Probate is a process that many people hope to avoid, yet it remains a reality for countless families across Texas. When a person dies, their estate—meaning all the assets they owned—must be settled. This involves paying off any remaining debts and ensuring the remaining assets are distributed according to the deceased’s will. It is done according to Texas law in cases where no will exists. For some estates, probate is relatively straightforward. However, for others, probate costs can be an expensive and drawn-out process that takes months or even years to resolve. Many people underestimate just how much probate can cost, both financially and emotionally, and fail to take proactive steps to keep their estate out of it.

Whether you are planning your estate or dealing with the probate of a loved one’s assets, understanding the real cost of probate in Texas is essential. This guide will break down the actual expenses involved, the hidden costs that many don’t anticipate, and the strategies you can use to protect your estate from excessive fees and unnecessary complications.

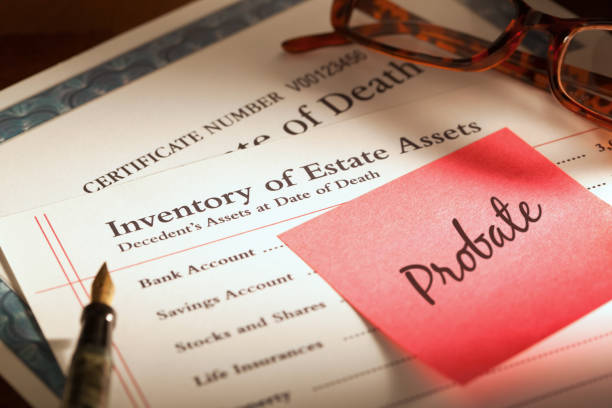

What Exactly Is Probate, and Why Does It Matter?

Probate is the legal process used to validate a will (if there is one), settle debts, and distribute the remaining assets to heirs. In Texas, probate is often simpler than in other states due to its streamlined court procedures, but it can still be costly and time-consuming. The primary goal of probate is to ensure that the deceased person’s financial affairs are handled properly. The court oversees the process to prevent fraud and ensure that assets are distributed according to the law. However, the process can be expensive, particularly if the estate is large, complex, or contested by family members.

The Breakdown of Probate Costs in Texas

Many people assume that probate is just about paying a small court fee and waiting for assets to be distributed. In reality, multiple costs add up throughout the process, significantly reducing the value of an estate. Here’s a breakdown of the main expenses associated with probate in Texas:

Court Filing Fees

Every probate case requires filing with the court, and these fees vary by county. On average, filing fees in Texas range from $250 to $400. While this may not seem like a large sum, it’s just the beginning of the expenses involved.

Attorney Fees

Although Texas does not require an attorney for probate, many executors find legal assistance necessary, particularly when dealing with complicated estates or potential disputes among beneficiaries.

Attorney fees in probate cases can be structured in different ways:

- Flat fees: Some attorneys offer a fixed price, often starting at around $3,000 for simple cases.

- Hourly rates: Lawyers may charge between $200 and $500 per hour, and if the case drags on, legal costs can quickly escalate.

- Percentage of the estate: Some attorneys take a percentage of the estate’s value, typically ranging from 3% to 5%. While this may seem reasonable at first glance, it can amount to tens of thousands of dollars for high-value estates.

Executor Fees

The executor—the person responsible for managing the estate through probate—is entitled to compensation. Texas law allows executors to take a fee of up to 5% of all income and cash received by the estate. This compensation is meant to cover the time and effort required to handle estate matters, but it adds another expense that reduces the estate’s overall value.

Appraisal and Valuation Costs

If the estate includes real estate, a business, or valuable personal property, professional appraisals may be required. These appraisals determine the fair market value of assets for tax and distribution purposes.

Typical appraisal costs in Texas range from $300 to $600 per property. However, for large or complex estates—especially those involving multiple properties or business interests—appraisal fees can be significantly higher.

Bond Fees

In some probate cases, the court requires the executor to obtain a probate bond. This bond acts as a financial safeguard for beneficiaries, ensuring that the executor handles the estate responsibly. Bond costs depend on the size of the estate and the executor’s credit history but typically range from $500 to several thousand dollars.

Accountant and Tax Preparation Fees

If the deceased earned income in the year of their passing, an accountant may need to prepare and file a final income tax return. If the estate itself generates income, additional tax filings may be necessary. Estate tax preparation costs can range from a few hundred dollars to several thousand, depending on the complexity of the estate.

Miscellaneous Costs

Several additional costs can arise during probate, including:

- Publishing legal notices: Texas law requires executors to notify creditors of the estate by publishing a notice in a local newspaper, which can cost between $50 and $300.

- Debt payments: Before heirs receive any inheritance, debts must be settled. If the estate owes significant debts, this can greatly reduce the remaining assets.

- Property maintenance costs: If real estate is involved, the estate may have to cover mortgage payments, property taxes, insurance, and maintenance expenses while probate is pending.

How Long Does Probate Take?

The probate timeline varies based on the size and complexity of the estate. In Texas, a straightforward probate case can be completed in as little as six months. However, contested cases, disputes among heirs, or complex estates with significant debts can take years to resolve. The longer probate takes, the more it costs in legal fees, executor fees, and administrative expenses.

How to Avoid Probate (Or At Least Minimize Its Costs)

Avoiding probate can save time and money for your heirs. Texas law offers several legal strategies to bypass or simplify the process:

Establish a Revocable Living Trust

A revocable living trust allows assets to transfer directly to beneficiaries without going through probate. This option is particularly beneficial for those with significant assets, real estate, or business interests.

Use Payable-on-Death (POD) and Transfer-on-Death (TOD) Accounts

Many financial institutions allow account holders to name beneficiaries, allowing funds to transfer automatically upon death. This applies to:

- Bank accounts

- Investment accounts

- Retirement funds

- Life insurance policies

Joint Ownership with Right of Survivorship

If property or bank accounts are jointly owned with the right of survivorship, they pass directly to the surviving owner without probate.

Utilize Lady Bird Deeds and Transfer-on-Death Deeds

Texas allows homeowners to use Lady Bird Deeds or Transfer-on-Death Deeds, ensuring that real estate transfers directly to beneficiaries without probate.

Consider a Small Estate Affidavit

If an estate is worth $75,000 or less (excluding real estate), Texas law allows heirs to use a Small Estate Affidavit, avoiding probate altogether.

Final Thoughts

Probate in Texas can be an expensive and time-consuming process, but careful planning can help minimize or avoid these costs. Understanding the real financial impact of probate is crucial for anyone looking to protect their estate and ensure that their loved ones receive their inheritance without unnecessary delays or expenses.

By utilizing legal tools like living trusts, designated beneficiaries, and joint ownership arrangements, you can significantly reduce the burden of probate. While some estates may still require probate, taking proactive steps now can make the process smoother, faster, and less costly for your family. If you are uncertain about the best strategy for your estate, consulting with an experienced estate planning attorney can provide valuable guidance. Making informed decisions today can save your family from unnecessary complications and financial strain in the future.