When you're grieving a loved one, the last thing you want is a surprise bill. For most Texas families facing the Texas Probate Process, attorney fees can feel like a giant, looming question mark. The good news? These costs are almost always paid directly from the estate's assets, not your own pocket. This provides a critical buffer during an already stressful and emotional time.

Understanding Your First Question: How Much Will This Cost?

After a loved one passes away, the practical questions can feel overwhelming. Of all the concerns we hear from families, the cost of professional legal guidance is right at the top of the list. It’s a perfectly valid—and important—question. Grieving is hard enough without adding financial anxiety to the mix.

Getting a handle on how probate attorneys charge for their work is the first step toward gaining clarity and peace of mind.

Fortunately, Texas law doesn't leave this to guesswork. The Texas Estates Code establishes a framework for what it calls "reasonable and necessary" fees, which ensures the cost aligns with the actual work involved. An attorney's job is to make a complex legal journey simpler, and having a clear, upfront conversation about fees is a huge part of that. This guide breaks down the most common ways probate attorneys structure their fees in Texas, so you know exactly what to expect.

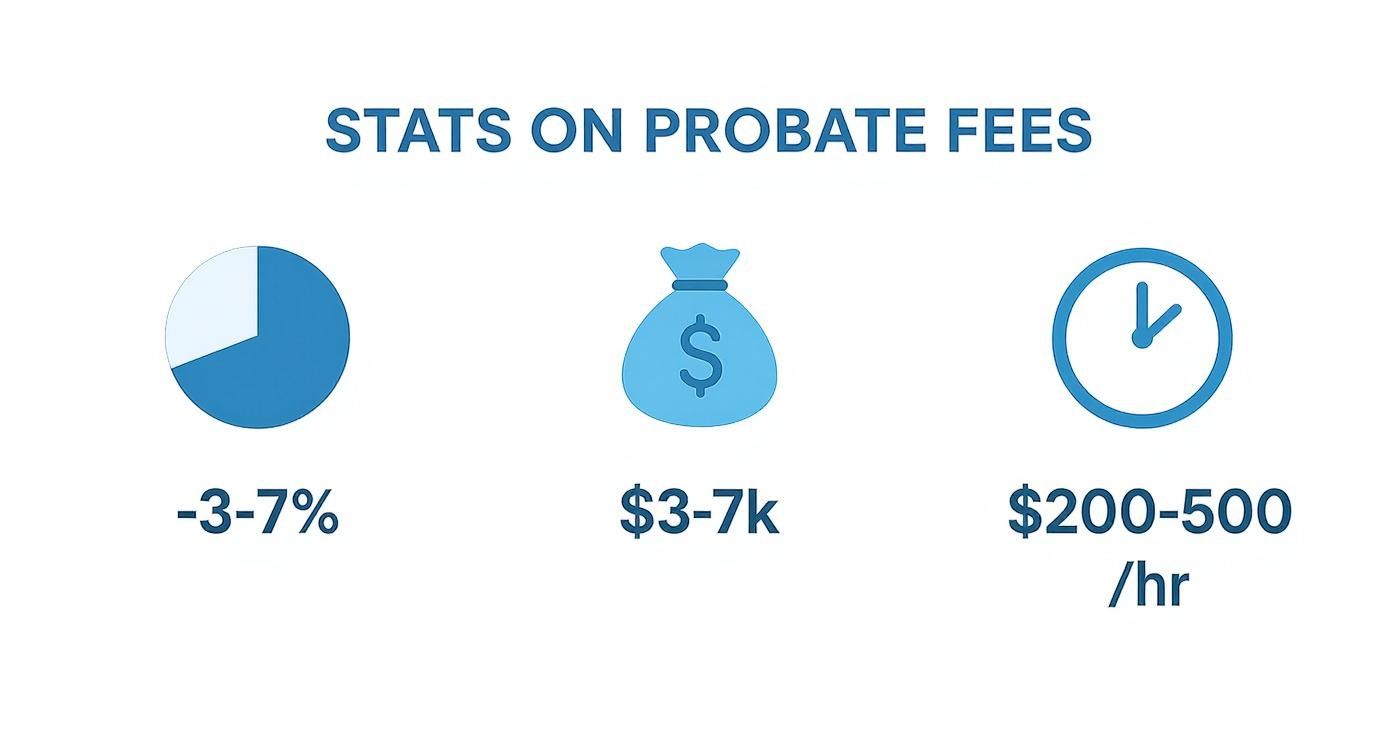

As you can see, the fee structure really depends on the complexity of the estate. It could be a percentage of the estate's value, a flat rate for predictable cases, or an hourly charge for more involved situations.

A Quick Look at Texas Probate Attorney Fees

Probate attorney fees are often one of the largest expenses in settling an estate, but they are also fairly predictable. To give you a ballpark idea, costs typically fall between 3% to 7% of the estate's total value. For simpler, uncontested estates, many attorneys offer a flat fee ranging from $3,000 to $7,000. If the case is more complex, hourly rates in major cities like Houston or Dallas usually run between $200 and $500 per hour.

Again, these fees are paid from the estate itself, so you won't be paying out-of-pocket. For a more detailed look at these expenses, you can explore our guide on the costs associated with probate in Texas.

Most attorneys in Texas use one of three primary billing methods. Let's compare them in plain English so you know what to expect.

| Fee Type | How It Works | Best Suited For |

|---|---|---|

| Hourly Rate | The attorney bills for the actual time spent on your case. This includes everything from phone calls and emails to court filings and meetings. | Estates with unpredictable twists and turns, such as potential will contests, creditor disputes, or complex assets. |

| Flat Fee | A single, all-inclusive price for handling the entire probate process from start to finish. You know the exact cost upfront. | Straightforward, uncontested estates where the assets are easy to identify and the family is in agreement. |

| Percentage Fee | The attorney’s fee is calculated as a percentage of the gross value of the estate. | This is less common today but may be used for very large or highly complex estates where the value of the work is tied to the value of the assets. |

Ultimately, the right fee structure depends entirely on the unique circumstances of the estate. A simple, uncontested probate will always be less expensive than one bogged down by family disputes or complicated financial assets. The key is to have an open, compassionate conversation with your attorney from day one.

How Texas Probate Attorneys Bill for Their Time

To really get a handle on probate attorney fees in Texas, you need to understand how lawyers package their services. Just as every family’s situation is unique, the way an attorney bills for their time can vary. The main goal is always to find a structure that feels clear, fair, and reassuring for the work that needs to be done.

The billing method a lawyer chooses often depends on the estate's size, its complexity, and even the city where the case is filed. While there’s no single “right” way, most attorneys use one of three common approaches. Hourly rates can range anywhere from $400 to $900 per hour, depending on the lawyer's experience and reputation. For a very simple estate, a flat fee might fall between $1,500 and $5,000. And though it's less common now, some attorneys might charge a percentage of the estate, often 3% to 5%. You can dig deeper into how probate attorneys charge in Texas to get a better sense of what to expect.

The Hourly Rate Method

This is the most traditional way lawyers bill for their time. Your attorney tracks every minute they spend on your case—every phone call, every document they draft, every court appearance, and every email they respond to—and bills you for that time.

This approach makes the most sense for estates with a lot of unknowns, like potential family fights or complicated assets that are hard to value. It ensures you’re only paying for the work that’s actually performed, but the downside is that it can be unpredictable. A crystal-clear fee agreement is crucial here so you know exactly what activities are billable and what’s not.

The Flat Fee Arrangement

A flat fee offers a welcome dose of predictability during what is often a very uncertain time. For a single, agreed-upon price, the attorney handles the entire probate process from start to finish. This is a fantastic option for straightforward, uncontested estates where the scope of work is clear from day one.

It lets you budget effectively without worrying about surprise costs down the road. Before you agree to a flat fee, make sure you understand exactly which services are included and what might be considered an "extra" that could trigger an additional charge.

The Percentage Fee Model

This model is less common these days but still pops up in certain situations. A percentage fee is based on the gross value of the estate, meaning the attorney’s payment is a set percentage of the total assets being probated.

This structure might be used for very large or complex estates that involve things like business valuations or extensive real estate holdings. However, it’s really important to have an honest conversation about whether this structure truly aligns with the amount of legal work required to get the estate settled.

Key Factors That Influence the Final Cost

Ever wonder why one family’s probate bill is drastically different from another's? The secret isn’t the total dollar value of the estate—it's the complexity. Think of it this way: navigating a quiet country road is a lot simpler than hitting Houston rush-hour traffic. A straightforward estate is just easier, and cheaper, to settle.

The single biggest driver of probate attorney fees in Texas is the amount of work required to legally wrap things up. An estate with a clear, valid will, a few easy-to-find assets, and no family drama will almost always cost less. The legal journey is simply shorter with fewer roadblocks.

The Impact of Estate Complexity

An estate's complexity is really just a collection of moving parts. The more parts you have, the more legal work is likely involved.

Here are the big ones:

- The Will (or Lack Thereof): Is there a professionally drafted will, or did the person die without one (intestate)? A clear will is a roadmap, while intestacy forces the court to figure out who the heirs are from scratch under Texas Estates Code, Title 2, Chapter 201.

- Family Dynamics: Are all the heirs on the same page? Any disagreement, especially a formal will contest, can dramatically drive up costs and drag things out, often requiring extensive Probate Litigation.

- Types of Assets: An estate with a single bank account and a house is worlds away from one with a family business, multiple real estate properties, or oil and gas royalties. More complex assets mean more work.

- Debts and Creditors: Juggling numerous debts or fielding claims from creditors adds layers of administrative work and potential legal hurdles for the attorney to clear.

Geography and Attorney Experience

Where your attorney practices and how long they've been doing this also play a role in the final bill. Just like the cost of living varies across the state, so do legal rates.

Data from a statewide survey shows probate attorneys in rural Texas might charge around $187 per hour. In contrast, their counterparts in major metro areas like Dallas or Austin often bill between $250 and $425 per hour.

An attorney’s expertise matters, too. Lawyers with over a decade of dedicated probate experience might charge between $250 and $350 per hour, while attorneys newer to the field may have rates closer to $165 per hour. A lower hourly rate might seem appealing at first, but a seasoned attorney's efficiency can often save the estate money in the long run. You can explore the full attorney fee survey to see the numbers for yourself.

A Realistic Scenario: The Martinez Family

Imagine the Martinez family. Their father passed away with a valid, professionally drafted will leaving everything to his three children equally. His estate included a paid-off home, a checking account, and a car. The children were all in agreement and chose the eldest sibling to serve as executor. Because there were no disputes, no complex assets, and a clear will, the probate process was purely administrative. The attorney was able to complete the entire process for a predictable flat fee, and the estate was settled in a few months.

Now, contrast this with another estate where there is no will, three estranged heirs who can’t agree on selling the family business, and significant credit card debt. The attorney has to file for an heirship determination, mediate family fights, and negotiate with creditors. It’s easy to see why the second estate will justifiably incur higher legal fees.

No matter the circumstances, the Texas Estates Code insists that all fees must be "reasonable and necessary." A judge has the final say and can review attorney fees to make sure they're fair and proportional to the work performed, protecting the estate from being overcharged.

When a Simple Probate Turns Complicated (and Costly)

Even with a perfectly clear fee agreement in hand, some situations can throw a wrench in the works, turning what looked like a straightforward probate into a far more complex—and expensive—process. Nobody wants these complications, but knowing what they are ahead of time helps you stay prepared and truly understand the value of having a skilled attorney in your corner.

Most of these issues kick a case out of simple administration and straight into the world of Probate Litigation.

At the heart of almost every unexpected cost increase is one thing: conflict. When family members can't agree, the legal work needed to untangle the mess can multiply quickly.

Will Contests and Family Fights

A will contest is probably the most common reason legal costs shoot up. This is when an heir—or someone who thinks they should have been an heir—formally challenges the will's validity in court.

These challenges usually boil down to a few key arguments:

- Undue Influence: Someone claims the deceased was manipulated or pressured into creating or changing their will.

- Lack of Capacity: The argument here is that the deceased wasn't mentally sound when they signed the will.

- Improper Execution: This is a technical challenge, arguing the will wasn't signed or witnessed according to the strict rules of Texas law.

Fighting these battles involves depositions, court hearings, and hours of legal research and argument—all of which are billed by the hour. It’s not just will contests, either. Simple disagreements over who gets the antique furniture or whether to sell the family home can stall the process for months, adding to the legal bill every step of the way.

Problems with the Executor or Knotty Assets

Another area where costs can spiral is when issues pop up with the executor or the estate's assets themselves. The executor has a fiduciary duty—a legal term for the highest duty of trust and loyalty—to manage the estate with complete honesty and responsibility. But what happens when they don't?

Sometimes, an executor goes rogue—they might mismanage funds, refuse to act, or start favoring one beneficiary over others. Getting a non-compliant executor removed and replaced requires court intervention, which naturally adds to the final cost. The Texas Estates Code, particularly in Title 2, Chapter 351, outlines these duties very clearly.

Finally, some assets are just plain difficult to handle. Finding heirs who have been missing for years, keeping a family business running during probate, or negotiating with multiple creditors to settle significant debts—these aren't simple tasks. They demand extra time, specialized knowledge, and a ton of detailed work from your attorney, which understandably leads to higher—but necessary—probate attorney fees in Texas.

Practical Ways to Manage and Reduce Attorney Fees

While legal fees are a necessary part of probate, you have more control over the final cost than you might think. As the executor or administrator, being organized and proactive makes the entire process more efficient, which almost always translates into lower probate attorney fees in Texas.

Think of your attorney as your guide on a journey. Your preparation is the fuel that makes the trip smoother and quicker. Every hour they spend tracking down documents or clarifying basic facts is an hour billed to the estate. But every step you take to streamline their work preserves those resources for the complex legal matters that truly require their expertise. It all starts with having an open conversation about billing from your very first meeting and insisting on a clear, written fee agreement.

Be an Organized and Proactive Client

An organized client is an attorney’s best friend—and the estate’s biggest money-saver. When a lawyer or their paralegal has to hunt for missing paperwork or answer the same questions repeatedly, those hours add up on the final bill. You can reduce this administrative time with a bit of effort upfront.

Here’s a simple checklist to get you ready for your first consultation:

- Gather Key Documents: Bring the original will (if you have it), the death certificate, and any trust documents you know about.

- Compile a List of Assets: Start a preliminary inventory of the decedent's property. This includes bank accounts, real estate, vehicles, and investment statements. Even rough estimates help.

- Outline Known Debts: Make a list of all known liabilities, like mortgages, credit card bills, and recent medical expenses.

- List Heirs and Beneficiaries: Put together the names and contact information for everyone named in the will or who would be a legal heir if no will exists.

Do-It-Yourself Tasks With Your Attorney’s Blessing

There are quite a few administrative tasks you might be able to handle yourself, but only with your attorney's approval. These jobs are often straightforward but can be time-consuming—and therefore costly—if left to your legal team. For instance, you could potentially handle things like notifying creditors, closing social media accounts, or collecting the mail.

Always check with your lawyer first. This ensures you aren’t overstepping your legal authority or accidentally making a mistake that could complicate things later. By working as a team, you empower yourself to keep costs down while your attorney focuses on the heavy lifting.

Of course, the most effective way to cut probate costs is to avoid the process altogether. You can learn more about those strategies in our guide on how to avoid probate in Texas.

Key Insight

Transparency is everything. A good Texas probate attorney will be crystal clear about their fee structure from the very beginning, putting it all in a written agreement. This clarity builds trust and ensures there are no surprises down the road. The Texas Estates Code requires all fees to be "reasonable and necessary," and a judge can review any fee to ensure it's fair. This protects the estate from excessive charges, no matter which billing method is used.

Wading through the costs of probate can feel daunting, but it doesn't have to be a mystery. The single most important thing to remember is this: probate attorney fees are paid from the estate’s assets, not out of your own pocket. This is a crucial protection that allows you to settle a loved one's affairs without shouldering the financial burden personally.

A little forethought can make a world of difference. Comprehensive estate planning with Wills & Trusts can dramatically reduce or even eliminate these costs for your family. In the same way, setting up a Guardianship ahead of time can prevent expensive court battles if a loved one ever becomes unable to care for themselves. In the end, being informed is your best defense against unexpected probate expenses.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.

Unpacking Common Questions About Texas Probate Fees

When you're navigating probate, the practical, day-to-day questions about money are often the most stressful. Families have a lot of common concerns about how these costs work, so let's clear up some of the most frequent ones with straightforward answers.

Can I Pay the Attorney From My Own Pocket and Get Paid Back Later?

Many executors ask if they can front the legal fees from their personal funds just to get the ball rolling, then reimburse themselves from the estate. While it’s possible, it’s not the best way to handle things.

The cleanest and most legally sound approach is to pay all estate expenses directly from an estate bank account. Paying yourself back adds an extra layer of bookkeeping that can get messy. More importantly, it can look like a loan to the estate, which might raise eyebrows with beneficiaries or even the court. Paying directly from estate funds keeps the financial trail crystal clear and reinforces your role as a fiduciary acting purely on the estate's behalf.

Are Court Filing Fees Included in What the Attorney Charges Me?

This is a really important distinction. Your attorney’s bill is for their legal services—their expertise, their time, and their advice. The administrative costs of the probate process are entirely separate expenses the estate has to cover.

Think of it like building a house: you pay the contractor for their labor (the legal fee), but you also have to pay for the materials like lumber and nails (the administrative costs). These other costs are direct expenses paid by the estate and typically include:

- Court Filing Fees: The mandatory fee paid to the county clerk just to open the probate case.

- Executor Bond: An insurance policy the court might require to protect the estate’s assets from being mishandled.

- Appraiser Fees: The cost to have a professional value unique assets like real estate, art, or valuable collections.

- Notice to Creditor Fees: The cost to publish a legal notice in a local newspaper to inform potential creditors.

These are not part of your attorney’s fee structure; they are simply the costs of doing business with the court and settling the estate.

What if the Estate Doesn't Have Any Cash to Pay the Attorney?

This is a more common scenario than you might think, especially when the main asset is a house or another piece of property that isn’t cash. We get it—this can be a huge source of stress. But there are practical solutions.

Often, an attorney will agree to be paid when an asset is sold. For example, the legal fees can be deferred until the estate’s home is sold, with the payment handled right at the closing table. In other situations, a small, non-essential asset might be sold early on to generate enough cash to cover the initial filing fees and legal costs.

An experienced probate attorney can walk you through these options with compassion and help find a path forward that doesn’t put a financial burden on you personally.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.