When you're dealing with the loss of a loved one, the last thing you want to worry about is a surprise legal bill. The good news is that when it comes to Texas probate attorney fees, you won’t have to pay out-of-pocket. These costs are paid directly from the deceased person's estate assets, not from your personal funds.

This simple fact often brings a huge sense of relief to families who need legal help but are concerned about the expense. At The Law Office of Bryan Fagan, our goal is to provide clear, compassionate guidance to Texas families navigating this process. This guide will walk you through what to expect, how fees are structured, and what you can do to keep costs manageable.

Your First Look at Probate Costs in Texas

When someone passes away, everything they owned—property, bank accounts, investments, and even their debts—becomes part of their "estate." Probate is the court-supervised process of settling that estate: paying debts and distributing what's left to the rightful heirs. Naturally, one of the first questions executors and heirs ask is, "How much is this going to cost?"

Understanding how attorneys structure their fees is the first step toward getting a clear picture. While every estate is different, Texas probate lawyers generally use one of three common billing methods. Knowing the difference will help you anticipate the costs and find a lawyer whose approach makes sense for your family.

The cost is almost always tied to the complexity of the estate and the work required. A simple, uncontested will is going to be far less expensive to probate than a complicated estate with business assets and feuding heirs. This is also why many families wonder if they even need professional guidance. To help clarify this, you can learn more about when you need a probate lawyer in our detailed guide.

Common Fee Structures You Will Encounter

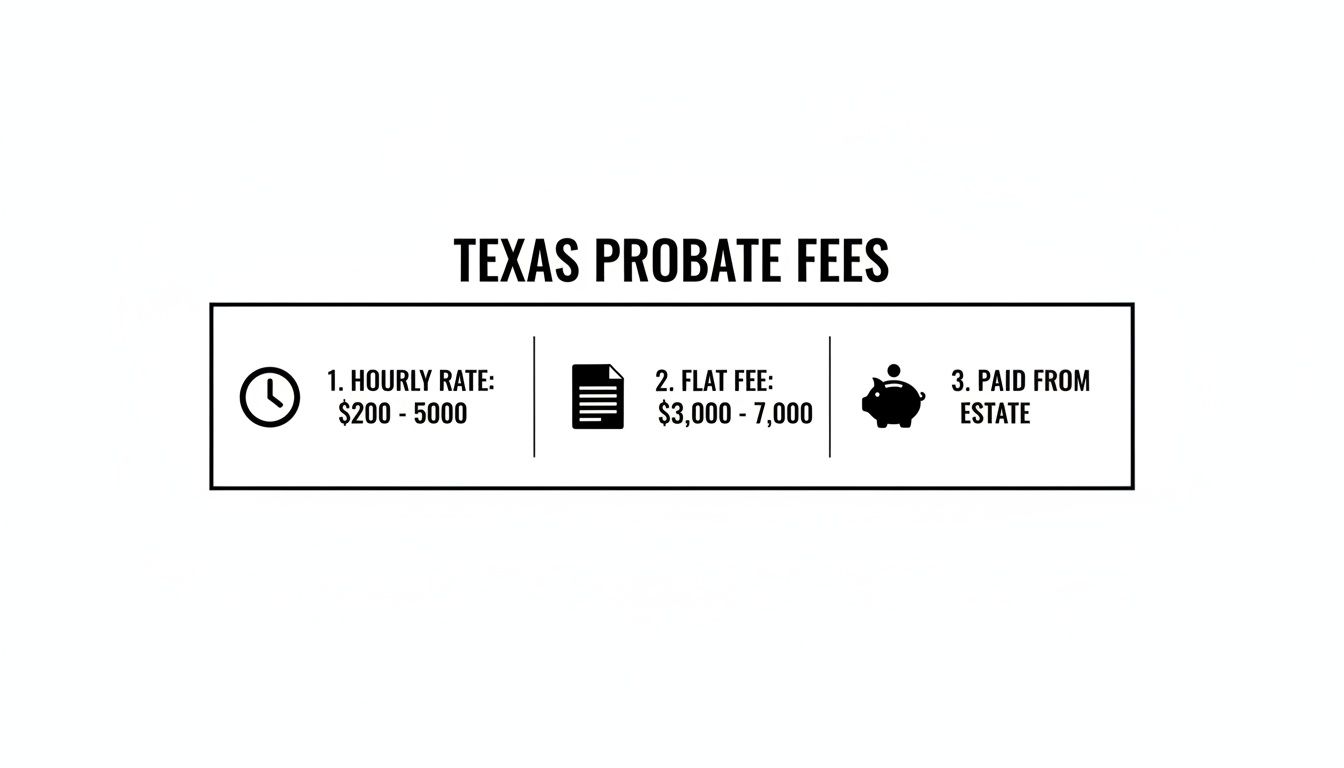

So, what can you actually expect to pay? In Texas, probate attorney fees typically range from $200 to $500 per hour. For very straightforward estates, many attorneys offer a flat fee, which usually falls between $3,000 and $7,000. All told, total legal fees often land somewhere between 3-7% of the estate's total value.

This infographic gives you a quick summary of the typical fee arrangements you'll run into.

As you can see, the options range from predictable flat fees for simple cases to hourly billing for more hands-on situations. The most important thing to remember is that these costs are covered by the estate itself, not you personally.

A Quick Glance at Probate Attorney Fee Structures

To help you get a better handle on the options, here’s a breakdown of the most common billing methods used by probate attorneys in Texas. This should help you figure out which one might apply to your situation.

| Fee Type | How It Works | Best For |

|---|---|---|

| Hourly Rate | The attorney bills for their time in increments, often tenths of an hour. You receive detailed invoices showing the work performed. | Complex or unpredictable cases, such as those with will contests, creditor disputes, or complicated assets that require significant time and research. |

| Flat Fee | A single, upfront price for a defined scope of legal services. The fee is agreed upon before work begins and doesn't change. | Simple, uncontested probates where the process is predictable. This includes probating a straightforward will or a muniment of title. |

| Percentage Fee | The attorney's fee is a percentage of the total value of the estate. While less common in Texas, it is sometimes used for very large or complex estates. | Estates with substantial assets where the executor prefers to align the attorney's compensation directly with the size of the estate. |

Each of these structures has its place. A flat fee gives you cost certainty, while an hourly rate ensures you only pay for the time actually spent on your case. The right fit really depends on the unique circumstances of the estate you're handling.

How Probate Attorneys Calculate Their Fees

Trying to figure out how a probate lawyer comes up with their final bill can feel like a bit of a mystery, but it doesn't have to be. In Texas, attorneys generally stick to one of the three main ways of charging for their services, and each one makes sense for different kinds of estates. Once you understand how they work, you can have a much clearer conversation about costs from day one.

The goal is always transparency. You should never be left guessing how your attorney is billing for their expertise and time. Let's pull back the curtain on each method so you know exactly what to expect.

The Hourly Rate Model

The most traditional approach is the hourly rate. With this model, the lawyer bills you for the actual time they spend working on your case, usually broken down into small increments like six or fifteen minutes. This is the go-to method for cases where it's difficult to predict the total amount of work needed right from the start.

Hourly billing is almost always used for more complex or contested estates. If a will is being challenged, heirs are in a dispute, or the estate involves tricky assets like a family business, the path forward is rarely a straight line. An hourly rate ensures the legal fees accurately reflect the real effort it takes to resolve those challenges.

What counts as billable time?

- Preparing and filing all necessary court documents

- Representing the estate in court hearings

- Communicating with heirs, creditors, and other involved parties

- Conducting legal research on issues specific to the estate

- Drafting letters and official legal notices

Realistic Scenario: An Estate with Family Conflict

Imagine an estate where two siblings are fighting over whether their parent’s will is valid. This disagreement could easily lead to full-blown Probate Litigation. The attorney would need to spend many hours gathering evidence, taking sworn statements (depositions), and attending multiple court hearings. Billing this work by the hour is the only fair way to ensure the fee matches the significant time and legal skill required to resolve the dispute.

The Flat Fee Model

For many Texas families, a flat fee offers a welcome dose of predictability and peace of mind. Here, your attorney quotes you a single, all-in price for handling the entire probate process, start to finish. This fee is locked in before any work begins, so you won’t have to worry about surprise charges on the final invoice.

This model is perfect for straightforward, uncontested probate cases. If there's a clear, valid will and every heir is on the same page, the legal process is much more predictable. Cases like an Independent Administration or a Muniment of Title are excellent candidates for a flat fee because an experienced attorney can accurately estimate the time involved.

The Percentage Fee Model

A third option, though less common in Texas, is the percentage-based fee. In this arrangement, the attorney's fee is a percentage of the gross value of the estate's assets. While some states have laws that set these percentages, Texas law simply requires that fees must be "reasonable." For most Texas probates, the hourly or flat-fee models offer a clearer and more direct link between the work being done and the cost. To get an even deeper look at this, check out our guide on how probate attorneys charge in Texas.

It's also worth remembering that deciding on a fee structure is a critical business decision for any law firm. For more insight into the professional side of this, you can explore the art of setting and communicating legal fees from a law practice perspective.

The Key Factors That Drive Probate Costs

It’s a common source of confusion: why does one estate cost so much more to probate than another, even when they’re worth the same amount? The truth is, the total dollar value of an estate is only part of the story. The real cost drivers are complexity and conflict.

Think of settling an estate like a road trip. A smooth, straight highway is always a quicker and cheaper journey than a winding mountain pass full of potholes and unexpected detours. The same principle applies to the Texas Probate Process. Anything that adds more work and time to your attorney’s plate will be reflected in the final bill.

The Complexity of Estate Assets

The kind of property left behind plays a huge role in how much legal work is needed. An estate with a house, a bank account, and a car is relatively straightforward. But when the assets get more complicated, the process gets more involved—and more expensive.

Certain types of assets are known for increasing the complexity and cost of probate:

- Business Ownership: Valuing a family business, settling its debts, and determining how to transfer or sell it requires specialized legal and financial expertise.

- Multiple Properties: Owning real estate in different counties or states adds layers of administrative work, sometimes requiring separate court proceedings called ancillary probate.

- Disorganized Records: If the deceased left behind incomplete financial records, the attorney and executor must act as detectives, spending hours tracking down every asset and liability.

- Unique Assets: Items like mineral rights, intellectual property, or valuable art collections often require professional appraisals and careful handling to preserve their value.

Each of these factors adds hours of work. This is why a $500,000 estate consisting of a single investment account can be far cheaper to probate than a $500,000 estate with a small business and three rental properties.

Independent vs. Dependent Administration

The type of probate administration the court requires is another massive cost factor. In Texas, we have two main paths: independent administration and dependent administration, both governed by Title 2 of the Texas Estates Code.

An independent administration is the preferred method in Texas. It allows the executor to manage the estate with minimal court supervision. They can pay bills, sell property, and distribute assets without asking a judge for permission at every turn. This makes the process faster and significantly cheaper.

A dependent administration, on the other hand, means the court looks over the executor's shoulder for nearly every action. The executor must get a judge’s approval for almost everything, from paying a utility bill to selling a house. This constant oversight means more paperwork, more hearings, and much higher attorney fees. It’s usually required when the will doesn't request an independent administration or when heirs are in conflict.

The Impact of Family Disputes

Sadly, nothing inflates Texas probate attorney fees faster than a family fight. When heirs disagree, a straightforward administrative process can explode into a full-blown legal battle. A simple task can turn into costly Probate Litigation.

Scenario A: The Smooth Probate

A father passes away, leaving a clear will that names his two children as equal heirs and co-executors with independent administration. The children get along and cooperate. The estate has a house and some retirement accounts. The process is efficient, and the attorney’s flat fee comes in at $5,000.

Scenario B: The Contested Probate

Now, take that same estate, but the siblings are estranged. One child contests the will, claiming the other manipulated their father. Suddenly, the case involves depositions, multiple court hearings, and tense negotiations. The legal fees, now billed hourly, quickly surpass $20,000. The conflict doesn't just drain the estate's money; it can permanently destroy family relationships.

Understanding the typical duration of probate is key, as more time almost always means more money spent on hourly attorney fees and court costs. Family disputes are the number one cause of long, drawn-out, and painfully expensive probate cases.

Understanding the Full Cost of Settling an Estate

When you’re settling an estate, it’s easy to focus on attorney fees. While they are often the largest single cost, they are far from the only one. As an executor, your job is to manage all of the estate's financial obligations. This means getting a complete picture of every expense you’ll face to budget properly and avoid surprises.

Think of it like renovating a house. The contractor's fee is the big-ticket item, but you also have to account for materials, permits, and inspections. In the same way, probating an estate involves several mandatory and variable costs that are separate from what you pay your lawyer. These are legitimate debts of the estate, paid from estate funds, just like legal fees.

Mandatory Court and Administrative Costs

Some expenses are non-negotiable in any Texas probate case because they're required by the court and state law. These are the foundational costs needed to get the process started.

The most common mandatory costs include:

- Court Filing Fees: The initial fee paid to the county clerk to officially open the probate case.

- Cost to Issue Letters Testamentary: The official documents that grant the executor legal authority to act.

- Fees for Posting Notices: The law requires posting public notices to inform potential creditors about the probate.

On average, total Texas probate costs often land between 3-7% of the total estate value. While legal fees are the biggest slice of that pie, these other expenses add up. Initial filing fees typically fall between $250-$400, with higher costs in urban counties. If you'd like to dive deeper, you can discover more insights about average Texas probate costs here.

Variable Expenses Based on Estate Needs

Beyond standard court fees, many estates require extra professional help, depending on the assets involved. These costs can vary widely. For instance, if the estate includes a house, a business, or valuable art, you'll likely need an appraiser to determine their fair market value. If the estate has complex finances, an accountant becomes essential.

Common Non-Attorney Probate Expenses in Texas

To help you put together a realistic budget, let’s look at the most common non-attorney expenses you might encounter.

This table provides a snapshot of the kinds of bills an executor might need to pay from the estate's funds.

| Expense Category | Typical Cost Range | Purpose of Expense |

|---|---|---|

| Court Filing Fees | $250 – $400+ | To officially open the probate case with the county court. |

| Appraisal Fees | $500 – $5,000+ | To determine the fair market value of real estate, businesses, or unique assets. |

| Executor or Administrator Bond | $500 – $2,000+ | An insurance policy required in some cases to protect heirs and creditors. |

| Accountant Fees | $1,000 – $5,000+ | For preparing the estate’s final income tax returns or federal estate tax returns. |

| Notifying Creditors | $75 – $150 | The cost of publishing a legal notice in a local newspaper. |

By anticipating these costs from the start, you can manage the estate’s finances more effectively, which provides much-needed peace of mind to the family.

Actionable Strategies to Reduce Probate Expenses

While probate is often a necessary step, the final bill is far from set in stone. Families can take proactive measures to significantly lower Texas probate attorney fees and related costs. Smart planning and clear communication are your best tools for making the process smoother and more affordable.

When you hand an attorney a well-organized file instead of a shoebox full of scattered papers, you're saving them time—and saving the estate money. This section will walk you through practical strategies to keep those costs down.

Proactive Estate Planning: The Best Defense

The most effective way to control probate costs is to plan ahead with comprehensive Wills & Trusts. Thoughtful estate planning today can simplify or even eliminate the need for lengthy and expensive court proceedings tomorrow.

- Create a Clear and Valid Will: A professionally drafted will is the foundation of a smooth probate. It should clearly name an executor and detail your wishes, leaving little room for ambiguity.

- Designate an Independent Executor: Including a clause for independent administration in the will is a game-changer. This simple step allows the executor to act with minimal court supervision, drastically cutting down on court appearances and attorney hours.

- Utilize Beneficiary Designations: Many assets can bypass probate entirely. Life insurance policies, retirement accounts (401(k)s, IRAs), and bank accounts with Payable-on-Death (POD) designations go directly to the named beneficiary without court involvement.

- Explore Trusts: For more complex estates, a living trust can be a powerful tool. Assets held in a trust are not part of the probate estate, allowing for a private and often faster transfer of wealth.

Organizing for Efficiency During Probate

If you're the executor, your organization has a direct impact on the attorney’s final bill. The more groundwork you do, the less time your lawyer has to spend on administrative tasks.

Before meeting with an attorney, try to gather these key documents:

- The original signed will.

- A list of all known assets (bank accounts, property deeds, vehicle titles).

- A list of all known debts (mortgages, credit card statements, medical bills).

- Contact information for every heir named in the will.

Every hour an attorney spends hunting for a missing document is an hour billed to the estate. By acting as an organized partner, an executor can substantially reduce the final legal fee.

Fostering Cooperation Among Heirs

Finally, maintaining open and honest communication among family members can prevent the single biggest driver of probate costs: litigation. When heirs feel they are being kept in the loop and treated with respect, they are far less likely to challenge the will or the executor's actions.

Encourage transparency from the beginning. While some families consider going it alone to save money, this can often backfire. Understanding the difference between self-probate vs. attorney costs can make it clear why professional guidance is often the most cost-effective path. A skilled attorney can help facilitate communication and mediate small disagreements before they escalate into expensive court battles, preserving both the estate’s assets and fragile family relationships. In some cases, this may even extend to needing a Guardianship to protect vulnerable family members.

Key Insights on Texas Probate Attorney Fees

Navigating the financial side of probate can feel overwhelming, especially while grieving. Let's simplify it down to the essentials to help you feel more confident about the path ahead.

Takeaway: The most important thing to remember is that all legitimate estate expenses, including Texas probate attorney fees, are paid from the estate’s assets, not from your personal funds. The complexity of the estate—not just its dollar value—is the primary driver of cost. An organized estate with a clear will and cooperative heirs will always be cheaper and faster to probate than a disorganized one tangled in family conflict. Proactive planning, clear communication, and working with an experienced attorney are the keys to a smooth and cost-effective process.

Here’s a final checklist to keep handy:

- Communicate with Your Attorney: Ensure you understand how they bill and provide them with organized information to save time and money.

- Complexity Drives Cost: It’s the type and number of assets, not the total value, that create legal work.

- A Good Will is Your Best Tool: A well-drafted will calling for independent administration is the gold standard for avoiding unnecessary costs, a principle supported by the Texas Estates Code.

- Budget for All Expenses: Remember to account for court fees, appraisals, and other non-attorney costs to avoid surprises.

Working with an experienced and compassionate attorney makes the process manageable. Your role as an organized executor, paired with solid legal guidance, is the recipe for a smooth and cost-effective administration.

Common Questions About Texas Probate Fees

Navigating the financial side of probate brings up many questions. Here are plain-English answers to some of the most common concerns we hear from Texas families.

Are Texas Probate Attorney Fees Negotiable?

Yes, in most situations, they are. While an attorney has standard rates, there's often room for discussion, especially when setting a flat fee for a straightforward estate. The key is to have an honest conversation about costs during your initial consultation. A compassionate attorney will understand your concerns and work with you to find a transparent and reasonable fee arrangement that fits the work required.

How Do Executors Get Paid for Their Work?

Being an executor is a serious commitment. Texas law recognizes this and provides a way for executors to be compensated.

Under the Texas Estates Code, Section 352.002, an executor is typically entitled to a commission of five percent (5%) on all money the estate receives and another five percent (5%) on all money it pays out.

However, keep in mind:

- The Will's Instructions Come First: A will can specify a different compensation amount or state that the executor should not be paid.

- Some Transactions Don't Count: The 5% commission doesn't apply to cash already in a bank account or to the final distribution of assets to heirs.

- The Court Has Final Say: The executor's compensation is subject to court approval to ensure it is reasonable for the work performed.

Many executors, especially if they are also the main heir, choose to waive this fee.

When Are Probate Attorney Fees Paid?

This is a critical point that often brings families relief: probate attorney fees are paid from the estate’s assets, usually at the end of the process. You are not expected to pay your attorney from your own pocket.

The attorney's final invoice is submitted to the court as one of the estate's debts. These fees are treated as an administrative expense, giving them high priority for payment before assets are distributed to heirs. This ensures the estate bears the cost of its own administration.

What Happens if the Estate Can't Afford the Attorney Fees?

This is a rare but valid concern. If an estate is insolvent (its debts exceed its assets), Texas law has a clear priority system for payments. Attorney’s fees and other administrative costs are high-priority claims, paid before most other creditors. If there truly isn't enough money, available assets are used to pay these expenses. A good attorney will assess an estate’s financial health at the beginning and may recommend simpler alternatives to formal probate, like a Small Estate Affidavit, for very small estates.

If you’re facing probate in Texas, our team at The Law Office of Bryan Fagan can help guide you through every step — from filing to final distribution. Schedule your free consultation today.