Dealing with a loved one's estate is an overwhelming task, especially when you're also navigating grief. We understand that legal processes can feel intimidating during such a difficult time. In Texas, there's a unique legal tool designed to make this process a little less painful for families: the Muniment of Title. Think of it as an express lane for probate, a way to transfer property directly to beneficiaries using a valid Will, but without the time, cost, and complexity of a full estate administration.

A Simpler Path to Transferring Property

When an estate qualifies, probating a Will as a Muniment of Title is a much faster and more affordable alternative to traditional probate. Instead of appointing an executor to manage the entire estate, the court simply issues an order. This order legally recognizes the Will as the official document transferring ownership from the deceased to their beneficiaries.

This process is a game-changer for estates where the main asset is real estate, like the family home. The name itself, "muniment," comes from a Latin word for "fortress." It’s meant to describe a document that serves as solid proof of ownership, protecting a person’s rights to their property. Historically, things like deeds and court judgments have served this very purpose, creating a clear and defensible chain of title. You can discover more about the history of ownership documents on Wikipedia.com.

Comparing the Two Probate Paths

To really grasp the benefits, it helps to see how this streamlined process stacks up against a full, traditional probate administration. The differences in time, cost, and complexity are stark, and for grieving families, choosing the right path can provide significant relief.

Let's break down the key distinctions.

Muniment of Title vs. Traditional Probate at a Glance

| Feature | Muniment of Title | Traditional Probate |

|---|---|---|

| Executor Required | No, an executor is not appointed. | Yes, the court appoints an executor. |

| Timeline | Typically faster (weeks to a few months). | Often longer (several months to over a year). |

| Primary Purpose | To legally transfer title of property. | To pay debts and distribute all estate assets. |

| Cost | Generally more affordable due to fewer steps. | More expensive due to administrative duties. |

| Complexity | Simpler, with a single court hearing. | Involves multiple steps and court oversight. |

As you can see, the Muniment of Title path cuts out a lot of the administrative red tape.

This option is available only under specific conditions, which are laid out in the Texas Estates Code, Section 257.001. For the right situation, it provides families with a clear, direct, and far less stressful path to honoring their loved one's final wishes without unnecessary delay or expense.

Does Your Estate Qualify for This Process?

Not every estate can take this probate shortcut. Texas Estates Code, Chapter 257 is very clear—it sets out strict, non-negotiable requirements. Figuring out if you meet these qualifications is the first and most critical step in deciding whether a Muniment of Title is the right path for your family.

This process can simplify things during an already difficult time, but only if the estate's circumstances are a perfect fit. If not, a more traditional probate will be necessary. For situations where there isn't a Will at all, other routes like an Affidavit of Heirship might be on the table.

The Three Core Requirements

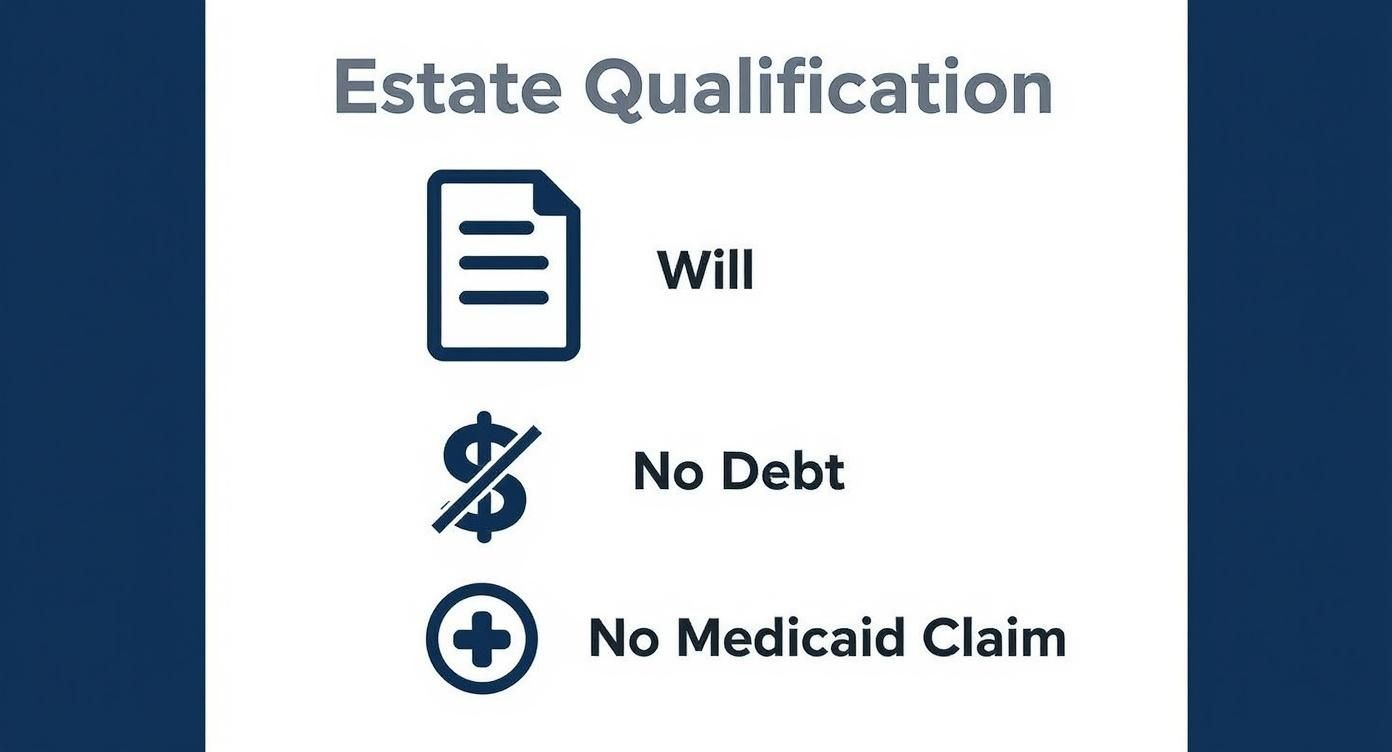

To probate a Will as a Muniment of Title, the estate has to check three specific boxes. An experienced attorney can give you a definitive answer, but here are the key factors a probate court is going to look at.

- There Must Be a Valid Will: This is the absolute starting point. The person who passed away must have left behind a legally sound, written Will that clearly spells out their wishes for their property. Without a valid Will, this process is not an option. Our firm can help you create legally sound Wills & Trusts to protect your family's future.

- The Estate Must Have No Unsecured Debts: This is where many people get tripped up. It’s perfectly fine for the estate to have debts secured by property, like a mortgage on a house. What it cannot have are unsecured debts—think credit card bills, medical expenses, or personal loans. The logic is simple: a Muniment of Title doesn't involve an executor, so there's no one officially appointed to pay off those creditors.

- No Pending Medicaid Claims Exist: The State of Texas can't have a pending claim against the estate to recover the costs of any Medicaid benefits the deceased might have received.

Key Insight: That "no unsecured debt" rule is the single most common reason an estate gets disqualified. It's crucial to understand the difference. A mortgage is tied to the house (a secured debt), but credit card debt is just floating out there (an unsecured debt) and needs to be settled from the estate's assets.

Breaking Down the Muniment of Title Process Step by Step

Knowing the legal road ahead can bring a sense of clarity and control during what is often a very difficult time. The muniment of title process was designed to be a more direct path than traditional probate, and understanding what to expect can make the whole experience feel less intimidating. At its core, it’s a clear series of steps to validate a Will and officially transfer property ownership.

What makes this process so efficient is that it completely sidesteps the need to appoint an executor. That single difference is what dramatically cuts down on both the time and the costs that usually come with settling an estate. If you want to see how this fits into the bigger picture of estate administration, you can find some great general info on how to settle an estate.

This infographic neatly sums up the key qualifications an estate must have to even be considered for this streamlined path.

As you can see, those three conditions—a valid Will, no unsecured debts, and no Medicaid claims—are the absolute, non-negotiable starting point. Without them, this option is off the table.

The Five Key Stages

Once an attorney gives the green light and confirms the estate qualifies, the journey through the probate court follows a very predictable path. Each step is designed to be straightforward and get you to a final resolution quickly.

File the Application: The process kicks off when an interested party—almost always a beneficiary named in the Will—files an application with the proper Texas probate court. It's crucial that the original Will is submitted right along with it.

Public Notice and Waiting Period: After the application is filed, Texas law mandates a short waiting period. During this time, a public notice gets posted at the courthouse, letting the public know about the pending probate action.

Attend a Single Court Hearing: This is really the main event. You'll attend a hearing where a judge reviews the Will and the application. The judge's job is simple: confirm the Will is legitimate and that the estate meets all the legal requirements for a muniment of title.

Receive the Court's Order: If everything checks out, the judge will sign a court order admitting the Will to probate as a muniment of title. This order is the powerful legal document that officially recognizes the Will's authority to transfer property.

Record the Order: The last step is to take a certified copy of that court order and file it in the real property records for whatever county the property is in. This action officially updates the chain of title, much like filing a new deed would. For a closer look at this part of the process, our guide on how to change a deed on a house has some helpful details.

A Real-World Example of Muniment of Title

Legal processes can feel abstract and distant, so let’s walk through how a Muniment of Title works for a real Texas family.

Picture the Garcias—two adult children grieving the recent loss of their father. He left behind a clear, valid Will that named them as the sole heirs to the family home. It was a straightforward situation with no complicating factors, which is exactly what this process is designed for.

While their father still had a mortgage on the house, he had no other significant debts—no lingering credit card bills or outstanding medical expenses. During such a difficult time, the thought of navigating the full Texas Probate Process felt completely overwhelming.

A Simpler Path Forward

Their attorney reviewed the Will, looked at the estate’s simple financial picture, and recommended probating the Will as a Muniment of Title. You could almost feel the wave of relief wash over the Garcias. This route meant they could sidestep the lengthy duties of a full probate administration, like appointing an executor or formally notifying creditors.

The process moved surprisingly fast. After filing the application and the Will with the court, they only had to attend a single, straightforward hearing. The judge reviewed the documents, confirmed the estate met all the requirements under the Texas Estates Code, and signed an order. That order was the key—it officially recognized the Will as the legal document transferring the house to them.

The very last step was simple. Their attorney filed a certified copy of the court’s order in the county property records. Just like that, the family home was officially in their names. Their story is a perfect example of how this unique Texas tool helps families transfer property with efficiency and compassion.

The Good, The Bad, and The Complicated

When you're settling an estate, you want the clearest, most direct path forward. For the right kind of estate, the Muniment of Title process in Texas feels like a godsend. But it's not a magic wand, and it's crucial to understand both its powerful benefits and its very real limitations before you head down this road.

The upsides are compelling: speed, privacy, and lower costs. Because you skip appointing an executor and all the formal administrative steps of a traditional probate, the whole thing is dramatically faster and cheaper. We're often talking a matter of weeks, not months or years, giving families a quick, private resolution without the court looking over their shoulder.

Knowing the Trade-Offs Before You Commit

That simplicity, however, comes at a price. A Muniment of Title is a specialized tool, not a one-size-fits-all solution. You have to know what you're giving up.

- No Unsecured Debts Allowed: This is a hard-and-fast rule. The process is only an option for estates without debts like credit card bills, lingering medical expenses, or personal loans. If the estate owes money to anyone other than a mortgage lender, you'll need a more formal probate administration to settle those claims. Sometimes, disputes over debts can lead to Probate Litigation.

- No Executor Means No Letters Testamentary: In a full probate, the court issues a document called Letters Testamentary. Think of this as the executor's hall pass—it’s the official paper that proves they have the authority to act. With a Muniment of Title, there is no executor, so there are no Letters.

- Potential Headaches with Banks: This is where the lack of Letters Testamentary can cause real problems. Financial institutions, especially big national banks with headquarters outside of Texas, are trained to ask for Letters. When you show them a Muniment of Title order instead, you might get a blank stare, creating frustrating delays or forcing you back to your attorney for help.

If you're looking for other ways to simplify the process, our guide on when probate is not necessary in Texas is a great place to start.

Common Questions About Muniment of Title

Any legal process comes with its own set of questions. When Texas families are considering a Muniment of Title, a few key concerns almost always come up. Let's tackle them head-on.

How Long Does This Process Usually Take?

One of the biggest draws of a Muniment of Title is its speed. While every case has its own timeline, this process is usually wrapped up in just a few weeks to a couple of months.

That's a world away from traditional probate, which can easily drag on for many months or even more than a year. For families looking for a quick, clean resolution, the difference is huge.

What Happens If a Debt Is Found Later?

This is a really important question, and it gets to the heart of why a thorough upfront review of the estate is so critical. If an unsecured debt—think an old credit card bill—pops up after the court has already granted the Muniment of Title, things can get complicated fast.

Because this process doesn’t appoint an executor to handle creditors, the beneficiaries themselves could become personally responsible for sorting out that debt. In some situations, it could even mean having to reopen the estate and go through a more formal administration, which wipes out all the time and money you saved.

Can This Transfer Assets Besides Real Estate?

A Muniment of Title is truly designed to transfer title to real estate—that’s its primary job. That said, it can sometimes work for simple financial accounts like a local bank account.

Key Insight: Here’s a big heads-up: many financial institutions, especially the large national banks, might not be familiar with a Muniment of Title. They are used to seeing Letters Testamentary, which are official documents issued only in a full probate. They might dig in their heels and refuse to release funds without them, creating frustrating delays. An attorney can often step in to resolve these logjams, but it’s a potential roadblock you need to be aware of from the very beginning.

How a Probate Attorney Can Guide You

While a Muniment of Title is definitely one of the more straightforward probate paths in Texas, navigating any court proceeding still demands legal precision. Think of an experienced Texas probate attorney as your advocate—the person who makes sure every document is filed correctly and on time, all while confirming the estate meets the strict eligibility rules under the Texas Estates Code.

Your lawyer is the one standing beside you at the court hearing. They’ll field any questions from the judge and help you sidestep common pitfalls that could otherwise delay or even completely derail the transfer of the property. A huge part of their job is simply clarifying the legal pathways for inherited assets and offering general guidance on selling an inherited house and probate if that's your end goal. Should a loved one become unable to manage their own affairs, we can also assist with establishing a Guardianship.

Ultimately, hiring an attorney gives you peace of mind. It allows you to focus on your family during a difficult time, confident that all the legal details are in expert hands.

Key Takeaway

Muniment of Title is an excellent, cost-effective tool for Texas estates with a valid Will, no unsecured debts, and real estate as the primary asset. It provides a direct path to transfer property, avoiding the lengthy and complex process of full probate administration. However, its limitations mean it isn't suitable for every situation, especially if the estate has debts or complex assets. Consulting with a probate attorney is the best way to determine if this streamlined option is the right choice for your family.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.