When you're planning for your family's future, one of the first questions that comes to mind is the cost to set up a trust. The truth is, the investment can range from a few hundred dollars for a do-it-yourself online service to several thousand for a comprehensive plan crafted by an experienced Texas attorney.

Navigating estate planning can feel overwhelming, especially when you're trying to protect the people you love. It helps to think of creating a trust not as an expense, but as a foundational investment in your family’s long-term security and peace of mind. This guide will walk you through the factors that influence the cost, explain complex terms in plain English, and provide the clarity you need to make an informed decision.

Your Quick Guide to Texas Trust Setup Costs

Deciding to create a trust is a significant step toward protecting your assets and ensuring your wishes are honored after you're gone. For most Texas families, the immediate question is a practical one: "What's this going to cost me?" Understanding the financial commitment upfront helps you plan effectively and choose the right path for your situation.

The reality is there's no single price tag. The final cost hinges on how complex your estate is, the specific type of trust you need, and whether you work with an attorney or use a DIY service. A simple estate with straightforward goals will naturally cost less than one involving business assets, multiple properties, or complicated family dynamics requiring special provisions under the Texas Estates Code.

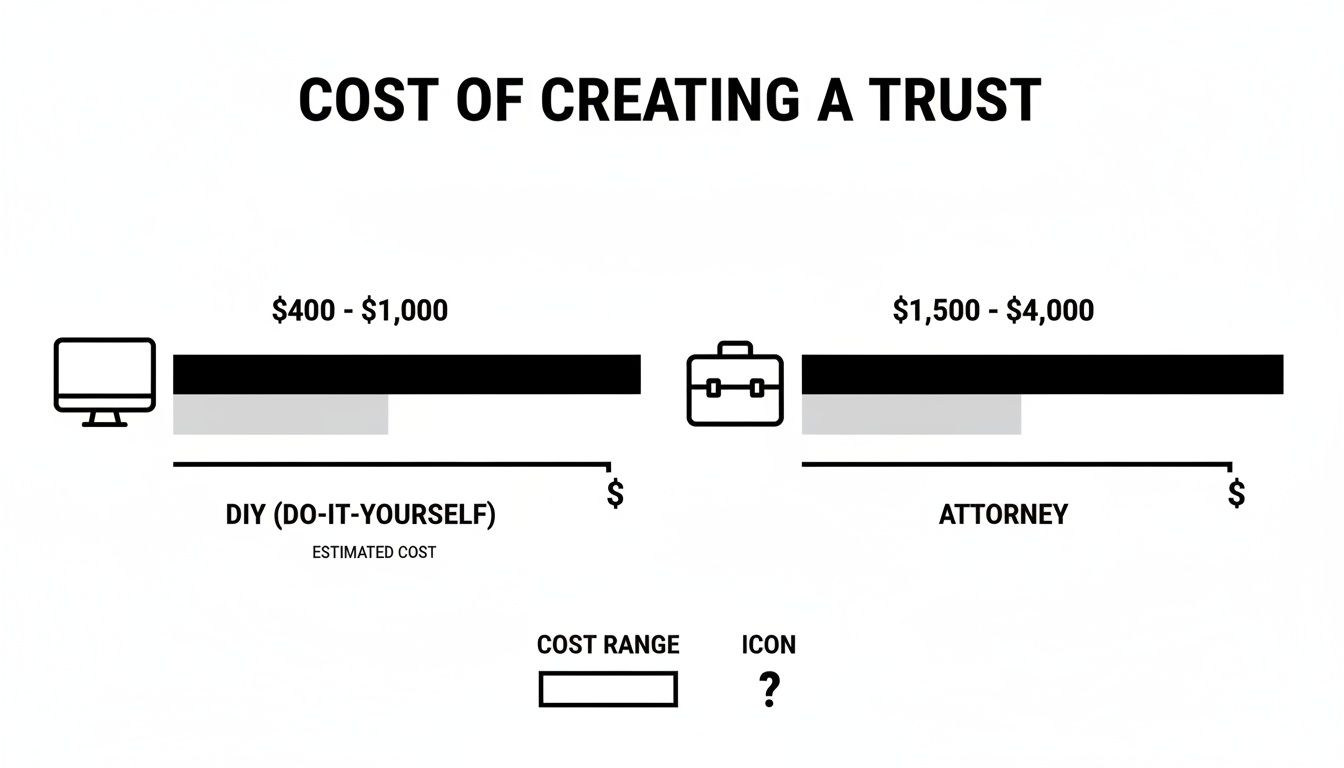

To give you a clearer picture, here's a quick comparison of the typical cost ranges you can expect.

Estimated Trust Setup Costs at a Glance

| Method | Typical Cost Range | Best For |

|---|---|---|

| DIY Online Service | $400 – $1,000 | Simple estates with very few assets and straightforward beneficiary designations. |

| Attorney-Prepared | $1,500 – $4,000+ | Most situations, especially those involving real estate, business interests, or complex family needs. |

While online tools offer a lower entry point, they can't replace the personalized strategy and legal safety net that an attorney provides, ensuring your plan is sound and legally enforceable in Texas.

Attorney-Guided vs. DIY Services

The financial investment for a trust varies quite a bit. Generally, you can expect to pay between $400 and $4,000 to get one established.

For those using online tools, costs typically fall between $400 and $1,000. This can be an option for very simple estates. However, for personalized guidance and the assurance that everything is done right, most families find it's worth it to work with an attorney. In that case, the cost often ranges from $1,500 to $4,000, with more complex plans sometimes exceeding $5,000.

This chart breaks down the typical cost differences between these two approaches.

As you can see, while DIY options have a lower initial price, investing in professional legal services provides customized planning that can protect you from costly future mistakes. This is especially critical for ensuring your trust complies with the Texas Estates Code and is properly funded—steps that are frequently botched in generic online kits.

For a deeper look into what's involved in the process, check out our guide on how to set up a trust fund.

What Really Drives the Cost of Your Trust

If there isn’t a single, fixed price for a trust, what truly determines the final bill? Understanding the key factors demystifies the numbers and empowers you to have a confident conversation with an estate planning attorney. At the end of the day, the cost to set up a trust is a direct reflection of the work required to build a plan that truly protects your family.

Think of it like building a custom home. A simple, one-story house is going to have a different price tag than a multi-level home with unique architectural features. It's the same with trusts. A trust for a straightforward estate is less complex—and therefore less costly—to draft than one for a family with diverse assets and intricate needs.

Your Estate's Complexity

The single biggest driver of cost is how complex your financial and family situation is. A more detailed and sophisticated plan simply requires more of an attorney's time, expertise, and careful drafting to make sure every single detail is legally sound under the Texas Estates Code.

Here are some key factors that ramp up the complexity:

- Asset Diversity: Owning multiple properties, holding business interests, or having significant investment portfolios requires more detailed planning to fund the trust correctly.

- Family Dynamics: Blended families, beneficiaries with special needs, or concerns about a potential heir's spending habits all call for specialized trust provisions. For example, a loved one may need a Guardianship established.

- Specific Goals: If your plan needs to account for Medicaid eligibility, protect assets from creditors, or minimize estate taxes, your trust will require more advanced legal strategies.

Each of these elements adds another layer to your estate plan, moving it from a standard template to a highly personalized legal shield for your loved ones.

The Attorney's Billing Structure

Another major factor is how your attorney charges for their services. This is a crucial point to clarify during your initial consultation, as it directly impacts your total investment. There are two primary models you’ll see in estate planning.

When you're trying to understand the total expenditure of setting up a trust, it helps to look at how professional fees work in other fields, much like examining the cost of professional services.

- Flat Fee: Many estate planning attorneys offer a flat-fee package. This is a set price that covers a specific list of services, like drafting the trust, a pour-over will, and powers of attorney. This model gives you predictability and transparency, so you know the full cost right from the start.

- Hourly Rate: Some attorneys bill by the hour. This model might be used for exceptionally complex estates or for ongoing trust administration tasks down the road. While it can be cost-effective for simple matters, it can also lead to unpredictable final costs if unexpected issues pop up.

Getting a clear picture of these variables—your estate’s unique needs and your attorney’s fee structure—is the first step toward creating a trust that delivers true, lasting value for your family. This knowledge helps ensure the plan you build is a perfect fit for your life.

Attorney-Drafted Trusts vs DIY Online Kits

When you start digging into the cost to set up a trust, it’s impossible to ignore the lure of low-cost, do-it-yourself (DIY) online kits. The sticker price is tempting, and it’s only natural to wonder if you really need to spend the money on an attorney. It’s a fair question, and one that every Texas family should explore before making a decision that will impact their legacy for generations.

While DIY services promise a quick and cheap solution, they often come with a whole host of hidden risks. These platforms rely on generic, one-size-fits-all templates that simply can't account for your unique family situation, the specific assets you own, or what you actually want to achieve. That lack of personalization can lead to disastrous—and expensive—mistakes down the road.

The Hidden Dangers of DIY Trusts

One of the most common and devastating mistakes we see with DIY trusts is improper funding. Just creating the trust document isn't enough; you have to legally transfer your assets—like your house, bank accounts, and investments—into the trust's name. It's a critical step that generic online kits often gloss over, leaving you with nothing more than an empty, useless legal shell.

On top of that, these templates might not fully comply with the nuances of the Texas Estates Code. An invalid clause or a poorly worded instruction could expose your family to the very thing you were trying to avoid: a long, public, and expensive probate process. For many, the initial "savings" from a DIY kit get wiped out many times over by future legal bills.

A Realistic Scenario: A Blended Family’s Dilemma

Think about a common Texas scenario: a blended family. Mark and Sarah are on their second marriage. Mark has two kids from his previous marriage, and Sarah has one. Their goal is to make sure that when they’re gone, their assets are divided fairly among all three children, but with specific protections in place.

They opt for a $300 online trust kit, assuming it will cover all their bases. The problem is, the generic document doesn't have the specific language needed to protect the inheritance for Mark's children if he passes away first. When Mark dies, the vague terms of the DIY trust allow the assets to be handled in a way he never wanted, igniting a painful and costly probate litigation battle between Sarah and his children. This heartbreaking outcome was completely avoidable. An attorney would have immediately flagged the blended family dynamic and drafted a custom trust with clear, legally binding instructions that honored their exact wishes.

The Value of Professional Guidance

Working with an attorney isn't just about getting a document; it's about getting a personalized legal strategy. While an attorney-drafted trust is a bigger investment upfront, the cost reflects the expertise needed to get it right. You can generally expect to pay between $1,000 and $4,000 for an attorney to create your trust, though the final price will depend on things like your marital status and how complex your estate is. You can learn more about how these costs are determined from SmartAsset.com.

This investment ensures your legal documents are prepared correctly from the start, dramatically lowering the risk of conflict later on.

Ultimately, the choice comes down to certainty. A DIY kit might save you a few hundred dollars now, but an attorney-drafted trust from a firm that specializes in Wills & Trusts provides something far more valuable: peace of mind, knowing your family’s future is truly secure.

Understanding Costs for Different Types of Trusts

A trust isn't a single, one-size-fits-all product. Think of trusts as a collection of powerful legal tools, each designed for a specific job. Just like you wouldn't use a hammer to turn a screw, you wouldn't use a simple living trust to protect your life savings from creditors.

The cost to set up a trust is a direct reflection of its complexity and the goals you're trying to achieve. Getting familiar with the common types of trusts used by Texas families will help you figure out where your needs might fit and have a much more productive conversation with an attorney.

To give you a clearer picture, let's break down the most common trust types and what you can generally expect them to cost when prepared by an experienced lawyer.

| Type of Trust | Primary Purpose | Estimated Attorney Cost Range |

|---|---|---|

| Revocable Living Trust | Probate avoidance and streamlined asset management during incapacity. | $1,500 – $3,500 |

| Irrevocable Trust | Asset protection, tax reduction, and long-term care (Medicaid) planning. | $3,000 – $7,000+ |

| Special Needs Trust (SNT) | Protecting eligibility for government benefits for a person with a disability. | $2,500 – $5,000 |

These ranges are a starting point. Your final cost will depend on the unique details of your family, your assets, and your long-term goals.

Revocable Living Trusts

The Revocable Living Trust is the workhorse of modern estate planning. For many families, it's the foundational tool for managing their assets. Think of it as a flexible container you create to hold your property—your house, bank accounts, and investments—during your lifetime.

Its main job is to help your estate sidestep the public, often lengthy, and expensive probate process. Because you, as the creator (or "grantor"), can change it or even cancel it at any time, it offers maximum flexibility.

- Primary Goal: Probate avoidance and simplified asset management.

- Typical Attorney Cost:$1,500 – $3,500. The price tends to go up with the number and complexity of assets you need to transfer into the trust.

Irrevocable Trusts

Now we get into more advanced territory. Once you create and fund an Irrevocable Trust, it generally can't be changed. That rigidity is actually its greatest strength. By giving up control over the assets you place inside it, you can achieve powerful goals that a revocable trust simply can't.

These are the tools of choice for serious planning, like shielding assets from future creditors, minimizing estate taxes for high-net-worth families, or planning for long-term care costs. Because they are permanent and complex, they demand meticulous drafting to comply with the Texas Estates Code. A deep dive into the differences between a revocable trust vs. irrevocable trust can really highlight which structure is right for you.

- Primary Goal: Asset protection, tax minimization, and Medicaid planning.

- Typical Attorney Cost:$3,000 – $7,000+. Costs can climb higher depending on the specific asset protection strategies involved.

Specialized Trusts

Some families face unique circumstances that require highly specialized legal tools. These trusts are crafted with very specific provisions to solve particular challenges, like caring for a loved one with a disability.

A Special Needs Trust (SNT) is a perfect example. It's carefully designed to hold assets for a beneficiary with special needs without jeopardizing their eligibility for crucial government benefits like Medicaid or Supplemental Security Income (SSI). The legal rules for these are incredibly strict, making professional drafting an absolute necessity.

- Primary Goal: To provide for a loved one with a disability without disqualifying them from essential government aid.

- Typical Attorney Cost:$2,500 – $5,000, a price that reflects the precision required to navigate both federal and state regulations.

Looking Beyond the Initial Setup Fee

Getting your trust document signed is a huge milestone, but it’s definitely not the end of the road. To make sure your trust actually works the way you want it to, you have to look past the initial drafting fee and understand the full picture of what it costs to maintain. This helps your family avoid any nasty financial surprises down the line.

One of the most critical—and most frequently missed—steps is funding the trust. Think of it this way: the legal document creates a secure box, but that box is empty until you actually put your assets inside it. This funding process means legally retitling things like your house, bank accounts, and investment portfolios into the name of the trust.

The Overlooked Costs of Funding and Administration

Funding isn't just about shuffling papers; it can come with real costs. Transferring your home into the trust, for example, requires preparing and recording a new deed with the county, which has filing fees. Some banks or financial institutions might also charge a small administrative fee to retitle an account. These costs are usually pretty small compared to the initial setup, but they are absolutely necessary to make your trust legally effective.

Beyond getting everything funded, you should also plan for a few potential ongoing expenses:

- Professional Trustee Fees: If you name a bank or a corporate trustee to manage the trust, they will charge an annual fee for their services. This is often a small percentage of the total assets they’re managing. It’s a common choice for complex estates or for people who don't have a suitable family member to step into that role.

- Future Amendments: Life changes. You might buy a new vacation property, welcome a new grandchild, or have a major shift in your finances. Modifying your trust to reflect these changes will require an attorney’s help, and that will come with a cost.

Costs for More Complex Trust Structures

For estates with highly specialized needs, like those requiring offshore trusts for international asset protection, the costs jump significantly. The difference between domestic and offshore trust costs is massive. Offshore trusts involve much larger expenses due to complicated regulations and fees specific to that jurisdiction. If you're considering this path, you'll need to budget for steep initial setup costs and substantial annual maintenance fees for administration, accounting, and ongoing compliance. You can discover more insights about these specialized expenses from AFSIC.

Understanding these additional costs is just part of responsible estate planning. Having a clear view of both the initial and ongoing investments ensures your trust remains a powerful and effective tool for your family for years to come. For a deeper dive into what’s involved in managing a trust after it's created, check out our guide on trust administration in Texas.

Takeaway: Your Trust Is an Investment, Not an Expense

It’s easy to look at the cost to set up a trust as just another bill to pay. But that’s the wrong way to think about it. The money you put into creating a trust isn't an expense—it’s a powerful investment in your family’s future. It's an investment in certainty, security, and most importantly, peace of mind.

A properly drafted trust, one that’s fully compliant with the Texas Estates Code, acts as your family's shield. It protects them from the public, stressful, and often shockingly expensive Texas probate process. More than that, it guarantees your assets are managed and handed down exactly as you wanted, without courtroom interference or needless delays.

The ultimate value of a trust isn't measured in dollars saved, but in the seamless protection it provides for your loved ones during a difficult time. This upfront investment pays dividends for years to come. It brings clarity and efficiency to otherwise complicated tasks, like selling a house in a trust after death.

Ultimately, taking this proactive step provides the profound comfort of knowing you have a solid plan in place to care for your family, no matter what happens. That feeling is the true return on your investment—a legacy of protection that will last for generations.

Answering Your Top Questions About Trust Costs

When Texas families start exploring trusts, the conversation always turns to cost. It's a practical and important question. Let's tackle some of the most common questions we hear, breaking them down into plain, straightforward answers.

Is the Cost to Set Up a Trust Tax-Deductible in Texas?

This is a great question, but the answer for most people is no. Generally, the legal fees you pay to create a personal trust, like a standard revocable living trust, are seen as a personal expense. That means they are not tax-deductible.

However, there can be gray areas. If a portion of your attorney's work involves specific tax planning advice or helps manage income-producing assets that will go into the trust, those fees might be deductible. This is definitely a conversation to have with your CPA or tax advisor, who can look at your specific financial picture.

What Is Usually Included in an Attorney's Flat-Fee Trust Package?

A flat fee for a trust should be more than just a single document. Think of it as a comprehensive estate planning toolkit designed to work together seamlessly. A good attorney's package isn't just about drafting paperwork; it's about building a complete plan.

Most quality flat-fee packages will include:

- An in-depth initial consultation to really understand your goals, family dynamics, and financial situation.

- The drafting of the main trust document itself.

- The creation of crucial supporting documents, like a pour-over will, financial power of attorney, and medical directives.

- Clear, practical guidance on the critical next step: funding your trust by transferring assets into it.

Before you sign on with any firm, always ask for a detailed breakdown of what their flat fee covers. You want to make sure there are no surprises down the road.

Can I Pay for a Trust in Installments?

Absolutely. Many law firms get that estate planning is a significant but essential investment for a family. To make it more manageable, offering flexible payment options is common. Most firms will work with you on a payment plan or accept credit cards.

Don't ever hesitate to bring this up during your first meeting. A good attorney wants to make the process accessible and stress-free, and finding a payment solution that fits your budget is part of that commitment.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.