A last will and testament template for Texas is far more than just a fill-in-the-blank document. It is a final act of care for your family, providing clarity and peace of mind when your loved ones need it most. Creating a will ensures your property is distributed exactly as you wish, preventing the state from making those deeply personal decisions for you.

Why Every Texan Needs a Will

Planning for the future can feel overwhelming, but drafting a will is one of the most protective and thoughtful actions you can take. It’s easy to postpone, but understanding what happens without one often provides the motivation needed to get started.

When a Texan passes away without a will, the legal term is “intestate.” In this situation, Texas doesn’t guess what you might have wanted. Instead, it applies a rigid, one-size-fits-all formula from the Texas Estates Code (Title 2, Subtitle E) to divide your property.

The Reality of Dying Without a Will (Intestate Succession)

This legal process, called intestate succession, means a judge must follow the law precisely, which can lead to outcomes you never would have intended. For example, in blended families, assets a parent wanted for their children might legally pass to a new spouse instead. In other cases, community property could be divided in a way that creates financial hardship for the surviving partner.

The consequences extend beyond property. Dying without a will creates unnecessary stress and conflict for a grieving family, often forcing them into a longer, more complicated, and more expensive probate process. Unfortunately, a surprising number of people end up in this situation. Only about 31% of American adults currently have a will. This means the majority of estates could face drawn-out court proceedings, which in Texas can last from nine to eighteen months without clear instructions.

An Act of Love and Protection

Viewing the creation of a will as an act of love can change the entire perspective. By taking the time to prepare this document, you are:

- Protecting Your Children: You can name a guardian for your minor children, ensuring they are raised by someone you trust implicitly. A Guardianship designation is one of the most critical parts of a will for parents.

- Preventing Family Disputes: Clear instructions leave no room for arguments over who gets what, helping to preserve family harmony during a difficult time.

- Controlling Your Legacy: You decide which heirlooms go to whom and exactly how your financial assets should be distributed.

Ultimately, a will is a cornerstone of responsible estate planning. For a deeper dive into Texas-specific laws, you might be interested in understanding the importance of wills in Texas estate planning. It is the single best way to ensure your wishes are honored and your loved ones are cared for, just as you intended.

Navigating Your Texas Will Template

Staring at a blank will template can feel intimidating, but it’s really just a series of logical steps. A last will and testament template for Texas is a roadmap. Each section exists to protect your wishes, guide your family, and ensure the process goes smoothly. Let’s walk through it together and translate the legal language into plain English.

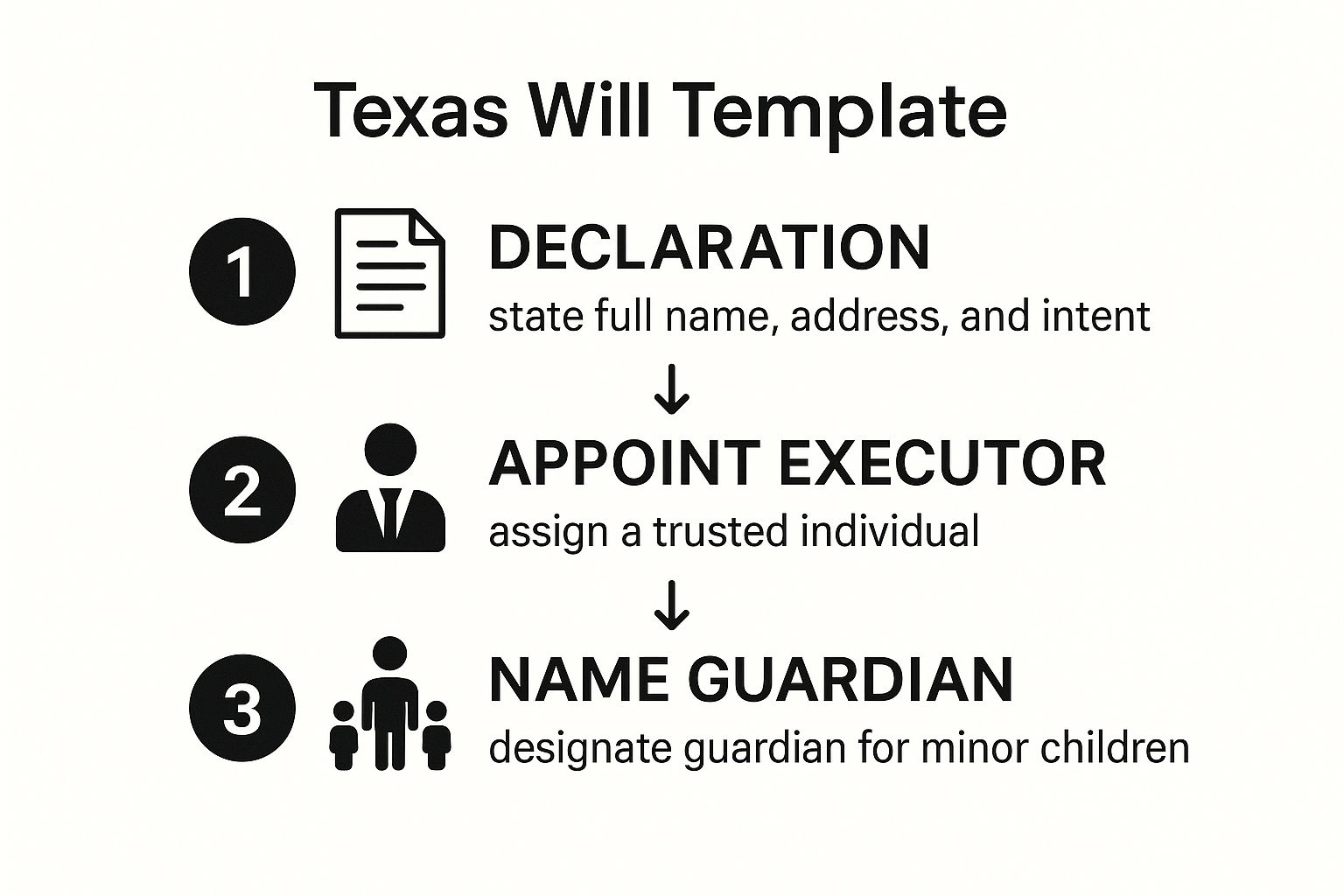

The purpose of a will is to create clarity. This visual guide breaks down the first few critical decisions you’ll need to make.

As you can see, a will starts by clearly stating who you are and what you intend, then moves on to appointing the key people who will carry out your plan. Let’s get into the details of what each part really means.

Before we dive into the section-by-section breakdown, here’s a quick overview of what to expect in a standard Texas will. Each part serves a distinct purpose, from identifying you to distributing your property.

Key Sections of a Texas Will

| Section Name | Purpose in Plain English | Information You Will Need |

|---|---|---|

| Declaration | Stating “This is my will.” | Your full legal name and county of residence. |

| Executor Appointment | Naming the person in charge of your estate. | The full names of your primary and alternate choices. |

| Guardian for Minors | Choosing who will raise your kids. | The full names of your primary and alternate guardians. |

| Property Distribution | Deciding who gets what. | A list of specific items/funds and beneficiaries. |

| Self-Proving Affidavit | Making it easier for the court to validate the will. | The presence of a notary and two witnesses. |

Understanding these components ahead of time makes the process of filling out your will template far less daunting. Now, let’s explore what goes into each one.

The Opening Declaration

The very first paragraph of your will is the declaration. While it seems like a simple formality, this statement is legally crucial. Here, you’ll state your full legal name, your county of residence in Texas, and declare that this document is, in fact, your last will and testament.

This section also does something incredibly important: it revokes any and all previous wills and codicils (amendments to a will) you might have made. This prevents confusion and keeps an old, outdated document from surfacing and causing legal headaches. It creates a clean slate, ensuring this will is the only one that matters.

Appointing Your Executor

Next, you will name your executor, sometimes called a personal representative. This is one of the most important decisions you’ll make. Your executor is the person (or institution, like a bank) you trust to manage your estate, pay your final bills, and distribute your assets exactly as you’ve instructed.

Choose someone trustworthy, organized, and capable of handling financial details. It is also wise to name at least one alternate executor. If your first choice is unable or unwilling to serve, this backup can step in without requiring court intervention.

Most Texas wills grant the executor “independent administration,” which is highly recommended. As outlined in the Texas Estates Code, this allows your executor to handle most estate tasks without needing constant court supervision. It saves significant time, money, and stress during the Texas Probate Process.

The Heart of the Matter: Appointing a Guardian

For parents with minor children, this is the most critical part of the entire document. If you and your spouse were to pass away, this section is where you name a guardian to care for your kids. Without this, a judge who doesn’t know you, your children, or your family will be forced to make this profound decision. Naming a guardian gives you control, ensuring your children are raised by someone who shares your values and whom you trust completely.

A Realistic Scenario: The Garcia Family

Take Maria and Carlos Garcia, parents of two young children in Houston. They spent weeks discussing who would be the best guardian. Maria’s sister, Elena, lives nearby and shares their parenting philosophy. Carlos’s brother, David, is financially successful but lives out of state and travels constantly.

They named Elena as the primary guardian in their will and David as the alternate. This simple act gave them immense peace of mind, knowing their children’s future was secure in hands they had chosen together. It’s a perfect example of how the Wills & Trusts process protects what matters most.

Distributing Your Property

This is the “who gets what” part of your will. It’s usually broken down into two categories: specific gifts and the residuary estate.

- Specific Gifts (Bequests): These are instructions to give a particular item or a set amount of money to a specific person or organization. For example, “I give my antique grandfather clock to my nephew, James,” or “I give $10,000 to the Houston SPCA.”

- The Residuary Estate: This is everything left over—the “rest and remainder” of your property after specific gifts are made and all debts and taxes are paid. You’ll name who gets this portion. Often, people leave their residuary estate to one person (like a spouse) or divide it equally among their children.

Clarity is essential here. Vague instructions like “my personal items” can lead to bitter family disputes. Be as specific as possible to prevent confusion or potential Probate Litigation.

The Self-Proving Affidavit

Finally, any good Texas will template will include a Self-Proving Affidavit. This isn’t technically part of the will itself but is a separate statement that you and your witnesses sign in front of a notary public.

Under the Texas Estates Code § 251.101, this affidavit essentially pre-validates the signatures on the will. When it’s time for probate, the court can accept the will as valid without needing your witnesses to testify in court. This one small step is a game-changer; it makes the probate process faster, smoother, and less expensive for your family.

Making Your Texas Will Legally Binding

https://www.youtube.com/embed/pn1OxM7kF-U

You’ve carefully filled out your Texas will template, named your executor, and decided who gets what. That’s a huge step. But right now, it’s just a piece of paper. To make it a powerful, legally binding document, you must follow a formal signing process known as “executing” the will.

This part is absolutely critical. Under Title 2 of the Texas Estates Code, the requirements are very specific. These rules are designed to protect your will from being challenged later, creating a solid record that proves the document reflects your final wishes and was signed free from any pressure or confusion.

Step-by-Step: The Formal Signing Ceremony

To make your will legally valid in Texas, you must sign it in the presence of two credible witnesses, who then must sign it in your presence. While it may sound formal, it is a straightforward process.

- Gather everyone together: You and your two witnesses must be in the same room.

- Declare it is your will: State clearly to your witnesses that the document you are about to sign is your will.

- Sign the will: Sign the document while both witnesses are watching you.

- Witnesses sign: Each witness then signs the will while you and the other witness are watching.

The phrase “in your presence” is a key legal requirement. This means everyone involved needs to be in the same room, observing the entire signing process.

Choosing Your Witnesses Carefully

Who you pick as a witness matters significantly. Texas law requires a credible witness to be at least 14 years old and, most importantly, not be a beneficiary in your will. They must be a neutral third party.

Who cannot be a witness?

- A Beneficiary: Anyone who stands to inherit property from your will is disqualified. If a beneficiary signs as a witness, it can create major legal problems and might even void the gift intended for them.

- Your Spouse or Children (if they are beneficiaries): For the same reason, it is best to use people who have no financial stake in the will.

Good choices are often neighbors, colleagues, or friends who are not named as beneficiaries in the will.

The Power of a Self-Proving Affidavit

Here’s a professional tip that will make life much easier for your loved ones: include a Self-Proving Affidavit. This is a separate page attached to your will that you and your witnesses sign in front of a notary public.

By signing this affidavit, you and your witnesses swear under oath that all legal formalities were followed correctly during the signing. When it’s time for probate, this affidavit is typically all the proof a judge needs to validate the will. Without it, your executor might have to locate your original witnesses—who could have moved or passed away—and bring them to court to testify. This can cause serious delays and increase legal fees. For more on this, see our guide on self-proving vs. traditional wills.

As you finalize your document, it’s also wise to understand the broader legal considerations for your estate plan to ensure your will aligns with your overall goals.

Common Pitfalls When Using a Will Template

While a last will and testament template for Texas is an excellent tool, it’s easy to make small mistakes that create significant problems. These templates are a fantastic starting point, but they cannot anticipate every unique life situation. Thinking through these potential missteps now is an act of care that safeguards your family from future confusion, conflict, and costly legal battles.

Improper Signing or Witnessing

This is the most common mistake we see. A will can be perfectly drafted, but if it is not signed according to the strict rules in the Texas Estates Code, it is invalid. You must sign your will in the presence of two credible, disinterested witnesses, who then must sign it in your presence. Failing to follow this ceremony can invalidate the entire document during the Texas Probate Process.

Using Vague or Ambiguous Language

Clarity is your best defense against family disputes. Vague language describing property or beneficiaries is a recipe for conflict. Phrases like “my personal effects” can mean different things to different people.

- Vague Example: “I leave my jewelry to my daughters to be divided among them.”

- Clear Example: “I leave my sapphire engagement ring to my daughter, Jane Smith, and my pearl necklace to my daughter, Emily Jones.”

The more precise you are, the less room there is for arguments that could escalate into painful and expensive Probate Litigation.

Forgetting to Name Backups

Life is unpredictable. The person you name as your executor or your children’s guardian might be unable or unwilling to serve. Failing to name an alternate is a critical oversight. Without a backup, the court must appoint someone for you—a decision made without your input. Always name a primary and at least one alternate for every key role.

Failing to Update After Major Life Events

A will should reflect your current life, not the life you had a decade ago. It is essential to update your will after major life events.

A Realistic Scenario

Consider Mark, who created a will during his first marriage, naming his then-wife as the sole beneficiary and executor. After a difficult divorce, he remarried and had two children with his new wife, Sarah. Tragically, Mark passed away suddenly without ever updating his old will.

Under Texas law, while some provisions favoring an ex-spouse are voided upon divorce, the situation became a legal nightmare. His ex-wife was still named, creating a complex mess that pitted her against Sarah and the children. The resulting court battle was expensive, stressful, and emotionally devastating for a family already grieving—all because a simple update was overlooked. This highlights the vital importance of keeping all estate planning documents, including potential Wills & Trusts and Guardianship designations, current.

Key Insight

A will is not a “set it and forget it” document. Think of it as a living plan that should evolve as your life changes. Regular reviews are essential to ensure it continues to protect your family and reflect your true wishes.

Knowing When to Call an Estate Planning Attorney

A last will and testament template for Texas can be a fantastic starting point, especially for people with straightforward estates. But life is rarely simple. The beautiful complexity of modern families and finances often means a one-size-fits-all document is not enough. Recognizing when to seek professional guidance is crucial to protecting your loved ones. An experienced attorney can build a plan that truly fits your life, heading off unintended consequences and securing your legacy.

Red Flags That Signal You Need a Lawyer

Certain life events are clear signs that a simple will template might leave your family exposed. If any of the following sound familiar, it’s time to consult with an estate planning attorney.

- You Have a Blended Family: Second marriages and stepchildren create unique planning challenges. A template won’t easily navigate how to provide for your current spouse while ensuring children from a prior marriage receive their intended inheritance.

- You Own a Business: A will alone is almost never sufficient for business succession. An attorney can help create a detailed plan for a smooth transition of ownership, protecting your family and your employees.

- You Have Significant or Complex Assets: If your estate includes multiple properties, assets in other states, or large investment portfolios, a custom plan is essential to minimize tax burdens and streamline the transfer process.

- A Beneficiary Has Special Needs: Leaving money directly to a loved one with a disability could disqualify them from critical government benefits like Medicaid or SSI. An attorney can establish a Special Needs Trust to hold their inheritance, protecting both the assets and their eligibility for aid.

Beyond the Will: Advanced Planning Tools

An attorney does more than fill in blanks on a form; they provide access to a toolbox of strategic planning instruments. For example, a revocable living trust can help your estate avoid the public, time-consuming, and often expensive probate process. These are sophisticated strategies a template simply can’t offer.

To better understand what a professional brings to the table, you can learn more about the role of a probate attorney in Texas. It’s a step that moves you from a basic document to a robust, personalized plan that will truly protect your family’s future.

Takeaway

Hiring an attorney isn’t just about drafting a document; it’s about building a complete strategy. A good plan anticipates potential roadblocks—from family disputes to tax liabilities—and gives you genuine peace of mind that you’ve covered all the bases.

Final Thoughts: Why Your Texas Will Matters

Creating a last will and testament is more than a legal task—it’s a final act of love for the people you care about most. A carefully considered will is the cornerstone of a strong estate plan, giving you the final say and your family a clear path forward during an incredibly difficult time.

As you move ahead, keep these core truths in mind:

- Your Will is Your Voice. Without one, the State of Texas decides who inherits your property and who cares for your minor children. A will ensures your wishes are legally binding.

- Texas Law Has Rules. For a will to be valid, it must follow the Texas Estates Code. It must be in writing and signed by you in front of two credible witnesses who also sign it.

- Templates Aren’t a Cure-All. A template is a great starting point, but it cannot navigate complex family dynamics or unique financial situations. Those scenarios often require an attorney’s guidance to prevent potential Probate Litigation.

Protecting your legacy is one of the most powerful things you can do. A clear, legally sound will is your best tool for minimizing stress and conflict, allowing your family to focus on what truly matters—grieving and healing together.

Common Questions About Texas Wills

When it comes to creating a will in Texas, many questions arise. It’s a process that feels weighty, and it’s natural to want to get it right. Here are answers to some of the most common questions we hear from Texas families.

Can I Write My Own Will in Texas?

Yes, you can. Many people use a last will and testament template for Texas, and that’s a valid starting point. For your will to be legally binding, it must meet the requirements of the Texas Estates Code: it must be in writing, signed by you, and witnessed by two credible people over the age of 14 who also sign it in your presence.

What Is a Holographic Will?

A “holographic will” is a will written entirely in your own handwriting. Under Texas law, these handwritten wills do not require witnesses. However, we strongly advise against them. Because they are unwitnessed, holographic wills are frequently challenged in court. Family members may dispute the handwriting or the meaning of the provisions, leading to stressful and expensive Probate Litigation. A formal, properly witnessed will is the gold standard for protecting your wishes.

How Often Should I Update My Will?

Think of your will as a living document that should change as your life does. It’s a good practice to review it every three to five years. More importantly, you must update it after any major life event, such as:

- Getting married or divorced

- The birth or adoption of a child

- The death of a beneficiary or executor

- A significant change in your finances

Keeping your will current ensures it accurately reflects your life and final wishes, preventing painful oversights that could harm your loved ones.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.