If you’ve started searching for sample Texas will forms, you know how quickly it can feel overwhelming. Planning for the future is a profound act of love, but the legal steps can seem intimidating. The goal is simple: find a legally sound, state-specific document that fits your life—whether you’re single, married, or have children. The good news is, creating a valid will in Texas has become more accessible, with reliable options to get you started.

This guide will walk you through finding the right form, understanding its key parts, and avoiding common mistakes, all in plain English.

Finding the Right Texas Will Form for Your Family

Creating a will is one of the most fundamental acts of care you can perform for your loved ones. It’s your voice, making sure your wishes are heard loud and clear long after you’re gone. Yet, the internet is flooded with templates, and picking the wrong one can be disastrous. Using a generic, out-of-state form often leads to it being invalidated because it doesn’t comply with the specific requirements of the Texas Estates Code. An invalid will can cause the very stress and confusion you were trying to prevent.

To cut through the confusion, Texas has made state-approved resources more accessible. These aren’t just generic documents; they are designed to be straightforward while meeting the legal standards needed for a smooth Texas Probate Process down the road.

State-Approved Will Forms

Recognizing that not everyone can afford full legal representation, the Supreme Court of Texas took a major step forward by introducing standardized, legally sound will forms. This initiative was specifically designed to help Texans create a valid will without significant expense. Even better, they’re available in both English and bilingual English-Spanish versions, reflecting our state’s diverse population.

These official forms are built for common family situations, making it easy to find one that fits your life:

- For a single, widowed, or divorced person with children: This form is crucial because it helps you name a guardian for your minor kids—a step no single parent should skip.

- For a married person with children: This document addresses the complexities of community and separate property, guiding how assets should be handled between your spouse and children.

- For a single, widowed, or divorced person without children: A straightforward option that allows you to distribute your assets to other relatives, friends, or charities.

- For a married person without children: This form helps clarify how your assets will pass to your spouse and any other beneficiaries you choose.

Other Trusted Resources

Beyond the official state forms, Texas Law Help offers excellent, plain-language will templates and checklists. These resources are put together by legal aid organizations and are tailored specifically for Texas law. They provide easy-to-follow instructions that can demystify the process and give you more confidence as you fill out the document. For a basic framework, our own guide provides a helpful last will and testament template for Texas residents to review.

Before you settle on a form, it helps to understand what you’re working with. Here is a quick comparison of the most common types available.

Comparing Common Texas Will Forms

| Form Type | Ideal for This Situation | Important Considerations |

|---|---|---|

| Simple Will | Individuals with straightforward assets and clear beneficiaries. Perfect for leaving everything to a spouse or children. | Not suitable for complex situations like blended families, special needs trusts, or significant tax planning. |

| Testamentary Trust Will | Parents who want to leave assets to minor children in a trust that becomes active upon death. | Requires naming a trustee and defining the terms of the trust within the will itself. |

| Pour-Over Will | Individuals who have a living trust. This will “pours” any assets not already in the trust into it upon death. | Works in tandem with a living trust; it’s not a standalone solution for distributing all property. |

| Holographic Will | Emergency situations where a formal, witnessed will isn’t possible. | Must be written entirely in your own handwriting. Risky and often subject to challenges in court. |

Choosing the right starting point is half the battle. Once you know which form aligns with your needs, the rest of the process becomes much clearer.

Will Forms vs. Other Estate Planning Tools

As you explore your options, it’s important to see how a will fits into your bigger financial picture. When deciding what’s best for your family, you need to understand the difference between a will and a living trust. A will is a document that only takes effect after you die, while a trust can manage assets during your lifetime and beyond.

For many families, a simple will is all that’s needed. However, understanding the key differences, such as those in this living trust vs. will comparison, can help clarify which path is truly best for your specific goals and assets.

Ultimately, choosing the right sample form is the foundation of a solid plan. It brings peace of mind, knowing you’ve taken a firm step to protect the people you care about most.

Anatomy of a Texas Will Form

Once you get a sample Texas will form in your hands, it can feel intimidating. It often looks like a wall of dense, formal language. But don’t think of it as a legal maze—think of it as a set of clear instructions you’re leaving for your family.

Each section has a specific job to do. Understanding them is the key to filling out the form with confidence and making sure your wishes are crystal clear.

Let’s break down the essential parts of a standard Texas will, ditching the confusing legal jargon.

Appointing Your Executor

Right at the top, one of the first big decisions you’ll make is naming your executor. This is the person or institution you trust to be in charge of carrying out your will’s instructions. In plain English, their job is to guide your estate through the probate process, from paying final bills to making sure your property gets to the right people.

Think of your executor as the captain of the ship, steering your final wishes to their destination. It’s a job with real responsibility, so choosing someone who is organized, trustworthy, and level-headed is vital. Under Title 2 of the Texas Estates Code, this person must be legally capable of serving.

Just as important is naming a successor or alternate executor. If your first choice can’t or won’t serve when the time comes, this backup plan ensures the process doesn’t get stuck in court.

Naming Your Beneficiaries

This is the heart and soul of your will—the section where you say who gets what. Your beneficiaries are the people, organizations, or even charities you choose to inherit your property. Being specific here isn’t just a good idea; it’s non-negotiable. Vague phrasing like “I leave some money to my cousin” is a recipe for family disputes and legal bills.

Instead, be painfully clear:

- Identify the person: Use their full legal name and relationship (e.g., “my sister, Jane Elizabeth Smith”).

- Describe the asset: State exactly what they’re receiving (e.g., “my 2022 Ford F-150” or “50% of my residuary estate”).

- Name alternates: Just like with your executor, always name a backup beneficiary in case your first choice passes away before you do.

That term, “residuary estate,” is crucial. It’s a simple concept: it covers everything left over after your specific gifts are handed out and all debts and expenses are paid. Most simple wills leave the entire residuary estate to one or more primary beneficiaries.

Designating a Guardian for Minor Children

For parents with children under 18, this is arguably the most critical part of the entire document. If you and the other parent were to pass away unexpectedly, this clause is where you name a guardian to raise your minor children. This is your chance to decide who will be responsible for their care, education, and well-being.

If you don’t make this designation, a court will make the decision for you. It might not be the person you would have wanted. Naming a guardian is one of the most powerful protections you can give your children through your Wills & Trusts.

A Real-World Example: Sarah’s Plan

Let’s put this into a practical scenario. Sarah is a widowed mother with two children, ages 10 and 14. She is grieving but knows she must secure her children’s future. She uses a state-approved Texas will form to create her plan.

- Executor: She names her responsible older brother, Mark, knowing he’s organized and will handle the finances diligently. She names her best friend as the alternate, just in case.

- Beneficiaries: She leaves her entire residuary estate to her two children in equal shares. She names her sister as the alternate beneficiary should something happen to both of her children.

- Guardian: She appoints her sister, Emily, as the guardian for her children. Emily has a close relationship with the kids and shares similar values. She also names her parents as the backup guardians, providing another layer of security.

With just these three simple but powerful sections, Sarah has created a clear, legally sound plan. She has made sure her assets are protected for her children and—most importantly—decided who will care for them, preventing what would be a difficult situation from turning into a full-blown legal crisis.

How to Properly Sign and Witness Your Texas Will

After you’ve carefully filled out your will form, you’ve arrived at the single most critical moment: the signing. Until it’s properly signed and witnessed, a will is just a piece of paper outlining your wishes. The official signing, known as the execution ceremony, is what breathes legal life into the document, making it binding under the strict rules of the Texas Estates Code, Title 2, Subtitle C.

Getting this part right isn’t just a formality. A small mistake here can cause massive headaches for your family down the road. It could even lead to your will being challenged or completely thrown out by a probate court, defeating the purpose of all your careful planning.

Who Can Witness Your Will

Texas law is very specific about who can act as a witness, and for good reason. The requirements are there to ensure your witnesses are impartial and credible, which adds a strong layer of security to the entire process.

To be a valid witness in Texas, a person must be:

- At least 14 years old.

- Credible, which simply means they are competent and could testify in court if ever needed.

- Not a beneficiary in the will. This is a big one. If a witness is also set to inherit property, it creates a clear conflict of interest and can seriously complicate the probate process.

Choosing the right people is crucial. Think about neighbors, colleagues, or friends who have absolutely no financial stake in your estate. Asking someone who will inherit from you to also sign as a witness is one of the most common—and damaging—mistakes people make when handling a will on their own.

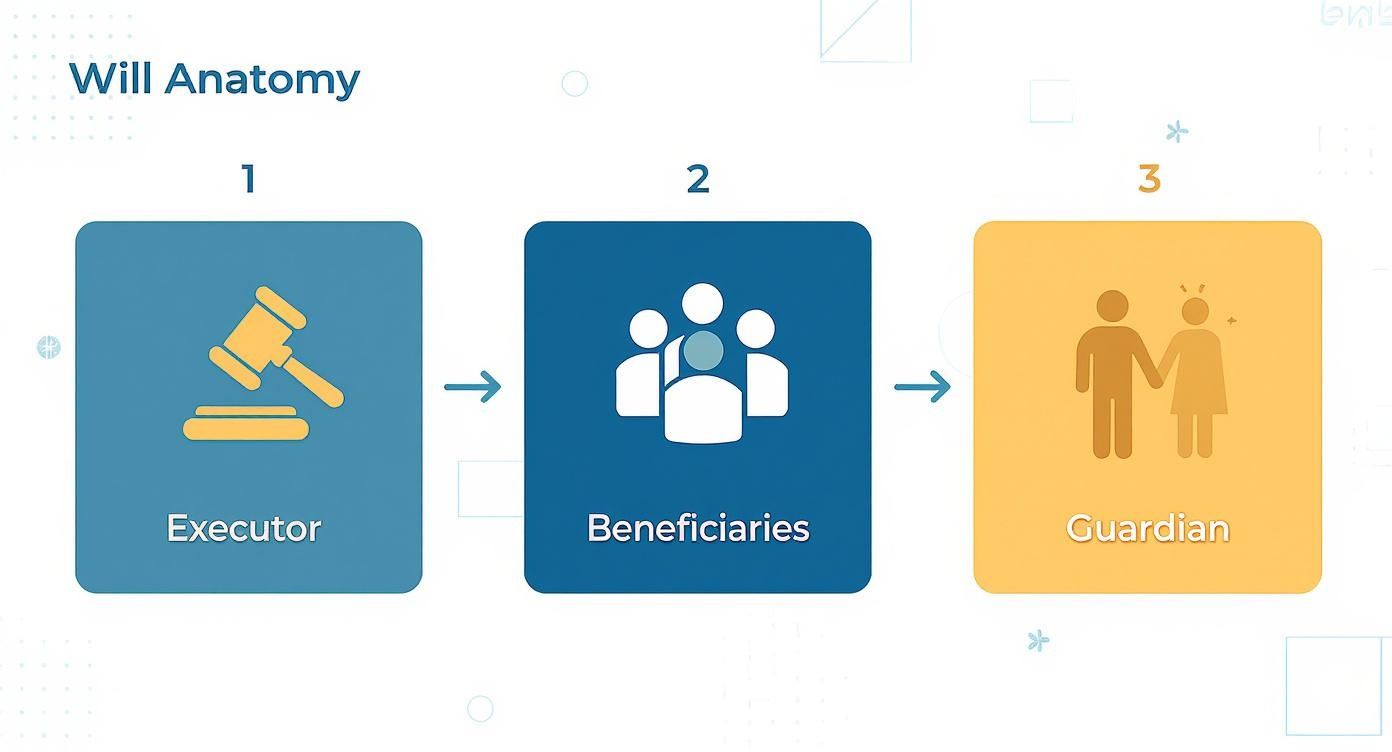

The three core roles in any will are the Executor, the Beneficiaries, and the Guardian (if you have minor children). They all have separate jobs to do.

This visual highlights why beneficiaries should never double as witnesses—their interests are directly tied to the document’s contents, while a witness must be neutral.

The Signing Ceremony: A Step-by-Step Guide

The signing itself is a formal procedure with a specific sequence of events. The Texas Estates Code requires that you, the testator (the person making the will), must sign the will in the presence of your two witnesses. Then, both of those witnesses must sign the will in your presence.

Here’s a step-by-step guide to ensure you do it correctly:

- Gather everyone in one room. You (the testator) and your two witnesses must stay together for the entire process.

- Declare your intent. State clearly to your witnesses, “This is my last will and testament, and I am signing it voluntarily.”

- Sign the will. While your two witnesses watch you, sign your name at the end of the document.

- Witnesses sign. Hand the will to the first witness. They must sign their name in the designated witness section while you and the other witness watch.

- Second witness signs. The first witness then passes the will to the second witness, who signs it in front of you and the first witness.

Everyone needs to be physically present and aware of what’s happening for the entire sequence. This continuous presence is what prevents questions about the will’s authenticity from cropping up years later.

The Power of a Self-Proving Affidavit

Many Texas will forms come with an extra page called a self-proving affidavit. This isn’t actually part of the will itself. Instead, it’s a separate sworn statement that you and your witnesses sign in front of a notary public.

This affidavit essentially pre-validates the signatures, which can make the probate process much, much smoother for your executor. With a self-proving affidavit attached, the court won’t have to track down your witnesses—who might have moved or passed away—to testify that they saw you sign. It is generally accepted as valid on its face. It’s not legally required, but it’s a highly recommended step that adds a powerful layer of legal protection. To dig deeper into this, check out our guide on self-proving vs. traditional wills.

Common Mistakes to Avoid With DIY Will Forms

While sample Texas will forms can feel like a straightforward solution, a simple oversight today can become a massive headache for your family tomorrow. In our practice, we’ve seen countless families grapple with the fallout from well-intentioned but flawed DIY wills. A small mistake can mushroom into a significant legal and emotional burden right when your loved ones are most vulnerable.

Understanding the common pitfalls is the first step toward creating a document that is clear, legally sound, and actually protects your family. These aren’t just technicalities; they are the kinds of errors that can drive a wedge between the very people you want to bring together.

Vague Language and Unclear Descriptions

The single most damaging mistake we see is ambiguous language. Phrases like “I leave my personal effects to my children” or “I give my car to my nephew” are invitations for conflict. Which car? Does “personal effects” include your grandfather’s watch or just the furniture? This lack of specificity forces your family—and potentially a judge—to guess what you meant, often leading to costly Probate Litigation.

You have to be painstakingly specific.

- For property: Use the full street address (“my primary residence located at 123 Oak Street, Houston, TX”).

- For vehicles: List the make, model, year, and even the VIN if possible (“my 2021 Toyota RAV4”).

- For bank accounts: Provide the financial institution and the last four digits of the account number.

- For sentimental items: Describe the object with enough detail that it can’t be confused with anything else (“my grandfather’s gold Elgin pocket watch with the initials ‘J.D.’ engraved on the back”).

Forgetting to Name Backups

Life is unpredictable. The person you name as your executor might pass away before you, become incapacitated, or simply decline the responsibility. The same goes for your beneficiaries. Failing to name successor executors or contingent beneficiaries creates a legal vacuum.

If your chosen executor can’t serve and there’s no backup, the court will appoint someone—and it might not be the person you would have trusted with the job. If a beneficiary dies before you without a contingent beneficiary named, that gift could “lapse” and be distributed according to state law, not your wishes. Always, always have a Plan B.

Improper Storage of the Original Will

A will is completely useless if no one can find it. A classic blunder is stashing the original will in a safe deposit box. The problem? After you pass away, the bank will likely seal that box until an executor is formally appointed by the court. This creates a frustrating catch-22, since the executor often needs the original will to get appointed in the first place.

The probate court requires the original, signed document. A copy almost never cuts it. Your best bet is to store the will in a secure but accessible place, like a fireproof safe at home, and tell your executor exactly where it is. While digitized historical archives, like the collection of Texas wills and probate records from 1833 to 1974, are great for genealogical research, they can’t replace the physical document needed for modern probate.

A Scenario of Unintended Conflict

Consider the real-world case of a client, we’ll call him Mr. Henderson, who wrote his own will. He left his “art collection” to his daughter and his “investments” to his son. It sounded simple enough. But after he passed, a bitter fight erupted over a series of valuable paintings he had purchased specifically as an investment.

His daughter argued they were art and belonged to her. His son insisted they were investments and belonged to him. The vague terms forced them into a lengthy, expensive court battle that permanently fractured their relationship. This entire heartbreaking scenario could have been avoided with a few sentences clearly defining which assets fell into which category. This story is a powerful reminder that precision in a will isn’t just a legal detail—it’s an act of love for your family.

When to Get Help from an Estate Planning Attorney

While sample Texas will forms are a fantastic starting point for many, they are really designed for straightforward situations. Think of them as a basic toolkit—perfect for a simple job, but you wouldn’t use them to build an entire house. Your family’s future is far too important to trust to a one-size-fits-all solution, especially when your life has unique financial or personal layers.

Knowing when your situation has outgrown a simple form is a critical act of love for your family. It’s about ensuring your final wishes are protected and minimizing the risk of confusion, conflict, or unintended consequences down the road. Certain life events and family structures are clear signals that it’s time to bring in a professional.

Complex Family Structures and Dynamics

Blended families are the new norm in Texas, but they bring unique estate planning challenges that a simple form just can’t handle. A DIY will might not adequately protect your children from a previous marriage or ensure your current spouse is cared for exactly as you intend.

The same goes for disinheritance. If you plan to disinherit a direct heir, like a child, you absolutely need an attorney. This action requires precise, ironclad legal language to survive an almost certain legal challenge. One small mistake in a DIY will could give a disinherited heir the opening they need to contest it, dragging your family into painful and expensive litigation.

Substantial or Unique Assets

If your estate is more than just a home, a car, and a bank account, a sample form is almost certainly not enough. It’s time to seek professional guidance if your assets include:

- A Business: Ownership in a company requires a succession plan. A simple will can’t manage this complex transition on its own.

- Real Estate Holdings: Multiple properties, out-of-state real estate, or commercial properties need specific legal handling to avoid messy probate issues in multiple states.

- Significant Investments: Large portfolios, retirement accounts with tricky beneficiary rules, or other valuable assets demand a more sophisticated strategy to minimize taxes and get them distributed efficiently.

Providing for Loved Ones with Special Needs

This is one of the most critical reasons to work with an attorney, and it’s non-negotiable. If you have a child or another loved one receiving government benefits like Medicaid or Supplemental Security Income (SSI), leaving them an inheritance through a simple will can be devastating.

That inheritance could immediately disqualify them from the very benefits they depend on for medical care and daily living. An attorney can help you establish a Special Needs Trust. This vital legal tool allows you to set aside funds for your loved one’s care without jeopardizing their eligibility for crucial government assistance. It’s a must-do for any family in this situation.

Creating Trusts for Asset Protection

Sometimes, a will isn’t even the right tool for the job. If you want to protect assets from creditors, control how a beneficiary receives their inheritance over time, or avoid the public probate process altogether, you may need a trust. A trust offers a level of control and privacy that a will simply cannot provide.

Trusts can also be essential for Guardianship planning for minor children or incapacitated adults. For a deeper dive into these options, you can learn more about the differences between a living trust and a will to see what might better suit your family’s needs.

A sample form cannot achieve these specific, protective goals. Consulting an attorney ensures you’re using the right legal tools for your unique family situation, giving you—and them—peace of mind.

Key Takeaway

Creating a will is about taking control. It’s about replacing uncertainty with clarity and ensuring your final wishes are honored. Whether you use a straightforward form for a simple estate or partner with an attorney for a more complex plan, the goal is always the same: peace of mind for you and protection for the people you love. For those with more complex financial pictures, a good estate planning attorney can also introduce you to advanced estate tax planning strategies designed to preserve as much of your legacy as possible.

Answering Your Questions About Texas Will Forms

When families start looking into sample Texas will forms, a lot of the same questions tend to pop up. Let’s tackle some of the most common ones we hear every day with clear, straightforward answers.

Can I Just Write My Will by Hand in Texas?

Yes, you can. Texas law recognizes these as holographic wills, and for one to be valid, it has to be written entirely in your own handwriting. Not a single part of it can be typed, and you don’t need any witnesses.

But here’s the caution we offer families: while it’s legal under the Texas Estates Code, holographic wills are notorious for causing confusion and legal fights during the Texas Probate Process. Handwriting can be hard to read, and the language used may be unclear. A typed, properly witnessed will is almost always a safer bet to make sure your wishes are actually followed without any ambiguity.

What Happens If I Die Without a Will in Texas?

If you pass away without a valid will, the law says you died intestate. When that happens, Texas takes the wheel and decides who gets your property based on a rigid legal formula defined in the Estates Code. The state’s intestacy laws divide everything up based on your family tree—spouse, children, parents, and so on.

The problem is, this formula probably doesn’t match what you would have wanted. For instance, it could force your spouse to split community property with your children from a previous relationship, which can create incredible financial strain and family drama. The only way to guarantee you’re in control is to create a will.

How Often Should I Update My Will?

It’s a good habit to pull out your will and review it every three to five years just to make sure it still reflects your wishes. More importantly, though, you need to update it immediately after any major life event.

Think about things like:

- Getting married or divorced

- The birth or adoption of a child

- The death of a beneficiary or the person you named as executor

- Any big change in your finances, like selling a business or inheriting property

Keeping your will current ensures it reflects your real life, not your life from a decade ago. For tiny changes, an amendment called a codicil might work. But for anything significant, it’s usually much cleaner and safer to just draft a new will to protect your family’s future.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.