Choosing an executor is one of the most important decisions you will make when creating your will and estate plan. You are entrusting this person with carrying out your final wishes, so they must be trustworthy, organized, and capable of handling the legal and emotional weight of the job. This guide offers plain-English explanations to help Texas families make this critical choice with confidence and peace of mind.

Understanding The Executor's Role In Texas

When you write a will, you name an executor—known in Texas law as a personal representative—to manage your estate after your passing. This isn’t just an honorary title; it’s a critical job with serious legal duties. Think of this person as the captain of a ship, responsible for steering your estate through the often-choppy waters of the probate process.

Their main job is to ensure your final wishes, as laid out in your will, are followed precisely. This involves a series of steps that demand patience, diligence, and a clear head, especially during what is already a difficult time for your grieving family.

What an Executor Actually Does

An executor’s work begins the moment your will is accepted by a probate court, and it doesn’t end until the very last asset has been distributed. While every estate is different, the core duties are consistent across the Texas Probate Process:

- Filing the Will: The first step is to submit your will to the proper Texas probate court to officially begin the administration of the estate.

- Managing Estate Assets: They must locate, secure, and manage all of your property—from bank accounts and real estate to personal belongings.

- Notifying Heirs and Creditors: The executor is legally required to notify all beneficiaries named in the will, as well as any known creditors, of your passing.

- Paying Debts and Taxes: Before anyone inherits, the executor must use estate funds to pay off all legitimate debts, final expenses, and any taxes owed.

- Distributing Property: Once all debts are settled, the executor distributes the remaining assets to the beneficiaries exactly as your will instructs.

This role is legally defined by a fiduciary duty, which is the highest standard of care under the law. It means your executor must always act in the best interests of the estate and its beneficiaries, never their own. To really get a handle on this, it helps to understand all of the executor of a will's responsibilities.

A Profound Act of Trust

Choosing someone for this role is far more than a legal formality; it's a profound act of trust. You are placing your legacy in their hands. A thoughtful, well-informed choice now can save your loved ones from stress, family conflict, and expensive delays down the road. Making the right decision starts with understanding exactly what you're asking of them.

Who Can Legally Serve as an Executor in Texas

Not just anyone can serve as an executor in Texas. The law establishes clear requirements to ensure the person you pick is up to the task. While the natural instinct is often to name a spouse, child, or close friend, you must first ensure they clear the legal hurdles set out in the Texas Estates Code.

The foundational criteria are straightforward. To serve as an executor in Texas, a person must be:

- At least 18 years old.

- Of sound mind, meaning they have the mental capacity to understand and carry out the required duties.

- Not a convicted felon, unless their civil rights have been fully restored.

- A resident of Texas (though an out-of-state resident can serve, they must appoint a resident agent to accept legal notices).

These baseline qualifications are non-negotiable and ensure your representative is a legally competent adult.

Grounds for Disqualification in Texas

Even if your nominee meets the basic criteria, a probate court can still disqualify them. The Texas Estates Code § 304.003 outlines specific reasons a judge might find someone "unsuitable" to serve, even if you named them in your will. This often occurs when a conflict of interest or a character issue could put the estate at risk.

Common reasons for disqualification include:

- An Incapacitated Person: Someone a court has legally determined cannot manage their own affairs.

- A Convicted Felon: This is an automatic disqualification unless their civil rights have been restored.

- A Person Found Unsuitable by the Court: This is a broad but powerful category. A judge may deem someone unsuitable due to a history of dishonesty, poor financial management, or a deep-seated conflict with beneficiaries that would make it impossible to act impartially.

- A Corporation Not Authorized to Act as a Fiduciary: A company must have proper state authorization to manage estates.

It's also worth noting the difference between an executor (whom you name in a will) and an administrator (whom the court appoints when there's no will). You can get a deeper understanding of the distinction between an executor and an administrator on our blog.

A Real-World Scenario: Why Legal Vetting Matters

Consider this common situation: A father named his eldest son as executor in his will. The son was a good person who loved his dad, but his personal finances were a mess, including a recent bankruptcy and significant personal debt.

After the father passed away, the younger daughter, also a beneficiary, filed an objection with the probate court. She argued that her brother's financial instability made him "unsuitable" to manage the estate’s assets. The judge agreed, citing the potential risk. The court disqualified the son and appointed a neutral third-party administrator instead. The result? Months of delays and thousands in extra legal fees, all because the father hadn't vetted his choice from a legal standpoint. This story illustrates why a probate court’s primary duty is to protect the estate's assets and ensure they go where you intended.

Evaluating Your Best Candidates

Passing the legal test laid out by the Texas Estates Code is just the first hurdle. The true challenge in choosing an executor isn't about checking boxes; it's about finding someone who is genuinely capable of handling this immense responsibility. The best person for the job isn't just someone you love and trust. It's someone with the right blend of character, resilience, and practical skills to navigate what is often a complex and emotionally draining process.

The Makings of a Great Executor

This role demands more than good intentions. Think of your executor as the temporary CEO of your estate. They'll be juggling paperwork, communicating with grieving family members, and making financial decisions that impact everyone's inheritance.

When weighing your options, look for someone who embodies these traits:

- Rock-Solid Trustworthiness: This is the non-negotiable foundation. You must believe, without a doubt, that this person will act honestly and put the interests of your estate first.

- Meticulous Organization: Probate is a marathon of deadlines and forms. A naturally organized person who pays attention to details will keep the process on track and prevent costly mistakes.

- Clear, Calm Communication: Your executor will need to speak compassionately but firmly with beneficiaries, attorneys, and financial institutions. Someone who can handle tough conversations with grace is invaluable.

- Emotional Impartiality: Family dynamics can become complicated after a loss. Your executor must be a calming presence, remaining neutral and fair even if disagreements arise.

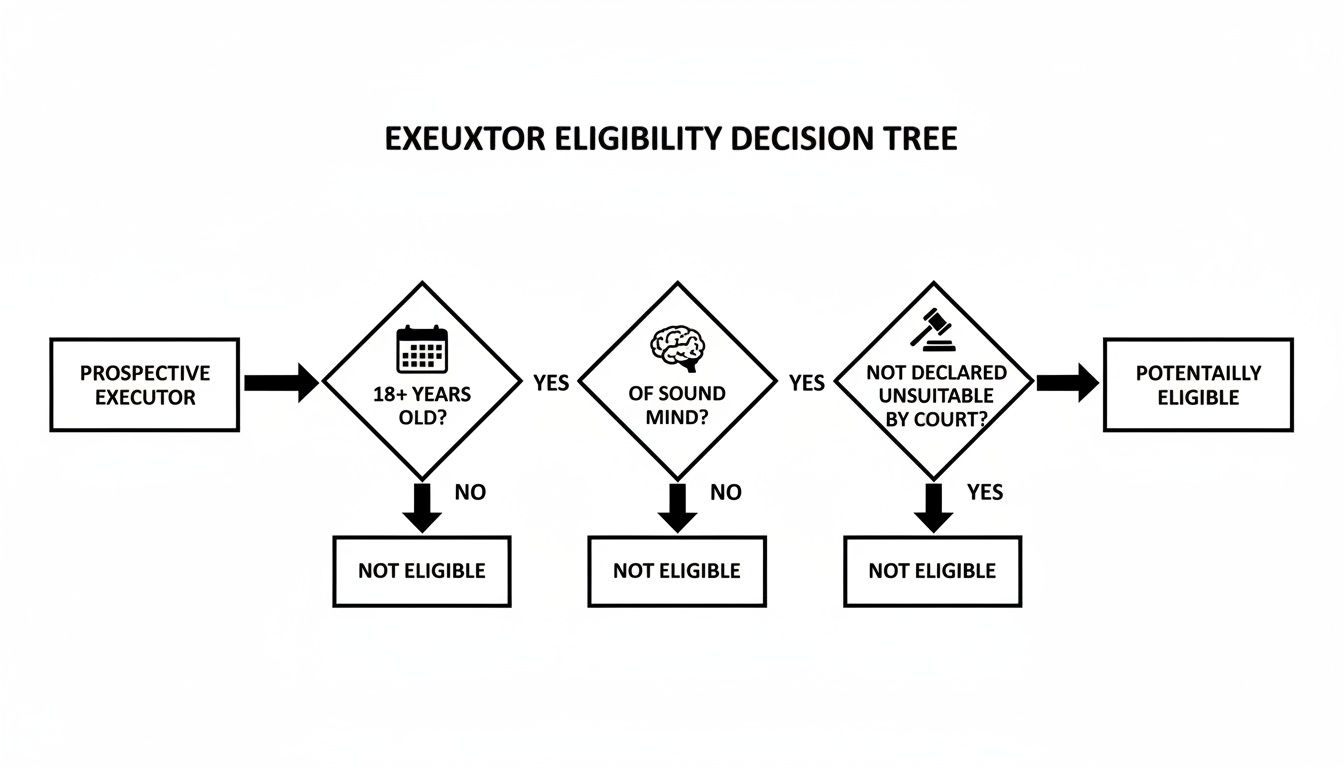

This decision tree gives you a quick visual rundown of the baseline legal qualifications we just covered.

As you can see, meeting the legal requirements is just the starting point. The real work is in figuring out if a candidate has the temperament and practical ability to see it through.

Practical Realities You Just Can't Ignore

Beyond personal qualities, you have to be realistic about the practical side of things. Asking someone to be your executor is a significant request, and their own life circumstances will directly affect their ability to do the job well.

Consider the candidate's:

- Age and Health: Are they likely to be physically and mentally able to handle the task when the time comes? Settling an estate can easily take a year or more.

- Location: While Texas law allows an out-of-state executor, it adds complexity. Managing property and attending court hearings is far easier for someone who lives nearby.

- Current Commitments: Does this person realistically have the time? Someone juggling a demanding career or young children might not have the bandwidth for the time-consuming duties of settling an estate.

Comparing Potential Executor Candidates

Most people immediately think of a spouse, an adult child, or a close sibling. These are often great choices due to the deep personal trust already in place. But it’s smart to weigh the pros and cons of family against other options.

| Candidate Type | Potential Advantages | Potential Disadvantages | Best For… |

|---|---|---|---|

| Family Member | Deeply understands family dynamics and your wishes. Often waives executor fees. | May be overwhelmed by grief. Potential for conflicts of interest or family disputes. May lack financial or legal experience. | Simple estates where family relationships are strong and the candidate is organized and impartial. |

| Trusted Friend | Can offer an objective perspective while still providing personal care. Less likely to be embroiled in family conflicts. | May not know the family's financial details as well. The responsibility could strain the friendship. | Estates where naming one family member over another could cause friction, but a personal touch is still desired. |

| Professional Fiduciary (Attorney, CPA, Trust Company) | Has expert knowledge of the Texas Probate Process. Completely impartial and efficient. Experienced in handling complex assets. | Charges professional fees, which reduces the estate's value. Lacks a personal connection to the family. | Complex estates with business assets, significant investments, or a high potential for Probate Litigation. Also ideal for individuals without a suitable family or friend candidate. |

Ultimately, there is no one-size-fits-all answer. By carefully evaluating both the character and the practical circumstances of your potential candidates, you can select someone who is not just willing, but truly prepared to honor your legacy.

How to Ask Someone to Be Your Executor

Once you've landed on the right person, the next step is one of the most important conversations in the entire estate planning process. Asking someone to be your executor is a significant request that deserves a thoughtful, honest, and direct discussion. Approaching it with care ensures you’re both on the same page and gives your chosen candidate the respect and information they need to make an informed decision. Remember, they have every right to say no.

Setting the Stage for the Conversation

Before you talk, get your thoughts in order. Be ready to explain not just what the job entails, but why you believe they are the right person for it. This conversation is as much about affirming your trust in them as it is about laying out the legal duties.

Schedule a specific time to talk, preferably in person, where you won't feel rushed. Let them know ahead of time that you’d like to discuss something important about your estate plan. When you talk, lead with your trust. You could start by saying, "I've been putting a lot of thought into my will, and I keep coming back to you. Your integrity and common sense are exactly what I believe is needed to handle things for me."

Key Topics You Must Cover

Your goal is total transparency to avoid future surprises. You need to give them a realistic preview of what they’d be signing up for.

Here are the non-negotiable points to cover:

- The Job Description: Give them a plain-English rundown of the duties—from finding the will and hiring a lawyer to paying final bills and distributing assets.

- The State of Your Estate: Be honest about your financial situation. Is it straightforward, or are there complexities like a business, out-of-state property, or potential family disagreements?

- Location of Important Documents: Let them know where you keep critical documents—your will, deeds, bank statements, and digital passwords. They don’t need the details now, but they must know where to find them.

- Their Support Team: Reassure them they won’t be alone. Mention the professionals who will be there to help, like your estate planning attorney or accountant.

- Executor Compensation: Discuss how executors of estates get paid. Texas law allows for payment, and it’s important they understand this. You can decide whether to stick to the statutory fee or specify a different amount in your will.

Questions You Should Ask Them

This conversation is a dialogue. After you've laid out the details, ask some direct questions to gauge their willingness and ability to take this on. Encourage them to be completely honest when you ask:

- "Looking at your life right now, do you realistically have the time and emotional energy for something like this?"

- "How comfortable are you making tough financial decisions or standing firm if disagreements pop up?"

- "Does the thought of dealing with legal paperwork and deadlines feel overwhelming?"

- "Do you feel you could be completely impartial to everyone involved, even if things get tense?"

Give them space to think it over. Don't press for an immediate answer. A great candidate will appreciate the chance to reflect. Be sure to tell them you have a backup plan in mind—this takes the pressure off and makes it easier for them to give you an honest answer.

Creating a Backup Plan with Successor Executors

Life is unpredictable. The person you’ve carefully selected to be your executor might move, face health issues, or simply find themselves overwhelmed when the time comes. This is why a solid backup plan isn’t just a good idea—it’s a critical piece of any resilient estate plan. If your chosen executor cannot serve and you have no backup, the decision falls to the court, taking control completely out of your hands.

The best way to build this safety net is by naming one or more successor executors in your will. A successor is the person who steps up if your first choice can't or won't serve. I always advise clients to name a "first successor" and even a "second successor." This creates a clear line of succession, ensuring someone you trust is always ready to take the reins.

Why Every Will Needs a Successor (or Two)

Think of it like naming an emergency contact. You hope you never need them, but you feel more secure knowing they're there. When you name alternates in your will, you’re planning for life's uncertainties and protecting your estate from the delays and extra costs of court intervention. Texas courts are some of the busiest in the nation, and a court-appointed solution can drag on for months. Learn more about the scale of probate across the country and see why efficiency is so important. Having a successor ready keeps the process moving as you intended.

Considering a Corporate Executor as a Failsafe

For some families, the best choice isn't an individual at all. It's a corporate executor, also known as a professional fiduciary. These are typically banks or trust companies licensed by the state to administer estates. You can name one as your primary choice, but it’s more common to see them named as the final successor if all your individual choices are unable to serve.

This option offers powerful advantages:

- Total Impartiality: A corporate executor has no emotional stake in family drama, which is a game-changer for estates with a high risk of conflict.

- Deep Expertise: They have ironclad processes for managing assets, navigating tax laws, and ensuring legal compliance.

- Unwavering Continuity: A trust company can't get sick, move away, or pass away. They offer a permanent, reliable backstop.

Of course, there are trade-offs. Professional fiduciaries charge fees for their services, which are paid from the estate. They also lack the personal touch and intimate knowledge of your family that a loved one brings.

A Real-World Example: Preserving Family Harmony

I once worked with a family who owned a successful small business. They had three adult children who did not get along. The parents knew that naming any one of them as executor would ignite a firestorm of jealousy.

Their solution was brilliant: they named a local trust company as the executor in their will.

When they passed away, the corporate executor stepped in. It professionally valued the business, managed its operations during probate, and oversaw its sale, exactly as the will instructed. The proceeds were then distributed equally and transparently to the three children. The fight the parents had feared never happened. The professional fees were a small price to pay for family peace.

Finalizing Your Choice and Next Steps

You’ve done the hard work. You’ve evaluated candidates, had honest conversations, and set up a solid backup plan. Now it's time to make your decision official. This is the crucial step where your thoughtful planning becomes a legally binding instruction that will protect your family and honor your final wishes. Choosing an executor is a profound gift, providing your loved ones with a clear roadmap and a trusted leader during a difficult time.

The Final Checklist

Before you meet with your attorney to formally name your executor in your will, run through this final review:

- Legal Eligibility Confirmed: Does your primary choice—and your successors—meet all legal requirements set by the Texas Estates Code?

- Practical Skills Match: Have you honestly assessed their organizational skills, financial sense, and ability to communicate under pressure?

- Willingness and Availability: Did they give you a confident and informed "yes" after you explained the full scope of the role?

- Open Communication: Have you told them where to find your important documents and who your legal and financial advisors are?

- Backup Plan in Place: Have you selected at least one successor executor who is also qualified and willing to serve?

Officially naming your executor in your will is what transforms your choice from a private agreement into a powerful legal directive. This is the single most important step in ensuring your estate is managed by the person you trust most. To make sure your will is drafted correctly and your choice is legally sound, getting professional guidance is the best way to navigate the Texas Probate Process.

Key Takeaways for Choosing Your Executor in Texas

Choosing an executor is about more than just trust; it's a strategic decision that requires balancing legal eligibility, practical skills, and emotional intelligence. The ideal candidate is not only someone you trust implicitly but also someone who is organized, a clear communicator, and has the time and emotional resilience to handle the job. Always name at least one successor executor in your will to avoid court intervention and ensure your wishes are followed, no matter what life throws your way. This thoughtful preparation is one of the greatest gifts you can give your family.

Common Questions We Hear About Choosing an Executor

As you work through your estate plan, many "what if" scenarios may arise. Below are some of the most common questions we hear from Texas families, with clear answers to guide your decision.

Can I Name Two of My Children as Co-Executors in Texas?

Yes, Texas law allows you to name co-executors. While this often feels like the fairest choice, it can backfire. The biggest risk is gridlock. Co-executors must agree on nearly every decision. If they can't see eye to eye, the entire probate process can grind to a halt, leading to delays and higher legal fees. A more effective strategy is often to name one child as the primary executor and the other as the first successor. This honors both while creating a clear line of authority.

Does My Executor Have to Live in Texas?

No, your executor is not required to be a Texas resident. However, appointing someone out of state comes with practical hurdles. Under the Texas Estates Code, a non-resident executor must appoint a resident agent in Texas to accept legal notices. Beyond that, managing an estate from afar is difficult. Your executor might need to travel to Texas for court hearings, manage property, or meet with local professionals, which can slow down the Texas Probate Process and add costs.

How Is an Executor Paid for Their Work in Texas?

Executors are entitled to be paid for their time and effort. The Texas Estates Code sets a default commission if your will doesn't specify otherwise. The standard fee is five percent (5%) of all money the executor receives and pays out in cash on behalf of the estate. This does not apply to cash already in bank accounts or to non-cash assets like real estate passed directly to beneficiaries. You can also define a different payment structure in your will, such as a flat fee or hourly rate.

What Happens If I Do Not Name an Executor in My Will?

If you have a valid will but fail to name an executor—or if your chosen executor cannot serve—you lose the right to decide who manages your estate. The probate court will step in and appoint an "administrator with will annexed." The judge follows a priority list established by Texas law, usually starting with the surviving spouse, then the main beneficiary. This underscores why it's so important to not only choose an executor but also to name at least one successor, especially in complex situations involving Wills & Trusts or potential Guardianship issues.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.