When a loved one passes away, the last thing their family wants is to face a complex, lengthy, and public legal battle over their assets. Unfortunately, that’s often what happens with probate—the court-supervised process in Texas for validating a will, paying off debts, and distributing what’s left to your heirs. Dealing with the court system while grieving is an emotional and financial burden no one should have to bear.

The good news is that with thoughtful estate planning, you can sidestep this entire process. Using the right legal strategies, like living trusts, beneficiary designations, and joint ownership, you can ensure your assets—from bank accounts and real estate to investments—transfer directly and privately to your loved ones without court intervention. This proactive approach saves them a world of time, money, and heartache.

What Is Probate and Why Should You Avoid It?

While probate serves a necessary legal function, it often becomes a significant burden for families already navigating a difficult time. Understanding its drawbacks is the first step toward creating a plan that offers your family peace of mind when they need it most.

The Major Drawbacks of Texas Probate

First things first: you need to understand why avoiding probate is so critical for your family's well-being. The process, governed by the Texas Estates Code (specifically Title 2), throws up several major roadblocks for grieving families.

- It Can Be Incredibly Slow: A straightforward probate case in Texas can easily take six months to a year to resolve. If any complications arise, like a contested will or complex assets that could lead to Probate Litigation, that timeline can stretch out even longer. Your heirs are left waiting for their inheritance, unable to move forward.

- It Is Expensive: Probate isn’t free. Court filing fees, attorney's fees, and other administrative costs are paid directly from the estate's assets. This means the inheritance you intended for your family gets chipped away by legal and administrative expenses.

- It Is a Public Process: Every document filed with the probate court, from the will to a complete inventory of your assets, becomes a public record. For families who prefer to keep their financial matters private, this lack of confidentiality can be a serious and unwelcome intrusion.

Different Levels of Probate Administration

Not all probate is created equal. Texas law allows for a couple of different approaches, depending on the estate's circumstances.

The best-case scenario is independent administration. This is the simplest form, allowing an executor to manage the estate with minimal court supervision. It's faster, less expensive, and gives the family more control.

However, if a will doesn't specifically request it, or if heirs cannot agree, a judge may order dependent administration. This is a far more restrictive and frustrating process. The executor must get the court’s permission for nearly every action, from selling a car to paying a utility bill. It adds significant time, expense, and stress to settling the estate.

As you can imagine, this is where things get complicated. To get a better feel for how assets are handled after death, it’s helpful to explore the different methods for settling an estate, like deciding between an estate sale and an auction.

Using a Living Trust to Bypass Texas Probate

Of all the tools available for avoiding Texas probate, the Revocable Living Trust is arguably the most powerful and comprehensive. It's best to think of a trust not as a document, but as a private legal entity—like a bucket—that you create to hold your most valuable assets for the benefit of your loved ones.

While you're alive, you serve as the trustee. This means you maintain 100% control over everything you put inside it. You can buy, sell, invest, and manage the assets just as you always have. Nothing changes in your day-to-day life.

When you pass away, the assets inside the trust are not considered part of your "probate estate." A successor trustee—someone you've already hand-picked, like a trusted child or a professional—simply steps in to manage and distribute the property according to the private instructions you left behind. This entire transfer happens outside the watchful eye of a probate judge, ensuring privacy and efficiency.

How a Living Trust Works in Practice

Let’s walk through a realistic scenario to see how this plays out for a Texas family.

Imagine a couple in Houston, Maria and David. They've spent their lives building a comfortable estate: they own their home in Harris County, have a healthy investment portfolio, and keep several bank accounts. Their primary goal is to pass everything to their two adult children with as little fuss and public exposure as possible.

- Scenario 1: With Only a Will. If they only have a will, their entire legacy—the house, the stocks, the cash—gets dragged into the probate system. Their children will have to hire a lawyer, file the will in court, attend hearings, and wait months, maybe longer, before they can access their inheritance. Every detail of the estate becomes public record.

- Scenario 2: With a Living Trust. Instead, Maria and David work with an attorney to create the "Maria and David Family Living Trust." The next crucial step is called funding the trust, where they retitle their major assets:

- The deed to their home is changed from "Maria and David" to "Maria and David, Trustees of the Maria and David Family Living Trust."

- Their investment and bank accounts are similarly updated to show the trust as the legal owner.

They still live in their house, spend their money, and manage their investments. When they pass away, their chosen successor trustee can immediately step in, pay any final bills, and distribute the assets directly to the children according to their private instructions. No court dates, no judicial approval, no public filings.

The Clear Advantages Over a Will-Based Plan

The primary benefit is the complete avoidance of probate for every asset properly placed in the trust. This saves your loved ones a tremendous amount of time, money on legal fees, and the emotional stress of a drawn-out court case.

A well-drafted trust also includes a framework for managing your affairs if you become incapacitated and can't make decisions for yourself—a critical protection a will doesn't provide and a way to avoid a potential Guardianship proceeding. Understanding the key differences between a living trust vs. a will is the first step toward building an estate plan that actually works for your family.

Texas probate courts are already burdened with a wide range of duties, which contributes to their caseloads and potential for long delays. You can learn more about the workload of Texas probate courts and see for yourself why so many are choosing smarter, more private alternatives.

While a living trust is a fantastic solution for many families, it's not the only tool for keeping your assets out of the courthouse. Texas law provides several simple, direct ways to transfer specific assets to your loved ones, letting them skip the probate process entirely. Think of them as targeted solutions for individual assets.

Streamlining Financial Accounts

For your bank accounts—checking, savings, and even CDs—you can add a Payable-on-Death (POD) designation. This is a simple form provided by your bank where you name who should receive the funds when you pass away. For investment accounts holding stocks or mutual funds, you can use a Transfer-on-Death (TOD) designation. Both are essentially beneficiary forms that allow for a direct, court-free transfer.

Passing on Real Estate Without a Judge's Approval

For most Texans, their home is their biggest asset. Thankfully, there’s a powerful tool designed specifically to keep real estate out of probate: the Texas Transfer-on-Death Deed (TODD).

Established in Chapter 114 of the Texas Estates Code, this simple deed lets you name a beneficiary who will automatically inherit your property upon your death. The process is straightforward: you sign and file the TODD in the county property records. The best part? You remain the full owner during your lifetime, free to sell, mortgage, or even revoke the deed if you change your mind.

When you pass, your beneficiary simply needs to file an affidavit (a sworn statement) in the property records, and the property is theirs. No court involvement is needed. Our firm has a detailed guide explaining the ins and outs of using a Texas Transfer-on-Death Deed as a probate alternative.

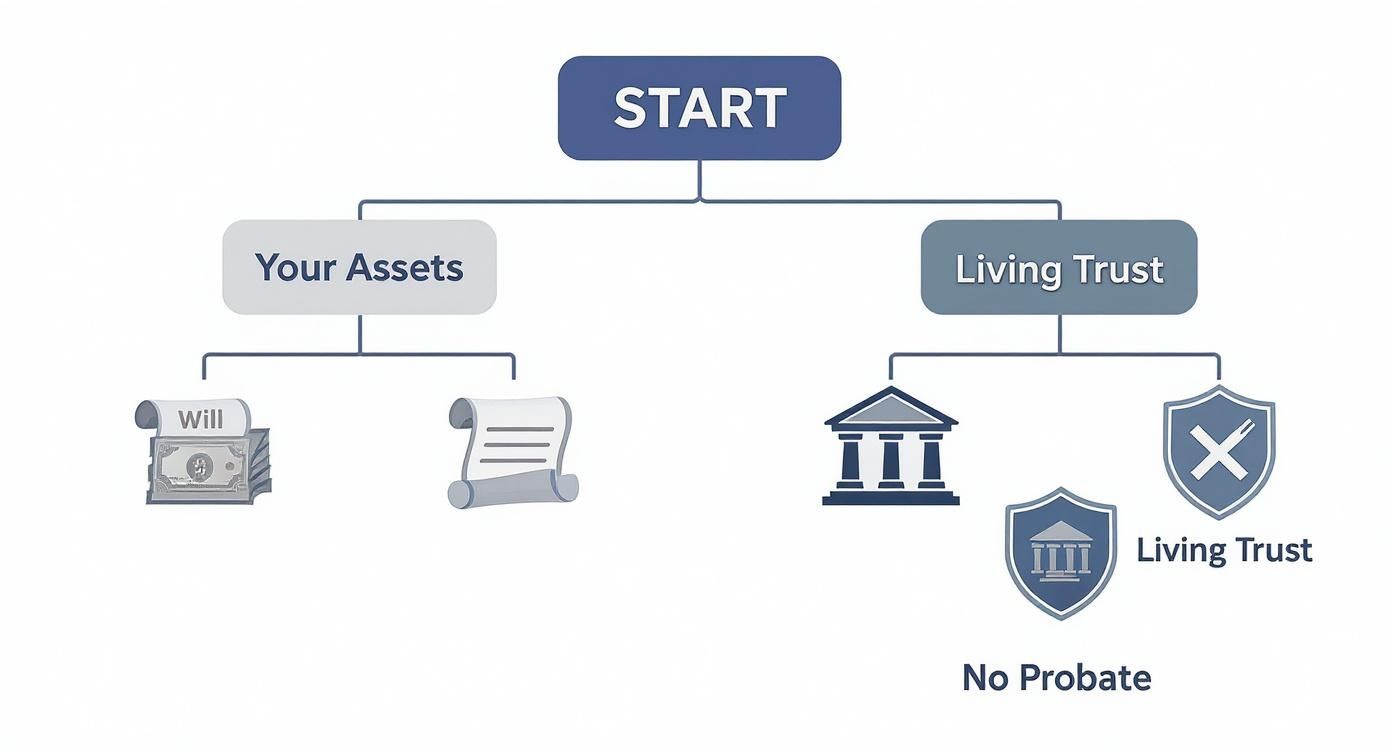

The decision tree below clearly shows the different paths your estate can take. As you can see, tools like trusts and deeds steer your assets away from the public, complex world of probate court.

This visual really drives home the point: you have a choice. You can direct your assets toward a private, efficient transfer or let them get tied up in a public, court-supervised process.

To better understand these differences, let's look at how assets move with and without these strategies.

Comparing Probate vs. Non-Probate Asset Transfers

| Characteristic | Assets in a Will (Goes to Probate) | Assets with Beneficiary Designations (Avoids Probate) |

|---|---|---|

| Transfer Process | Court-supervised; requires a judge's approval. | Direct transfer from institution to beneficiary. |

| Time to Access | Can take months or even years. | Typically available within days or weeks. |

| Privacy | Public record; anyone can see the details. | Private transaction between the beneficiary and institution. |

| Cost | Involves court fees, attorney fees, and administrative costs. | Usually free or very low-cost to set up and claim. |

| Control | Executor must follow court procedures. | Beneficiary claims the asset with a death certificate. |

This table highlights the stark contrast. Probate is a formal, public process, while non-probate transfers are direct, private, and much faster.

Joint Ownership as a Probate-Avoidance Strategy

Another common and effective strategy is joint ownership with right of survivorship.

When two or more people own an asset this way—whether it's a house, a car, or a bank account—the surviving owner automatically inherits the entire asset when the other owner dies. The transfer is instant and happens by operation of law, completely outside of the probate system.

Let's consider a classic scenario: a husband and wife buy a home together as "joint tenants with right of survivorship." If the husband passes away, his share of the house automatically transfers to his wife. She becomes the sole owner without needing to open a probate case, file documents with the court, or get a judge's approval. This simple choice on the deed saves her an immense amount of stress during an already difficult time.

Making Gifts and Using Small Estate Options

For many Texas families, a full-blown probate process is often unnecessary. Thankfully, there are smarter ways to handle things. Two effective strategies—giving gifts during your lifetime and using simplified small estate procedures—can help pass on assets efficiently and keep your family out of court. These methods work particularly well for estates that are more modest in size.

Making strategic gifts while you're still alive lets you pass assets to your loved ones and see them enjoy the benefits. It also serves a practical purpose: it reduces the value of your estate, which might help it qualify for simpler procedures after you’re gone. Just be sure to consult with a professional regarding IRS gift tax rules to avoid any unexpected tax consequences.

The Small Estate Affidavit: A Simpler Path Forward

When an estate isn't large, Texas law offers a streamlined alternative to formal probate. The magic number here is $75,000. If the total value of an estate (not counting the homestead and certain other non-probate assets) is under that amount, you can sidestep the traditional probate process.

One of the most common tools for these situations is the Small Estate Affidavit (SEA). Governed by Chapter 205 of the Texas Estates Code, an SEA is a sworn statement filed with the court that allows heirs to collect a decedent's property without a formal probate administration. It confirms that the estate meets a specific set of criteria.

To qualify for a Small Estate Affidavit, these conditions generally must be met:

- The person died without a will.

- The value of the estate's assets (excluding the homestead and exempt property) is $75,000 or less.

- The estate's assets are worth more than its debts.

- All the heirs have been identified and are in agreement about how the property should be divided.

Real-World Example: Putting the SEA to Work

Let's imagine an elderly gentleman passes away in Austin. He was living in a rented apartment, and his only assets were a $25,000 savings account and a paid-off car worth $10,000. He didn't have a will and left behind two adult children.

Instead of launching a full, costly probate case, his children can use a Small Estate Affidavit. They work together to complete the affidavit, listing the assets and any debts, and file it with the Travis County probate court. Once the judge signs off on it, they get a court order. They can then take that order to the bank and the DMV to transfer the assets directly into their names.

The whole process can often be wrapped up in a matter of weeks, not months. If you want to dig deeper into how this works, we have a helpful guide covering the basics of an affidavit of transfer without probate.

Key Insights for Your Texas Estate Plan

Taking the time to plan your estate is one of the most practical and compassionate things you can do for your family. You are giving them a clear, private roadmap for handling your affairs, shielding them from the stress, expense, and public scrutiny of the Texas probate courts. The goal is to make a difficult time as smooth as possible, and a few smart decisions now will make all the difference later.

Many people believe a simple will is enough, but that’s a common misconception. Understanding how to avoid probate in Texas starts with realizing that a will is actually an instruction manual for the probate court, not a way around it. True probate avoidance comes from using legal tools that transfer your assets automatically and privately.

Key Takeaway

Proactive estate planning isn’t about preparing for death—it’s about protecting your family’s future. By using the right legal tools, such as a revocable living trust, transfer-on-death designations, or joint ownership, you provide your loved ones with security, privacy, and peace of mind when they need it most. This ensures your legacy is passed on smoothly, efficiently, and exactly as you intended.

You don't have to figure this all out on your own. The Texas Estates Code is complex, and each of these strategies has nuances that require professional guidance. An experienced attorney can help you understand the full Texas Probate Process and build a plan that truly protects what matters most. A skilled Wills & Trusts attorney can ensure your plan is comprehensive and legally sound.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.

Common Questions About Avoiding Probate

Navigating estate planning in Texas brings up a lot of questions. It's completely normal to feel a bit overwhelmed by the details. Let's clear up some of the most common points of confusion families run into when trying to keep their estate out of court.

If I Have a Will, Does My Estate Automatically Avoid Probate?

This is easily the biggest misconception in estate planning, and the answer is a firm no. A will does not avoid probate; in fact, it's a set of instructions written specifically for the probate court.

Think of it this way: your will tells the judge how you want your property divided. But before that can happen, the court must first legally validate the will and officially appoint your executor. This is the probate process. To bypass the court entirely, you need different tools—like trusts or beneficiary designations—that are designed to transfer assets automatically.

Can a Transfer on Death Deed Keep My House Out of Probate?

Yes, absolutely. A Texas Transfer on Death Deed (TODD) is a powerful tool designed for this exact purpose. It allows you to name a beneficiary who will inherit your real estate the moment you pass away, no court approval needed.

Once you properly draft and file a TODD in the county property records, the transfer is set. It’s private, efficient, and saves your family from the significant costs and delays that come with probating a house.

Is a Living Trust Too Expensive or Complicated?

It's true that setting up a living trust has a higher upfront cost compared to drafting a simple will. But it's an investment that often saves your family a tremendous amount of money and stress down the road by completely avoiding court costs and probate-related attorney fees.

The process has two main parts: creating the legal trust document and then retitling your major assets into the trust’s name (this is called "funding" the trust). While it requires careful attention to detail, an experienced estate planning attorney can make the process straightforward and ensure it's done correctly to give your family maximum protection.

What Happens If I Own Property in Another State?

Owning real estate outside of Texas—like a vacation cabin in Colorado or a rental property in Florida—can create a significant headache for your heirs. It usually forces them to open a second probate case in that state, a process known as ancillary probate.

This is where a living trust truly shines. By placing all your properties, regardless of their location, into a single Texas-based trust, you consolidate ownership. This unified plan bypasses probate in every state where you own property, saving your family from the nightmare of dealing with multiple court systems, lawyers, and expenses.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.