When it comes to estate planning in Texas, you’ll hear a lot of talk about wills and trusts. But one of the most practical and powerful tools for homeowners often flies under the radar: the Lady Bird Deed.

Officially known as an Enhanced Life Estate Deed, this document is a compassionate way to transfer your real estate to a loved one automatically when you pass away—all without getting tangled up in the expensive and time-consuming probate process. It’s a plain-English solution designed for Texas families.

What Is a Lady Bird Deed in Simple Terms?

Let’s be honest, estate planning can feel complicated and intimidating. Most families are just looking for a straightforward way to pass on their home without creating a legal headache for their children during a time of grief. This is exactly where a Lady Bird Deed shines.

Think of it like a "payable-on-death" designation you might put on a bank account, but for your house. While you're alive, the property is 100% yours to do with as you please. After you’re gone, ownership flips to the person you named as your beneficiary, almost instantly and without court intervention.

The Power of Full Control and Flexibility

This isn't one of those estate planning tools that locks you into a decision you might regret later. The "enhanced" part of its official name is what gives you total freedom and peace of mind.

While you're alive, you keep the right to:

- Sell the Property: Change your mind and want to sell? You can, at any time, without asking your beneficiary for permission. The money is all yours.

- Mortgage or Refinance: Need to pull equity out of your home or get a new loan? Go right ahead. Your beneficiary has no say in the matter.

- Change or Revoke the Deed: Life is unpredictable. If your relationships change, you can easily switch the beneficiary or cancel the deed entirely.

This level of control is what makes a Lady Bird Deed so appealing. Your home remains your asset, under your command, for the rest of your life. Your beneficiary has zero legal claim to it until you pass away.

To make this clearer, here’s a quick breakdown of how the rights are split between the property owner (the Grantor) and the future heir (the Remainderman).

Lady Bird Deed at a Glance

| Feature | Owner's Rights (Grantor) | Beneficiary's Rights (Remainderman) |

|---|---|---|

| Control During Lifetime | Complete control. Can sell, lease, or mortgage the property without beneficiary's consent. | No rights or control. Cannot interfere with the owner's decisions. |

| Right to Sell | Yes. Can sell the property and keep all proceeds. | No. Beneficiary's interest is eliminated if the property is sold. |

| Right to Change Beneficiary | Yes. Can change or remove the beneficiary at any time by filing a new deed. | No. Their future interest is not guaranteed and can be revoked. |

| Transfer on Death | The property automatically transfers to the beneficiary upon the owner's death. | Receives the property automatically, avoiding probate. |

| Creditor Protection | Property is subject to the owner's creditors during their lifetime. | Receives the property subject to any existing liens (like a mortgage). |

This table shows the clear division: the owner holds all the cards, while the beneficiary simply has a future interest that only becomes real after the owner’s death.

Bypassing the Texas Probate Process

Perhaps the most compassionate feature of a Lady Bird Deed is how it shields your family from probate court. Probate is the formal legal process of settling an estate. It can drag on for months, sometimes years, racking up court costs and attorney’s fees that eat into the inheritance you meant to leave behind.

Instead of hiring lawyers and waiting for a judge, your loved one just needs to file your death certificate with the county clerk. That simple act makes the transfer official, giving them clear title to the property quickly and privately. It’s a clean, efficient path that protects your legacy and lets your family grieve without an added legal burden. You can learn more about what this avoids by exploring the Texas Probate Process.

How a Lady Bird Deed Helps Texas Families Avoid Probate

When a loved one passes away, the last thing a grieving family wants to face is a drawn-out court proceeding. Yet, that’s often what traditional Texas probate feels like—a public, court-supervised process that can drag on for months, adding stress and expense when you’re most vulnerable.

This is where a Lady Bird Deed becomes an incredibly powerful tool. It’s designed to sidestep the entire probate system. Officially known as an enhanced life estate deed and recognized under Texas law, it allows for a direct, seamless transfer of property the moment the owner dies.

Instead of hiring lawyers and waiting for a judge, the beneficiary simply takes a certified copy of the death certificate down to the county clerk’s office where the property is located. The clerk records the death, updates the property records, and just like that, the property has a new owner.

This straightforward process, supported by principles in the Texas Estates Code, is a game-changer for families looking to avoid the cost and headache of probate court.

A Realistic Scenario: The Thompson Family

Imagine Maria, a widow in Houston, who wants to leave her home to her son, David. Concerned about probate delays, her attorney helps her create and file a Lady Bird Deed naming David as the beneficiary. Years later, when Maria passes away, David is grieving and overwhelmed. However, because of the deed, he doesn't have to open a probate case. He gets a few certified copies of his mother’s death certificate, takes one to the Harris County Clerk’s office, and files a simple affidavit. Within days, the house is legally his, and he can focus on his family instead of court dates.

The Filing Process Is Simple and Fast

Once the property owner passes away, the beneficiary's next steps are clear and manageable:

- Obtain a certified copy of the death certificate from the local vital statistics office.

- Take the death certificate to the county clerk's office in the county where the property is located.

- File an affidavit (a sworn statement) and the death certificate, paying a small recording fee.

- The clerk officially records the transfer, making the new ownership a matter of public record.

A Path Forward with Empathy and Privacy

We know that navigating legal steps after a loss can feel overwhelming. The beauty of avoiding probate is that it keeps your family’s affairs private. There are no public notice requirements for creditors to see and no court hearings for the public to attend. The transfer happens quietly and efficiently, letting loved ones focus on healing instead of being buried in paperwork.

If the beneficiaries are minors, it's also important to plan for their care. Our firm can provide Guardianship guidance to ensure a smooth transition and secure their well-being.

To see how this stacks up against other estate planning tools, take a look at our guide to Wills & Trusts.

What Happens Without a Probate-Avoidance Plan?

When a property goes through traditional probate, the process is far more involved and can take months, if not longer.

- An executor must file an application with the probate court to get "Letters Testamentary."

- A notice must be published in a local newspaper to alert potential creditors.

- All assets have to be inventoried, appraised, and filed with the court.

- The court has to approve all actions, including paying debts and finally distributing the property.

It’s a long, drawn-out path that can leave families drowning in legal bills and administrative tasks. A Lady Bird Deed cuts through all that, turning a months-long court case into a simple, one-time filing. In short, a Lady Bird Deed offers Texas families a faster, more compassionate way to handle real estate inheritance.

Our team can help review your deed, answer your questions, and even assist with Probate Litigation if other parts of an estate become contested.

Key Advantages and Protections You Gain

While avoiding probate is often what brings Texas families to the Lady Bird Deed, its real power lies in the layers of protection it offers. Think of it as more than just a probate workaround; it's a powerful shield for your family's most valuable asset, defending it against financial threats, hefty tax bills, and giving you total peace of mind.

One of the biggest worries we hear from clients is what happens to their home if they need long-term care and have to rely on Medicaid. This is where a Lady Bird Deed isn't just helpful—it can be a financial lifesaver.

Safeguarding Your Home from Medicaid Recovery

Texas has a program called the Medicaid Estate Recovery Program (MERP). In simple terms, this means that after a person who received Medicaid benefits passes away, the state can try to get its money back by making a claim against their probate estate. For most folks, their home is their biggest asset, making it the number one target for MERP.

This is where the Lady Bird Deed shines. Because the deed transfers your home to your chosen beneficiary the moment you pass away, the property never officially enters your probate estate. It completely bypasses that process. By keeping the house out of probate, you effectively shield it from MERP's reach, preserving it for your kids or grandkids just as you intended. You can read more about the power of non-probate transfers on FTIC.net.

Securing Valuable Tax Benefits for Your Heirs

Here’s another huge win: the "step-up in basis." When your beneficiary inherits the property through a Lady Bird Deed, the home's value for tax purposes gets "stepped up" to whatever it was worth on your date of death.

Let’s make that real with an example: Say you bought your home years ago for $50,000. Now, it’s worth $350,000. If your child inherits it and decides to sell it right away for that price, their capital gains are calculated from that new $350,000 value, not your old $50,000 purchase price.

This means your beneficiary could sell the house for its current market value and likely pay zero—or very little—in capital gains tax. Without that step-up, they'd be on the hook for taxes on the $300,000 profit, a massive financial hit. This tax benefit alone makes it far superior to simply gifting the house during your lifetime. For a deeper dive into your options, check out our guide on the five ways to give your house to your kids.

Maintaining Ultimate Flexibility and Control

Finally, and this is what makes the Lady Bird Deed so unique, you give up absolutely none of your rights as the homeowner. This isn't a traditional life estate where you're stuck and need your kids' permission to do anything. The "enhanced" part of this deed means you keep all the power.

You can still:

- Sell the house to anyone you want, whenever you want, without even telling your beneficiary.

- Take out a mortgage or a reverse mortgage to pull cash out of your home's equity.

- Completely change your mind. You can file a new deed naming a different beneficiary or just cancel the Lady Bird Deed altogether.

This flexibility is priceless. Life is unpredictable. You might need to move, access money, or have a change of heart about who inherits. The Lady Bird Deed lets you adapt to whatever comes your way without being legally handcuffed to an old decision. It truly delivers the best of both worlds: future protection for your family and complete control for you today.

Comparing Your Estate Planning Options for Real Estate

Deciding how to pass your home on to your loved ones is one of the biggest choices you'll make in estate planning. Texas offers several tools, but they all come with different costs, complexities, and levels of control. A Lady Bird Deed is a popular, streamlined option for real estate, but how does it really stack up against a traditional will, a revocable living trust, or a Transfer on Death Deed (TODD)?

To make the right choice for your family, you have to look at these tools side-by-side.

Lady Bird Deed vs. a Traditional Will

The biggest difference here boils down to one word: probate. A will guarantees your estate will go through probate court. Think of the will as a set of instructions for the judge, who then supervises how your assets are distributed according to the Texas Estates Code. This process means court fees, attorney costs, and a public record of your family's private affairs.

A Lady Bird Deed, on the other hand, avoids probate completely. The property transfers automatically to your beneficiary the moment you pass away. Your loved one simply needs to file your death certificate with the county clerk, completing the transfer quickly, privately, and for a fraction of the cost of probate.

Lady Bird Deed vs. a Revocable Living Trust

A revocable living trust is a fantastic, powerful tool for managing a whole range of assets, not just your house. It gives you detailed control over how and when your assets are distributed and can also avoid probate.

The trade-off? A trust is almost always more complex and expensive to create and maintain. You have to formally transfer your property into the trust—a process called "funding"—which adds another layer of legal paperwork. For families whose main goal is just to transfer their home efficiently, a Lady Bird Deed is a far simpler and more cost-effective solution.

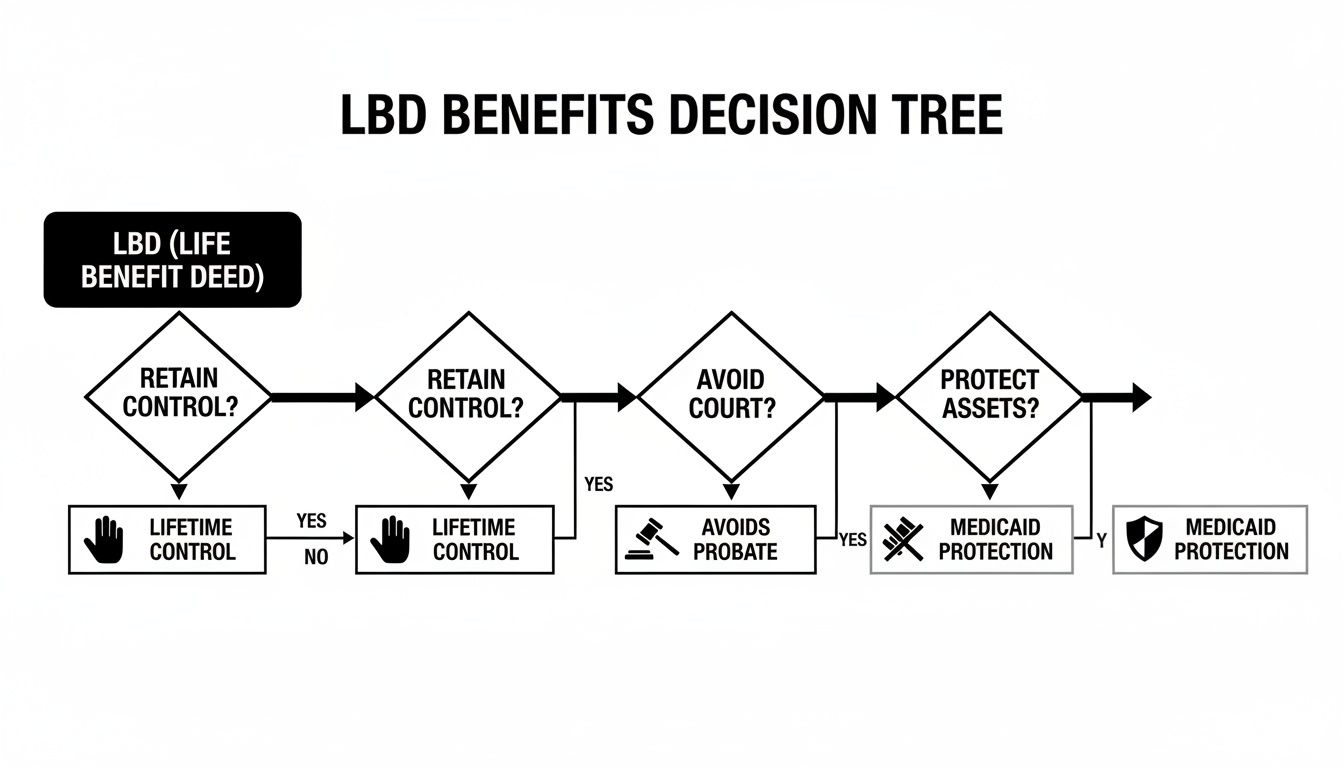

The decision tree below shows why the Lady Bird Deed is such a compelling choice for many Texas homeowners.

This visual gets to the heart of it. A Lady Bird Deed lets you maintain complete lifetime control, bypasses the headaches of probate court, and offers valuable protection for Medicaid planning.

Lady Bird Deed vs. a Transfer on Death Deed (TODD)

The Transfer on Death Deed, or TODD, is often seen as a close cousin to the Lady Bird Deed. Both are authorized by the Texas Estates Code (specifically Chapter 114) and designed to transfer property outside of probate. But there are a few critical distinctions that often make the Lady Bird Deed a more flexible and protective option.

A key difference lies in how they handle creditor claims and Medicaid recovery. While both deeds avoid probate, a TODD comes with a two-year "look-back" period where creditors of the estate can still try to lay claim to the property after your death. A Lady Bird Deed typically offers more robust protection from these claims, especially from the Medicaid Estate Recovery Program (MERP), because the property is never considered part of the probate estate to begin with.

If qualifying for Medicaid is even a remote possibility, the Lady Bird Deed is almost always the superior choice. You can explore a more detailed comparison by reading about the Texas probate transfer on death deed alternative.

Estate Planning Tools for Your Home Compared

To help you see the differences more clearly, we’ve put together a simple comparison table. This chart lays out the key features of each tool side-by-side, so you can quickly see how they measure up on the things that matter most.

| Feature | Lady Bird Deed | Will | Revocable Living Trust | Transfer on Death Deed (TODD) |

|---|---|---|---|---|

| Probate Avoidance | Yes, avoids probate entirely. | No, guarantees probate. | Yes, avoids probate entirely. | Yes, avoids probate entirely. |

| Control During Lifetime | Full control to sell, mortgage, or change. | Full control during your lifetime. | Full control as trustee. | Full control to sell, mortgage, or change. |

| Cost to Create | Low | Moderate | High | Low |

| Medicaid Protection | Yes, protects against MERP recovery. | No | No | No, subject to a 2-year creditor look-back period. |

| Complexity | Simple and straightforward. | Simple to create, but probate is complex. | Complex to create and maintain (funding required). | Simple and straightforward. |

| Flexibility with POA | Yes, an agent can sell the property. | N/A | Yes, successor trustee manages property. | Limited; agent can revoke but not easily sell. |

As you can see, each tool has its purpose. A will is fundamental but ensures a court process. A trust offers comprehensive control but at a higher cost. And while the TODD is simple, the Lady Bird Deed provides superior protection and flexibility, making it a powerful choice for many Texas homeowners.

Steps to Create and Record a Lady Bird Deed in Texas

Creating a Lady Bird Deed is a precise legal process that delivers incredible benefits—but only when it's done right. While it might seem like simple paperwork, a single mistake in the language or a slip-up in the filing process can render the deed invalid. That could force your family right back into the probate court you were trying so hard to avoid.

Here is a step-by-step guide on what to expect when working with an attorney to create this important document.

Every step demands meticulous attention to Texas property law to make sure your wishes are legally protected.

Step 1: Gather Essential Information

Before an attorney can draft your deed, they need specific, accurate information. A mistake at this stage can create major title issues for your family down the road.

You’ll need to have this information ready:

- The Full Legal Name of the Grantor: This is you, the current property owner. Your name must be written exactly as it appears on the current deed to the property.

- The Full Legal Name(s) of the Beneficiary: This is the person (or people) you want to inherit the property. Using full legal names prevents any confusion about who is supposed to inherit.

- The Property's Legal Description: This is not your street address. It’s a detailed description found on your existing deed that precisely identifies the property’s boundaries, lot, and block numbers.

Step 2: Draft the Deed with Precise Legal Language

This is where professional legal guidance is critical. The deed must contain very specific language to create the "enhanced life estate," which is the legal engine that lets you keep total control during your lifetime.

The deed must explicitly state that the grantor reserves the right to "sell, convey, mortgage, lease, and otherwise dispose of the property" without needing the beneficiary's permission. If this phrase is worded incorrectly or left out, you could accidentally create a traditional life estate, which would severely limit your ability to manage your own property. An experienced attorney ensures this language is perfect and complies with Texas law.

Step 3: Sign and Notarize the Document

Once the deed is drafted, you (the grantor) must sign it in the presence of a notary public. The notary’s job is to verify your identity, witness your signature, and then apply their official seal and signature to the document. This formal execution is an absolute requirement in Texas.

Step 4: Record the Deed with the County Clerk

The final step is to take the original, signed, and notarized Lady Bird Deed and file it with the county clerk in the county where your property is located. This "recording" makes the deed a part of the official public record. Recording is what gives the document its legal power. Until it’s filed, it has no effect. You can learn more about the formalities of deed changes in our guide on how to change a deed on a house in Texas.

Key Insight: Why a Lady Bird Deed is an Act of Care

Let's cut through the legal jargon and get straight to the point. For Texas homeowners, a Lady Bird Deed is one of the most powerful, flexible, and compassionate estate planning tools you can have.

It’s designed to pass your most significant asset—your home—to your loved ones with dignity and efficiency, keeping your family out of the stressful and often expensive probate court system.

A Lady Bird Deed accomplishes two incredible goals at the same time:

- You keep total control. During your lifetime, the property is 100% yours. You can sell it, mortgage it, or change your mind without needing anyone's permission.

- Your family is protected. The moment you pass, the property automatically transfers to the person you named, steering clear of the delays, costs, and public nature of probate.

Creating a Lady Bird Deed is more than just signing a legal document. It's an act of foresight and a profound gesture of care for your family, designed to make a difficult time simpler for the people you love most.

Frequently Asked Questions About Texas Lady Bird Deeds

Estate planning always brings up important questions. Here are plain-English answers to some of the most common concerns we hear from Texas families.

Can I Name More Than One Beneficiary?

Yes, absolutely. It’s very common for parents to name all of their children as beneficiaries. However, it's critical to specify how they will own the property together. You can name them as "joint tenants with right of survivorship," meaning if one beneficiary passes away, their share automatically goes to the surviving beneficiaries. The other common option is "tenants in common," where each beneficiary's share is their own to pass down to their heirs. An attorney can help you decide which structure best fits your family's goals.

What Happens If I Sell My Home After Signing?

This is where the flexibility of a Lady Bird Deed really shines. If you decide to sell your home, you have every right to do so. You don't need your beneficiary's permission. Selling the property simply makes the Lady Bird Deed irrelevant. The full proceeds from the sale are 100% yours to use however you see fit.

Does a Lady Bird Deed Protect My Home From All Creditors?

This is a crucial distinction. A Lady Bird Deed offers fantastic protection against one specific, and very significant, creditor: the Medicaid Estate Recovery Program (MERP). Because the home passes outside of your probate estate, it's generally shielded from MERP.

However, a Lady Bird Deed does not protect the property from other types of creditors or liens that were attached to it during your lifetime, such as an existing mortgage, a home equity loan, or a tax lien. Your beneficiary will inherit the property subject to these existing debts. This is why personalized legal advice is so important—it helps you see the full picture for your estate.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.