Revoking a Power of Attorney (POA) in Texas requires a formal written process. It’s not enough to simply state your wishes verbally. You must create a formal document declaring the revocation, sign it in front of a notary, and deliver a copy to your former agent and any institution, like a bank or doctor, that has been relying on the original POA. The revocation is only legally effective once your agent has actual notice of your decision.

Knowing When and Why to Revoke a Power of Attorney

Making the choice to revoke a Power of Attorney can feel heavy. Life circumstances change, and what was once a source of security can become a significant risk. A POA gives another person—your “agent”—a great deal of control over your affairs. Reclaiming that authority is not a sign of failure; it’s a responsible and necessary step to protect your well-being. Before diving in, it helps to understand the fundamental aspects of a Power of Attorney to grasp the full weight of the document you’re canceling.

Common Reasons for Revocation

Life is rarely predictable, and the reasons for needing to change your agent are almost always deeply personal. We have helped countless Texas families navigate this transition for a variety of valid reasons.

Here are a few common situations that trigger a revocation:

- A Change in Relationships: A divorce, a serious falling out, or simply growing apart from your agent can make the arrangement feel wrong or even risky.

- Loss of Trust: This is the most critical reason. If you lose confidence in your agent’s judgment, their financial responsibility, or their ability to truly act in your best interests, you must act quickly.

- The Agent is Unable to Serve: Your agent might pass away, move far away, or become incapacitated themselves, making it impossible for them to fulfill their duties.

- You No Longer Need Assistance: Perhaps your health has improved or your situation has stabilized, and you feel perfectly capable of managing your own affairs again.

A Realistic Scenario in Texas

Let’s consider a realistic scenario we often see. Imagine Maria, a retiree in Houston, appointed her son, David, as her agent years ago. Lately, she’s noticed David struggling with his own finances and making decisions about her accounts that seem to benefit him more than her. Her trust is broken, but she’s scared of causing a family conflict.

Maria’s gut feeling is a clear signal that a change is necessary. Revoking the POA isn’t about punishing David; it’s about protecting her life savings and ensuring her needs are met by someone she can fully trust. As we explain in our guide on what a power of attorney is, this document is built entirely on a foundation of trust. Once that foundation cracks, you must take protective action.

Key Insight: Takeaway

Revoking a Power of Attorney is a proactive measure of self-protection. It ensures the person managing your affairs is someone you trust completely to act solely in your best interest, aligning with your current wishes and life circumstances.

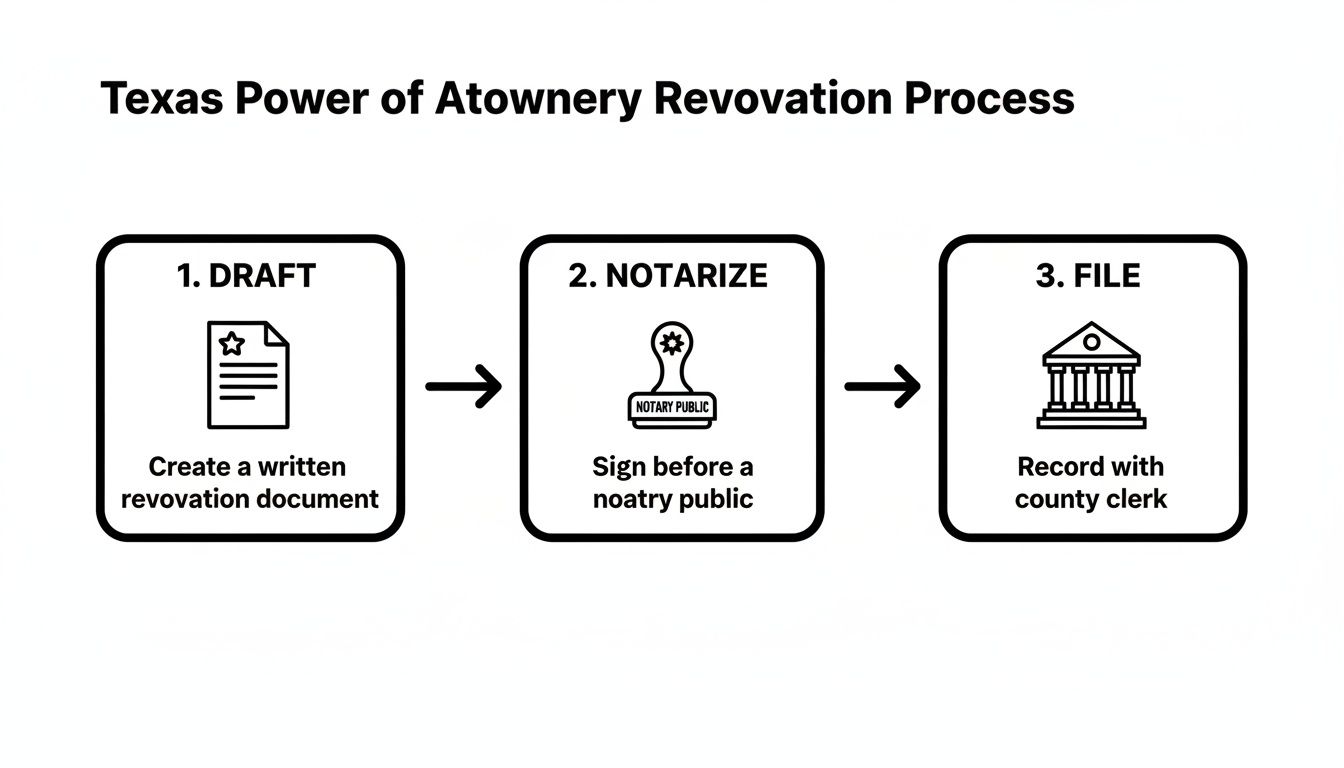

Understanding the Legal Steps for POA Revocation in Texas

Once you’ve decided to revoke a Power of Attorney, the Texas process is quite direct. It’s designed to protect you—the “principal” (the person who created the POA)—and make your intentions legally clear. It all begins with putting your decision in writing.

Under the Texas Estates Code (specifically Title 2, Subtitle P), simply saying you want to cancel a POA is not legally sufficient. You must create a formal Revocation of Power of Attorney document. This document should clearly state your full name, the name of the agent you are removing, the date of the original POA, and a direct statement that you are revoking all authority granted in that document.

Why Notarization is Non-Negotiable

After drafting the revocation, the next step is absolutely critical to making it legally binding: you must sign it in front of a notary public. A notary serves as an impartial official witness, verifying your identity and confirming that you are signing the document of your own free will. This is a powerful safeguard against any future claims of fraud or coercion.

In Texas, a notarized signature gives your revocation the legal weight it needs to be honored by banks, hospitals, and courts. It eliminates any doubt about the document’s authenticity. This is especially important when you consider the different types of authority an agent might hold, such as in a durable vs. medical power of attorney, as each comes with serious responsibilities.

The Critical Concept of Actual Notice

A signed and notarized revocation is a great start, but it’s not the final step. For the revocation to be effective, Texas law requires that any third party—like your bank or doctor’s office—must have “actual notice” or “actual knowledge” of the change. You cannot just sign the document and file it away. You must actively inform everyone who was relying on the old POA.

If the original POA was recorded with the county clerk (a common step if real estate is involved), you must also file your written revocation in the same county’s public records. This creates an official, public timestamp of the change, preventing a former agent from trying to sell or transfer your property without authority.

Key Insight: Takeaway

Recording your revocation with the county clerk is a non-negotiable step if the original POA involved real estate. It puts the entire world on “actual notice” that the agent’s power is gone. We have seen situations where this simple step prevented massive financial abuse and saved families from years of legal headaches.

Drafting and Distributing Your Revocation Notice

Once you’ve made the decision to revoke a Power of Attorney, the next steps are all about action. This isn’t just about writing a letter; it’s about creating a clear, legally sound record and making sure it gets into the right hands. Think of it as building a legal firewall around your assets and personal decisions.

The process in Texas really boils down to three key actions: drafting the notice, getting it notarized, and then distributing it to everyone who needs to know.

Each of these steps is essential. If you skip one, the whole effort could be invalid, leaving your old agent with the power you intended to take away.

Creating the Revocation Document

Your written revocation notice doesn’t need to be filled with complex legal jargon, but it absolutely must be precise. This document is your official declaration, and it must be crystal clear.

To be effective under the Texas Estates Code, it must include:

- Your full legal name as the principal.

- The full legal name of the agent whose authority you are revoking.

- The date the original Power of Attorney was signed. This is crucial for identifying the specific document you’re canceling.

- An unmistakable statement of revocation. Something as direct as, “I hereby revoke any and all authority granted to [Agent’s Name] in the Power of Attorney dated [Original Date].”

After you’ve drafted the notice, you must sign it in the presence of a notary public. This step is non-negotiable in Texas. The notarization confirms your identity and your intent, giving the document its legal authority, similar to the formal execution required when creating legally sound Wills & Trusts.

Notifying Your Former Agent and Third Parties

A signed and notarized revocation notice has no power until the right people know it exists. The single most important person to notify is the former agent themselves. In legal terms, their authority only ends when they receive “actual notice” of the revocation.

Do not rely on a phone call or an email. You need proof. Send the signed and notarized revocation notice via certified mail with a return receipt requested. That little green card that comes back to you is your legal proof that they received the document and the date they signed for it. Hand-delivering it with a neutral third-party witness present is another solid option.

Key Insight: Takeaway

Simply telling your agent “you’re fired” is not enough. You must formally deliver the written revocation. This physical delivery is what legally terminates their power under Texas law and protects you from any further actions they might attempt to take on your behalf.

Next, you need to make a list of every single bank, doctor’s office, financial advisor, or institution that has a copy of the old POA and send them a copy of the revocation. This notification step is a vital part of the overall Texas Probate Process, which relies heavily on proper notice to all involved parties.

If your revocation notice needs to be presented in a different language for an institution or agent, you might want to review some tips for translating legal documents to ensure nothing gets lost in translation.

The Importance of Notifying Banks and Other Institutions

Signing your revocation document is a monumental step, but it’s only half the battle. To truly pull the plug on an old Power of Attorney, you have to tell everyone who was relying on it. Until third parties have “actual notice” of the change, they can legally continue to honor the old POA, even if you’ve revoked it.

This is where things can go sideways, fast. Financial institutions, medical providers, and government agencies like the Social Security Administration are required to follow the documents they have on file. Simply put, they don’t know what they don’t know, and that communication gap could leave your finances or healthcare decisions exposed.

The High Stakes of Incomplete Notification

Failing to notify every institution leaves you incredibly vulnerable. A dishonest former agent could exploit this gap to withdraw funds, change beneficiaries, or even take out debt in your name. The fallout from something like that isn’t just financially devastating; it’s an emotional nightmare that often requires complex legal action to untangle.

This isn’t just theoretical. The heartbreaking story of Sarah Fauntleroy, an 88-year-old grandmother, is a sobering real-world example. She trusted a former attorney with her power of attorney, who then abused that authority to liquidate her annuity and siphon off nearly $96,000. This case, which ended in a federal conviction for wire fraud, underscores the severe risks of not closing the loop after a POA is revoked. You can learn more about how these devastating situations unfold in FBI reports.

Creating Your Communication Plan

To make sure your revocation is effective everywhere, you need a methodical game plan. Start by making a comprehensive list of every single person and organization that has a copy of the old POA or has ever dealt with your former agent on your behalf.

Your notification list should absolutely include:

- Financial Institutions: Banks, credit unions, brokerage firms, and financial advisors.

- Healthcare Providers: Doctors’ offices, hospitals, pharmacies, and insurance companies.

- Government Agencies: The Social Security Administration, IRS, and Department of Veterans Affairs.

- Other Professionals: Your accountant, insurance agent, and any other attorneys.

Once you have your list, send a copy of the signed and notarized revocation notice to each one. We always advise clients to use certified mail, as it provides a receipt proving they were officially informed.

Key Insight: Takeaway

Keep a detailed communication log. For every institution you contact, write down the date you sent the revocation, the certified mail tracking number, the name of anyone you spoke with, and the date they confirmed the update. This log becomes invaluable evidence if a dispute ever arises and could be the very thing that protects you from costly probate litigation.

What to Do When Your Former Agent Won’t Cooperate

It’s a deeply unsettling thought. You’ve done everything by the book to revoke a power of attorney, but your former agent simply refuses to accept it. What happens then? This is an incredibly challenging and emotionally draining situation, but you are not powerless.

When an agent digs in their heels, refusing to acknowledge the revocation or return the original POA document, you have clear, firm options under Texas law to protect yourself or your loved one.

The first move is usually a formal demand letter from an attorney. This isn’t just a simple request; it’s a legal notice that warns the uncooperative agent of the serious legal consequences of continuing to act as if they have authority they no longer possess. At the same time, you must directly contact every bank, investment firm, and medical provider to put them on notice that the POA is no longer valid.

When You Have to Escalate

If you suspect the agent has been misusing funds or is taking advantage of the principal, the situation demands a much stronger response. In cases of suspected exploitation, especially when a vulnerable adult is involved, your next call should be to Texas Adult Protective Services (APS). Their investigation adds an official layer of protection and creates crucial documentation.

Furthermore, if there is hard evidence of theft or fraud, it may be time to contact law enforcement. These actions can feel drastic, but they are absolutely essential to stop the abuse and hold the former agent accountable. You can learn more about the warning signs in our guide on the abuse of power of attorney.

Key Insight: Takeaway

When an agent goes rogue, speed and documentation are your best allies. Acting swiftly to send legal notices and alert institutions creates a paper trail that protects the principal and limits the damage an uncooperative agent can inflict.

Considering Guardianship When the Principal Is Incapacitated

What if the person who created the POA (the principal) is no longer mentally competent to protect themselves? In this heartbreaking scenario, you can’t simply revoke the POA on their behalf. The most effective legal remedy is often to pursue a Guardianship.

A Texas court can intervene, officially terminate the agent’s authority, and appoint a responsible guardian to manage the principal’s affairs and safeguard their well-being. This legal process ensures a difficult family conflict doesn’t have to be faced alone.

What to Do After Revoking a Power of Attorney

You’ve successfully revoked your power of attorney, which is a huge step in protecting yourself and your assets. But the job isn’t quite done. Think of it like this: you’ve removed a bad driver from behind the wheel, but now you need to make sure a trusted person has the keys for any future emergencies.

Lock In Your New Plan

Your first and most important move is to create a new Power of Attorney. Do not leave that seat empty. Having a trustworthy agent in place is your best defense against future uncertainty. If you become incapacitated without a valid POA, your family could be forced into a court-ordered Guardianship, which is a far more public, expensive, and complicated ordeal.

At the same time, it’s time for a clean sweep. Track down every single copy of the old, revoked document—originals, photocopies, digital scans—and destroy them securely. This isn’t just about being tidy; it’s about preventing any possibility of confusion. You don’t want an old, invalid POA floating around for someone to mistakenly accept.

Taking these two steps brings clarity and strength to your new estate plan. It’s a fundamental part of good Wills & Trusts planning.

Key Insight: Takeaway

Dropping the ball on notification can have disastrous consequences. Legally, third parties can still rely on an unrevoked POA if they haven’t been properly notified, meaning you could be held responsible for actions taken by your former agent. You can dig deeper into the legal framework behind POA notification requirements.

Common Questions About Revoking a Power of Attorney in Texas

When it comes to unwinding a power of attorney, families often have a lot of questions. The process can feel intimidating, but understanding your rights is the first step. Here are some of the most common scenarios we see and how Texas law addresses them.

Can I Revoke a “Durable” Power of Attorney?

Absolutely. This is a common point of confusion. The term “durable” simply means the POA was designed to stay in effect even if you become incapacitated. It does not mean it’s permanent or irreversible.

As long as you (the principal) are still mentally competent and can make your own decisions, you have the absolute right to revoke a durable power of attorney at any time, for any reason. The process is exactly the same: draft a formal revocation, sign it before a notary, and deliver notice to the agent and all relevant institutions.

What if My Loved One Is No Longer Mentally Competent?

This is a heartbreaking and difficult situation. If the person who created the POA (the principal) has lost the mental capacity to understand their actions and make decisions, they can no longer legally revoke it themselves. The right to revoke belongs to them, and if they can’t exercise it, the document stands.

In these cases, concerned family members can’t just step in and tear up the POA. The only path forward is to petition a Texas court to establish a guardianship.

A judge will evaluate the situation, and if they determine the agent is not acting in the principal’s best interest, the court can terminate the agent’s authority. The judge will then appoint a guardian to take over and manage the person’s affairs, ensuring they are protected from that point on.

Does Divorce Automatically Revoke a POA in Texas?

Yes, in most cases, it does. Under the Texas Estates Code § 751.132, when a final divorce decree is signed, any power of attorney you granted to your former spouse is automatically terminated by law.

Key Insight: Takeaway

Even though the law handles this for you, don’t rely on it alone. It’s a critical best practice to also issue a formal, written revocation. Sending this document to banks, doctors, and title companies prevents any confusion and slams the door shut on any potential disputes over your ex-spouse’s authority. It’s about making a clean break and leaving no room for error.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.