When a loved one passes away, the last thing your family needs is to get tangled up in a complex and lengthy legal process. Grieving is difficult enough without added stress. Fortunately, for certain estates, Texas law offers a unique, simplified probate procedure called a Muniment of Title that can act as a legal shortcut to honor their final wishes.

In plain English, a Muniment of Title allows a valid will to function as the new deed, transferring property to the people named in it. It’s a compassionate and efficient way for qualifying estates to sidestep the more formal, time-consuming, and expensive steps of a full probate administration, offering families a clearer path forward.

Understanding Muniment of Title in Texas

After a loss, the word "probate" can sound intimidating. At its core, probate is simply the court-supervised process of validating a will, settling any of the estate's debts, and distributing property to the rightful heirs. But for estates that qualify, Texas law provides a much more direct path through a Muniment of Title. Seeing how this fits into broader estate management strategies can highlight just how streamlined this approach can be.

This special process asks a court to officially recognize a valid will and record it as evidence of title—or legal proof of ownership—for the beneficiaries. It's a faster, less expensive, and more private alternative to a traditional, full estate administration.

Under Texas Estates Code, Chapter 257, a court can admit a will to probate as a Muniment of Title if the person who passed away had a valid will and the estate has no unpaid debts, other than debts secured by a lien on real estate (like a mortgage).

This legal language means that if your loved one’s only major debt was a mortgage on their house, this process could be a perfect fit for your family.

Muniment of Title vs. Traditional Probate: A Quick Comparison

To see the benefits more clearly, it helps to compare the two processes side-by-side. A Muniment of Title cuts out several time-consuming steps required in the full Texas probate process.

| Feature | Muniment of Title | Traditional Probate |

|---|---|---|

| Executor/Administrator | None appointed | An Executor is appointed by the court |

| Creditor Notices | Not required | Formal notice must be given to creditors |

| Estate Inventory | Not required to be filed with the court | A detailed inventory must be filed |

| Court Oversight | Minimal; typically just one court hearing | Ongoing court supervision |

| Timeline | Typically a few weeks to a couple of months | Can take six months to over a year |

| Cost | Generally lower legal and court fees | Higher legal fees and administrative costs |

This table makes it clear just how much simpler probating a will as a Muniment of Title can be. It eliminates the administrative burdens that can make traditional probate feel so overwhelming for grieving families.

How It Simplifies the Probate Journey

The main advantage of a Muniment of Title is that it legally transfers assets from the decedent to the beneficiaries without appointing an executor or administrator. In a traditional probate, an executor is named by the court to manage the estate. Their long list of duties includes:

- Gathering all the estate's assets.

- Notifying creditors and paying off any valid debts.

- Filing a detailed inventory of the estate with the court.

- Distributing the remaining property to the heirs.

A Muniment of Title gets rid of all those steps. Once the judge signs the order admitting the will as a Muniment of Title, that court order and the will itself become the official legal documents proving the beneficiaries now own the property. This is especially powerful for transferring real estate, as the certified court order can be filed directly in the county’s property records to clear the title.

A Clearer Path for Your Family

Imagine your family is grieving and now also facing the responsibility of handling your loved one's home. The idea of a long, drawn-out court process only adds to the stress. A Muniment of Title provides a clear, efficient solution that gets straight to the most important task: transferring ownership according to the will’s instructions.

It avoids the administrative headaches that can make probate feel like a second job. There’s no need for an executor, no requirement to file an inventory, and no formal notices to send to creditors. This simplicity directly translates into saved time, reduced legal fees, and, most importantly, peace of mind for you and your family during an incredibly difficult time.

Determining Your Eligibility for Muniment of Title

While the Muniment of Title process offers a refreshingly direct path to transferring property, it's not a one-size-fits-all solution for every Texas estate. The law is quite specific about who can use this shortcut, reserving it for situations where a full, court-supervised administration is simply not needed.

Think of it as an express lane at the courthouse, designed for straightforward estates where there are no complicated financial loose ends to tie up. Understanding these requirements is the very first step in figuring out if this streamlined option is right for your family.

The Essential Checklist for Qualification

To successfully probate a will as a Muniment of Title, the estate must check a few critical boxes laid out in the Texas Estates Code, Title 2. Each one is there for a reason—to confirm that the estate is simple enough to bypass the traditional, more involved probate process.

Your loved one's estate is likely a good candidate if:

- There is a valid, original will. The court needs to see the original document signed by your loved one to be certain of their final wishes. A copy usually won't work unless you go through extra legal steps to prove its validity.

- The estate has no unsecured debts. This is the most important rule. The estate cannot owe money on things like credit card bills, personal loans, or lingering medical expenses.

- There are no pending Medicaid claims. If the State of Texas has a potential claim against the estate to recover Medicaid costs, a Muniment of Title is not an option.

These rules exist to protect creditors. Since this process doesn't appoint an executor to formally notify and pay off debts, it’s strictly for estates where those debts don't exist in the first place.

Understanding Secured vs. Unsecured Debts

The difference between secured and unsecured debt can be confusing, but the concept is fairly simple. A secured debt is tied to a specific piece of property, which acts as collateral. The classic example is a home mortgage—the loan is "secured" by the house itself.

An unsecured debt, on the other hand, isn't backed by any collateral. This includes things like credit card balances, hospital bills, and personal loans. The Muniment of Title process is perfectly fine for an estate with a secured debt like a mortgage, but it's an absolute no-go if there are any unsecured debts.

The Four-Year Rule and a Compassionate Exception

In Texas, you generally have four years from the date of a person's death to file their will for probate. This deadline can be a source of great stress, especially for families who discover a will long after their loved one has passed.

But here’s some good news: Texas law provides a vital exception.

Under Texas Estates Code § 256.003, a will can still be probated as a Muniment of Title even after four years have passed, but only if the person filing can prove they were "not in default" for the delay. This is a plain-English way of saying you didn't intentionally or negligently fail to file the will on time. For instance, if a will was hidden in an old safe and you only just discovered it, a court would likely agree you weren't at fault. It’s a compassionate provision that offers a lifeline for many families.

If you're reading this and think your situation might be more complex or doesn't quite fit these criteria, it’s worth looking into other simplified procedures. For example, you can check out our guide to the Small Estate Affidavit in Texas to see if that option is a better fit. A good probate attorney can help you confidently size up all the available paths and choose the right one for your family.

Navigating the Muniment of Title Process Step by Step

Understanding the journey ahead can bring a sense of calm and control during what is often an uncertain time. While the Muniment of Title process is a simpler, more direct route than traditional probate, it still involves a series of specific legal steps. Our goal is to demystify this journey for you, providing a clear roadmap so you know exactly what to expect.

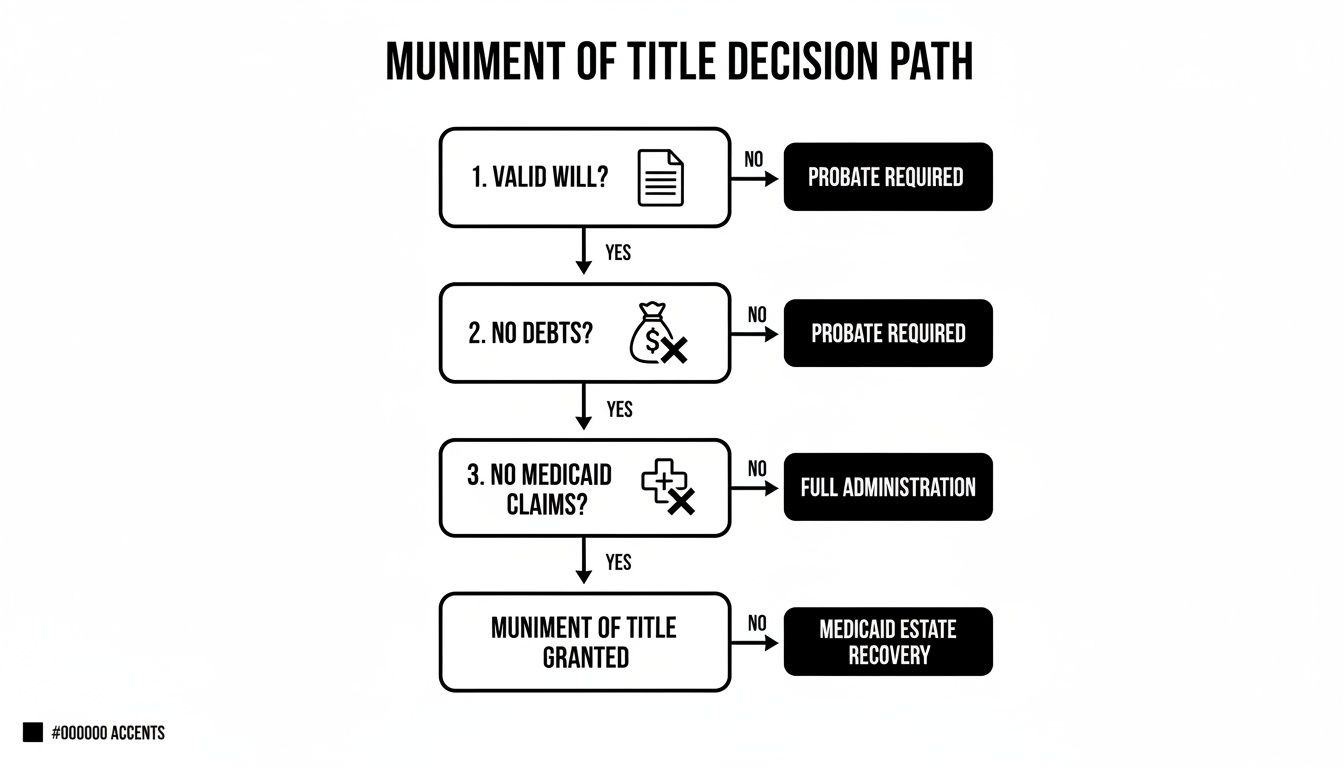

To get started, here is a simple decision tree that helps visualize whether an estate might qualify for a Muniment of Title in Texas.

As this visual guide shows, the path begins with three critical questions about the estate's will, its debts, and any potential Medicaid claims.

At The Law Office of Bryan Fagan, our team handles every detail with precision and compassion, ensuring the process feels manageable for your family. Here is a step-by-step look at how we navigate it together.

1. Filing the Application with the Court

The first step is to prepare and file an Application to Probate Will as a Muniment of Title. This is the formal legal document that kicks things off, asking the proper probate court to recognize the will and start the process. This application must be filed in the county where your loved one resided. It contains all the essential facts: the date of death, the names and addresses of all beneficiaries named in the will, and a sworn statement confirming the estate meets the legal requirements—most importantly, that it has no unsecured debts.

2. Presenting the Original Will

Along with the application, we must submit the original, signed will to the court. This is a non-negotiable requirement. The court needs to see and verify the authenticity of the very document that spells out your loved one’s final wishes. Losing an original will can complicate matters, but it doesn't always close the door. In some situations, a copy can be probated, but it requires a much more involved legal proceeding to prove its validity.

3. Fulfilling the Public Notice Requirement

Texas law requires that a public notice, known as a citation, be posted at the courthouse. This notice must remain posted for a minimum of 10 days before a hearing can take place. This is a procedural safeguard to ensure transparency in the system, and our team handles the entire posting process for you from start to finish.

4. Attending the Court Hearing

Once the 10-day notice period is over, we'll schedule a court hearing, which is typically brief and straightforward. Just one person with firsthand knowledge of the facts—usually a beneficiary—will need to attend with one of our attorneys. The judge will ask a few simple questions to confirm the details in the application. We will provide testimony to prove the will is valid and that the estate qualifies for this streamlined process. These hearings are usually very short and are not confrontational.

A Note on Testimony: The court needs someone to swear to the facts. The person testifying will confirm things like when the decedent passed away, that the will being presented is indeed their last one, and that the estate has no outstanding unsecured debts. Our attorneys will walk you through these questions beforehand so you feel completely comfortable and prepared.

5. Obtaining the Judge's Signed Order

When the judge is satisfied that every legal requirement has been met, they will sign an Order Admitting Will to Probate as a Muniment of Title. This is the single most important document in the entire process. It's the court order that officially recognizes the will and gives it the legal power to transfer property.

6. Recording the Order in Property Records

The last step is to obtain a certified copy of the judge's order and the will, then file them in the official property records of any county where your loved one owned real estate. This action officially updates the chain of title, informing the public that the beneficiaries are now the legal owners of the property. This final recording step is what makes a Muniment of Title so powerful—it essentially transforms the will and the court order into a new deed. For estates that don't include real estate, this step might not be necessary. In other situations involving heirship, different tools might be a better fit. You can learn more about one common alternative by reading about the Texas Affidavit of Heirship form.

When to Choose Muniment of Title and When to Avoid It

Choosing the right probate path in Texas can feel overwhelming, but understanding the specific strengths and weaknesses of a muniment of title brings a lot of clarity. Think of it as a powerful tool for the right situation—a faster, simpler, and more affordable way to honor a loved one’s will.

However, knowing when to avoid it is just as crucial as knowing when to use it. A muniment of title is a streamlined probate process that validates a will and makes it a public record of ownership for the beneficiaries. It is unique to Texas law and uses the will itself to prove ownership without appointing an executor. Cases often wrap up in just four to eight weeks, slashing fees by 60-70% compared to a full probate.

Ideal Scenarios for a Muniment of Title

Certain family situations are perfectly suited for this simplified approach. A muniment of title is most effective when an estate is straightforward and the main goal is to transfer property.

Consider this path if:

- The main asset is a home or land. This process is incredibly efficient for moving the title of real estate from the decedent to the beneficiaries named in the will.

- The estate has no unsecured debt. If your loved one only had secured debts like a mortgage but no credit card bills, medical debt, or personal loans, the estate is a great candidate.

- All beneficiaries are in agreement. When there’s no family conflict and everyone is on the same page, a muniment avoids the formal oversight that can sometimes stir up disputes.

- You need a fast and affordable solution. For families looking for closure without a long, drawn-out, and expensive court process, the speed and lower cost are significant benefits.

When a Muniment of Title Is Not the Right Fit

Despite its advantages, a muniment of title has firm limitations. Trying to use this process for an estate that doesn't qualify will only lead to complications and legal headaches.

You should seek a different path in these circumstances:

- The estate has debts. If there are credit card balances, hospital bills, or other unsecured debts, they must be paid. A muniment provides no mechanism for this, making traditional probate the necessary route.

- Family disputes are possible. If you anticipate a will contest or disagreements among beneficiaries, a formal probate with a court-appointed executor provides the structure needed to manage and resolve conflicts fairly.

- Financial institutions require Letters Testamentary. Some banks or investment firms may not be familiar with a muniment of title. They might demand Letters Testamentary to release funds, and those letters are only issued in a traditional probate where an executor is appointed.

- The will is complex. If the will contains complicated instructions or sets up trusts that require active management, you need an executor to carry out those duties. A muniment simply cannot handle that level of complexity.

Making the right choice comes down to a careful look at your loved one’s finances and family dynamics. While a muniment of title is a fantastic tool for many, other estate planning instruments might also fit your needs. For instance, a Transfer on Death Deed in Texas can bypass probate altogether for real property. An experienced probate attorney can help you weigh these options and confidently select the best path forward for your family.

A Realistic Scenario: Transferring a Texas Home

Legal concepts can feel abstract until you see them in action. To truly understand how a Texas muniment of title works in a real-world situation, let’s walk through a scenario our firm often helps families navigate.

Imagine the Sanchez family from Houston. Their mother, Maria, recently passed away, leaving behind the family home she had owned for decades. Thankfully, she had a valid, properly signed will that clearly named her three adult children—Carlos, Sofia, and Elena—as the equal beneficiaries of her estate. The siblings were heartbroken and overwhelmed. On top of their grief, they were facing the dreaded prospect of probate, having heard stories from friends about long, expensive court battles.

A Path Forward for the Sanchez Family

Fortunately, Maria’s financial situation was straightforward. Her main asset was her home, which still had a mortgage. A mortgage is a secured debt, meaning it is tied directly to the property. Crucially, Maria was diligent with her finances and had no other outstanding debts—no credit card balances, personal loans, or unpaid medical bills.

When the Sanchez siblings came to our office, we reviewed their mother's will and financial papers and quickly realized her estate was a perfect candidate for a muniment of title. This news brought immense relief. They wouldn’t have to go through a full, drawn-out probate administration.

The step-by-step process we guided them through was clear and manageable:

- We drafted and filed the Application to Probate Will as a Muniment of Title with the Harris County probate court.

- We ensured the original will was submitted and the required public notice was posted.

- We prepared Carlos to give simple testimony at a brief, informal court hearing.

- The judge quickly signed the order, officially validating the will.

- Finally, we filed a certified copy of both the will and the court’s order in the Harris County property records.

The Result: A Clear Title and Peace of Mind

That final step was the most powerful. Filing those documents in the property records created a new, official link in the home's chain of title, legally and publicly transferring ownership directly to Carlos, Sofia, and Elena. The entire process was completed in a matter of weeks, not the months or years they had feared.

The Sanchez family avoided the high costs and stress of a traditional probate, which allowed them to focus on honoring their mother’s memory. Their story is a perfect example of how the Texas muniment of title process provides a compassionate, efficient, and direct path forward for families with straightforward estates.

Key Takeaways for Texas Families

When you're grieving the loss of a loved one, you deserve clarity, not a complicated legal maze. We've distilled the most critical points about using a Texas muniment of title to help you feel informed and confident about your family’s next steps.

Your Core Insights

The Muniment of Title process is a powerful but very specific tool. If you remember nothing else, remember these key points:

- A Simpler Path: Think of a Muniment of Title as a legal shortcut. It's a faster, more affordable way to probate a will in Texas, but it's only for estates with a valid will and no unsecured debts like credit cards or medical bills.

- Not a Universal Solution: This process isn't the right fit for every family. If the estate owes money to creditors, family members are in disagreement, or a bank insists on seeing Letters Testamentary to release funds, a more traditional probate will be necessary.

- Professional Guidance is Key: The most important step you can take is to speak with an experienced probate attorney. They can review your unique family circumstances and confirm if this streamlined path is truly the best choice, ensuring every step is handled correctly and compassionately from the start.

While a muniment of title is great for transferring a home or other real estate, families often face the separate task of handling personal belongings. If you need help with that part of the process, you can learn more about organizing an estate sale successfully.

Key Takeaway: The Texas muniment of title offers an efficient, compassionate alternative to full probate for qualifying estates. It effectively turns a valid will into a direct instrument of property transfer, saving families precious time, money, and emotional energy.

Understanding all your options is crucial. Whether your situation calls for help with Wills & Trusts, requires assistance with a Guardianship, or involves potential Probate Litigation, our team is here to provide the resources you need.

If you’re facing probate in Texas, our team can help guide you through every step—from filing to final distribution. Schedule your free consultation today.

Frequently Asked Questions About Muniment of Title

Navigating the probate process always brings up practical questions. When considering a Texas muniment of title, it’s completely normal to wonder how it applies to your family’s unique situation. Below, we’ve provided plain-English answers to some of the most common questions we hear.

What if we found the will more than four years after our loved one passed?

This happens more often than you’d think. The general rule in the Texas Estates Code is that a will must be filed for probate within four years of a person's death. However, Texas law offers a compassionate exception. You can still probate a will as a muniment of title after the four-year mark if you can prove to the court that you were "not in default." This simply means you weren't negligent. If the will was tucked away in a safe deposit box you just found or discovered in old family papers, a judge will likely agree you weren't at fault and allow the case to proceed.

Can we use a Muniment of Title to access a bank account?

This is where things can get tricky. While a muniment of title is excellent for transferring real estate, it can be challenging for financial assets like bank accounts. The issue is that the process doesn't appoint an executor or issue Letters Testamentary—the official documents banks are trained to look for. Many large banks, especially national ones, may not be familiar with this specific Texas process. Even though the court's order is legally binding, you might encounter institutional red tape. An experienced probate attorney can be invaluable here, helping to educate the bank and ensure they comply with the court's order.

What happens if we find an unexpected debt after we file?

Discovering an unknown debt after starting the process can stop a muniment of title in its tracks. A core requirement is that the estate has no unsecured debts. If a valid debt like an old credit card bill or a surprise medical expense emerges, a muniment of title is no longer the right tool. In that scenario, your attorney would likely need to convert the case into a more traditional probate administration. This allows an executor to be appointed who can legally notify creditors, handle claims, and settle debts before distributing assets. This is why a thorough search for all debts at the very beginning is so critical.

Do all beneficiaries need to agree on this process?

While it’s always best when everyone is on the same page, unanimous agreement isn't legally required to begin the process. Any interested person, usually a beneficiary named in the will, can file the application. However, all beneficiaries must be officially notified. If one of them objects—perhaps they believe the will is invalid or want to contest it for another reason—they have the right to do so. A serious disagreement is often a sign that a more structured formal administration might be a better route to resolve conflicts under a judge’s supervision.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.