When a loved one passes away in Texas, the first step in settling their affairs often involves the probate court. One of the initial questions we must answer is whether they left a valid will. This single fact determines the entire path forward, beginning with the type of legal authority you will need from the court.

The core difference between letters testamentary or letters of administration boils down to that one critical element: the presence of a valid will. While these terms may sound like complex legal jargon, both documents serve the same fundamental purpose. They are official court orders that grant a specific person the legal power to manage and settle a loved one's estate. We understand this is a difficult time, and our goal is to make this process as clear and straightforward as possible for you and your family.

The Keys to Managing a Texas Estate

After a loved one passes, their assets—think bank accounts, real estate, and investments—are essentially frozen. You cannot simply walk into a bank with a death certificate and a copy of the will and expect to access their funds. Financial institutions require legal proof that you are the person authorized to act on behalf of the estate.

This is where letters testamentary and letters of administration come in. Think of these letters as the official "keys" to the estate. They unlock your ability to perform the crucial duties required to settle your loved one's final affairs, such as:

- Accessing and managing the deceased's bank accounts.

- Communicating with creditors and paying valid debts.

- Selling property, like a house or a car, to distribute funds to the rightful heirs.

- Filing the final tax returns for your loved one.

- Legally transferring assets to the beneficiaries named in the will or the heirs determined by law.

Without these court-issued documents, you have no legal standing, and the entire process of settling the estate cannot begin.

Letters Testamentary vs. Letters of Administration at a Glance

To simplify, here’s a plain-English comparison to help you understand which document applies to your situation.

| Scenario | Governing Document | Document Issued | Person Appointed |

|---|---|---|---|

| Person died WITH a valid will | The Last Will and Testament | Letters Testamentary | Executor |

| Person died WITHOUT a will | Texas Intestacy Laws | Letters of Administration | Administrator |

As you can see, the will is the deciding factor. It dictates not only what document you get but also what you are called in the eyes of the court.

Understanding the Two Types of Letters

The type of letter you need depends entirely on whether your loved one left a valid will. The Texas Estates Code is very clear on how each scenario plays out.

-

Letters Testamentary: These are issued when a person dies with a valid will (the legal term is testate) and has named an executor in that document. The probate court first validates the will and then officially appoints the named executor. These letters are the executor's proof of authority to carry out the instructions left in the will, as outlined in Title 2 of the Texas Estates Code.

-

Letters of Administration: These are granted when a person dies without a will (known as dying intestate). Since there is no will to name an executor, the court must appoint someone. This person, called an administrator, is tasked with managing the estate according to Texas's strict inheritance laws (intestate succession). The court typically appoints a close family member, like a surviving spouse or an adult child.

Although the names are different, the day-to-day responsibilities of an executor and an administrator are quite similar. The main distinction is who appoints them (the will or the court) and what rules they follow (the will's directives or state law). For a deeper look into these roles, you can explore the difference between an executor and an administrator in our detailed guide.

Knowing which path your family needs to take is the first and most critical step toward settling your loved one's final affairs with clarity and peace of mind.

The Executor's Authority: Letters Testamentary

When a loved one honors you by naming you the executor in their will, they are entrusting you with their final wishes. However, many first-time executors are surprised to learn that the will itself does not grant any legal power to act. It is simply a set of instructions. To bring those instructions to life, you need the court's official stamp of approval, which comes in the form of Letters Testamentary.

Think of a will as the architect's blueprint for settling an estate. The Letters Testamentary are the construction permit issued by the court. They legally authorize you, the executor, to build according to that blueprint. This single document is your absolute proof to banks, creditors, and government agencies that you are the one in charge.

Turning the Will's Wishes into Action

Without Letters Testamentary, an executor's hands are tied. You may know exactly what your loved one wanted, but you have no legal authority to make it happen. This document is the key that unlocks your ability to perform all the essential duties outlined in Title 2 of the Texas Estates Code.

With this authority, you can finally get to work settling the estate:

- Secure Financial Assets: You can legally take control of the deceased's bank accounts, access investment portfolios, and manage retirement funds.

- Manage Real Estate: You gain the power to sell the family home, transfer titles, or handle any rental properties owned by the estate.

- Pay Final Debts: This allows you to formally notify creditors, review their claims, and use estate funds to pay off valid debts like medical bills or credit card balances.

- Distribute Property to Beneficiaries: Once all debts and taxes are settled, you can legally transfer the remaining assets to the people named in the will.

Essentially, Letters Testamentary transform you from a name on a piece of paper into the estate's official legal representative.

A Real-World Example of Why Letters Testamentary Matter

Consider a scenario involving Maria, whose mother recently passed away in Houston. Her mother had a clear, well-drafted will that named Maria as the executor. Feeling prepared, Maria took a copy of the will and the death certificate to her mother’s bank, hoping to close the checking account to pay for funeral expenses.

The bank manager was compassionate but firm. "I'm very sorry for your loss, Maria," he explained, "but the will isn't enough. We need a court order called Letters Testamentary before we can grant you access to these funds."

That moment was a turning point for Maria. She realized that her mother’s wishes, while clearly stated, were powerless without the court’s official validation. The will named her, but only the probate court could empower her.

This scenario is incredibly common and perfectly illustrates the critical, non-negotiable role that letters testamentary or letters of administration play. They bridge the gap between the will’s intentions and the executor's legal ability to get things done. For anyone navigating the Texas Probate Process, understanding this step is fundamental. It's not just a formality; it's the first and most important action in honoring your loved one’s legacy.

What Happens When There’s No Will? Understanding Letters of Administration

Losing a loved one is hard enough. Discovering they didn’t leave a will can add a layer of stress and confusion to an already painful time. When someone passes away without a will, it is legally known as dying intestate. It means they did not leave a roadmap for their final wishes.

Fortunately, Texas law provides a clear, structured process to ensure their estate is handled correctly and fairly. This is where Letters of Administration come into play. They are an official court order that gives someone the legal power to manage and settle an estate when no will exists. Instead of an executor named in a will, the court appoints an administrator to take charge.

How the Court Chooses an Administrator

With no will to name an executor, the probate court must appoint a suitable person. The judge follows a strict legal priority order laid out in the Texas Estates Code, specifically Section 304.001. This law is designed to put a trusted family member in charge, and the priority generally flows like this:

- The surviving spouse.

- The principal beneficiary from a will (this can happen if a will is found but is invalid, yet still shows the deceased's preference).

- Any other beneficiary named in that will.

- The next of kin, which usually starts with the deceased's children, then parents, and then siblings.

This framework ensures that the person managing the estate has a direct, personal interest in seeing it settled properly. If you find yourself in this situation, our guide on how to file for probate in Texas without a will breaks down the steps in more detail. A skilled attorney can also help with complex family situations, such as seeking a Guardianship for minor heirs.

What’s an Administrator with Will Annexed?

Occasionally, a unique situation arises where someone leaves a valid will but fails to name an executor. Or, the named executor may be unable or unwilling to serve. In these cases, the court issues Letters of Administration with Will Annexed. This term simply means "with the will attached." It empowers a court-appointed administrator to follow the exact instructions in the will, even though they were not the person originally named.

This process acts as a legal safeguard, ensuring the deceased's wishes are still honored even when the designated executor cannot fulfill the role. The court steps in to appoint a qualified person to finish the job.

Bringing Order to a Difficult Time

Losing a loved one without a will can feel chaotic, but the Texas probate system is designed to create order. Obtaining Letters of Administration is the crucial first step. It provides the legal structure needed to distribute assets according to state law when a will is missing.

This court-supervised process has deep roots in American history. For centuries, probate records have offered a look into the past, and letters of administration were common. For example, historical data from the early 1800s shows that in Pennsylvania, about 60% of adults died intestate. You can learn more about the history of probate records on legacytree.com.

For Texas families today, obtaining Letters of Administration turns confusion into a clear plan. It grants you the legal authority needed to communicate with banks, pay final bills, and ensure your loved one's property passes to the rightful heirs as defined by Texas law.

How to Obtain Probate Letters in Texas

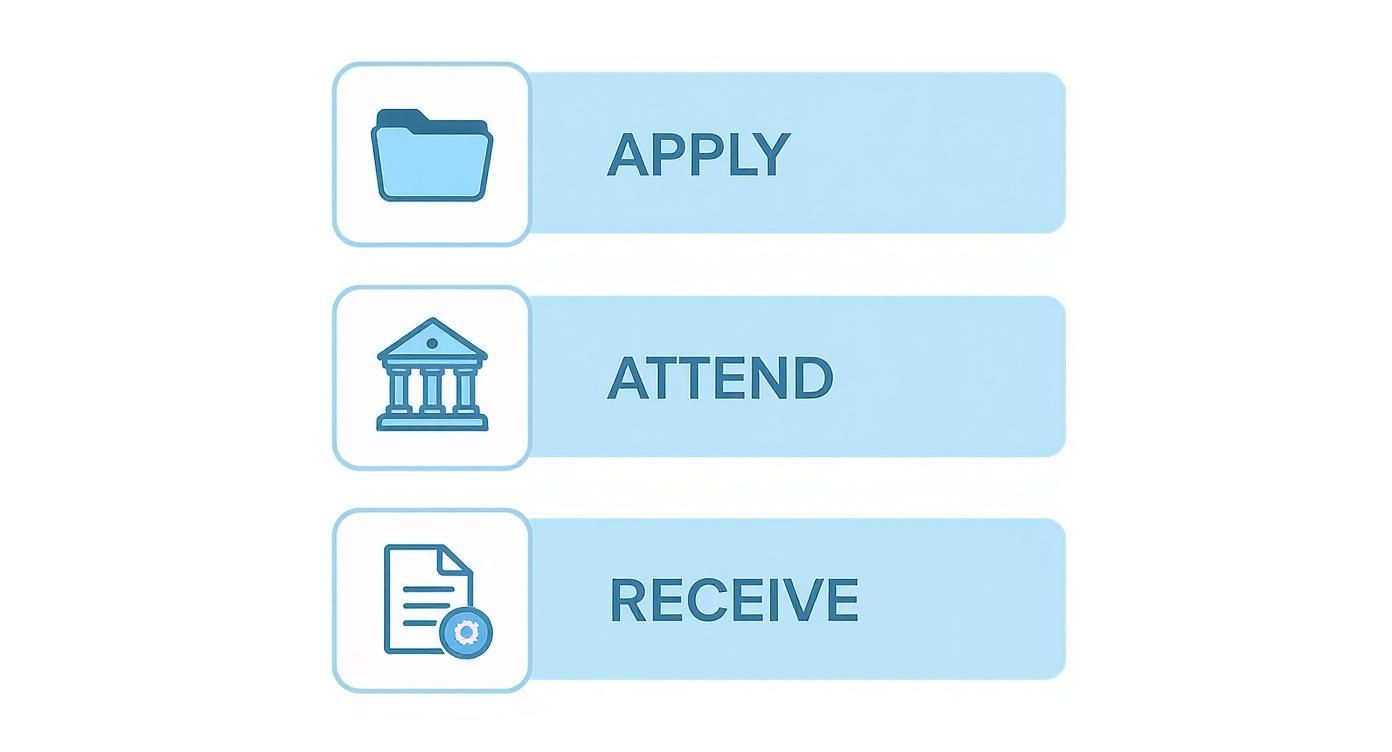

The process of getting the court's official permission to manage an estate can feel overwhelming, but the Texas probate system is a structured path, not a maze. Whether you need letters testamentary or letters of administration, the process follows a predictable sequence. Understanding this step-by-step roadmap can bring reassurance during a difficult time.

This visual guide breaks down the journey into three simple stages.

With the right guidance, obtaining the legal authority you need is entirely manageable.

Step 1: File the Application

Your journey begins by filing an Application for Probate with the court. This document provides essential details such as the date of death, the decedent's residence, and a list of their known heirs. If there is a will, the original document must be filed with the application. If there is no will, the application will instead ask the court to officially determine who the legal heirs are and to appoint an administrator. Our firm can help you identify all the key documents required when filing a petition for probate in Texas.

Step 2: Posting of Notice and Waiting Period

Once your application is filed, Texas law requires a public notice to be posted at the courthouse. This serves to inform the public that an estate has been opened. This posting initiates a mandatory waiting period, typically about two weeks. It gives anyone with an interest in the estate—like a creditor or a potential heir—an opportunity to come forward with an objection.

Step 3: Attend the Court Hearing

After the waiting period, the court schedules a short, formal hearing with a probate judge. This is not a dramatic courtroom battle; for most cases, it is a straightforward proceeding to confirm the facts in your application. You will give brief testimony under oath, and the judge will ask questions to:

- Confirm the person has passed away.

- Verify the court has jurisdiction.

- If a will exists, prove its validity.

- Confirm that you are qualified to serve as executor or administrator.

In most uncontested cases, this hearing is brief. Your attorney will prepare you for every question, so you feel confident and prepared.

Step 4: Take an Oath and Post Bond if Required

Once the judge approves your application, you will take an official Oath of Executor or Administrator. By taking this oath, you legally swear to faithfully carry out all duties required under Texas law. In some situations, particularly when there is no will, the judge may also require you to post a bond. A bond is an insurance policy that protects the estate’s heirs and creditors from potential mismanagement.

Step 5: Receive Your Official Letters

After you have taken the oath and posted a bond (if required), the county clerk will issue the formal Letters Testamentary or Letters of Administration. This official, court-sealed document is your proof of legal authority to act on behalf of the estate. With these letters, you can begin the important work of settling your loved one's affairs.

Common Roadblocks in the Probate Process

Even with a seemingly straightforward will, the path through probate can have challenges. When you're grieving, the last thing you need is a legal surprise. Understanding potential roadblocks can make them feel less like a crisis and more like a manageable step in the process. With the right support, every challenge has a clear path forward.

Contested Wills and Family Disputes

One of the most emotionally draining roadblocks is a contested will. This occurs when an heir—or someone who believes they should have been an heir—formally challenges the will’s validity in court. They might argue that the deceased was not of sound mind when they signed it or was under undue influence from another family member.

When a will is contested, the probate process is effectively frozen, and no assets can be distributed until the court resolves the dispute. This often involves lawyers, evidence, and tense courtroom proceedings.

This is where having an experienced legal team is non-negotiable. A contested will turns an administrative task into a courtroom battle, which requires a completely different set of skills.

Navigating these disputes demands a firm that understands the delicate balance between family dynamics and the letter of the law. If you are facing a potential will contest, our Probate Litigation team can step in to protect the estate and fight for your loved one’s final wishes.

Locating Heirs and Assets

Another common hurdle is simply finding everyone and everything. Sometimes, a will might name a long-lost cousin whose location is unknown. In cases without a will, the administrator has a legal duty to identify and notify all potential heirs according to Texas law, which can become a significant undertaking. The same applies to assets. Your loved one might have owned property you never knew about or had accounts at various financial institutions.

- Due Diligence: A skilled attorney can help perform "due diligence"—a thorough search to locate missing heirs or uncover forgotten assets.

- Attorney Ad Litem: In some situations, the court may appoint an "attorney ad litem" to represent the interests of unknown or missing heirs, adding another layer to the process.

Dealing with Estate Debts and Complex Assets

Significant debts or complicated assets can also complicate the process. If an estate owes more to creditors than it holds in cash, the executor or administrator must make difficult decisions about which assets to sell to pay those debts.

Complex assets bring their own unique challenges:

- Business Ownership: Valuing and managing a family business requires specialized expertise.

- Extensive Real Estate: Handling multiple properties, especially if any are outside of Texas, adds layers of legal complexity.

- Unique Investments: Assets like mineral rights or valuable art collections require careful appraisal and management.

These situations can slow down the process of obtaining your letters testamentary or letters of administration. An experienced attorney can help untangle these complexities, turning them into a clear, manageable plan that ensures every legal and financial detail is handled correctly.

Key Insight

The authority granted by Letters Testamentary or Letters of Administration is powerful, but it comes with a significant legal duty. As an executor or administrator, you are a fiduciary, meaning you must act with complete honesty and always put the interests of the estate and its beneficiaries first. This legal obligation, outlined in the Texas Estates Code, is the guiding principle for every decision you make. Partnering with an experienced probate attorney ensures you meet these duties while protecting you from personal liability, providing peace of mind during a difficult time.

Your Responsibilities as Executor or Administrator

Stepping into the role of an executor or administrator is an act of service to your family, built on trust and responsibility. This guide has explained how letters testamentary and letters of administration are the legal keys you need to settle an estate in Texas. Now, let’s summarize your core duties.

Your Core Responsibilities in a Nutshell

The authority the court grants you comes with serious fiduciary duties under the Texas Estates Code. It helps to think of your job in four main stages:

- Gather and Protect: Your first mission is to identify, secure, and create an inventory of every asset belonging to the estate—from bank accounts and real estate to personal belongings.

- Manage and Notify: You are responsible for formally notifying all legal heirs and any known creditors that the estate is being administered. This also involves using estate funds to pay legitimate debts and file final taxes.

- Account and Report: You must keep meticulous records of all money coming into and going out of the estate. The court and the beneficiaries have a legal right to review a detailed accounting.

- Distribute and Close: Once all bills are paid, your final duty is to distribute the remaining assets to the rightful beneficiaries (as named in a will) or heirs (as determined by state law). After distribution, you can formally close the estate.

A crucial part of your role may involve ensuring real estate titles are transferred cleanly. This is where you will see the importance of title insurance, especially if a property from the estate is being sold.

The Most Important Insight: You Don't Have to Go It Alone

Navigating the probate process alone can lead to stress and costly mistakes. While this guide provides a solid roadmap, the legal and financial complexities can quickly become overwhelming. Creating a comprehensive Wills & Trusts plan ahead of time can simplify many of these steps for your loved ones.

If you remember one thing from this guide, let it be this: Knowing the process is empowering, but having a professional guide provides true peace of mind. An experienced probate attorney is your partner in this journey. They ensure every legal box is checked, protecting you from missteps and allowing you to focus on your family.

From filing the correct paperwork to negotiating with creditors, legal counsel transforms an overwhelming burden into a series of manageable steps. You have already taken the first step by educating yourself. Now, take the next one and get the support you need to fulfill this role with confidence.

Common Questions We Hear About Texas Probate Letters

Navigating the probate process often brings up practical, everyday questions that can cause stress. Getting clear, compassionate answers can turn that anxiety into confidence. Here are some of the most common questions Texas families ask us about letters testamentary or letters of administration.

How Long Does It Actually Take to Get Probate Letters in Texas?

This is often the first question on everyone's mind. In a straightforward case—where the estate is simple and there are no disputes—you can typically have official letters in hand within four to eight weeks after filing the application.

However, several factors can extend this timeline:

- The Court's Schedule: Some probate courts are busier than others, which can affect how quickly a hearing is scheduled.

- A Complicated Estate: An estate with numerous assets, complex debts, or hard-to-find heirs will naturally take longer.

- Family Disagreements: If a will is contested, the process is paused until the dispute is resolved, which can take months or even years.

A smooth, quick process depends on filing a complete application and having all heirs in agreement.

What’s the Average Cost to Get These Letters?

There is no single flat fee; the total cost is a sum of different parts. Understanding these components helps you prepare financially.

You can generally expect these key expenses:

- Court Filing Fees: Counties charge a fee to open a probate case, typically in the $300 to $500 range.

- Attorney Fees: This is often the most significant expense. Most Texas probate attorneys work on an hourly basis or charge a flat fee, which should be discussed upfront.

- Administrator's Bond: If the court requires a bond (common when there is no will), its cost is based on the size of the estate.

We believe in complete transparency. During your initial consultation, we will provide a clear breakdown of all expected costs, so there are no surprises.

Can I Just Handle an Estate in Texas Without These Letters?

For nearly every estate, the answer is a firm no. Attempting to manage an estate without the court's official permission is legally impossible and exposes you to significant personal liability.

Key Takeaway: Letters Testamentary or Letters of Administration are not just paperwork. They are the legal key that unlocks the estate. Without this court-sealed document, banks, title companies, and financial institutions will not discuss the deceased's assets with you.

Sidestepping the probate process is a common and costly mistake. It is the only lawful way to transfer title to a house, access bank accounts, or pay debts on behalf of your loved one. These letters are essential for doing your job correctly and protecting both the estate's assets and yourself. To learn more about your duties, explore the Texas Probate Process on our site.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.