Planning for what happens to your property after you’re gone is one of the most thoughtful actions you can take for your family. During a time of grief, the last thing they need is to become entangled in the Texas probate process, which can be public, costly, and incredibly slow.

Fortunately, there’s a simpler way to handle what is often your most significant asset—your home. It’s called a Transfer on Death Deed, or TODD, and it offers Texas families a direct path to inheriting property.

Understanding the Transfer on Death Deed in Texas

In plain English, a Transfer on Death Deed (TODD) is like naming a beneficiary for your house, much like you would for a bank account or life insurance policy. It’s a straightforward legal tool that allows Texas homeowners to pass their real estate directly to a chosen person or entity, completely bypassing the probate courts.

This instrument is officially authorized under Title 2, Chapter 114 of the Texas Estates Code. The beauty of it is that you keep total control over your property while you’re alive. You can sell it, refinance it, or even change your mind and cancel the TODD altogether. The person you name as your beneficiary has absolutely no rights to the property until after you pass away.

Core Purpose and Function

At its heart, the TODD was created to make life easier for families in transition. It turns what could be a complicated legal headache into a simple, direct transfer of your property. Because it’s a “non-probate” transfer, the title passes to your beneficiary outside of your will and without a judge needing to sign off on it.

This is a game-changer for many Texas families for several key reasons:

- It Avoids Probate Court: Your home will not be considered part of your probate estate. This saves your family from the months of waiting, court appearances, and legal fees that often come with probate.

- It Keeps Things Private: When a will goes through probate, it becomes a public record for anyone to see. A TODD keeps the transfer of your home private and out of the public eye.

- You Retain Full Control: Nothing changes for you. You are still the owner and can do whatever you want with your property.

- It’s Simple and Revocable: Life changes, and so can your plans. If you decide you want to name someone else or not use the TODD anymore, you can simply file a cancellation.

Of course, a TODD is just one tool in the toolbox. It’s worth knowing about the common types of property deeds and their implications to see how a TODD fits into a complete estate plan.

Transfer on Death Deed at a Glance

This table breaks down the essential features of a TODD and shows how each one directly benefits your family.

| Feature | Description | Benefit for Your Family |

|---|---|---|

| Probate Avoidance | The property transfers automatically upon death, keeping it out of the probate estate. | Saves them significant time, stress, and money by avoiding a lengthy court process. |

| Owner Control | You maintain 100% ownership and can sell, mortgage, or change the deed at any time while you are alive. | Your financial flexibility isn’t limited, and the beneficiary has no control over your property. |

| Privacy | The transfer occurs outside of the public record of probate court. | Keeps your family’s financial matters private and away from public scrutiny. |

| Simplicity | It’s a straightforward legal document that is relatively easy and inexpensive to prepare and record. | A simple, cost-effective way to pass on your largest asset without the need for a complex trust. |

| Revocability | You can easily revoke or change the beneficiary by filing a new TODD or a cancellation document. | Gives you the freedom to adapt your estate plan as your relationships or circumstances change over time. |

Ultimately, this deed is a powerful tool for homeowners who want peace of mind, knowing their wishes will be honored efficiently and without creating a burden for the people they leave behind.

Key Insight

Think of a Transfer on Death Deed as a direct instruction slip attached to your property’s title. It simply says, “When I pass away, this house goes directly to this person.” It cuts out the middleman—the court system—and makes inheritance a much smoother process for your family.

How a TODD Helps Your Family Avoid Probate

The single greatest benefit of a Texas Transfer on Death Deed is its power to help your family completely sidestep the formal probate process for your real estate. When a loved one passes away, their will typically has to go through a court-supervised procedure known as probate. This is where a judge validates the will, makes sure any outstanding debts are settled, and oversees the distribution of assets. While necessary in many cases, the Texas Probate Process can often be a source of stress, expense, and long delays for grieving families.

A TODD offers a much more direct and compassionate path. Instead of your home becoming tangled up in your probate estate, its ownership transfers automatically to your designated beneficiary the moment you pass away. This simple, non-probate transfer is a powerful way to ensure your most valuable asset passes to your loved ones without ever needing a judge’s permission.

The Time and Cost Savings of Bypassing Court

The probate system in Texas, while thorough, is rarely fast. In busy urban counties like Harris or Dallas, the average processing time can easily stretch from 9-12 months, especially if any disputes pop up. These delays can tie up your property, preventing your family from selling it or taking full ownership while it racks up holding costs. You can discover more about how a TODD can accelerate this timeline by reading the complete analysis of property transfer times in Texas.

A TODD completely eliminates this waiting period. There are no court filings for the property, no hearings to attend, and no lengthy inventories to prepare. The transfer is nearly instantaneous, providing your family with immediate certainty and control over the home.

Removing a Critical Legal Deadline

Here’s a detail many people miss: the Texas Estates Code generally requires a will to be submitted for probate within four years of the person’s death. If that deadline is missed, transferring property through the will becomes significantly more complicated and can even require a much more complex and expensive legal proceeding.

A Transfer on Death Deed removes this four-year clock entirely. Because the property never enters the probate estate in the first place, this statutory deadline simply doesn’t apply. This provides an invaluable safety net, ensuring your property transfer isn’t jeopardized by administrative oversights or delays during a difficult time.

Realistic Scenario: Passing on the Family Home

Let’s imagine Maria, a widow in Austin who owns her home outright. She has two adult children and wants to ensure the house passes to them equally and without any hassle when she’s gone. She prepares a simple will that covers her personal belongings and bank accounts.

For her home, however, she works with an attorney to create and record a Transfer on Death Deed, naming both of her children as equal beneficiaries.

Years later, when Maria passes away, her children can handle the transfer of the house by simply filing her death certificate along with an “Affidavit of Death” in the county property records. The title immediately and legally transfers to them. Meanwhile, her will can be probated separately for her other assets, but the house—her largest asset—is already securely in her children’s names. This simple move saves them thousands in legal fees and avoids nearly a year of waiting.

This streamlined process not only protects your assets but also shields your family from unnecessary public exposure. Probate proceedings are public records, meaning anyone can look up the details of your will and estate. A TODD keeps the transfer of your home a private family matter.

Takeaway

A Transfer on Death Deed is one of the most effective tools available to Texas homeowners for avoiding the time, expense, and public nature of probate for real estate. It provides a direct, automatic transfer of property that honors your wishes and eases the administrative burden on your family.

Your Step-by-Step Guide to Creating and Recording a TODD

Creating a legally sound Texas Transfer on Death Deed involves more than just filling out a form. It’s a precise process that demands careful attention to detail to ensure your wishes are carried out. While designed to be straightforward, getting any step wrong can render the entire document invalid.

Since Texas introduced them in 2015, the transfer on death deed has become a go-to tool for families wanting to keep their property out of the probate courts. The numbers don’t lie. According to the Harris County Clerk’s office, TODD filings shot up by 35% between 2020 and 2024. This jump shows a clear trend: people are actively seeking simpler ways to handle their estates. For a closer look at this shift, the Texas A&M Real Estate Research Center’s analysis offers some great insights.

Here is a step-by-step guide to preparing and recording a TODD that will stand up to legal scrutiny.

Step 1: Draft the Deed Correctly

This is the foundation of the whole process. The deed must contain all the elements of a regular deed, plus specific language required by Title 2, Chapter 114 of the Texas Estates Code.

Here’s the essential information you must get right:

- Grantor Information: That’s you, the property owner. Your name must be spelled out exactly as it appears on the current deed to your property.

- Legal Property Description: This is not your mailing address. It is the full, official legal description found on your existing deed or through your county’s appraisal district.

- Beneficiary Designation: Clearly name the person, people, or even an organization you want to receive the property. It is also wise to name an alternate beneficiary in case your first choice passes away before you do.

Accuracy here is non-negotiable. A simple typo in a name or an error in the property description can invalidate the deed, throwing the property right back into the probate system you were trying to avoid.

Step 2: Sign and Notarize the Document

Once the deed is drafted, you must sign it in front of a notary public. A TODD is a formal legal document, and under Texas law, your signature must be officially witnessed and notarized to be valid.

Do not sign it ahead of time. The notary must physically watch you sign the deed. This step confirms your identity and intent, creating a legal safeguard against any future claims of fraud or undue influence.

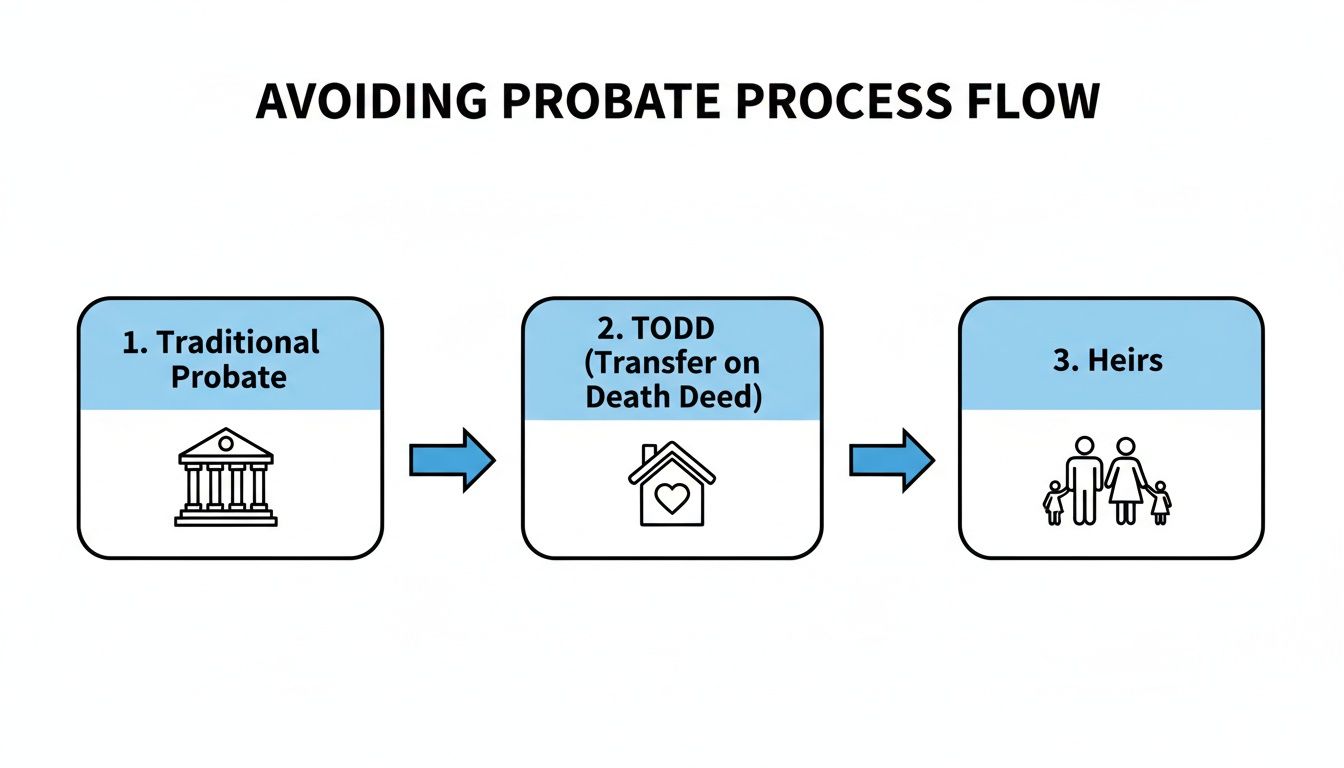

This simple diagram shows how a properly handled TODD creates a direct pipeline for your property to your heirs, steering clear of the traditional probate court maze.

As you can see, the advantage is clarity and speed. It creates a direct path from you to your loved ones, bypassing the potential delays and headaches of the courthouse.

Step 3: Record the Deed Before Your Passing

This is the final, and most frequently missed, step. For a Texas Transfer on Death Deed to be effective, it must be filed with the county clerk’s office in the county where the property is located. This must be done before you pass away.

Just signing the document and tucking it away in a safe deposit box does nothing. An unrecorded TODD is legally worthless. Filing it makes the deed part of the official public record, giving it the legal authority to automatically transfer the title upon your death. If you’re curious about other ways deeds are modified, our guide on how to change a deed on a house provides more context.

Takeaway

Creating a valid Texas Transfer on Death Deed is a precise, three-step process: accurate drafting, proper notarization, and timely recording. Missing any one of these steps can undermine your efforts and force your family into the very probate process you sought to avoid.

Key Advantages of a Transfer on Death Deed

While helping your family sidestep the probate process is a significant benefit, a Texas transfer on death deed brings several other powerful advantages. These perks protect your financial legacy and personal freedom, ensuring your property goes exactly where you want it to without creating a burden for your loved ones.

One of the biggest financial wins is something called a “step-up in basis” for tax purposes. In plain English, this means your heirs may be able to avoid paying significant capital gains taxes, preserving the real value of the home you pass on.

Maximizing Your Heir’s Inheritance with Tax Savings

When you leave property to someone, it’s almost always worth much more than what you originally paid for it. A “step-up in basis” means that for tax purposes, the property’s cost is “stepped up” to its fair market value on the date of your death. This resets the starting point for calculating capital gains if your beneficiaries ever decide to sell.

Let’s use an example. Imagine you bought a house in Houston in 1990 for $120,000. By 2025, that home is now worth $500,000. With a properly filed TODD, the tax basis for your beneficiaries automatically jumps to $500,000. If they sell it right away for that price, their capital gains tax bill is essentially zero. You can dig deeper into this topic by checking out this guide on TODD tax implications in Texas. This single benefit can easily translate into tens of thousands of dollars saved.

Retaining Absolute Control and Flexibility

Here’s another key advantage: you give up absolutely zero control during your lifetime. The person you name as your beneficiary has no legal claim or right to your property while you are alive. This means you are completely free to:

- Sell or Refinance: You can sell your home, take out a new mortgage, or even get a reverse mortgage without asking for anyone’s permission.

- Live in and Use the Property: Your right to live in and enjoy your home is totally unchanged.

- Revoke or Change the TODD: If your circumstances change, you can cancel the deed or simply file a new one naming a different beneficiary.

This level of control ensures the TODD doesn’t tie your hands financially or interfere with your life decisions. It’s your property, and it stays that way until you’re gone.

Protection from Beneficiary Creditors

A TODD also offers a critical layer of protection for your home. Because your beneficiary has no legal interest in the property during your lifetime, your home cannot be touched by their creditors to pay off their debts. If your chosen heir gets hit with a lawsuit, files for bankruptcy, or goes through a divorce, your property remains safe and sound under your exclusive control.

The property only becomes their asset after your death, shielding it from their financial troubles while you’re still alive. This is a huge distinction from adding someone to your deed as a joint owner, which would immediately expose your home to their creditors. We can help you explore other ways to protect your assets with tools like Wills & Trusts.

Takeaway

A Transfer on Death Deed offers powerful advantages that go far beyond just avoiding probate. It delivers significant tax savings through a step-up in basis, lets you keep full control over your property, and protects your home from your beneficiary’s creditors during your lifetime.

How a TODD Compares to Other Estate Planning Tools

Choosing the right estate planning tool can feel overwhelming, but understanding where a Texas Transfer on Death Deed fits in can bring a lot of clarity. A TODD is an excellent, straightforward solution for passing on real estate, but it isn’t a one-size-fits-all answer for your entire estate.

It helps to think of these tools as different items in a toolbox. You wouldn’t use a hammer to turn a screw. In the same way, you wouldn’t rely on a TODD to distribute personal belongings or manage assets for a minor child. Each tool—from a simple will to a complex trust—has a specific job.

Let’s break down how a TODD stacks up against other common methods to help you make an informed choice for your family.

TODD vs. a Traditional Will

A last will and testament is the cornerstone of most estate plans. It’s where you name an executor to manage your affairs, designate a guardian for your children, and spell out who gets your personal property, from family heirlooms to bank accounts.

However, a will does not keep your property out of probate. In reality, a will is essentially a set of instructions for the probate court. It has to be legally validated through the probate process before any assets can be distributed.

A TODD, on the other hand, is specifically designed to transfer your real estate outside of the will and the probate court system. This makes the process faster, less expensive, and more private for what is often a family’s largest asset.

TODD vs. a Revocable Living Trust

A revocable living trust is a more comprehensive (and typically more expensive) estate planning tool. It creates a separate legal entity to hold your assets, which you continue to manage as the trustee during your lifetime. When you pass away, a successor trustee you’ve chosen steps in to distribute the assets according to your instructions, completely avoiding probate.

While both a trust and a TODD avoid probate for real estate, a trust can manage a much wider variety of assets—stocks, bank accounts, business interests, and more. It can also handle complex situations, like managing funds for a beneficiary with special needs. A TODD is far simpler and less costly, but its function is limited to the direct transfer of real property at death.

For a deeper dive into other specialized deeds, you might explore what is a Lady Bird Deed, another option with its own unique benefits.

TODD vs. Joint Tenancy with Right of Survivorship

Another popular way to pass property automatically is by owning it as “Joint Tenants with Right of Survivorship” (JTWROS). When one owner dies, their share automatically passes to the surviving joint owner(s) without needing to go through probate.

However, this method comes with significant drawbacks. When you add someone as a joint owner, you give them immediate ownership rights. This exposes your property to their creditors, lawsuits, or a messy divorce. Their financial problems can suddenly become your problems.

A TODD completely avoids this risk. Your beneficiary has zero ownership rights and no control over the property while you are alive. You can sell it, mortgage it, or revoke the deed at any time without their permission.

Key Insight

A TODD is a specialized tool for your home, not a replacement for a comprehensive estate plan. It works best alongside a will, which handles all your other assets and personal wishes, providing a balanced approach to protecting your family’s future.

TODD vs. Other Estate Planning Tools

When deciding how to pass on your real estate, it’s helpful to see a direct comparison of a Transfer on Death Deed against other common tools like Wills, Trusts, and Joint Tenancy. This table highlights the key differences to help you and your family choose the right option.

| Feature | Transfer on Death Deed (TODD) | Will | Living Trust | Joint Tenancy (JTWROS) |

|---|---|---|---|---|

| Probate Avoidance | Yes, for real estate only | No, assets must go through probate | Yes, for all assets held in the trust | Yes, for the jointly owned property |

| Cost & Complexity | Low cost, simple to create | Moderate cost and complexity | Higher initial cost, more complex | Low cost, but creates immediate co-ownership |

| Control While Alive | Full control; can sell, mortgage, or revoke | Full control | Full control as trustee | Shared control; decisions require co-owner |

| Creditor Protection | Yes; protects property from beneficiary’s debts | No, assets are part of the probate estate | Yes, can offer creditor protection | No; property is exposed to co-owner’s debts |

| Asset Scope | Real estate only | All assets not otherwise designated | Can hold multiple asset types | The specific property jointly owned |

Ultimately, a Transfer on Death Deed is a powerful, focused instrument for Texas homeowners. It offers an efficient and private way to transfer your largest asset, but it should be part of a thoughtful, well-rounded plan that includes other essential documents like a will. This ensures all your assets—and your family—are protected.

Frequently Asked Questions About Texas TODDs

When you start planning for your family’s future, questions are a good thing. A Transfer on Death Deed is a powerful tool, but it’s only as good as the planning behind it. Getting the details right is what ensures it works the way you intend, providing reassurance rather than confusion for your loved ones.

Here are straightforward answers to the most common questions we hear from Texas families.

What Happens If a Beneficiary Dies Before I Do?

This is a critical question, and it’s a scenario that happens more often than you might think. If your main beneficiary passes away before you do and you have not named a backup, the Transfer on Death Deed becomes void. It’s as if it never existed.

In that case, your property gets pulled back into your estate. This means it will almost certainly have to go through the probate process—the very thing the TODD was intended to avoid.

Luckily, the Texas Estates Code provides a simple solution: you can name one or more alternate (or “contingent”) beneficiaries. Think of it as a plan B for your property. This simple step is a crucial safeguard, ensuring that if your first choice cannot inherit, your home still passes directly to the next person in line without getting tangled up in court.

Does a TODD Protect My House From Medicaid Estate Recovery?

This is a common and costly misconception. A Transfer on Death Deed does not shield your property from the Medicaid Estate Recovery Program (MERP).

While the TODD is excellent at keeping your home out of probate court, Texas law allows MERP to make a claim against non-probate assets. That includes property passed down with a TODD.

If you received Medicaid benefits for long-term care, MERP has the right to seek reimbursement from your estate after you pass away. This is a complex area of law, and if asset protection is a primary goal, you should speak with an attorney about more specialized tools, like certain types of trusts.

Can I Name My Minor Child as a Beneficiary?

Legally, yes, you can name a minor as a beneficiary on a TODD. But in practice, it creates a significant legal headache. A child under 18 cannot legally own or manage real estate on their own in Texas.

If a minor inherits your property this way, a court will have to step in and appoint a legal guardian to manage it for them until they become an adult. This process, known as a Guardianship, can be expensive and involves the exact kind of court oversight you were trying to avoid.

A far better strategy is to create a trust for your child’s benefit and name that trust as the beneficiary on the TODD. If you need official translations for a Transfer on Death Deed or other estate documents, especially for international beneficiaries, you should use reputable legal document translation services.

Key Insight

A TODD is a fantastic tool, but it demands careful thought. Naming alternates, understanding its limits with Medicaid, and planning correctly for minor beneficiaries are essential steps. They ensure your wishes are carried out smoothly and your family is protected.

Ensuring Your Legacy is Protected

A Texas Transfer on Death Deed offers a straightforward, compassionate way to pass on your home, but it’s most effective when used as part of a comprehensive estate plan. This simple document can save your family time, money, and stress, but it cannot replace the essential functions of other legal tools.

Here’s what every Texas family should know:

- A TODD Complements, Not Replaces, a Will: A TODD only transfers real estate. You still need a will to distribute personal property, name an executor, and appoint a guardian for minor children. Our firm can help you create comprehensive Wills & Trusts that work in harmony with your TODD.

- Guardianship is a Separate Matter: If you have minor children, a TODD does not address who will care for them. That critical decision must be legally documented in a will to establish a Guardianship.

- Proper Planning Prevents Disputes: A poorly drafted or improperly filed TODD can lead to confusion and family conflict, potentially resulting in the very Probate Litigation you sought to avoid.

A thoughtful estate plan provides clarity and peace of mind. By ensuring each legal tool works together, you protect your family from uncertainty during a difficult time.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.