When you're deciding between a living trust and a will, it often comes down to one crucial question: do you want your estate settled in a public courtroom or in a private office? A will guarantees your estate goes through the court process called probate, while a living trust is specifically designed to avoid it. Navigating this choice can feel overwhelming, especially when you are trying to protect your family's future during a difficult time.

Your choice ultimately depends on what you value more—the court-supervised structure of a will or the privacy and immediate control a trust offers your family. This guide will provide a compassionate, plain-English explanation to help you make the best decision for your loved ones.

Choosing Your Legacy: A Living Trust Or A Will in Texas

Making decisions about your estate can be a deeply emotional process, especially when all you want to do is protect your family’s future. In Texas, the two most common tools for this are a Last Will and Testament and a Revocable Living Trust. Understanding how they fundamentally differ is the first step toward building a plan that gives you true peace of mind. We are here to simplify these concepts, so you can feel confident and prepared.

Here’s the main distinction: a will is a set of written instructions that only becomes legally effective after you pass away and a judge validates it through the probate process. On the other hand, a living trust is a private legal arrangement you create and manage during your lifetime. This difference is the game-changer, as it dictates how your assets are handled both now and after you’re gone.

Core Functions Of Each Document

Think of a will as a set of instructions for the probate court. It becomes a public document that a judge must approve before your property can be distributed. It’s a formal, court-driven process that ensures your debts are paid and assets are legally transferred.

In contrast, a living trust acts like a private rulebook for your property. It allows for a seamless, immediate transfer of your assets to your loved ones, entirely outside of the court system, offering privacy and efficiency during what is already a stressful time for your family.

Here’s a simple way to frame the decision:

- A will tells the court what to do. It names an executor to manage the process, but the court supervises everything according to the rules in the Texas Estates Code.

- A trust empowers your chosen successor to act immediately. It bypasses the court system, keeping the process private and often much faster.

This single difference has a ripple effect, impacting everything from cost and privacy to how quickly your loved ones actually receive their inheritance.

Quick Comparison: Wills vs. Living Trusts In Texas

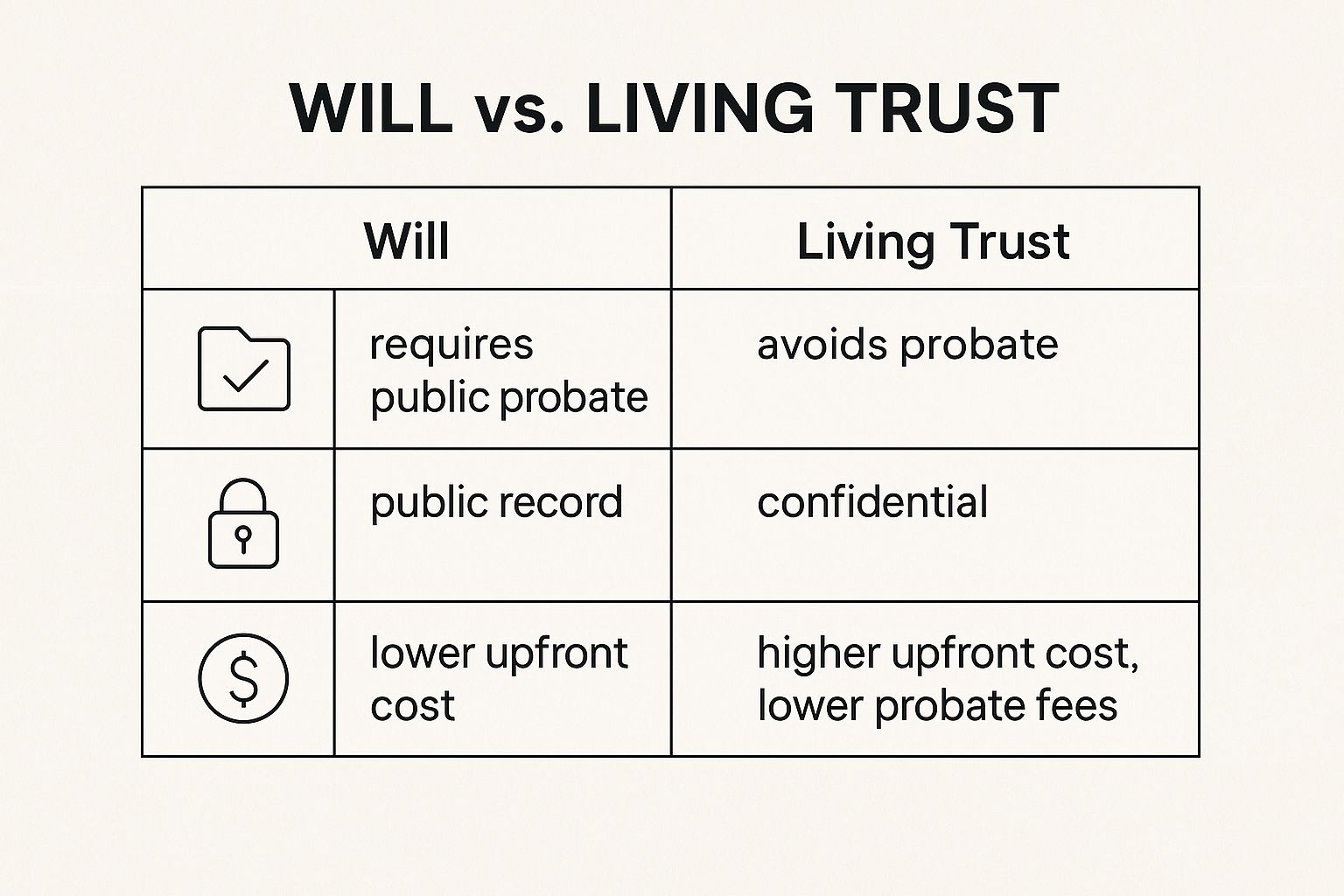

To make the differences even clearer, the table below gives you a side-by-side summary of how a will and a living trust stack up on the most important features under Texas law.

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate Requirement | Required. Must go through the court-supervised Texas Probate Process. | Avoided. Assets are distributed privately by the successor trustee. |

| Asset Control | You control assets until death. The executor takes over afterward, with court oversight. | You control assets as trustee. A successor trustee takes over at death or incapacity. |

| Privacy | Public record. The will and a list of your assets are filed with the court. | Private document. The trust and its terms remain completely confidential. |

| Upfront Cost | Generally lower initial cost to draft and sign. | Higher initial cost to create the trust and transfer assets into it (called "funding"). |

| Effectiveness | Only effective upon your death, and only after a judge validates it in probate. | Effective immediately once you create it and fund it with your assets. |

While a will might seem simpler and cheaper upfront, the long-term benefits of a trust—like avoiding probate and maintaining privacy—often make it a more powerful tool for many Texas families.

What A Last Will And Testament Really Does

A Last Will and Testament is often seen as the cornerstone of estate planning, but many families aren't quite sure what it actually accomplishes under Texas law. At its core, a will is a formal, written set of instructions you leave for the probate court. It spells out exactly how you want your property distributed and your final affairs handled after you pass away.

Think of it this way: your will is a direct message to a judge. It has no real legal power until that judge officially validates it through the probate process. This is a crucial distinction. The will itself doesn't transfer your house or your car; it just directs the court on how to get it done.

The Key Players Named In A Will

To understand how a will functions, you need to know who the main players are. The legal terms can seem intimidating, but their roles are straightforward and vital to making sure your wishes are carried out with care.

- Testator: This is simply the legal term for the person making the will—you.

- Executor: This is the person or institution you trust to be in charge of your estate. They act as your representative, responsible for gathering your assets, paying off debts, and distributing what's left according to your instructions, all under the court's supervision.

- Beneficiaries: These are the people, charities, or other entities you've chosen to inherit your property.

Under Texas Estates Code, Title 2, a will must be a written document, signed by you (the testator), and witnessed by two credible people in your presence. These strict legal requirements are there for a reason—they ensure the document is authentic and legally binding when it is presented to the court.

Directing Your Legacy And Protecting Your Children

A will’s primary job is to direct the distribution of your assets. You get to specify who gets your home, investments, car, and even sentimental family heirlooms. If you don't have a will, Texas law decides who inherits your property through a process called "intestate succession," and those default rules might not be what you wanted at all.

But for many parents, a will’s most profound responsibility is naming a guardian for minor children. If both parents pass away, the guardian you nominate in your will is your official recommendation to the court for who should raise your kids. This is arguably one of the most important reasons for any young family to have a will.

Takeaway: While the court always makes the final call on guardianship based on the child's best interest, your nomination carries immense weight. Failing to name a guardian forces a judge to choose someone without your input, which can lead to family disputes and terrible uncertainty during an already tragic time.

Why Probate Is A Necessary Step For A Will

A will must go through probate to become legally effective. Probate is the formal court process that validates the will, officially appoints your chosen executor, and oversees the entire settlement of your estate. It's a public process designed to ensure your debts are paid and your assets are transferred correctly and legally.

Unfortunately, many families are unprepared for this step. Recent trends show a worrying decline in will ownership. According to a June 2025 report, only 24% of American adults have a will, with families with young children being the most likely to have no plan in place. This lack of planning forces countless families into complicated and often expensive court proceedings that could have been simplified.

By creating a valid will, you provide a clear roadmap for the court, which can significantly simplify the administration of your estate. It's an act of foresight that protects your family from confusion and conflict. To better grasp the specifics, you can learn more about the importance of wills in Texas estate planning in our detailed guide.

How A Revocable Living Trust Works For You

While a will is a set of instructions for the probate court, a revocable living trust is a completely different tool. It’s a private legal entity you create during your lifetime to hold and manage your property, giving you a powerful way to sidestep the public court system altogether.

Think of it like creating a private container for your assets. You get to write the rulebook for how that container is managed, both while you're alive and long after you’re gone. This offers a level of control and privacy that a will just can't provide.

Creating And Funding Your Trust

The process begins with a legal document called a trust agreement. This is where you name the key players and lay out the ground rules for managing everything inside the trust.

With a revocable living trust, you’ll typically wear three hats at the beginning:

- Grantor: You're the one who creates the trust.

- Trustee: You’re the manager, controlling the assets just like you always have.

- Beneficiary: You’re the one who benefits from the trust while you’re alive.

Once the trust document is signed, the most crucial step comes next: funding it. This means you have to legally transfer ownership of your assets—your house, bank accounts, investment portfolios—from your personal name into the name of the trust. An unfunded trust is like an empty box; it offers no protection.

Seamless Transitions And Incapacity Protection

One of the biggest advantages of a living trust is how it prepares for the unexpected. Your trust agreement names a successor trustee—the person or institution you trust to take the reins when you no longer can.

The handoff is seamless and automatic. No court intervention is needed. If you become incapacitated from an illness or accident, your successor trustee can step in immediately to pay your bills and manage your finances. This built-in protection is a game-changer that a will simply doesn't offer.

Key Insight: A will only springs into action after you die. It provides zero protection if you become incapacitated. A living trust, on the other hand, is effective the moment it's created and funded, giving you a plan for both death and disability.

After your death, the successor trustee’s job continues. They’ll gather the trust assets, pay off any final debts, and distribute what’s left to your beneficiaries—all according to the private instructions in your trust. The entire process happens outside of probate court, keeping your family’s affairs private and relieving them of a significant burden.

Why Many Texans Choose A Trust

Despite the clear wins of privacy and probate avoidance, a shocking number of people haven't done any estate planning. As of 2025, a staggering 55% of Americans have no estate planning documents at all. While 31% have a will, only a small fraction—just 11%—have a living trust.

For Texas families who want to make sure their estate is handled privately, efficiently, and without a judge looking over their shoulder, a revocable living trust is often the perfect tool. It provides a structured, yet flexible, way to protect your legacy and your loved ones. Our comprehensive guide can help you learn more about how to avoid probate in Texas with a living trust.

Comparing Key Differences For Your Decision

Deciding between a will and a living trust isn't about picking a "better" option; it's about choosing the right tool for your family's unique situation. The differences here go way beyond simple legal definitions—they directly impact your family’s privacy, the costs they'll face, and how quickly your wishes are actually carried out.

Understanding these distinctions is the most important step you can take to make a confident, informed choice for your legacy.

The core difference really boils down to one critical event: probate. A will is designed to work through the probate court, while a living trust is built to work around it. That single distinction creates a ripple effect that touches every part of how your estate gets settled.

The Probate Process: A Public Affair vs. A Private Matter

Think of a will as a letter of instruction to the probate court. Under the Texas Estates Code, this will has to be filed with the court and validated by a judge before your executor can legally do anything. This court-supervised process is public, often takes months (or even years), and demands that specific legal steps be followed to the letter.

A living trust, on the other hand, operates entirely in private. Since the assets are already legally owned by the trust, your successor trustee can manage and distribute them exactly as you instructed without ever needing a judge's permission. It bypasses the whole probate system, which makes the process faster and keeps your family's financial affairs out of the public record.

Takeaway: A will guarantees your estate will go through probate. A living trust is specifically created to avoid it. This is the most fundamental difference between the two and often the primary reason families choose a trust—to shield their loved ones from the stress of a public court process.

Family Privacy: Keeping Your Affairs Confidential

Because probate is a public court proceeding, your will becomes a public document. That means anyone—from nosy neighbors to opportunistic solicitors—can walk into the courthouse and see the details of your estate. They can find out who your beneficiaries are and exactly what they inherited. For many families, this public exposure of their financial lives is a major drawback during a time of grief.

A living trust, by its very nature, is a private document. Its terms are confidential, shared only with the trustee and beneficiaries. Your assets, their values, and who gets what remains entirely within the family, offering a level of discretion and peace a will simply cannot provide.

This chart really drives home the contrast in how wills and trusts handle probate, privacy, and costs.

As you can see, a trust offers a private and streamlined alternative to the public, court-driven process that a will requires.

Upfront vs. Backend Costs: A Financial Trade-Off

Cost is a practical concern for every family, and there’s a definite trade-off here. A will generally has a lower upfront cost to create. However, those initial savings are often wiped out by the backend costs of probate, which can include court filing fees, executor compensation, and attorney's fees that can easily run into thousands of dollars.

A living trust requires a larger initial investment. The process involves not only drafting the trust document but also meticulously transferring your assets into it—a process called "funding." While this costs more upfront, it can save your family a significant amount of money in the long run by avoiding probate costs completely.

Incapacity Planning: A Trust's Hidden Strength

What happens if you become unable to manage your own affairs due to an illness or injury? This is a scenario many people overlook. A will offers no solution here, as it only takes effect after you pass away. If you only have a will, your family would likely have to go to court to get a Guardianship, which can be a slow, expensive, and very public process.

This is where a living trust truly shines. Your trust document names a successor trustee who can step in immediately to manage your finances if you become incapacitated. It provides a private, efficient plan for handling your affairs without court intervention, protecting both you and your family during what is already a difficult time.

Despite this clear advantage, trust adoption remains low. Surveys from 2025 show that only 13% of U.S. respondents have a living trust, compared to 24% who have a will. This suggests many families may be overlooking this crucial benefit. You can review more data about these estate planning trends and gain further insights.

When To Choose A Will Or A Trust

Knowing the definitions of wills and trusts is one thing, but seeing them in action is where it all clicks. The best way to understand the power of a living trust and a will is to see how these tools work for real Texas families. The right choice isn’t about which tool is “better” in theory—it’s about which one solves your specific problems with the most care and efficiency.

Let's walk through a few common, realistic scenarios. Each one brings a different set of priorities to the table, making it clear why one tool is a better fit than the other in certain situations.

Scenario 1: A Young Couple With Minor Children

Meet Sarah and Tom. They're in their early thirties with two little kids and a pretty straightforward financial picture: a house, some savings, and life insurance policies. Their biggest worry? What happens to the kids if the unthinkable happens.

For them, a Last Will and Testament is the perfect starting point. It's practical, cost-effective, and—most importantly—it lets them legally name a guardian. A trust can't do that. Since their estate isn't complex, the idea of probate isn't that scary; a simple estate can move through the Texas system without much drama.

Key Insight: When your number one priority is naming a guardian for your kids and your assets are straightforward, a will is the essential first move. It directly and efficiently solves your most pressing problem.

Scenario 2: A Blended Family With Complex Assets

Now, let’s look at David and Maria. They’re in their fifties, this is a second marriage for both, and they each have children from their previous relationships. Their assets are more complicated, including a family business, several investment accounts, and a vacation home. Their goal is to provide for each other while making sure their own children receive a protected, specific inheritance.

This is a textbook case for a Revocable Living Trust. A will would throw all their assets into a public probate process, creating a perfect storm for conflict between the surviving spouse and stepchildren. A trust, on the other hand, lets David and Maria create a private, detailed roadmap for everything they own.

They can design the trust to give the surviving spouse income for life, and then, after that spouse passes, the remaining assets are split among all the children exactly as they planned. This gives them a level of control and privacy that a will just can't offer, helping keep the peace and avoid messy Probate Litigation.

Scenario 3: The Business Owner Needing Seamless Succession

Next up is Frank, the 65-year-old sole owner of a thriving manufacturing company in Houston. His daughter has worked alongside him for years and is ready to take the reins. Frank’s main concern is ensuring the business keeps running smoothly if he suddenly passes away or becomes incapacitated.

For his business, a will would be a total disaster. The company would become a probate asset, meaning it would be frozen by the court until an executor is officially appointed. That kind of delay could kill contracts, stop payroll, and threaten the entire company's stability.

By placing his ownership of the company into a living trust, Frank can name his daughter as the successor trustee. If Frank becomes unable to run things, she can step in immediately. When he passes, she gains full control instantly. No courts, no delays, just a seamless transition.

Takeaway: For a business owner, a living trust isn't just an estate planning tool—it's a business continuity plan. It protects the company from being paralyzed by the probate process.

Scenario 4: The Individual Owning Out-of-State Property

Finally, meet Susan, a retired teacher who owns her home in Texas and a small condo in Florida for the winters. If Susan only has a will, her family is in for a huge headache: two separate probate cases in two different states.

Her Texas will would have to be probated here. Then, her family would need to hire a Florida lawyer to open a second probate case there, a process called ancillary probate. That means double the lawyers, double the court fees, and double the hassle.

By creating a living trust and transferring both properties into it, Susan simplifies everything. Her successor trustee can manage and distribute both the Texas and Florida properties from a single, centralized plan. This completely sidesteps the need for a costly and redundant probate in another state, saving her family a world of stress.

Ultimately, choosing between a will and a trust means looking at your life from every angle. If you need personalized guidance on building a Wills & Trusts plan that fits your unique family and financial situation, our team is here to help.

Making Your Final Estate Planning Decision

Choosing between a living trust and a will isn't about finding a one-size-fits-all answer. It's a deeply personal decision that comes down to your family, your finances, and what you want your legacy to look like. There's no single "better" option—only the one that aligns with your goals and provides the most comfort and protection for your loved ones.

Making this choice is a powerful act of love and foresight. When you create a formal estate plan, you're lifting a tremendous burden from your family's shoulders. You're replacing confusion and uncertainty with a clear, legally sound roadmap for them to follow during an incredibly emotional time.

Final Questions to Guide Your Choice

To help bring some clarity, think through these final questions. Your answers should point you toward the tool that fits your life.

- Is avoiding probate a top priority? If your goal is to spare your family the time, expense, and public scrutiny of the probate process, a living trust is almost certainly the stronger choice.

- Is family privacy essential? A will becomes public record once it's filed with the court. If keeping your financial affairs confidential is important, a living trust offers complete privacy from prying eyes.

- Do you need to plan for potential incapacity? A will offers zero protection if you become unable to manage your own affairs. A living trust provides immediate protection by allowing your chosen successor trustee to step in without any court intervention, helping you avoid a difficult Guardianship proceeding.

- Are your assets straightforward and your main goal naming a guardian? If your estate is modest and your primary concern is making sure your minor children are cared for, a will is an essential and effective tool for the job.

As you build your plan, especially if it involves real estate or other significant assets, it's also smart to think about the downstream effects on your beneficiaries, like the capital gains tax on inherited property.

Key Insight: The best estate plan often isn't an "either/or" choice. Many people use both documents. The living trust acts as the primary vehicle for transferring assets, while a special "pour-over" will serves as a safety net, catching any forgotten assets and moving them into your trust after you're gone.

Ultimately, the goal is peace of mind. Whether you choose a will, a living trust, or a combination of both, you are taking a definitive step to protect what matters most.

To explore this further, you can read about other legal tools for avoiding probate in Texas after death in our dedicated guide. An informed decision today ensures your wishes are honored tomorrow.

Common Questions About Living Trusts and Wills in Texas

Even after you’ve weighed the pros and cons of a living trust versus a will, a few practical questions almost always come up. It’s one thing to understand the theory, but another to know how these documents work in the real world. Here are some plain-English answers to the most common concerns Texas families have.

Do I Still Need A Will If I Have A Living Trust?

Yes, absolutely. Think of it as a crucial safety net. When you create a living trust, you should also create a special type of will called a pour-over will.

Here’s why it’s so important: a pour-over will is designed to "catch" any assets you may have forgotten to transfer into your trust, or assets you acquired right before your death. Without one, those forgotten assets get stuck outside the trust and have to be distributed according to Texas intestacy laws—which might mean they go to heirs you never intended. This special will ensures everything you own ultimately makes its way into your trust to be managed according to your private instructions.

How Much Does It Cost To Set Up A Trust Versus A Will?

A will is almost always cheaper upfront. But that initial savings can be misleading. The lower cost is often wiped out by the future expenses of probate, which can include court fees, mandatory notices, and attorney’s fees that slowly chip away at your estate’s value.

A living trust requires a bigger investment to get started. You're not just drafting a document; you're also taking the time to properly fund it by transferring assets. While it costs more today, it can save your family a massive amount of money, time, and stress down the road by avoiding the probate process completely.

Can I Change My Trust Or Will After I Create It?

Of course. Life changes, and your estate plan should change with it. Both a standard will and a revocable living trust are designed to be flexible. You can amend your will with a document called a codicil, or you can just scrap the old one and create an entirely new will.

It’s just as easy with a revocable living trust. You can amend it or even revoke it completely at any point during your lifetime, as long as you are mentally competent. This built-in flexibility is what allows your estate plan to grow with you through major life events like marriage, divorce, or the birth of a child.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.