in just one year, jumping from 465 to 721 cases. This trend underscores a widespread problem with the misuse of POA authority, often because the documents were created without professional legal advice. You can read more about these trends and the risks of unchecked POA abuse on Law Gazette.

This data shows why court intervention through guardianship is such a vital tool. It provides families with the legal authority they need to step in and fix a situation that has gone terribly wrong.

How a Power of Attorney Can End Automatically

While you can take deliberate steps to revoke a Power of Attorney (POA), it’s just as important to know that certain life events can terminate one automatically. Many Texas families are caught off guard by these legal triggers, leading to confusion during already stressful times. Understanding these built-in termination events ensures responsibilities transition smoothly and legally.

The most common and absolute end to a POA is the death of the principal—the person who created the document. The moment the principal passes away, the agent’s authority is terminated. A POA is a tool for managing someone’s affairs during their lifetime; its power does not extend beyond death.

Once the principal is gone, the agent’s job is over. The executor named in the principal’s will (or a court-appointed administrator) takes control. It’s a common myth that an agent can continue paying bills or managing assets after death, but doing so is illegal. Those duties now fall under the Texas Probate Process.

Divorce as an Automatic Trigger

Divorce is another major life event that can automatically dissolve a POA. Under Texas Estates Code § 751.052, if you named your spouse as your agent, their authority is revoked the moment the court finalizes your divorce.

This law acts as a critical safeguard, preventing an ex-spouse from having control over your finances or healthcare after the marriage has legally ended. There is one key exception: if the POA document includes specific language stating the agent’s authority continues even after divorce, that provision will stand.

When the Agent Cannot Continue

A Power of Attorney also terminates if something happens to the agent that makes it impossible for them to fulfill their duties. The agent’s authority ends immediately if they:

- Resign or formally step down.

- Become incapacitated and can no longer make sound decisions.

- Pass away.

These rules ensure that someone unwilling or unable to act in your best interest does not retain legal power over your affairs. This is why it’s a smart estate planning strategy to name at least one successor agent in your original POA, ready to step in if your primary agent can no longer serve.

A Scenario of Automatic Termination

Let’s look at a real-world example. Robert appointed his wife, Susan, as his agent in a durable POA. Tragically, Robert suffers a major car accident and falls into a coma. Susan rightfully uses the POA to manage his medical care and finances.

A year later, while Robert is still incapacitated, Susan dies suddenly from a heart attack. The moment she passes away, her authority as Robert’s agent automatically terminates. If Robert’s POA had named his daughter, Emily, as the successor agent, Emily could step in and take over seamlessly. If no successor was named, Robert’s family would have to go to court to seek a Guardianship to manage his affairs.

Knowing these automatic termination points isn’t just a legal technicality—it’s essential for practical estate planning. It prevents illegal actions, clarifies who is in charge, and helps families navigate the legal landscape with confidence, especially when dealing with complex Wills & Trusts or potential Probate Litigation.

Key Insight: Your Takeaway on Revoking a POA

Terminating a Power of Attorney is an act of taking back control. While life changes, your right to decide who manages your affairs remains paramount as long as you have the capacity to do so. The most critical takeaway is that this process must be formal and thorough. A written, notarized revocation is not just a suggestion—it is a legal necessity in Texas. Equally important is notifying your former agent and all financial and medical institutions. This simple step is your shield against unauthorized actions and is the key to ensuring your wishes are respected.

When Do You Need a Lawyer?

Revoking a Power of Attorney is a serious legal step, and the real power behind it comes from executing it correctly. While you can often handle the signing and mailing yourself, some situations are too complex and risky to manage alone. That’s when consulting an experienced estate planning attorney isn’t just a good idea—it’s essential.

When to Consult an Attorney

You should call an attorney if you find yourself in any of these scenarios:

- Questions About Mental Capacity: If there is any doubt about the principal’s ability to understand their actions, you need a lawyer. This is critical to ensure the revocation is legally valid and can withstand a future challenge.

- An Uncooperative Agent: If an agent refuses to acknowledge the revocation, or you suspect they have been misusing their power or committing financial abuse, an attorney can take formal legal action to enforce the revocation and protect your assets.

- Complex Financial or Real Estate Matters: If the POA was used for business operations, managing investments, or dealing with real property, a lawyer’s guidance is crucial to unwind the agent’s authority without making costly errors.

- Anticipated Family Disputes: If you know this revocation will likely ignite a family conflict or a legal battle, having a lawyer on your side from the beginning is your best defense.

A good lawyer does more than just draft a document; they build a legal shield around you. They can anticipate potential problems, protect you from liability, and ensure every step you take is legally sound and enforceable.

This is especially true if revoking the POA is part of a larger legal strategy, like navigating the Texas Probate Process or establishing a Guardianship to protect a vulnerable loved one. When you’re looking for legal help, responsiveness matters. Learning more about how law firms ensure client communication can help you pick the right team. In a difficult time, an attorney ensures your rights are protected and you don’t make expensive mistakes.

Common Questions About Terminating a POA

Ending a Power of Attorney can feel overwhelming. The process often brings up many “what if” scenarios, but getting clear answers is the first step toward regaining control and peace of mind. Here are some of the most common questions Texas families ask when it’s time to revoke a POA.

Can I Just Tell My Agent It’s Over?

It’s a tempting thought—a simple phone call or conversation to say, “You no longer have my power of attorney.” Unfortunately, in Texas, that is not enough. A verbal revocation has no legal weight and will not be recognized by a bank, a court, or any other institution.

To make it official, your revocation must be a written document, signed by you, and notarized. This isn’t just a formality; it’s your legal proof. It creates a clear, undeniable record that terminates the agent’s authority and prevents them from continuing to act on your behalf.

What if I Can’t Find the Original POA Document?

You can still revoke a Power of Attorney even if the original document is lost. The power lies in your new revocation document, not the old one.

Your written revocation just needs to be specific enough to avoid confusion. Make sure it clearly identifies the POA you’re canceling by including:

- The full name of the agent you appointed.

- The approximate date you signed the original POA.

- A direct and unmistakable statement revoking any and all authority you granted in that document.

An experienced attorney can draft a revocation that is legally airtight, ensuring the old POA is effectively terminated even without the original in hand.

Does a New POA Automatically Cancel an Old One?

This is a common and dangerous assumption. Creating a new Power of Attorney does not automatically cancel a previous one unless the new document contains specific language stating that it does. While any well-drafted new POA should include a clause revoking all prior ones, relying on that alone can create a legal mess.

The best practice is to always execute a separate “Revocation of Power of Attorney” document first. This creates a clean break. It completely eliminates the risk of having two different agents who both believe they have the authority to act for you—a situation that can easily lead to serious family disputes or even Probate Litigation.

What if an Agent Ignores the Revocation Notice?

Once you have delivered a formal, notarized revocation, the agent’s authority is terminated. If they continue to act on your behalf, their actions are no longer just inappropriate—they are unlawful.

If this happens, it is time to get legal help immediately. An attorney can send a formal cease-and-desist letter, which puts the former agent on official notice that they face serious legal consequences. Should the behavior persist, your lawyer can take court action to enforce the revocation, stop the agent’s actions, and help you recover any assets or damages that resulted from their unauthorized conduct.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.