When a loved one passes away, the last thing your family needs is a drawn-out, complicated legal process. Dealing with grief is hard enough. Fortunately, Texas law offers a unique probate process called a muniment of title that can act like an express lane for qualifying estates, helping families transfer property quickly and affordably. It’s a way for a court to officially recognize a valid Will as the legal document that transfers ownership, cutting out the need for a full, traditional estate administration.

At The Law Office of Bryan Fagan, we understand that you’re looking for clarity and reassurance, not more confusion. This guide will walk you through the muniment of title process in plain English, explaining what it is, who it’s for, and what to expect every step of the way.

A Simpler, More Compassionate Path for Texas Estates

Losing a family member is a deeply personal and emotional experience. The Texas probate system, with its unfamiliar terms and procedures, can feel overwhelming on top of everything else. Thankfully, the Texas legislature created options to simplify things for families in specific situations, and the muniment of title is one of the most powerful tools available.

Think of a full probate as a long road trip with many mandatory stops: you have to appoint an executor, formally notify creditors, and file detailed inventories with the court. A muniment of title, on the other hand, is more like a direct flight. It gets you to the same destination—transferring ownership of assets to the rightful heirs—but with far fewer steps.

What Does “Muniment of Title” Mean in Plain English?

The word “muniment” might sound like something out of a dusty old law book, but it simply means “proof of ownership.” When you probate a Will as a muniment of title, you’re asking the court to declare that the Will itself is the official legal evidence proving the beneficiaries now own the decedent’s property.

The court order validates the Will, which then acts as a new link in the property’s chain of title, making the transfer official. This entire process is authorized under the Texas Estates Code, Section 257.001. This law spells out how a Will can be admitted to probate just to create a clear record of who now owns what. To be eligible, an estate must meet a few key requirements, mainly having a valid Will and no outstanding unsecured debts (like credit card bills).

The Financial Advantage for Grieving Families

One of the most significant benefits of this process is the cost savings. For many Texas families, the expense of a full estate administration is a serious concern. A muniment of title might cost up to $3,000, while a full probate can easily run from $5,000 to $15,000 or more. For most estates, that difference means thousands of dollars go directly to the heirs instead of being consumed by administrative fees.

This streamlined approach isn’t just about saving money; it’s about giving your family peace of mind during an incredibly difficult time. By sidestepping the complexities of a full administration, your family can focus on healing instead of getting bogged down in paperwork. Our firm specializes in helping families determine if this is the right path for them. You can explore a general overview of what a muniment of title is in our dedicated article.

Is a Muniment of Title the Right Path for Your Family?

While a muniment of title offers a simpler, faster route through probate, it isn’t available for every estate. The Texas Estates Code is very specific about who qualifies, and the requirements are strict. Understanding these rules is the first, most important step in determining if this path is right for your family.

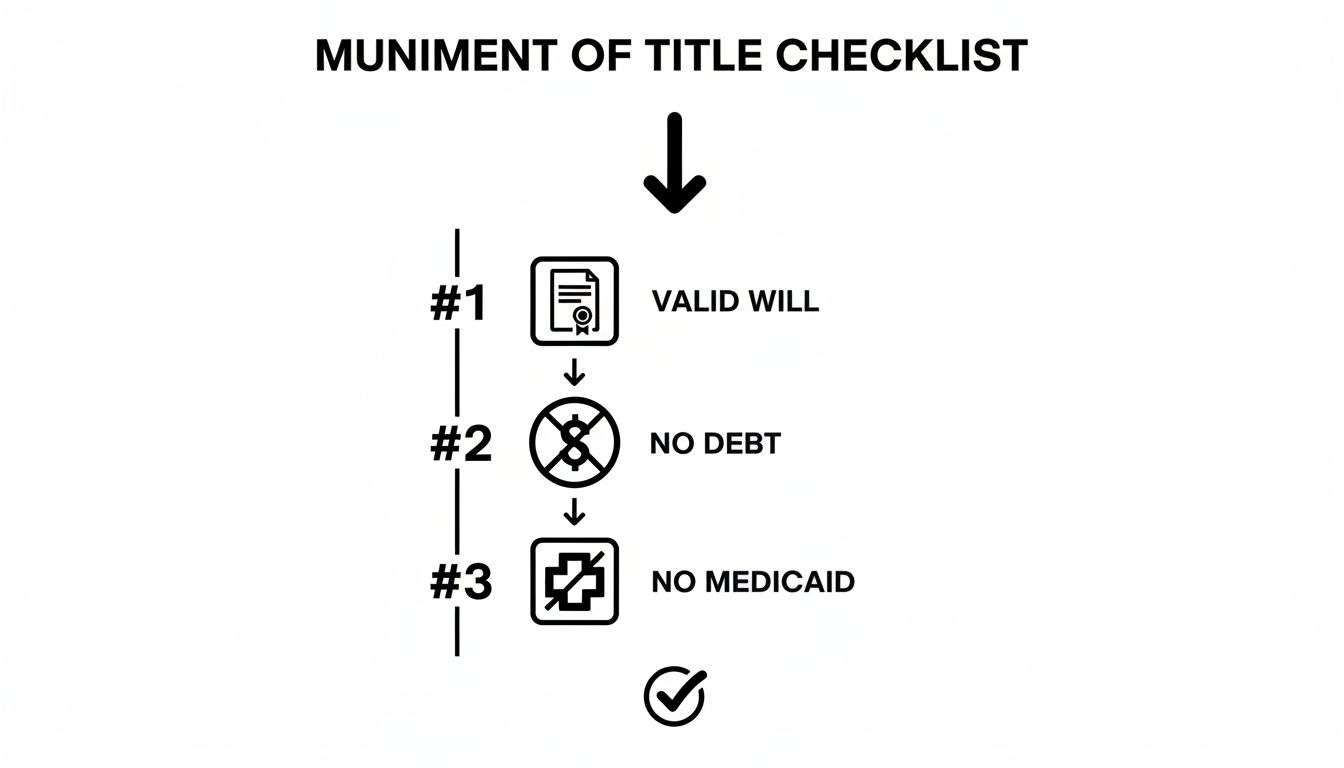

Think of it like an express lane at the airport. You need the right boarding pass (a valid Will), no extra baggage (no unsecured debts), and a clear security record (no Medicaid claims). If you meet all three conditions, you can bypass the long lines and complexity of a full probate administration.

The Three Pillars of Eligibility

To probate a Will as a muniment of title in Texas, the estate must stand firmly on three essential pillars. A compassionate probate attorney can help you confidently verify each one, but here’s a plain-English breakdown of what the court will look for.

- A Valid, Written Will: This is the absolute foundation. The person who passed away (the decedent) must have left a legally sound Last Will and Testament. The court must be able to confirm the document was signed and witnessed correctly according to Texas law. Without a valid Will, this process is not an option, and the estate will likely need to go through a more involved heirship proceeding.

- No Unsecured Debts: The estate cannot owe money on things like credit cards, hospital bills, or personal loans. The court needs assurance that there are no outstanding bills waiting to be paid. Since no executor is appointed to manage and pay creditors, the estate must be free of these debts from the start.

- No Medicaid Claims: The decedent must not have received Medicaid benefits that could trigger a claim from the state. The Texas Medicaid Estate Recovery Program (MERP) seeks reimbursement from the estates of deceased Medicaid recipients. The possibility of a MERP claim is enough to disqualify an estate from using a muniment of title.

Key Insight: People often get tripped up on secured debt, like a mortgage on a house. The Texas Estates Code carves out a specific exception here. An estate with a mortgage can still qualify for a muniment of title because that debt is “secured” by the property itself. The beneficiary simply takes on the property along with the mortgage.

A Realistic Scenario: The Garcia Family

Let’s look at a common situation. Imagine a father, David Garcia, passes away in Houston. He leaves behind his family home (with a mortgage), a car, and a checking account. Most importantly, he has a clear, properly executed Will naming his two adult children, Sarah and Mark, as the sole beneficiaries to inherit everything equally.

After his passing, Sarah and Mark review their father’s finances. They find no credit card balances, outstanding hospital bills, or other personal loans. They also confirm David never received Medicaid benefits. This is a textbook case for a muniment of title in Texas.

Because David’s estate checks all the boxes, Sarah and Mark can file an application to probate his Will as a muniment of title. A judge can then issue an order that acts like a deed, officially transferring the house, car, and bank account directly to them. They avoid appointing an executor and the drawn-out steps of a full administration, saving themselves a great deal of time, money, and stress during their time of grief.

Your Quick Eligibility Checklist

To help you get a clearer picture, we’ve put together a simple checklist. Use it to quickly assess whether a muniment of title might be a good fit for your loved one’s estate.

| Requirement | Explanation | Is This Met? |

|---|---|---|

| Is there a valid Will? | The deceased must have a formal, written Will that clearly outlines their wishes and meets all legal requirements. | |

| Is the estate debt-free? | There are no unsecured debts like credit cards or medical bills. A mortgage on real estate is okay. | |

| Are there any Medicaid claims? | The deceased did not receive Medicaid benefits that would require repayment from the estate. |

Assessing these factors is the critical first step. Our team has years of experience reviewing estate details to confirm eligibility for a muniment of title. We can help you understand all your options, from this simplified process to navigating a Guardianship or creating your own Wills & Trusts. For more complex situations that might involve disputes, we also handle Probate Litigation. Getting familiar with the full Texas Probate Process will give you even more context.

Navigating the Muniment of Title Filing Process: A Step-by-Step Guide

When you’re grieving, the thought of stepping into a courtroom is intimidating. Our goal is to pull back the curtain on the muniment of title Texas process, breaking it down into a clear, manageable series of steps so you know exactly what to expect.

Step 1: Filing the Application

The journey starts by filing a specific document with the probate court: the “Application to Probate Will as a Muniment of Title.” This isn’t just another form. It’s a sworn statement that tells the judge the essential facts—namely, that the decedent left a valid Will and that the estate has no unsecured debts. This application, along with the original Will, is filed with the county clerk.

Step 2: The Waiting Period and Notice

Once your application is filed, the process hits a brief, mandatory pause. A public notice gets posted at the courthouse, a step required by the Texas Estates Code. This is a standard formality designed to let the public know that a Will has been presented for probate. It’s all about transparency and typically lasts about two weeks.

Step 3: The Court Hearing

After the waiting period ends, the court schedules a hearing. For most families, this is the part that causes the most anxiety, but it’s usually very brief and straightforward. The judge simply needs to formally confirm a few key facts:

- That the Will is legally valid.

- That the person passed away.

- That the estate is free of unsecured debts.

- That the court has jurisdiction (the case is being heard in the correct county).

The person who filed the application—the applicant—will need to give short, honest testimony under oath confirming these points. A compassionate probate attorney will prepare you for this beforehand so you know exactly what to expect. Most of these hearings are over in just a few minutes.

Step 4: The Court Order and Final Steps

If the judge agrees that everything is in order, they will sign the “Order Admitting Will to Probate as a Muniment of Title.” This is the key legal document that validates the Will and authorizes the transfer of assets to the beneficiaries.

But you’re not quite done. The last critical step is to take a certified copy of that court order and the Will and file it in the property records of any Texas county where the deceased owned real estate. This officially updates the public record to show the beneficiaries are now the rightful owners. For other assets like bank accounts, you simply present a certified copy of the order to the financial institution to have the funds transferred.

Having your paperwork in order from the start makes this entire process smoother. To get a head start, you can review a list of required documents for a probate case to see what you’ll need. An attorney can ensure every filing, notice, and hearing is handled correctly, preventing frustrating delays and giving your family peace of mind.

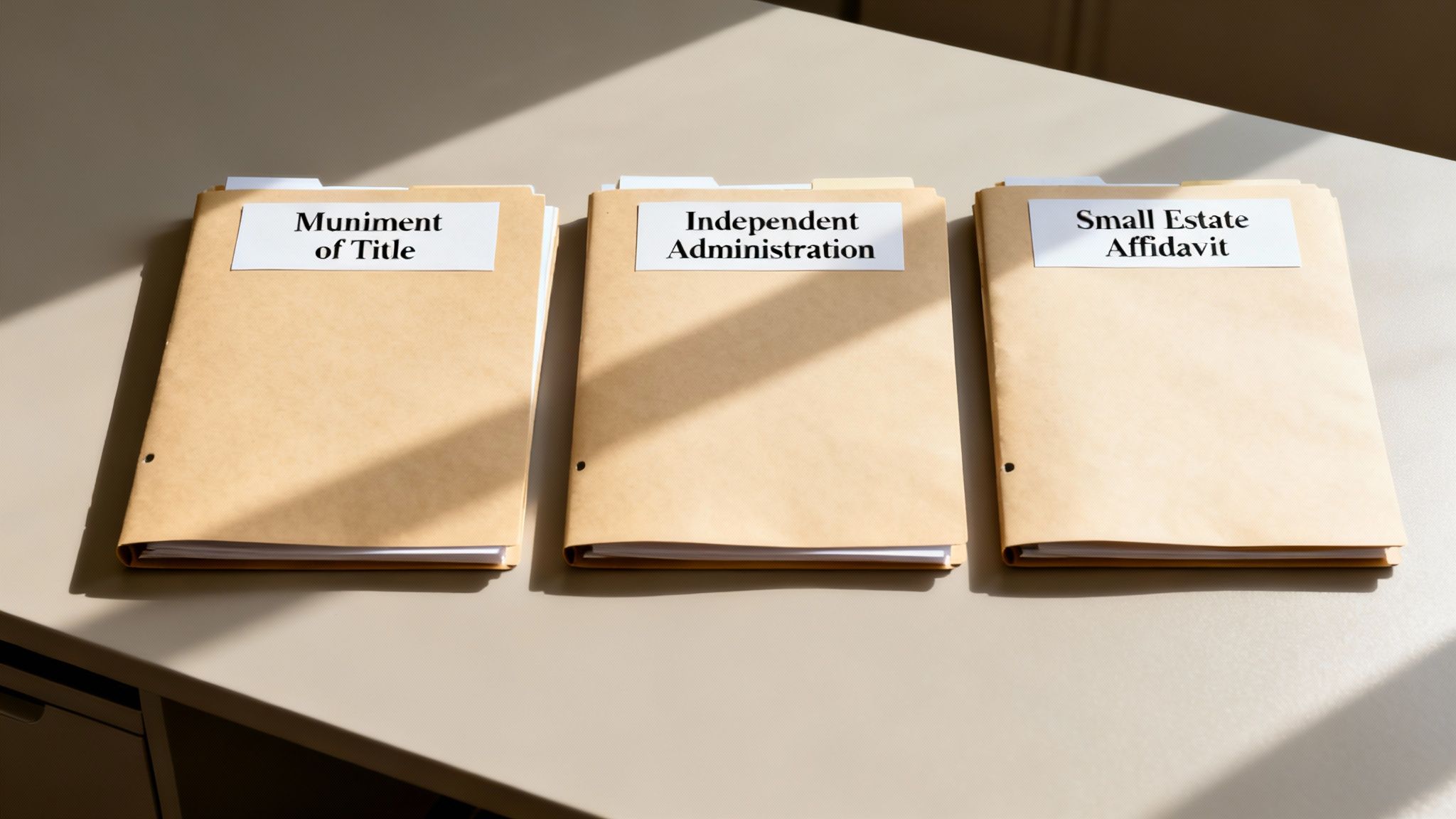

Comparing Texas Probate Alternatives

Choosing a legal path after losing a loved one can feel overwhelming. While a muniment of title in Texas is an excellent option for some, it’s not a one-size-fits-all solution. Understanding the other available routes helps ensure you are making the most efficient and compassionate choice for your family.

Think of these alternatives as different tools in a toolbox, each designed for a specific job. A muniment of title is like a precision screwdriver—perfect for a simple, uncomplicated task. But other situations might require a more versatile tool.

Muniment of Title vs. Independent Administration

The most common alternative to a muniment of title is a full probate with independent administration. This is the standard, most flexible probate process in Texas, and the key difference boils down to two things: debts and the role of an executor.

A muniment of title is only possible when there are no unsecured debts. If the estate owes money to creditors, an independent administration is necessary to get those bills paid. This process also grants an executor legal authority—through a document called Letters Testamentary—to manage the estate. This person is responsible for paying debts, selling property if needed, and distributing assets according to the Will. Independent administration provides the structure needed to handle more complex financial situations.

Muniment of Title vs. Small Estate Affidavit

For very small estates without a Will, a Small Estate Affidavit (SEA) offers another simplified path. This option allows heirs to collect property without going through a full probate process at all. However, its use is strictly limited.

An SEA is only an option if these strict conditions are met:

- The deceased died without a Will.

- The estate’s value (not counting the homestead) is $75,000 or less.

- The estate’s assets are worth more than its debts.

A muniment of title validates a Will for a debt-free estate of any size, while an SEA handles very small estates where no Will exists. For a deeper look, you can explore more about these and other estate settlement alternatives in Texas in our detailed guide.

A Clear Comparison of Your Options

To make this even clearer, this table contrasts the key features that matter most to families navigating this process.

| Feature | Muniment of Title | Independent Administration | Small Estate Affidavit |

|---|---|---|---|

| Is a Will Required? | Yes, absolutely required. | Yes, a Will is required. | No, only for estates without a Will. |

| Can it Handle Debts? | No, only for debt-free estates (mortgage is an exception). | Yes, the executor is empowered to pay creditors. | Yes, but assets must exceed liabilities. |

| Executor Appointed? | No, the Will itself transfers title. | Yes, the court appoints an executor. | No, heirs collect property directly. |

| Typical Timeframe | Fast (Weeks to a few months) | Moderate (Several months to a year+) | Fast (Often quicker than muniment) |

| Common Use Case | A debt-free estate of any size with a valid Will. | An estate with debts or complex assets that require management. | A very small estate (under $75,000) with no Will. |

Understanding these distinctions is crucial. It’s also important to remember that these aren’t the only tools available. Exploring other approaches like strategic legacy planning can also help families manage asset transfer and potentially simplify future estate matters. Our role is to help you select the most efficient legal path for your unique family situation, ensuring you feel supported and confident.

Understanding Critical Deadlines and Limitations

When you’re navigating probate, timing is everything. The Texas Estates Code lays out hard deadlines that can impact your family’s ability to use a muniment of title. Knowing these rules isn’t about adding more stress—it’s about protecting your loved one’s final wishes.

Typically, you have four years from the date of a person’s death to file an application to probate their Will. This deadline exists to bring certainty and finality to estate matters.

But life doesn’t always stick to a neat timeline. It’s not uncommon for a Will to be discovered years later, tucked away in a safe deposit box. In those moments, it can feel like you’ve missed your chance, but Texas law offers a compassionate—and crucial—exception.

The Four-Year Rule and Its “Not in Default” Exception

The Texas Estates Code allows a Will to be probated as a muniment of title even after the four-year mark if the person filing can prove they were not in “default” for failing to present the Will sooner. In plain English, you must have a good, legitimate reason for the delay.

Common reasons a court might accept include:

- The Will was lost or hidden, and you only recently discovered it.

- You genuinely did not know the Will existed.

- You had a mistaken belief that probate wasn’t necessary at the time.

This provision is a second chance built into the law, but the burden is on you to prove you weren’t just negligent. You can learn more about how Texas courts have interpreted this second chance for a late-filed Will.

Limitations After the Order is Granted

There are also limitations after a muniment of title is granted. Generally, there is a two-year window after the court order is signed during which a full administration could be opened if needed. This might happen if, for example, a previously unknown debt suddenly surfaces.

Key Insight: After two years have passed since the muniment of title was granted, it becomes extremely difficult to open a traditional administration. This makes it vital to be certain the estate is truly debt-free before choosing this path.

Understanding these timelines is key. Our attorneys can help you assess your situation, meet these critical deadlines, and choose the most effective and secure path for settling your loved one’s estate.

Key Takeaway

A muniment of title is a powerful tool in Texas for families with a straightforward estate. It allows a valid Will to serve as the legal document transferring property to heirs without the need for a full, lengthy probate administration. To qualify, the estate must have a valid Will, no unsecured debts (like credit card or medical bills), and no need for an executor. When these conditions are met, it offers a faster, more affordable, and less stressful path to settling a loved one’s affairs, providing peace of mind during a difficult time.

Our firm is dedicated to helping families with every aspect of the Texas Probate Process, from handling a Guardianship to drafting Wills & Trusts and managing complex Probate Litigation.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.

Frequently Asked Questions About Muniment of Title

Navigating probate raises many questions, especially when you’re grieving. Here are clear answers to the most common questions we hear from Texas families about using a muniment of title.

What Happens If a Debt Is Discovered After Filing?

Discovering an unsecured debt after a muniment of title is granted can create serious complications. The court order was approved based on a sworn statement that no such debts existed. A creditor could potentially sue the heirs directly to collect what they are owed, creating new financial and legal burdens for the family. This is why a thorough search for all outstanding debts before you file is so critical.

Can I Use Muniment of Title If There Is No Will?

No. The muniment of title Texas process is exclusively for estates where the person who passed away left a valid, written Will. The entire purpose of this proceeding is for a court to legally recognize that Will as the official document transferring ownership. If your loved one died without a Will (known as dying “intestate”), the estate must go through a different process, typically an heirship proceeding to legally identify the heirs under Texas law.

How Long Does the Muniment of Title Process Take?

While every county is different, a muniment of title is significantly faster than a full probate administration. Once the application is filed and proper notice is given, it often takes just a few weeks to a couple of months to get a court hearing and the final order. This quick timeline is a huge relief for families who qualify.

Do I Really Need a Lawyer for This Process?

While it is a simpler process, we strongly recommend hiring an experienced probate attorney. A probate court is a formal legal environment with strict rules and deadlines that can easily trip up someone unfamiliar with the system. An attorney ensures the estate truly qualifies under the Texas Estates Code, that all filings are correct, and that you are prepared for the hearing. Professional guidance provides peace of mind and makes sure the process is handled correctly from start to finish.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.