The real difference between guardianship and power of attorney comes down to a single question: who is in control? Is it you, making a proactive choice now, or a judge, making a reactive decision later?

A Power of Attorney (POA) is a document you create while you have full mental capacity, empowering someone you trust—your “agent”—to act for you. It’s a key part of proactive estate planning. A guardianship, on the other hand, is a court proceeding that happens after someone is already deemed incapacitated and has no POA in place. It’s a legal safety net, not a plan.

Choice vs. Court Order: The Core Difference

When a Texas family has to manage a loved one’s affairs, knowing the difference between these two legal tools is everything. One is a deliberate act of personal planning; the other is a legal remedy of last resort.

Think of a Power of Attorney as a cornerstone of smart estate planning through Wills & Trusts. It’s a private document where you (the “principal”) grant legal authority to a trusted person to make financial or medical decisions on your behalf. This is your plan, set up on your terms, long before a crisis hits. It preserves your autonomy by making sure your chosen representative is the one carrying out your wishes.

A Guardianship is the exact opposite. It’s a public, court-supervised process that becomes necessary when an adult can no longer make safe decisions for themselves and never put a POA in place. A concerned family member has to petition the court, which then legally determines incapacity and appoints a guardian to take control. It’s a path that can be costly, time-consuming, and emotionally draining for everyone involved, especially during a time of grief or stress.

A Visual Breakdown: Power of Attorney vs. Guardianship

To really get a feel for the practical differences, let’s put these two legal instruments side-by-side. This table shows you just how different they are in terms of how they start, who’s watching over them, and how much control you actually get to keep.

Key Differences Power of Attorney vs Guardianship

| Feature | Power of Attorney (POA) | Guardianship |

|---|---|---|

| Origin | Created voluntarily by you (the principal) while you still have capacity. | Imposed by a court order after you’ve been legally declared incapacitated. |

| Control | You choose your agent and decide exactly what powers they have. | A judge appoints the guardian and sets their authority based on Texas law. |

| Privacy | A private document you only share when needed with banks or doctors. | A public court proceeding with records that are accessible to the public. |

| Timing | Takes effect when you say so—either right away or only if you become disabled. | Begins only after a formal court hearing and a judge’s final ruling. |

| Oversight | Your agent has a legal duty to you, but there’s no direct court supervision. | The guardian must report to the court, file inventories, and get approval for major decisions. |

| Cost | Usually a one-time legal fee to draft the document. | Involves significant, ongoing court costs, attorney fees, and administrative expenses. |

As you can see, how these tools are initiated and controlled couldn’t be more different. It’s estimated that approximately 1.3 million adults are under guardianship in the U.S., a number that really highlights how many families end up in this court-driven process, often just because a POA was never created.

As you look into these options, it’s also useful to see how they fit into the bigger picture of legal documentation use cases. The bottom line is clear: planning ahead with a Power of Attorney gives you control, while waiting for a crisis can mean losing it entirely.

How a Power of Attorney Protects Your Autonomy

A Power of Attorney (POA) is one of the most powerful tools you can have in your estate planning toolbox. It’s a way to protect your future and maintain control over your life, even if you reach a point where you can’t speak for yourself. Think of it as your proactive plan, created entirely on your terms, to make sure your wishes are honored without a judge ever getting involved.

In Texas, the person creating the document is called the principal—that’s you. The trusted person you choose to act on your behalf is the agent. This isn’t just a casual favor; your agent has a fiduciary duty, which is a heavy legal obligation to act only in your best interest. It’s a relationship built on profound trust.

The Two Most Important Types of POA

While there are several kinds of POAs, two are absolutely essential for any complete plan. Understanding what a power of attorney is and how each type works is the first step toward securing your independence.

- Durable Power of Attorney: This document gives your agent the authority to handle your financial and property matters. We’re talking about paying bills, managing bank accounts, filing taxes, and even dealing with real estate. The word “durable” is key here. It means the document stays effective even if you become incapacitated—which, frankly, is the exact moment your family will need it most.

- Medical Power of Attorney: This document empowers your agent to make healthcare decisions for you when you can’t. This could include consenting to or refusing medical treatments, choosing your doctors, and accessing your medical records. It ensures someone who truly knows your values is making these deeply personal choices.

Creating a Valid POA in Texas

Putting a legally solid Power of Attorney in place is a straightforward process guided by the Texas Estates Code. The requirements are precise, but they’re designed to be accessible and to ensure your document holds up when needed.

- It Must Be in Writing: An oral agreement won’t cut it. The POA must be a written document that clearly identifies you, your agent, and the specific powers you are granting.

- You Must Sign It: As the principal, you have to sign the document. If you’re physically unable to sign, another person can sign on your behalf, but it must be done in your presence and at your direction.

- It Must Be Acknowledged: You must sign the POA in front of a notary public. The notary’s seal and signature are there to confirm your identity and that you signed the document willingly.

Unlike a Will, a POA in Texas doesn’t typically require witnesses, but that notarization is mandatory. Without it, the document is not effective.

How a POA Works in a Real-World Scenario

Let’s look at a realistic example. Imagine Sarah, a widow in her 70s, creates a Durable Power of Attorney and a Medical Power of Attorney. She names her responsible son, David, as her agent in both documents. Years later, Sarah has a bad fall and is hospitalized with a head injury, leaving her unable to communicate.

Because Sarah had those POAs in place, David can immediately step in and:

- Access her bank account to pay her mortgage and utility bills so nothing falls behind.

- Speak with her doctors to understand her prognosis and approve necessary medical procedures.

- File an insurance claim on her behalf to cover her hospital stay.

Without a POA, David’s hands would be tied. He would have to petition a court for guardianship—a public, expensive, and slow process that can take weeks or even months. Sarah’s proactive planning saved her family an incredible amount of stress and protected her financial stability during a crisis.

And here’s the most important part: you remain in control. As the principal, you can change or completely revoke your Power of Attorney at any time, as long as you are mentally competent. This ensures the document works for you, and only for as long as you want it to.

Understanding the Texas Guardianship Process

When someone can no longer care for themselves and never signed a Power of Attorney, Texas law provides a court-supervised safety net: a guardianship. This isn’t a voluntary process; it’s a legal intervention designed for situations where an individual can no longer make safe decisions about their own well-being, often when a crisis is on the horizon. This process can be part of the larger Texas Probate Process when estate matters are involved.

Unlike a Power of Attorney, which is a private document you create, a guardianship is born out of the court system. It starts when a concerned family member or friend files an application with the proper Texas court, explaining why they believe their loved one needs a guardian’s protection.

This isn’t a step the court takes lightly. The entire proceeding hinges on one critical question: is the proposed “ward” legally incapacitated?

What Incapacity Means in Texas

Under Title 3 of the Texas Estates Code, an “incapacitated person” is an adult who, due to a physical or mental condition, is substantially unable to provide their own food, clothing, or shelter, care for their physical health, or manage their finances.

Proving this requires clear and convincing evidence. Almost without exception, this means getting a detailed medical evaluation from a physician. The doctor’s report must spell out the nature and severity of the person’s condition and offer a professional opinion on whether a guardian is truly necessary.

The Steps of the Guardianship Process

Trying to navigate the court system during an already emotional time can feel like a maze. Knowing the basic steps can bring a sense of order and predictability for your family.

- Filing the Application: The process kicks off when someone files an “Application for Appointment of Guardian” with the probate court in the county where the proposed ward lives.

- Medical Examination: A physician must examine the proposed ward within 120 daysbefore the application is filed and submit a formal report to the court.

- Appointment of Attorney Ad Litem: The court appoints an independent attorney, called an “attorney ad litem,” to represent the proposed ward’s interests. This attorney’s job is to meet with them, explain their rights, and report their findings back to the judge.

- The Court Hearing: A formal hearing is held. The judge will review all the evidence, including the doctor’s letter and the ad litem’s report, listen to testimony, and then make a final decision on two things: whether the person is truly incapacitated, and who should be appointed as their guardian.

Types of Guardianship

Texas law recognizes that every situation is different, so it allows for several types of guardianships tailored to the person’s specific needs. The court will always choose the least restrictive option available.

- Guardian of the Person: This guardian makes decisions about personal matters—where the ward lives, what medical care they get, and their day-to-day activities.

- Guardian of the Estate: This guardian is responsible for the ward’s financial world, from paying bills and managing property to handling investments.

- Guardian of the Person and Estate: In many cases, it makes sense for one person to be appointed to handle both personal and financial duties.

Guardianship grants broad, court-supervised control for a simple reason: it’s meant to protect those who can no longer protect themselves. Nationally, family members make up 85% of all guardians for the 1.3 million adults under court protection, which shows just how often families step into this role.

A guardian carries significant responsibilities, including filing an inventory of the ward’s assets and submitting annual reports to the court. This ongoing oversight is a serious, long-term commitment and highlights a key difference between guardianship and power of attorney. One is a private agreement, while the other lives under constant judicial supervision. To learn more, you can take a deeper dive into the specifics of legal guardianship in Texas in our detailed guide.

Comparing Decision-Making Authority and Personal Rights

One of the biggest distinctions between a guardianship and a power of attorney comes down to a simple question: who is in control? An agent’s authority comes from choices you made, while a guardian’s power comes from a judge’s ruling. It’s a critical difference for Texas families to understand because it directly impacts a loved one’s freedom and dignity.

With a Power of Attorney, you are the architect of the arrangement. You get to decide exactly what your agent can and cannot do. You might grant them broad authority to handle all your financial affairs, or you could limit their power to a few specific tasks, like paying bills from a single bank account. This level of control ensures the person acting on your behalf is following a script that you wrote yourself.

A guardianship, on the other hand, operates from a completely different starting point. The authority isn’t granted by the individual; it’s handed down by a court order. This power is strictly defined and governed by the Texas Estates Code, which results in a significant—and legally binding—loss of rights for the person under the guardianship, known as the “ward.”

The Impact on Personal Autonomy

When a Texas court establishes a guardianship, it legally strips the ward of their ability to make certain decisions. This isn’t just a small shift; it’s a fundamental loss of personal freedom. A person under a full guardianship can no longer make their own choices about some of the most critical matters in their life.

These lost rights can include:

- Financial Control: The ward loses the right to enter into contracts, manage their own bank accounts, sell property, or handle their investments.

- Healthcare Decisions: The authority to consent to or refuse medical treatment is transferred from the individual to the guardian.

- Personal Freedom: The guardian often has the power to decide where the ward will live, which could mean moving them into an assisted living facility even if it’s against their wishes.

Authority and Autonomy: A Direct Comparison

Grasping the source of power and its limitations is the key to seeing the profound gap between these two legal tools. The table below really drives home how one preserves independence while the other, by its very nature, must restrict it.

| Aspect of Control | Power of Attorney Agent | Court-Appointed Guardian |

|---|---|---|

| Source of Power | Granted by you (the principal) in a private legal document. | Granted by a judge in a public court order. |

| Scope of Authority | Defined and limited by the specific terms you write into the POA document. | Defined by the judge’s order and the Texas Estates Code, often granting broad control. |

| Personal Rights | Your legal rights remain fully intact. You can revoke the POA at any time if you are competent. | Many personal and civil rights are legally removed and transferred to the guardian. |

| Decision-Making | The agent must act in your best interest and, where possible, follow your known wishes. | The guardian makes decisions they believe are in the ward’s best interest, supervised by the court. |

At its core, a Power of Attorney is a tool for delegation, not surrender. It lets you plan for a time when you might need help, ensuring your voice is still heard through the actions of someone you trust implicitly. A guardianship is a protective measure of last resort that, by necessity, involves a serious loss of personal liberty. This is why it’s crucial to address these documents when creating your Wills & Trusts, as proactive planning can often avoid the need for court intervention like Probate Litigation.

Real-World Scenarios: The Planner vs. The Crisis

Legal documents and court hearings can feel distant and abstract. To really grasp the massive difference between a Power of Attorney and a guardianship, it helps to see how these two paths unfold for real Texas families. Let’s walk through two stories: one of smart, proactive planning and one of a sudden, unexpected crisis.

Scenario 1: The Planner

Meet Robert and Susan, a married couple in their late 60s enjoying a quiet life in a Houston suburb. During a routine update to their estate plan, their attorney at The Law Office of Bryan Fagan advised them to also create Durable and Medical Powers of Attorney. It was a simple step—they named each other as the primary agent and their oldest son, Michael, as the backup.

For years, those documents just sat in a file, untouched. Then, one morning, Robert had a severe stroke. He was hospitalized, unable to speak or make decisions for himself. Susan’s world was instantly turned upside down, but the planning they did years ago became an invaluable shield.

Because Robert had a Medical Power of Attorney, Susan was immediately able to:

- Sit down with his doctors and go over his medical records.

- Make the tough decisions about his treatment, guided by conversations they’d had over the years about his wishes.

- Authorize his move to a specialized rehab facility without a single legal delay.

At the same time, the Durable Power of Attorney gave her the power to:

- Access Robert’s retirement account to pay the mounting hospital bills.

- Manage their joint investments and make sure their property taxes were paid on time.

- File their joint tax return without needing Robert’s signature.

There was no court, no judge, and no public record of their private health crisis. Michael was kept in the loop, ready to step in if needed, but the transition was seamless. Robert and Susan’s foresight allowed them to face a medical emergency with dignity, privacy, and control, saving them thousands in potential legal fees and an immeasurable amount of stress.

Scenario 2: The Crisis

Now, let’s look at another family. Margaret is an 82-year-old widow living by herself in Dallas. Her two adult children, Emily and David, have started to notice their mom is getting more and more forgetful. She’s missed bill payments and recently gave a large chunk of her savings to a phone scammer. When they try to help, Margaret gets defensive, insisting she’s perfectly fine. She never created a Power of Attorney.

One afternoon, a neighbor calls Emily—Margaret has wandered from her home and seems confused. After they bring her home safely, the kids realize they are in a full-blown crisis. They have no legal authority to get into her bank accounts to protect her from more scams, nor can they talk to her doctors about her rapid cognitive decline.

Their only choice is to pursue a Guardianship. This throws them into a stressful and unfamiliar legal maze:

- They have to hire an attorney just to file an application with the court.

- Margaret is required to undergo a formal medical evaluation to legally prove she is incapacitated—a process she finds humiliating.

- The court appoints another attorney to investigate their private family situation.

- They must attend a public court hearing where a judge will decide who gets to control their mother’s life.

The process drags on for months and costs thousands of dollars in court fees and attorney bills, all coming out of Margaret’s savings. The family’s private struggle is now a public court record. While the guardianship does ultimately protect Margaret, it comes at a huge emotional and financial cost—one that proactive planning with a Power of Attorney could have completely avoided.

These stories show that the most important part of estate planning happens long before it’s ever needed. By working with a knowledgeable attorney on Wills & Trusts and Powers of Attorney, you can make sure your family follows the planner’s path, not the crisis path.

Takeaway

Key Insight: A Power of Attorney is an extension of your own will, allowing a trusted person to carry out your wishes. A guardianship legally replaces your will with the court’s judgment and the guardian’s decisions, fundamentally altering your personal rights. The difference isn’t just about paperwork; it’s about peace of mind. A Power of Attorney is a plan for peace, while a guardianship is a solution born from a crisis.

Making the Right Choice for Your Family’s Future

Throughout this guide, my goal has been to cut through the legal jargon and give you the clarity needed to make a choice that protects you and your family. The difference between guardianship and power of attorney isn’t just a legal distinction—it’s deeply personal. It’s about preserving your control, dignity, and privacy for as long as you possibly can.

If there’s one thing to take away from all this, it’s simple: proactive planning with a Power of Attorney is almost always the better path. It keeps you in control, saves your family from the immense stress and expense of a court battle, and ensures your personal affairs stay private.

Overcoming the Fear of Losing Control

A common worry I hear from Texas families is the fear of giving up control by signing a POA. This is a complete misunderstanding of how these documents are designed to work. A Durable Power of Attorney is specifically created to activate only when you need it most, ensuring your chosen agent steps in if you become incapacitated. It’s a safety net you create yourself, not a surrender of your rights.

You are the one who decides who your agent is, what powers they have, and when those powers kick in. This is a world away from a guardianship, where a judge makes all those decisions for you after your rights have already been legally stripped away. In fact, you can learn more in our article about how to cancel a Power of Attorney, which shows just how much you remain in the driver’s seat.

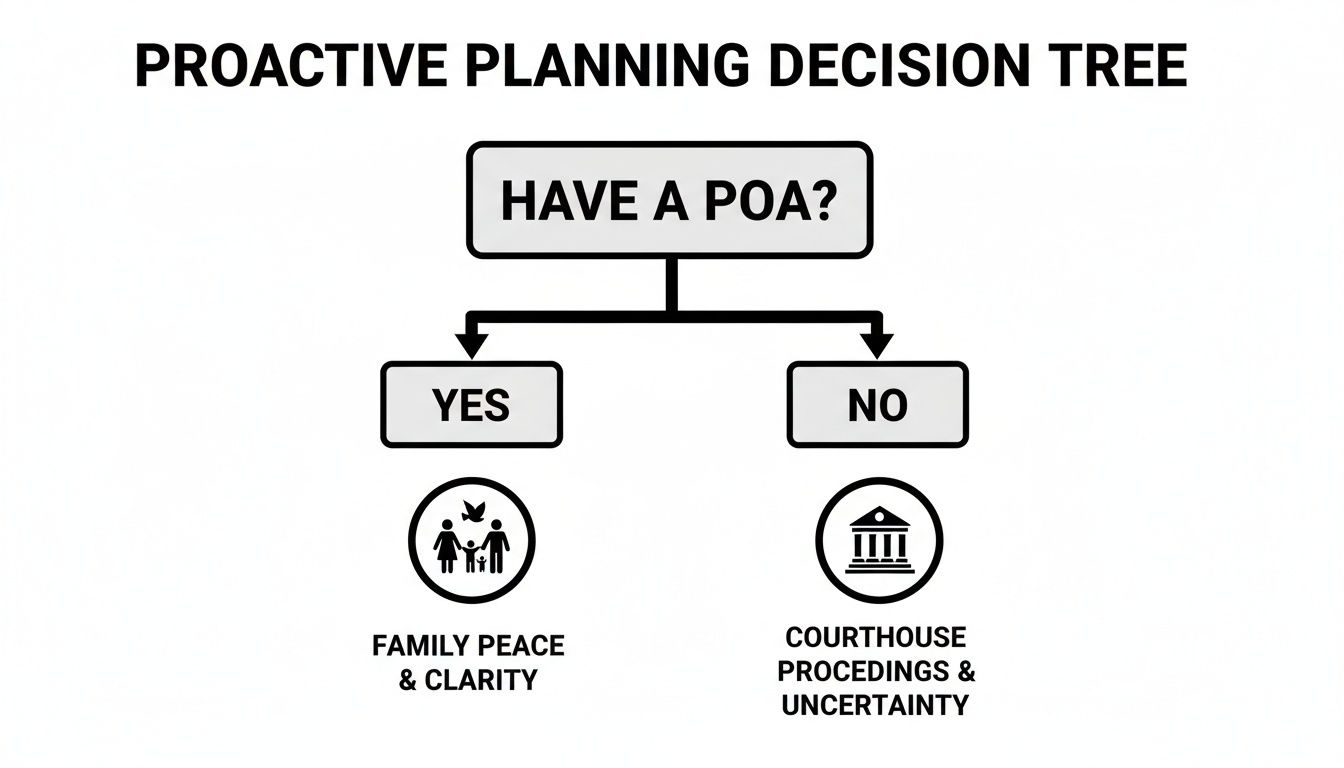

The decision tree below perfectly illustrates the two very different paths that stem from this single choice.

As you can see, planning ahead with a POA leads to family peace, while having no plan can lead directly to the courthouse steps. The choice you make now determines which path your family will have to walk later on.

Our team at The Law Office of Bryan Fagan is here to help you create a plan that reflects your unique wishes and circumstances. We will ensure your documents are prepared correctly under Texas law, giving you and your family the security and peace of mind you deserve. Protect your future and your family’s well-being by acting today.

Frequently Asked Questions

When families in Texas start weighing their options between a Power of Attorney and a guardianship, a handful of practical questions almost always come up. Let’s tackle some of the most common concerns we hear from our clients with plain-English answers.

Can a Power of Attorney Actually Prevent a Guardianship in Texas?

Yes, in most situations, it absolutely can. A well-drafted and properly signed Durable Power of Attorney is hands-down the most powerful tool you have to avoid a court-imposed guardianship.

Texas law actually requires judges to look for less restrictive alternatives before they’ll even consider a guardianship. If a valid POA is already in place and gives your agent the authority they need to act on your behalf, a court will almost always decide a guardianship isn’t necessary. This is precisely why planning ahead is so critical—it creates the exact off-ramp the court is looking for.

What Happens If My Chosen Agent Can’t Serve Anymore?

That’s a fantastic question, and it gets to the heart of what makes a POA truly effective. Any thoughtfully prepared Power of Attorney should name at least one successor agent, sometimes called an alternate agent. Think of it as a built-in backup plan.

If your primary agent passes away, becomes disabled, or simply can’t or won’t serve for personal reasons, the successor agent you named can step right in without missing a beat. Without that backup, your POA could become useless, potentially forcing your family into the very guardianship proceeding you were trying to prevent.

How Do the Costs of a POA and a Guardianship Compare?

The financial difference here isn’t just noticeable—it’s massive. Setting up a Power of Attorney with a seasoned attorney usually involves a straightforward, one-time fee to get the documents drafted and executed correctly.

A guardianship, on the other hand, is a full-blown court proceeding with a laundry list of recurring expenses. The costs can pile up quickly and often include:

- Initial court filing fees

- Fees for the attorney who files the guardianship application

- Fees for the court-appointed attorney (the ad litem) who represents the proposed ward

- Ongoing costs for filing annual reports and attending court hearings

A guardianship can easily run into thousands of dollars, making the proactive investment in a Power of Attorney a far more sensible and cost-effective choice for your family.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.