Planning for your family’s future is a profound act of love, and a last will and testament form for Texas is the foundational tool to make your wishes legally binding. Think of it as your official instruction manual for what happens to your property and—most importantly—who cares for your minor children after you're gone. This guide offers a plain-English explanation of how to create a valid will, ensuring your family is protected with clarity and care.

Why a Texas Will Is More Than Just a Form

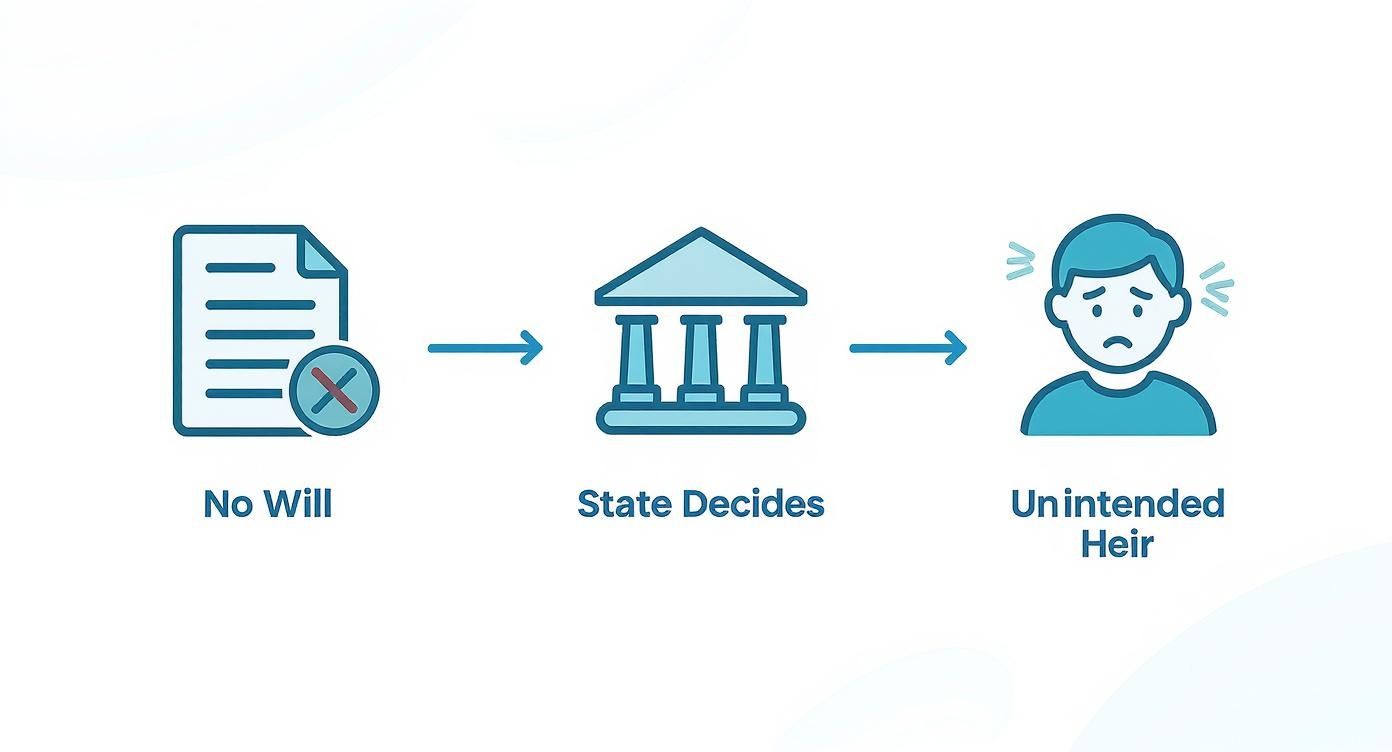

Thinking about a will can feel overwhelming, but at its core, it’s about empowerment. A will is your voice, ensuring your decisions are heard and respected when you can no longer speak for yourself. Without one, you leave those critical choices up to state law, which often creates outcomes you never would have wanted.

When you die without a will—a situation known in legal terms as dying "intestate"—you lose all control. Texas intestacy laws, found in Title 2 of the Texas Estates Code, dictate how your assets are split. The court steps in to choose an administrator for your estate and, most critically, a guardian for your children. The state’s choice may not align with who you would have trusted with such a profound responsibility.

For example, if you pass away without a will and have a spouse and children from a previous relationship, Texas law dictates a complex division of your property. Your surviving spouse might only receive a portion of your separate property, with the rest going to your children. This can lead to painful family disputes and financial hardship that a clear will could have easily prevented. Understanding the importance of a will in Texas estate planning is the first step toward protecting your family from this uncertainty.

The Key People in Your Texas Will

To understand how a will works, you need to know the main players involved. Think of it like casting the key roles in a play you’ve written. Each person has a specific job to do to make sure your final wishes are carried out exactly as planned. Here’s a simple breakdown of who’s who:

| Role | Who They Are | What They Do (Plain English) |

|---|---|---|

| Testator | This is you—the person creating the will. | You are the director of the entire process, making all the crucial decisions about your property and dependents. |

| Executor | The person you trust to carry out your will’s instructions. | They act as the manager of your estate, ensuring your assets are gathered, debts are paid, and everything is distributed according to your will. |

| Beneficiary | The people, charities, or organizations you choose to inherit your property. | They are the recipients of your legacy—the ones who receive the assets you've left behind. |

| Guardian | The person you designate to raise your minor children. | If you have kids under 18, this is arguably the most critical role you will fill. They step in to care for your children if you and the other parent cannot. |

These roles are the heart of your will. By carefully selecting the right people, you're not just filling out a form; you're building a reliable team to protect your family’s future.

Meeting the Legal Requirements for a Valid Texas Will

For a will to hold up in a Texas probate court, it has to follow a specific set of rules laid out in Title 2, Subtitle C of the Texas Estates Code. Think of these as the non-negotiables. Getting them wrong can unfortunately render the entire document invalid, which throws your estate into the exact kind of chaos and conflict you were trying to prevent.

The most critical requirements are straightforward, but they are absolute. Your will must be:

- In writing. Texas doesn't recognize purely oral wills.

- Signed by you (the testator). You can also have someone sign for you, but they must do it in your physical presence and at your direction.

- Attested to by two credible witnesses. These witnesses have to sign the will in your presence, too.

The Role of Witnesses in Texas

This is where many do-it-yourself wills fall apart. In Texas, a witness must be at least 14 years old and—this is crucial—cannot be a beneficiary in the will. If someone set to inherit from you also signs as a witness, it can create major legal headaches that might even void their inheritance, as outlined in Texas Estates Code § 254.002.

Your witnesses don't need to read the will or know what's in it. Their only job is to confirm that they saw you sign the document and understood it was your will. Their signatures add a layer of legal armor to the document, making it much harder to challenge later on.

Dying without a valid will means the state’s rulebook—not yours—determines who gets what.

This process is called "intestacy," and it completely removes your voice from the equation. Your assets could end up going to relatives you never would have chosen.

A Note on Handwritten Wills

Texas law does recognize something called a "holographic will," which is a will written entirely in your own handwriting. The big difference? It doesn't need witnesses.

While that might sound tempting, holographic wills are notorious for being challenged in court. Proving the handwriting is authentic and that you truly intended for that document to be your final will can ignite expensive and stressful legal battles. An improperly executed will can be far worse than having no will at all, which is why it is so critical to understand exactly what invalidates a will in Texas.

What to Include in Your Will for Complete Peace of Mind

Once you understand the legal rules, it's time to fill out your last will and testament form for Texas with clear, personal instructions. This is the moment you transform a legal document into a heartfelt plan that truly protects your family. Think of it as creating a definitive guide for your loved ones, leaving no room for doubt or confusion during what will already be a difficult time.

A well-drafted will does more than just hand out assets; it provides a roadmap that massively simplifies the entire Texas probate process for the people you leave behind. By spelling everything out, you’re giving them the gift of clarity when they need it most.

Appointing Your Executor

Your first big decision is choosing an executor. This is the person or institution you trust to be in charge of your estate. They are responsible for gathering your assets, paying off any debts, and making sure the remaining property gets to the right people, exactly as your will directs. This role demands integrity, patience, and organization. It’s absolutely critical to name a backup executor in case your first choice is unable or unwilling to serve. This one simple step can prevent massive delays and legal headaches down the road.

Naming Beneficiaries and Distributing Assets

This is the heart of your will—where you specify exactly who gets what. You can make specific bequests, like "I give my antique grandfather clock to my nephew, Samuel," or you can divide your property by percentages. Whatever you do, clarity is king. Vague language is a primary cause of family fights in probate court.

Designating a Guardian for Minor Children

If you have kids under 18, this is without a doubt the most important decision you will make in your will. You must name a guardian to care for them if something happens to both parents. This is not a decision to be taken lightly. You have to discuss your choice with the potential guardian beforehand to make sure they're willing to accept this profound responsibility. If you fail to name a guardian, a court will make that decision for you—and a judge's choice may not align with your wishes for your children's future. Our firm has extensive experience in Guardianship matters and can help you navigate this critical decision with confidence.

The Residuary Clause and Self-Proving Affidavit

What about assets you forgot to mention or that you acquire after you sign the will? That’s where a residuary clause comes in. It acts as a safety net, designating a beneficiary for any "leftover" property and ensuring every single asset is accounted for.

Finally, including a self-proving affidavit is just plain smart. This is a separate statement that you and your witnesses sign in front of a notary. It's governed by Texas Estates Code § 251.101, and its purpose is to allow the will to be admitted to probate without dragging your witnesses into court to testify. It saves your family time, money, and stress. Of course, a proper estate plan often involves more than just a will. Understanding the distinct roles of Wills & Trusts can provide even greater protection.

Common Mistakes People Make with Will Forms

Generic, one-size-fits-all will forms seem like a simple, affordable solution, but they often create costly and heartbreaking problems for the very families they were meant to protect. A DIY last will and testament form for Texas can feel like you're taking control, but even tiny, unintentional errors can have devastating consequences during the Texas probate process.

Many of these template documents fail to meet the strict legal standards laid out in the Texas Estates Code. Forgetting a signature, asking an heir to be a witness, or failing to include a self-proving affidavit can get the entire document thrown out by a judge. When that happens, it’s as if you died with no will at all.

Using Vague and Ambiguous Language

One of the most common—and destructive—issues with DIY will forms is unclear language. A phrase like "I leave my personal property to my children" sounds straightforward, but it's a recipe for disaster. What exactly is "personal property"? Does it include the classic car, Grandma's jewelry, or valuable digital assets? Which child gets the family heirlooms? This kind of ambiguity forces a judge to guess your intentions and often leads to painful, lasting rifts between your loved ones. Clear, precise wording isn't just a legal formality; it's a final act of care for your family.

Forgetting to Update Your Will

A will is a snapshot of your life at a specific moment. It's not a "set it and forget it" document. One of the most catastrophic mistakes is failing to update a will after major life events.

Consider this realistic scenario:

A man drafts a will leaving everything to his wife. Years later, they divorce. He remarries but never updates his will. Under Texas Estates Code § 123.001, any provisions benefiting his ex-wife are automatically voided, but the rest of the will stays valid. If he didn't name alternate beneficiaries, his assets could pass under intestacy laws—potentially disinheriting his new wife entirely.

This type of oversight can lead to expensive and emotionally draining Probate Litigation. Your will should evolve as your life does, reflecting changes like marriage, divorce, the birth of a child, or a significant change in your assets.

When Your Estate Plan Needs More Than a Will

A last will and testament form for Texas is the absolute bedrock of a solid estate plan, but for some families, it's just the starting point. Think of a will as the sturdy frame of a house—it provides the essential structure. But when you need to protect your family from specific challenges, like avoiding the public probate process or caring for a loved one with unique needs, you may need additional tools like trusts.

Is a Will Enough? When a Trust Might Be a Better Option

A will is powerful, but it must go through the public court process of probate, which can be slow and costly. A trust might be a better fit if you’re trying to:

- Avoid Probate: Assets held inside a trust don't go through probate. They pass directly to your beneficiaries according to your private instructions, saving time, money, and hassle.

- Provide for a Beneficiary with Special Needs: Leaving money directly to a loved one with a disability could disqualify them from critical government benefits. A special needs trust holds assets for them without jeopardizing their eligibility.

- Control Assets After You're Gone: With a will, beneficiaries generally get their inheritance in a lump sum. A trust lets you set the rules, distributing funds in stages or tying them to life milestones like graduating from college.

For many people, the first step is understanding the key differences between a living trust and a will. Understanding how each tool works is crucial to building a plan that truly protects your family.

A Quick Word on Estate Taxes in Texas

One common anxiety is the estate tax. The good news? Texas does not have a state-level estate or inheritance tax. The federal government does have an estate tax, but it only applies to the wealthiest estates. For 2024, the federal estate tax exemption is a substantial $13.61 million per individual. This means if your total estate is valued below that amount, you likely won't owe any federal estate tax.

While a simple will is often the right tool for the job, a truly effective plan takes your entire financial and family situation into account. This is why sitting down with a compassionate attorney is so valuable—they can help you figure out if your goals require more advanced tools to fully protect the people you love.

Key Insight: Your Will is a Final Act of Care

Putting together a legally sound last will and testament form for Texas is one of the most important things you can do for your family. It is more than just a legal document; it is your final instruction manual, written to bring clarity and peace of mind when your loved ones need it most.

Takeaway: A well-drafted will acts as a shield, protecting your family from conflict, legal headaches, and the confusion of intestacy. Texas law is very specific about the requirements for a valid will. Taking the time to get it right, with clear language and proper legal execution, is the best way to safeguard your legacy and the people you care about most.

When you’re ready to move forward, we’re here to make the process feel less overwhelming. We will listen to what you want to accomplish and walk you through your options in plain English. Our goal is to help you build a plan that lets you rest easy, knowing your family is protected. And if you are navigating the loss of a loved one, our team can guide you through every step of the Texas probate process with empathy and experience.

Common Questions About Texas Wills

When you start digging into the details of a last will and testament form for Texas, questions naturally arise. Here are straightforward answers to the questions we hear most often from Texas families.

How Much Does It Cost to Create a Will?

The cost can vary. A straightforward, attorney-drafted will may cost a few hundred dollars, while a more complex estate plan involving trusts will be higher. While a DIY form seems like a way to save money, a small mistake can lead to thousands of dollars in probate litigation fees for your family. Investing in professional advice now is the best way to secure your family's future and prevent a costly mess later.

Does My Will Need to Be Notarized?

No, a Texas will does not have to be notarized to be legally valid. However, you should include a self-proving affidavit, and that part does need to be notarized. This affidavit, governed by Texas Estates Code § 251.101, is a game-changer. It allows the court to accept your will without having to track down your original witnesses to testify, dramatically simplifying the Texas probate process for your loved ones.

Can I Disinherit a Child in Texas?

Yes, Texas law allows you to intentionally disinherit a child in your will. But you must be crystal clear about it. Your will must state your intention without any room for doubt. Simply leaving their name out isn't enough—a court could interpret that as a mistake. You need explicit language that shows the omission was deliberate.

Where Should I Store My Will?

Once your will is signed, you need to put it somewhere safe but also accessible. Your executor must be able to find the original document. A fireproof safe at home or a safe deposit box are both excellent choices. The most important part? Make sure your executor knows exactly where it is and how to get to it.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.