When you're grieving the loss of a family member, the last thing you want to deal with is a complicated and expensive legal mess. Thankfully, Texas law offers a simpler path for many families. A Small Estate Affidavit (SEA) is a straightforward alternative to the traditional probate process, designed specifically for estates with modest assets.

It’s a faster, less expensive way to transfer a loved one's property to their rightful heirs, especially when they passed away without a will. This guide will walk you through the process step-by-step, in plain English, to help you understand if this is the right choice for your family.

Understanding The Texas Small Estate Affidavit

Losing someone is emotionally draining, and the legal steps that follow can feel completely overwhelming. The State of Texas understands this. That’s why the law provides a simplified procedure for certain situations, known as the Small Estate Affidavit. This legal tool helps families sidestep the time, cost, and stress of a formal Texas Probate Process.

Think of it as a probate shortcut.

Instead of going through multiple court hearings and appointing an executor, the heirs can file a sworn statement with the court. In legal terms, this is a formal affidavit. This document outlines the deceased person's assets, debts, and family history, providing a clear picture of the estate for the judge.

What Is The Purpose Of An SEA?

At its core, a Small Estate Affidavit is designed to legally transfer property from the deceased person (the "decedent") to their heirs without a full-blown probate administration. This is a game-changer when the estate is small and doesn't involve complex assets like businesses or contested real estate.

An approved SEA gives you the legal authority to:

- Transfer Bank Accounts: Finally get access to the funds in the decedent's checking or savings accounts.

- Change Vehicle Titles: Legally transfer ownership of a car, truck, or boat without endless DMV headaches.

- Access Safe Deposit Boxes: Retrieve important documents, family heirlooms, or other valuables.

- Transfer Title to the Homestead: Clear the title to the decedent's primary home so it can be legally owned or sold by the heirs.

Before you dive in, it’s helpful to see the key requirements at a glance.

Here's a quick summary table to help you determine if a Small Estate Affidavit is the right tool for your family's situation.

Small Estate Affidavit Texas At a Glance

| Criteria | Details and Requirements |

|---|---|

| Asset Limit | Estate's non-exempt assets must not exceed $75,000. |

| Homestead | The value of the primary homestead is excluded from the $75,000 limit. |

| Exempt Property | Certain personal property (like furniture, family heirlooms, and vehicles) is also excluded. |

| Will Status | The decedent must have died without a will (intestate). |

| Heirs | All legal heirs must be identified and agree to sign the affidavit. |

| Debts | The estate’s assets must exceed its known debts (excluding homestead mortgage). |

| Court Filing | The affidavit must be filed in the probate court of the county where the decedent resided. |

| Timeline | Typically faster than traditional probate; can take 30-60 days for court approval. |

| Cost | Significantly cheaper, usually involving only court filing fees and notary costs. |

This table provides a snapshot, but the financial threshold is the most important piece of the puzzle. Let's dig into that a little deeper.

Key Financial Threshold and Rules

The single most important rule for using a small estate affidavit in Texas is the value of the estate. The magic number is $75,000.

This limit applies only to the decedent’s non-exempt assets—things like bank accounts, stocks, second homes, or vehicles. It does not include the value of their primary homestead or other exempt property like basic household furnishings or retirement benefits. This is a crucial distinction.

This $75,000 threshold, established in the Texas Estates Code, is what makes the SEA such a powerful probate shortcut for families dealing with a loved one who passed away without a will (intestate). You can find more practical insights on how this works for real estate on altituderealestatetx.com.

Key Insight: Don't get tripped up by the $75,000 number. The fact that the family home and other protected assets don't count toward this cap means the Small Estate Affidavit is available to far more families than you might initially think. It's a detail that often gets overlooked but can make all the difference.

Does Your Loved One's Estate Qualify?

When you're grieving, the last thing you want to do is get tangled up in the Texas Estates Code. Let's cut through the legal jargon and figure out if a Small Estate Affidavit (SEA) is the right path for your family. It's a simplified process, but it has very specific rules.

The biggest hurdle is usually the estate's value, but it's not as simple as adding everything up. The law makes a crucial distinction between exempt and non-exempt property, and understanding that difference is often what determines if you qualify.

Simply put, exempt property is protected and doesn’t count toward the limit. It’s the non-exempt property that the court looks at.

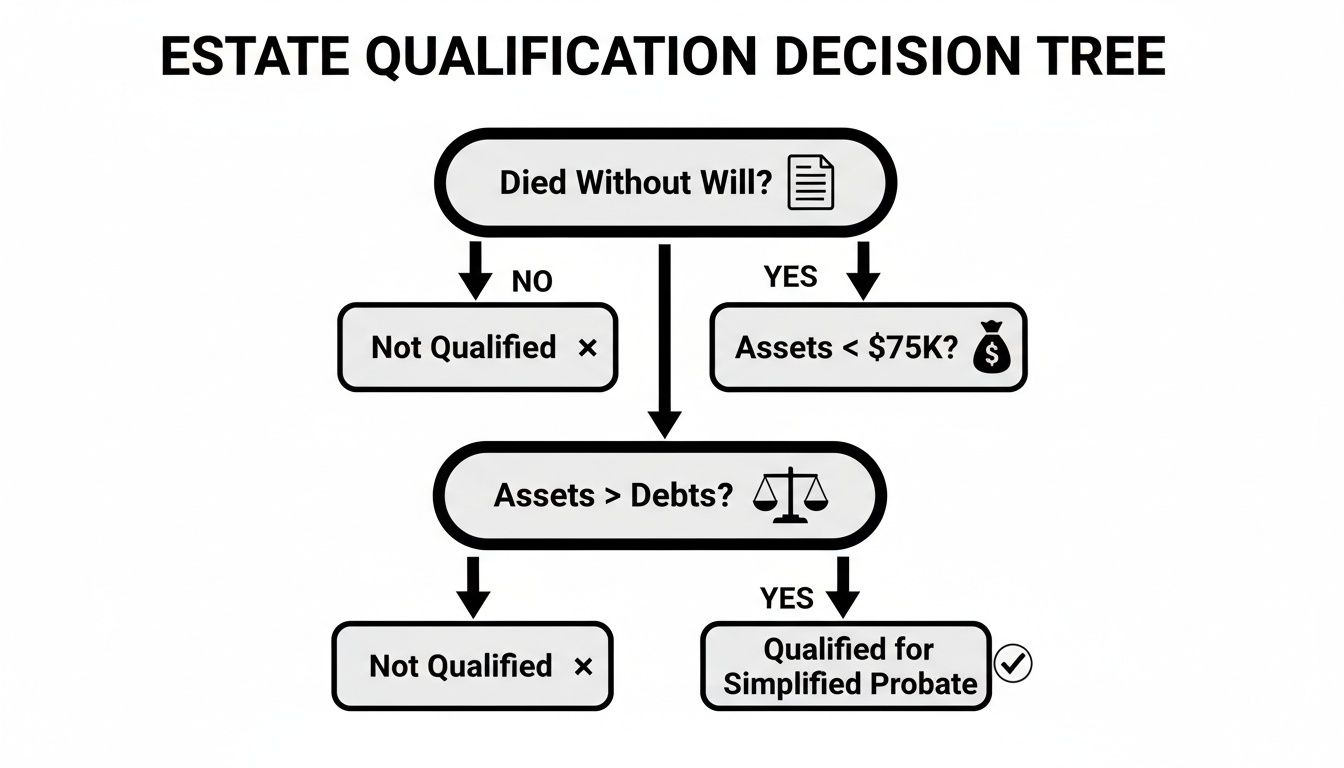

This flowchart is a great starting point to see if an SEA is even on the table.

As you can see, the three big checkpoints are: no will, non-exempt assets under the limit, and more assets than debts.

The $75,000 Asset Limit Explained

Under Texas Estates Code § 205.001, the total value of the estate's non-exempt assets can’t be more than $75,000. The law is designed this way to help more families avoid a complicated probate process.

So, what gets excluded from that $75,000 calculation?

- The Homestead: Your loved one's primary residence is not counted, regardless of its value.

- Exempt Personal Property: This includes things like furniture, family heirlooms, up to two firearms, and one vehicle for each licensed driver in the household. The total value here can be up to $100,000 for a family or $50,000 for a single adult.

- Certain Retirement Accounts: Benefits from many qualifying retirement plans are also exempt.

This means someone could own a $300,000 home, but if their bank accounts and other non-exempt property add up to less than $75,000, their estate could still qualify. It's another probate alternative, much like the process you can learn about in our guide on the Texas Affidavit of Heirship form.

A Real-World Scenario

Let's put this into practice to make it clear. Imagine a parent in Texas passes away without a will, leaving behind:

- A home valued at $350,000 (exempt homestead).

- An IRA with a named beneficiary worth $40,000 (exempt, as it passes outside probate).

- A checking account holding $30,000 (non-exempt).

- A car worth $15,000 (exempt, assuming it's the family vehicle).

- Personal belongings and furniture valued at $5,000 (exempt).

On paper, the total estate value is over $440,000. But the only asset that counts toward the SEA limit is the $30,000 in the checking account. Since that's well under the $75,000 cap, the estate is eligible for a Small Estate Affidavit. This example shows how crucial it is to correctly identify exempt versus non-exempt property.

The No Will Requirement

This one is non-negotiable. A Small Estate Affidavit can only be used when someone dies intestate—meaning, without a valid will. The affidavit's purpose is to legally identify the heirs based on Texas succession laws since there's no will to do so.

If a will exists, the SEA is the wrong tool for the job. You'll need to go through the probate process, though you might qualify for a simpler version like a Muniment of Title.

Key Insight: A common reason courts reject an SEA is because a will turns up later. Always do a thorough search for a will before you even think about starting this process.

The Solvency Rule: Assets Must Exceed Debts

The estate also has to be solvent. It’s a formal-sounding word, but it just means the estate’s assets are worth more than its known debts.

The one big exception is a mortgage or other debt secured by the homestead. You don't have to count that against the assets. But other debts—like credit card bills, medical expenses, and personal loans—must be covered by what's in the estate.

Finally, you can't file right away. The law makes you wait at least 30 days after your loved one's death before filing the affidavit. This gives you time to gather information and allows potential creditors a chance to make claims.

How to Complete the Affidavit Form Correctly

Filling out legal paperwork is intimidating, especially when you're grieving. The good news is the Small Estate Affidavit (SEA) is designed to be much more straightforward than the mountain of documents required for traditional probate. Let’s walk through what you’ll need to do, piece by piece, so you feel confident you're getting it right.

Think of the affidavit as telling the court a complete and honest story about your loved one's estate. To do that, you'll need three key parts: the decedent’s personal details, a full list of their assets and debts, and a clear family tree showing every legal heir.

Gathering the Essential Information

First things first, you need the basics. This section of the form asks for the decedent’s full legal name, their date of death, and the county where they lived. Get this part perfect. Even a small typo can cause delays and get your form kicked back by the clerk.

Next, you have to create a detailed inventory of all assets and liabilities. The total value of the non-exempt assets—think bank accounts, second properties, and vehicles—must come in under the $75,000 limit set by Texas Estates Code § 205.001. A very common mistake is miscalculating this value, which is an automatic rejection.

Meticulous preparation here is non-negotiable. For example, an estate might have $40,000 in an IRA, a $20,000 car, and a $15,000 checking account. While a homestead worth over $500,000 can pass outside of this calculation, errors in reporting other assets or identifying heirs are incredibly common. Anecdotal reports from clerks in major counties suggest that as many as 20-30% of initial SEA filings are rejected due to these kinds of mistakes. You can find more details on avoiding these common pitfalls on san-antonio-probate.com.

Identifying Heirs Under Texas Law

This is often where things get tricky. Since there’s no will, you have to identify the heirs based on Texas intestate succession laws. This means you’re essentially drawing a detailed family tree for the court.

You must list every child (including adopted ones), parents, and siblings, and note whether they are alive or deceased. If an heir has passed away before the decedent, you must then list their descendants. It can get complicated fast.

Key Insight: Honesty and thoroughness are non-negotiable when listing heirs. Intentionally leaving out a known heir isn't just a mistake; it can be considered fraud. The court relies entirely on your sworn statement to distribute the estate correctly.

Let's look at a common scenario. A man passes away without a will, leaving behind a wife and two children from their marriage. Under Texas law, here's how his property would be divided:

- Community Property: His wife inherits his half of all property acquired during the marriage.

- Separate Personal Property: His wife gets one-third, and the two children split the remaining two-thirds.

- Separate Real Property: His wife receives a life estate (the right to live there) in one-third of the property, while the children inherit the property outright, subject to her right to live there.

Understanding these details is critical for filling out the heirship section correctly. It's also why many families decide to get professional guidance on Wills & Trusts to avoid these complexities down the road.

Securing Disinterested Witnesses

Another absolute must-have for the affidavit is the signature of two disinterested witnesses. These are people who can swear under oath that they knew the decedent and their family history but will not inherit a single dollar from the estate.

So, who qualifies as a disinterested witness? It could be:

- A long-time family friend

- A neighbor

- A colleague from work

- A fellow member of a church or community group

These witnesses aren't testifying about the estate's finances. Their only job is to back up the family history you've laid out—specifically, confirming the identities of the spouse, children, and other heirs. Their sworn statements add a vital layer of credibility, assuring the court that all the right people have been identified. Finding two reliable people who are willing to sign in front of a notary is a step you should plan for early on.

If any of the heirs are minors, their rights can add another layer of complexity to the process. In those situations, you may need to look into Guardianship proceedings to protect their inheritance.

Filing the Affidavit and What Happens Next

You’ve carefully prepared and signed the Small Estate Affidavit—congratulations, the heavy lifting is done. The next phase is all about procedure: getting the document to the right court and using its approval to finally collect your loved one's assets.

First things first, you have to file the affidavit in the right place. Under the Texas Estates Code, the SEA must be filed in the probate court of the county where the decedent lived. Filing in the wrong county is a common mistake, and it's one that will get your affidavit rejected immediately. Always double-check this detail.

For a broader look at the mechanics of submitting legal paperwork, this guide on how to file court documents offers some helpful best practices.

Getting All Heirs on Board

Here’s a non-negotiable requirement for a valid small estate affidavit in Texas: every single legal heir has to sign it. This shows the court that the family is in complete agreement about handling the estate.

But what if heirs are scattered across the country?

Thankfully, this is a common scenario and there’s a solution. Each heir can sign their copy of the affidavit in front of a notary in their own city. These individually notarized signature pages are then gathered and compiled into one complete document for filing. It takes a bit of coordination, but it keeps the process moving even when family members are miles apart.

If any heirs are minors, things get a little more complicated. The minor’s legal guardian is required to sign for them. If a guardian hasn't been appointed, you might need to seek a Guardianship to protect the child's share of the inheritance.

The Court Review and Approval Process

Once the affidavit is filed, a judge will review it. This isn't like a dramatic courtroom scene from a movie; it's typically just a document review. In most cases, there is no formal court hearing where you need to show up and testify.

The judge is simply checking boxes to make sure the affidavit meets all the legal requirements:

- Is the estate value under the $75,000 threshold?

- Did the person die without a will?

- Have all the heirs and two disinterested witnesses signed it properly?

- Is all the required information present and accounted for?

This review is usually pretty quick, often taking just a few weeks. If everything checks out, the judge will issue an Order Approving the Small Estate Affidavit. This order is the official green light you've been waiting for.

Key Insight: The Order Approving the Small Estate Affidavit is the legal key that unlocks the estate. Without it, the affidavit is just a sworn statement. With the judge's order, it becomes a powerful legal instrument that banks and other institutions must honor.

Using the Approved Affidavit to Collect Assets

With the signed order in hand, you’re on the final step: collecting the assets. You'll need to go to the county clerk’s office and get certified copies of both the affidavit and the judge's order. These aren't just photocopies; they are officially stamped and verified as authentic, which is what banks and other institutions need to see.

For example, to close a bank account, you’ll take a certified copy of the approved SEA to the bank. They will verify the document and then release the funds to the heirs listed in the affidavit. To transfer a car title, you’ll present the same certified copy at your local DMV or county tax office.

Plan on getting multiple certified copies. Each institution will need to keep one for its records, so it’s best to get enough for every asset you need to transfer.

Common Mistakes and When to Ask for Help

Even though a small estate affidavit in Texas is designed to be a simpler path, the process is loaded with strict legal requirements. We have seen it time and time again—small, seemingly minor errors can lead to big delays. A rejected affidavit means you have to start the whole process over, which is the last thing your family needs during an already difficult time.

Understanding the common pitfalls is the best way to get your filing accepted on the first try. Many families stumble on the details. The process is straightforward, but it is not forgiving. From simple clerical errors to fundamental misunderstandings of the law, a single mistake can send you right back to square one.

Errors That Can Derail Your Affidavit

Certain mistakes pop up more often than others, and they almost always result in the court rejecting the document. Paying close attention to these specific areas can save you a world of time and frustration.

A frequent error we see is miscalculating the estate's value. Families sometimes include the value of the homestead or other exempt property in their $75,000 calculation. Remember, only the non-exempt assets count toward this limit.

Other common tripwires include:

- Forgetting an Heir: You absolutely must list every single legal heir as defined by Texas intestate succession law. Intentionally or accidentally leaving someone out will invalidate the entire affidavit.

- Using an Interested Witness: The two witnesses who sign the affidavit cannot be people who stand to inherit from the estate. A neutral neighbor or a family friend is a good choice; a child or sibling of the person who passed away is not.

- Filing in the Wrong County: The affidavit must be filed in the county where your loved one resided. It doesn't matter where they passed away or where you currently live—it's all about their primary residence.

- Incomplete Asset and Debt Lists: You are swearing under oath that you've provided a complete and accurate list of all assets and liabilities. Overlooking even a small credit card bill can make the affidavit inaccurate and lead to rejection.

Key Insight: Deadlines are another critical piece of the puzzle. Texas law generally requires that any action to declare heirship be filed within four years of the decedent's death. Missing this window could force the estate into a much more complex and expensive full probate process, which can easily eat up 3-5% of the estate's value in fees.

Knowing When the SEA Is Not the Right Tool

A Small Estate Affidavit is a fantastic option when it fits, but it isn't a one-size-fits-all solution. There are clear situations where an SEA is simply not the right legal path, and trying to force it will only lead to rejection and wasted effort.

It's time to seek professional legal advice if your situation involves any of the following:

- A Valid Will Exists: If your loved one left a will, you must go through the traditional probate process. An SEA is strictly for estates where there is no will (intestate estates).

- Complex or Unknown Debts: If the estate has significant debts, or if you can't get a clear picture of all the liabilities, a formal administration is needed to properly notify and pay creditors.

- Family Disagreements: The SEA requires every single heir to agree and sign. If there is any conflict or disagreement among family members, this process will not work.

- The Estate Owns Real Estate Besides the Homestead: An SEA can only transfer title to the decedent's primary residence. Any other real property, like a rental home or a piece of land, requires a different legal procedure.

Navigating these complexities alone can be daunting. If you're unsure whether your family's situation qualifies or you just feel overwhelmed by the requirements, it's a wise decision to ask for help. A brief consultation can clarify your options and prevent costly mistakes down the road. For more guidance, check out our article on when you might need a probate lawyer.

Tying It All Up: What to Do Next

Let's boil it all down. The small estate affidavit in Texas is a fantastic tool for families, capable of saving a ton of time, money, and heartache when you’re in the right situation. It’s a way to bypass the complexity of a full probate and get your loved one's affairs settled more quickly.

Just remember the big three rules we've covered. The estate's assets (not including the homestead) can't top $75,000, your loved one must have died without a will, and every single legal heir has to be on the same page and sign that affidavit. Getting the details exactly right isn't just a suggestion—it's everything.

Your Path Forward

Even though this process is simpler than traditional probate, we get it—it can still feel like a lot to handle, especially when you're grieving. Our goal here is to give you the confidence to move forward, knowing you have a reliable guide to lean on.

And if it turns out a will does exist? Don't worry, you're not necessarily headed for a full-blown probate. A different simplified route might be an option. You can learn more about it in our guide to Muniment of Title in Texas.

Takeaway: Think of the Small Estate Affidavit as an efficient probate shortcut. But its success lives or dies on following the legal requirements to the letter. Double-checking every detail, from how you value the assets to making sure you've identified every last heir, is what will save you from costly delays and having the court reject your filing.

Common Questions About Texas Small Estate Affidavits

Here are some quick, straightforward answers to the questions we hear most often from families navigating the Small Estate Affidavit (SEA) process in Texas. Think of this as a practical guide to handling those tricky "what if" scenarios.

What if We Find Another Asset After Filing the Affidavit?

It happens more than you’d think. You've filed the affidavit, and then another bank account or an old savings bond surfaces. Don't panic; this is often fixable.

If the newly discovered asset keeps the estate's total non-exempt value safely under the $75,000 limit, you can usually file an amended affidavit with the court. However, if that new asset pushes the total value over the cap, the SEA is no longer valid. At that point, a more formal probate administration will almost certainly be required. The best move is to contact an attorney immediately to figure out the right path and avoid any missteps.

Can We Use an SEA to Sell the Family Home?

Yes, but it's a two-step dance. An SEA doesn’t directly sell the house. Its job, when it comes to real estate, is to legally transfer the homestead's title to the heirs. A huge advantage here is that the value of the homestead doesn't count toward that $75,000 asset limit, which is why the SEA is so commonly used for this purpose.

Once the affidavit is approved and the title is officially in the heirs' names, they now have the legal standing to sell the property. Be warned: title companies scrutinize these affidavits with a fine-toothed comb. Making sure it’s prepared perfectly from the start is your best defense against delays at the closing table.

Key Takeaway: The Small Estate Affidavit is the tool that clears the title, which is the essential first step before any sale can proceed. An error-free affidavit is your best bet for keeping the title company happy and the sale on track.

What Happens If an Heir Refuses to Sign?

This is a dealbreaker for the Small Estate Affidavit. The process requires 100% cooperation. Under the Texas Estates Code, every single known adult heir must sign the affidavit for it to be valid.

If even one heir digs in their heels and refuses, you can't use this simplified route. A disagreement like this, unfortunately, forces the estate into a more formal court proceeding, like a Determination of Heirship, to legally settle who gets what. A refusal to sign is a clear signal that it's time to get legal guidance to handle what could become a contentious situation. For particularly complex family dynamics, exploring options like Probate Litigation might be necessary to protect everyone's interests.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.