When a loved one’s health starts to decline, the staggering cost of long-term care can quickly become the biggest source of stress for the entire family. Many Texans find themselves asking, how can we possibly afford this? This is precisely where Texas Medicaid comes in, acting as a critical financial lifeline for families navigating one of life’s most challenging transitions.

At The Law Office of Bryan Fagan, we understand that you are not just looking for legal answers; you are seeking reassurance and a clear path forward during a difficult time. This guide is written to provide just that—plain-English explanations and compassionate guidance to help you understand how to qualify for Medicaid in Texas.

What Is Texas Medicaid and Who Does It Help?

Think of Texas Medicaid as a crucial safety net. It’s a joint program funded by both the federal government and the state of Texas, so its rules are a blend of national standards and specific Texas regulations.

The program is designed to make sure vulnerable Texans—specifically those who are aged 65 or older, blind, or have a disability—can get the medical care they need without having to spend every last dollar they’ve saved. It’s a common myth that you have to be completely broke to qualify. The truth is much more nuanced and involves specific income and asset rules that we’ll break down in this guide.

A Lifeline for Texas Families

At its heart, Medicaid provides peace of mind. It’s not just about covering a nursing home bill; it supports a wide range of services that allow people to live with dignity. These services often include:

- Long-Term Nursing Care: Covering the often-overwhelming cost of skilled nursing facilities.

- In-Home and Community-Based Services: Helping people get the care they need right in their own homes, which is what most families prefer.

- Prescription Medications: Easing the burden of high-cost, essential drugs.

- Doctor Visits and Hospital Stays: Ensuring access to both routine and emergency medical treatment.

Nationally, Medicaid is a pillar of our healthcare system. As of early 2025, Medicaid and the Children’s Health Insurance Program (CHIP) provided coverage for roughly 23% of the U.S. population. Because eligibility rules and benefits can vary so much from state to state, understanding the specific Texas requirements is absolutely essential. If you’re interested in the bigger picture, you can explore what the data says about Medicaid enrollment on a national level.

Successfully navigating Medicaid qualification often goes hand-in-hand with smart estate planning, using tools like Wills & Trusts to protect assets while still meeting the strict eligibility rules. For families just starting this journey, getting a firm grip on the basics is the first real step toward securing the care a loved one needs and deserves.

The Three Pillars of Texas Medicaid Eligibility

When a family comes to us for help with Medicaid, they’re often overwhelmed. They’ve heard horror stories about losing everything to a nursing home and feel like the rules are designed to be confusing. The good news is, they’re not. Texas breaks down Medicaid eligibility into three core requirements. We call them the “three pillars.”

Think of it like building a foundation. If any one of these pillars is missing, the whole structure is unstable. But once you understand how each one works, you can build a solid plan to get the care your family needs without going broke.

We’ll walk through each pillar—categorical, income, and assets—and show you how they play out in the real world. This isn’t just about reciting rules; it’s about seeing how they apply to families just like yours.

Pillar 1: Categorical Requirements

Before Texas even glances at a bank statement, the person applying has to fit into a specific “category.” This is the first gate you have to pass through, and it has nothing to do with money.

For long-term care Medicaid, which covers services like nursing homes, the applicant must be:

- Aged 65 or older,

- Blind (based on the Social Security Administration’s definition), or

- Disabled (meeting Social Security’s strict disability criteria).

If the applicant doesn’t meet one of these basic requirements, the conversation stops there. Their income and assets simply don’t matter. This initial step ensures the program is reserved for the specific populations it was created to help.

The rules can get particularly tangled for different age groups. In states like Texas that chose not to expand Medicaid under the ACA, young adults often fall through the cracks. In fact, the uninsured rate for this group is projected to hit 20.9% in 2025. It’s a complex issue, and you can get a deeper look at the demographics and policies affecting young adults from the Urban Institute’s research.

Pillar 2: Income Limits

Once you’ve cleared the categorical hurdle, the state looks at income. The Texas Health and Human Services Commission (HHSC) totals up the applicant’s gross monthly income from every source imaginable.

For 2024, the magic number for an individual seeking nursing home Medicaid is $2,829 per month.

What exactly counts as income? Pretty much everything:

- Social Security checks

- Pension payments and retirement distributions

- Wages (if they’re still working)

- Veteran’s benefits

- Interest and dividends from investments

Now, here’s a critical point that trips people up: if your loved one’s income is over this limit, it does not automatically disqualify them. This is a common and costly misconception. Texas allows the use of a special legal tool called a Qualified Income Trust (QIT), which most people know as a “Miller Trust.” A QIT provides a legal pathway to eligibility, but setting one up correctly is where having an experienced attorney becomes absolutely essential.

Pillar 3: Asset and Resource Limits

This is the final pillar—and the one that causes the most fear and confusion for families. To qualify for long-term care Medicaid in Texas, a single person can have no more than $2,000 in “countable” assets.

Yes, you read that right. $2,000. When families see that number, their hearts sink. They immediately assume they have to spend down their entire life savings on care before Medicaid will step in.

But the most important word in that sentence is countable. Not every asset is counted against you. Understanding the difference between what’s counted and what’s not is the cornerstone of effective Medicaid planning.

So, what’s usually safe?

- Your primary home (up to an equity limit of over $713,000 in 2024).

- One car or truck, regardless of its value.

- Your household goods and personal belongings.

- An irrevocable, pre-paid funeral plan.

- Certain life insurance policies with a small cash value.

To make this clearer, let’s break down some common assets into a simple table.

Texas Medicaid Countable vs Non-Countable Assets

This table gives a quick overview of how Texas Medicaid typically views different types of assets. It’s not exhaustive, but it’s a great starting point for assessing where you stand.

| Asset Type | Typically Countable? | Key Considerations |

|---|---|---|

| Checking & Savings Accounts | Yes | All funds are counted dollar-for-dollar toward the $2,000 limit. |

| Primary Residence | No | Exempt up to $713,000 in equity (2024) if the applicant or spouse lives there. |

| One Vehicle | No | The value of one vehicle is completely exempt, no matter how new or old it is. |

| Second Vehicle / RV / Boat | Yes | The fair market value of additional vehicles is typically a countable asset. |

| Retirement Accounts (IRA, 401k) | Yes | The full balance is counted unless it’s in “payout status” (taking regular distributions). |

| Pre-Paid Funeral Plan | No | Must be irrevocable (meaning you can’t get the money back). |

| Life Insurance Cash Value | Depends | Countable if the total face value of all policies exceeds $1,500. |

| Stocks, Bonds, Mutual Funds | Yes | The current market value is fully countable. |

| Rental Property | Yes | Both the equity in the property and the rental income are counted. |

This distinction is why you hear about Medicaid planning. The goal isn’t to hide money; it’s to legally and ethically restructure countable assets into non-countable ones.

These rules become even more important when one spouse needs care and the other (the “community spouse”) is still living at home. Texas has special Spousal Impoverishment Rules designed to prevent the healthy spouse from being left with nothing. These rules, which are rooted in the principles of the Texas Estates Code, allow the community spouse to keep a significant share of the couple’s assets and income.

Navigating the interplay between income rules, countable assets, and spousal protections is where a strategic plan makes all the difference. While it’s complex, it’s absolutely possible to protect a family’s financial security with the right guidance, often using tools like properly structured Wills & Trusts.

Understanding the Medicaid Look-Back Period

Of all the hurdles in the Medicaid application process, the five-year “look-back” period is easily the most misunderstood—and the most unforgiving. This isn’t just a casual glance at your finances. It’s a non-negotiable rule where the Texas Health and Human Services Commission (HHSC) will meticulously examine every financial transaction for the 60 months right before you apply.

The state’s goal here is simple: they want to make sure you didn’t give away assets or sell them for pennies on the dollar just to get under Medicaid’s tight financial limits. The instinct to pass on your life savings to your kids is completely natural, but from the state’s perspective, these are considered improper transfers designed to get around the rules.

Making one of these transfers can trigger a devastating penalty period. This is a stretch of time where you’re completely ineligible for Medicaid benefits, even if you meet every other requirement. The penalty doesn’t even start until you’re in a nursing facility and have already spent down your assets. It can leave families in an impossible situation, forced to pay for incredibly expensive care out-of-pocket for months, or even years.

What Kinds of Transfers Trigger a Penalty?

So many well-intentioned actions can get flagged as improper transfers. Families often make these mistakes without a clue about the long-term consequences, only to find out years later when they’re in a crisis.

Here are some of the most common missteps we see:

- Gifting money to children or grandchildren. It doesn’t matter if it was for a wedding, a down payment on a house, or to help with college tuition. A gift is a gift, and Medicaid sees it as an uncompensated transfer.

- Selling a home or car for less than it’s worth. Selling a valuable asset to a family member for $1 is the classic example, and it’s a massive red flag for HHSC.

- Adding a child’s name to a bank account or property deed. This is often done for convenience, but legally, it can be viewed as gifting half the asset’s value to your child.

- Paying a family member for care without a formal agreement. If your daughter helps around the house and you give her money for her time, those payments are considered gifts unless you have a legally sound personal care agreement in place.

It’s a tough reality. As Medicaid programs face new pressures, the administrative scrutiny on applicants has only gotten more intense. Caseworkers are trained to look for these transfers, and every financial detail matters more than ever before. To get a sense of how these policy shifts are playing out on a larger scale, you can explore trends in Medicaid managed care enrollment.

A Realistic Scenario: The Look-Back Period in Action

Let’s consider the Garcia family, a situation we’ve seen play out time and time again. Mr. Garcia, a widower, was diagnosed with early-stage Alzheimer’s. He knew his health would eventually get worse, and he wanted to help his two children while he still could. Over the next couple of years, he gave each of them $30,000. He felt good about it, seeing his hard work benefit his kids.

Three years later, Mr. Garcia’s condition deteriorated, and he needed full-time nursing home care. His daughter, Maria, started the Medicaid application, thinking her father’s remaining $1,500 in savings would make him instantly eligible. She was wrong. During the review, HHSC uncovered the $60,000 in gifts made within that five-year window.

The Outcome: The state imposed a significant penalty period. Using the average daily cost of nursing home care in Texas to calculate the duration, HHSC informed them that Mr. Garcia would be ineligible for Medicaid for several months. The family was suddenly facing the nightmare of paying for his care privately until the penalty ran out.

This scenario is heartbreakingly common. The Garcias acted out of love and had no intention of defrauding the system. But their lack of knowledge about the Medicaid look-back period created a costly, stressful delay in getting Mr. Garcia the care he desperately needed. It’s a perfect example of why proactive legal planning isn’t just a good idea—it’s a necessity. You have to know the rules to avoid these devastating financial traps.

Legal Strategies to Protect Assets and Qualify for Care

One of the most devastating myths we hear from families is that qualifying for Medicaid means giving up everything you’ve ever worked for. This fear is powerful, and it often leads people to do nothing at all—which is far more costly than taking proactive steps. The truth is, with thoughtful, forward-thinking planning, you can absolutely protect your hard-earned assets while ensuring your loved one gets the critical care they need.

The process of legally and ethically meeting Medicaid’s strict financial limits is known in our world as a “spend-down.” This isn’t about hiding money or trying to trick the system. It’s about strategically converting countable assets—like cash in a savings account—into non-countable ones that Texas law explicitly allows you to keep.

Common Medicaid Spend-Down Strategies in Texas

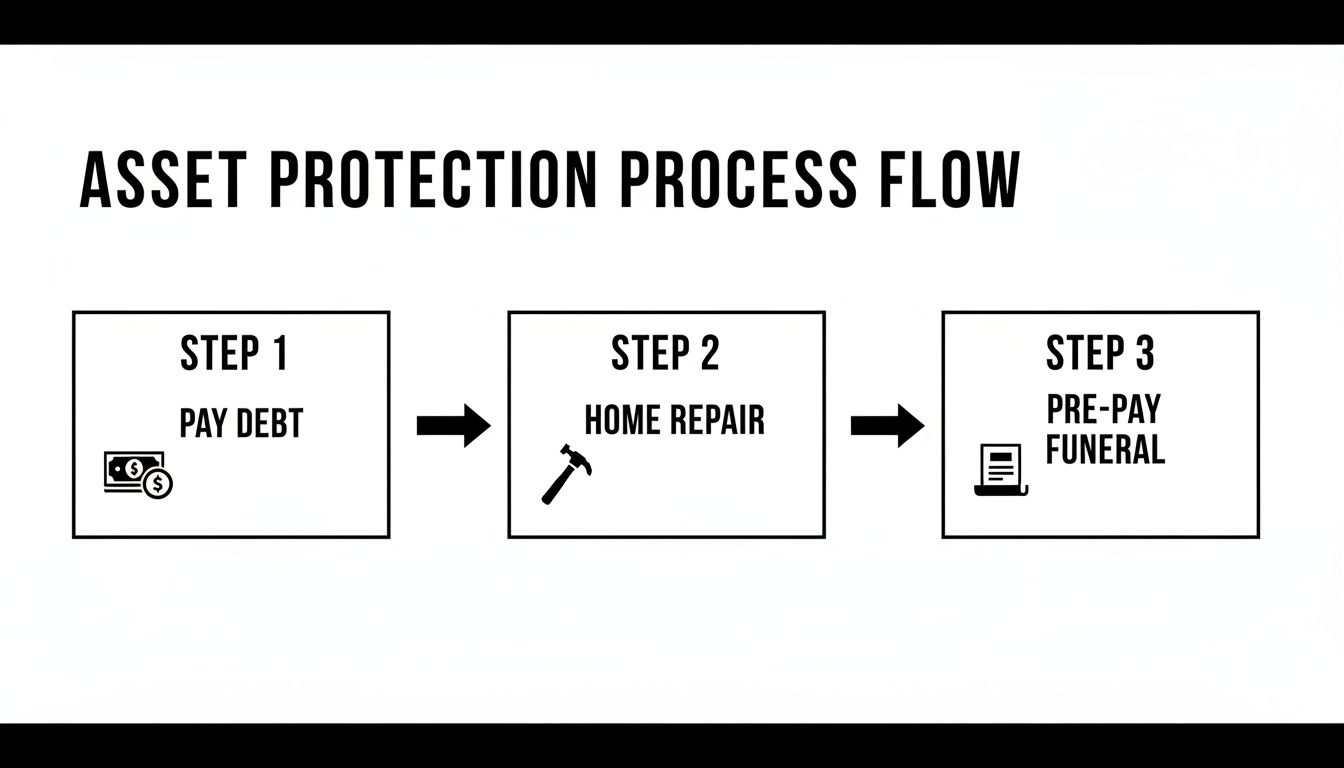

Before we dive into the specifics, it’s important to know there are permissible ways for applicants to reduce their countable assets to meet Medicaid’s strict eligibility thresholds. The table below outlines some of the most common and practical options we see families use.

| Strategy | Description | When to Consider It |

|---|---|---|

| Pay Off Debts | Use excess cash to eliminate mortgages, car loans, or credit card balances. This reduces your liquid assets without triggering transfer penalties. | You have significant debt and cash reserves that put you over the asset limit. |

| Home Repairs & Modifications | Invest in your primary residence, which is a non-countable asset. This can include a new roof, kitchen updates, or safety modifications like a ramp. | Your home needs updates, and you need to reduce countable assets. This improves your quality of life and protects your home’s value. |

| Purchase a New Vehicle | Since one vehicle is exempt regardless of value, upgrading to a newer, more reliable car is a permitted spend-down tactic. | Your current vehicle is old or unreliable, and you need to lower your cash on hand to qualify for Medicaid. |

| Pre-Pay Funeral Expenses | Establish an irrevocable funeral trust or pre-paid burial contract for yourself and your spouse. These are considered non-countable assets. | You want to plan ahead and reduce your countable assets. This is a common and highly effective strategy. |

| Purchase Personal Items | Buy necessary personal belongings like new furniture, appliances, or clothing. These are not typically counted as assets. | You have a modest amount to spend down and need to replace essential household items. |

These strategies are not loopholes; they are established, legal methods for repositioning your finances in a way that aligns with Medicaid rules.

Advanced Strategies for Income and Spousal Protection

Sometimes, the roadblock isn’t just about assets—it’s about income. We’ve seen countless cases where a person’s monthly Social Security and pension checks put them just a little over the income limit. It’s a common problem, but it’s entirely solvable.

In Texas, a Qualified Income Trust (QIT), often called a Miller Trust, is the specific legal tool used to fix this. An attorney helps you create this special trust, and any income over the Medicaid limit gets deposited into it each month. Those funds are then used to pay for medical expenses, including the patient’s share of their nursing home costs. Setting up a QIT is a technical process, but for an elder law attorney, it’s a routine part of Medicaid planning.

Protecting a healthy spouse who remains at home is another huge concern. The law recognizes this through Spousal Impoverishment Rules, which allow the community spouse to keep a significant portion of the couple’s assets and income. These protections are absolutely vital to ensure the spouse at home can maintain their standard of living without being financially wiped out.

A critical part of any asset protection plan is having a Durable Power of Attorney in place. This document empowers a trusted person to make financial decisions on your behalf if you become unable to do so yourself, which is essential when it’s time to implement these strategies. For a deeper dive, you can check out our guide on how to protect assets from Medicaid.

Properly structured Wills & Trusts are also fundamental to this process. By working with an attorney, you can make sure your estate plan aligns with your long-term care goals, preventing conflicts and protecting what you’ve built. The key is to act before a crisis hits, because your options become much more limited once the five-year look-back period is a factor.

Navigating the Texas Medicaid Application Process: Step-by-Step

Once you’ve wrapped your head around the financial rules, the next mountain to climb is the application itself. This part can feel overwhelming, but with the right preparation, you can approach it methodically and confidently. Honestly, the single most important thing you can do is gather all the right documents before you even start.

Think of it this way: you’re building a complete financial history of your loved one’s last five years for the Texas Health and Human Services Commission (HHSC). They will need proof for every single detail.

Step 1: Gathering Your Essential Documents

We can’t stress this enough: start collecting paperwork now. The number one reason applications get delayed or flat-out denied is missing documentation. Getting organized from day one is your best defense against a drawn-out, frustrating process.

Here’s a look at the core documents you’ll need to pull together:

- Proof of Identity and Citizenship: This could be a birth certificate, U.S. passport, or naturalization papers.

- Proof of Income: Round up Social Security and pension award letters, recent pay stubs, and statements for any other income sources.

- Financial Statements: This is the big one. You need complete bank and investment account statements for the entire five-year look-back period. Yes, that means all 60 months of statements.

- Property Records: Collect the deeds to any real estate owned, including the primary home.

- Vehicle Information: Have the titles for all vehicles on hand.

- Insurance Policies: Find any life insurance policies and get documentation of their current cash value.

It looks like a lot, we know. But providing a complete file right from the start prevents the HHSC from sending you requests for more information, which can easily stall your application for weeks or even months.

Step 2: The Application and Interview Timeline

After you submit the application, the clock officially starts. The HHSC will assign a caseworker to review the file, and you can generally expect a decision within 45 to 90 days.

During this window, the caseworker will probably schedule an interview, which could be over the phone or in person. This is their chance to ask clarifying questions about the information and documents you submitted. It’s absolutely essential to be honest and direct. If you don’t know an answer, it’s far better to say so and offer to find the information than to take a guess.

This is also where having a durable power of attorney for health care and finances proves invaluable. If your loved one can’t communicate clearly, having a legally designated agent to speak on their behalf is a lifesaver.

The infographic below shows a few of the first steps you can take to align assets with Medicaid’s rules before you even fill out the first form.

This illustrates how you can legally spend down countable assets—like cash in a bank account—by paying off debts, making home repairs, or prepaying for final expenses, effectively converting them into non-countable assets.

Step 3: When Guardianship and Medicaid Intersect

It’s a heartbreaking reality, but many families only start this journey after a loved one has already lost the capacity to make their own decisions and doesn’t have a power of attorney in place. In these difficult situations, a Guardianship proceeding often becomes unavoidable.

A court-appointed guardian is given the legal authority to manage the incapacitated person’s finances and personal affairs. This includes the power to apply for Medicaid on their behalf. Trying to navigate a Guardianship case while also preparing a Medicaid application adds a significant layer of complexity, making professional legal guidance absolutely critical to keep both processes moving forward correctly.

Navigating Common Medicaid Questions in Texas

Even after you think you have a handle on the rules, specific questions always pop up. It makes sense—this process is deeply personal, and every family’s situation is unique. Let’s tackle some of the most common and pressing questions we hear from families trying to navigate this complex journey.

Can My Parents Keep Their House?

Yes, in most situations, they can. This is often the biggest sigh of relief for families.

In Texas, the primary home is considered a non-countable asset. This means its value won’t disqualify your loved one from Medicaid, as long as the home’s equity is under the 2024 limit of $713,000.

But that answer leads to a critical follow-up question: “Can the state take the house after they pass away?” This is where the Medicaid Estate Recovery Program (MERP) enters the picture. MERP is the state’s legal authority to make a claim against the estate of a deceased Medicaid recipient to recoup the costs of care. The home, often being the most valuable asset, is a primary target.

Fortunately, you’re not powerless. Proactive legal strategies, like creating a Lady Bird Deed or specific types of trusts, can shield the home from MERP. This is where careful Wills & Trusts planning becomes essential to preserve this valuable family asset for the next generation.

What Happens if My Spouse Needs Care but I’m Still Healthy?

Texas law has specific protections in place to prevent the healthy spouse, known as the “community spouse,” from being forced into poverty when their partner needs long-term care. These are the Spousal Impoverishment Rules, and for many couples, they are a financial lifeline.

Under these rules, the community spouse is allowed to keep a significant portion of the couple’s combined assets and income. For 2024, the community spouse can hold onto:

- Up to $154,140 in countable assets.

- A monthly income of up to $3,853.50.

These protections are designed to ensure the healthy spouse can continue living independently with a reasonable quality of life. Without these rules, many would face financial devastation.

Does Medicaid Cover Assisted Living, or Is It Just for Nursing Homes?

This is a major point of confusion for many families. While Medicaid provides robust coverage for skilled nursing facility care, its role in assisted living is much more limited.

Traditional Texas Medicaid does not pay for the room and board portion of an assisted living facility.

However, certain Medicaid waiver programs, like the STAR+PLUS Waiver, can help pay for the services your loved one receives there—things like personal care and help with daily activities. The challenge is that getting into these waiver programs can be tough, and they often have long waiting lists. For many people, a key part of their planning revolves around whether assisted living is covered by Medicaid and understanding those nuances.

Can I Get Paid to Care for My Parent?

Yes, it is possible for a family member to be paid as a caregiver through certain Medicaid programs in Texas. This is usually managed through programs that allow for “consumer-directed services,” which gives the Medicaid recipient the power to hire, train, and manage their own caregivers.

This isn’t an informal arrangement, though. You can’t just accept cash from your parent, as those payments would be flagged as improper gifts during the look-back period. Instead, you have to be officially hired through the program, which means you’ll pay taxes on the income and follow all state requirements.

It can be a wonderful solution that provides your loved one with trusted care while offering much-needed financial support to the family member providing it. When a loved one’s health is declining, navigating complex family dynamics and legal requirements can be challenging. In some cases, a Probate Litigation attorney can help resolve disputes that arise over care and financial decisions.

Key Takeaway

Qualifying for Medicaid in Texas is a complex process with strict financial and categorical rules. However, it is not an insurmountable challenge. The key is proactive planning. Understanding the difference between countable and non-countable assets, respecting the five-year look-back period, and utilizing legal tools like Miller Trusts and proper estate planning can protect your family’s financial security while ensuring your loved one receives the care they need. Don’t wait for a crisis to start asking questions. A knowledgeable guide can help you navigate this journey with confidence and compassion.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.