When you hear people talking about getting their affairs in order, you’ll often hear “will” and “estate plan” used as if they’re the same thing. They’re not. The difference is simple but crucial: a will is a single document that tells everyone what to do with your property after you die. A full estate plan, on the other hand, is a complete strategy designed to protect you and your family both during your lifetime and after.

Think of a will as a vital part of the puzzle, but an estate plan is the entire protective structure built around it. We understand that this can feel overwhelming, especially when you're just trying to do the right thing for your loved ones. Our goal is to make these concepts clear and approachable.

Understanding the Core Difference: Will vs. Estate Plan

It’s a common mix-up here in Texas, but a Last Will and Testament and a comprehensive estate plan serve very different purposes. A will really only does three main things once you’ve passed away: it names an executor to handle your affairs, dictates how your property should be divided among your heirs, and appoints guardians for any minor children.

That’s it. Crucially, a will only kicks in after your death, and it almost always has to go through the public court process known as probate.

An estate plan is a much broader collection of legal tools. It includes a will, yes, but it also pulls in other critical documents. These additional tools can protect you if you become incapacitated and can often help your family sidestep the delays, costs, and public nature of the Texas probate process.

At a Glance: Key Distinctions Between a Will and an Estate Plan

The real difference snaps into focus when you see their functions side-by-side. A will is reactive—it only deals with the aftermath of death. An estate plan is proactive, giving instructions for your care and financial management if you ever can't make those decisions for yourself.

Here's a quick breakdown to make it clear:

| Function | Will Only | Comprehensive Estate Plan |

|---|---|---|

| Asset Distribution | Directs asset distribution after death, which is subject to probate court. | Can distribute assets during life and after death, often bypassing probate entirely. |

| Incapacity Planning | Offers no protection if you become ill or incapacitated. | Includes Powers of Attorney for financial and medical decisions if you're unable to act. |

| Privacy | Becomes a public record once it's filed for probate. | Can keep your financial affairs and family matters private through the use of trusts. |

| Effective Date | Only becomes effective upon your death. | Portions are effective immediately, providing you with lifetime protection. |

| Guardianship | Nominates guardians for minor children. | Nominates guardians and can also create a trust to manage their inheritance for them. |

This table shows that relying on a will alone leaves significant gaps in your plan, especially when it comes to lifetime planning and privacy.

Worryingly, recent data shows that only 32% of Americans have a will, a sharp decline from years past. That statistic is a real concern because a will by itself is often not enough. For many families, the question of 'Do I need a trust?' comes up when they want to protect assets from creditors or ensure a private, efficient transfer of their wealth—something a will simply can’t do on its own.

Ultimately, getting a handle on the difference between a will and a trust is the first real step you can take toward building a plan that gives your loved ones true security and peace of mind.

The Role and Limitations of a Texas Will

When Texas families start thinking about the future, the Last Will and Testament is usually the first document that comes to mind. It’s a powerful tool, legally recognized under Title 2 of the Texas Estates Code, that lays out clear instructions for what happens after you’re gone. Its role is specific and absolutely vital, often serving as the cornerstone for a family's entire plan.

In plain English, a will handles three primary jobs. First, it names an executor—the person or institution you trust to be in charge of settling your final affairs. Second, it dictates how your property, from your house down to your personal keepsakes, should be passed on to your loved ones.

Finally, and for parents, this is the big one: it allows you to nominate a guardian for your minor children. This is your chance to say who you want raising your kids if you can't, preventing a judge from having to make that deeply personal decision on your family's behalf. You can learn more about the importance of wills in our detailed guide on Wills & Trusts.

What Happens with Only a Will: A Realistic Scenario

To see the real-world limits of a will, let’s walk through a common scenario. Picture a Houston couple, Maria and David, with two young kids and a new home. They draft a simple will, naming Maria’s brother as executor and David’s sister as the kids' guardian. They feel like they’ve checked the box and are prepared.

If they were to pass away, their will would become the official roadmap for handling their estate. But here’s the catch: that roadmap leads directly to probate court. The process would look like this:

- Filing with the Court: Maria’s brother would have to file the will with the Harris County probate court and petition to be officially appointed.

- Court Appointment: A judge would review the will and, if valid, grant him Letters Testamentary, the legal document giving him the power to manage the estate—pay bills, access bank accounts, and eventually sell their home.

- Separate Guardianship Proceeding: The guardianship for the children would also need separate court approval, adding another layer to an already stressful process for the family.

The Built-in Limitations of a Will

While Maria and David's will makes their wishes known, it also exposes the document's inherent boundaries. Relying solely on a will often creates predictable headaches for the very people you’re trying to protect.

Three major limitations stand out:

- It’s Only Effective After Death: A will does absolutely nothing for you if you become incapacitated by an accident or illness. It can't grant someone the authority to pay your mortgage or make medical decisions for you while you're still alive.

- It Guarantees a Public Process: Once a will is filed for probate, it becomes a public record. This means anyone—a nosy neighbor, a distant relative, a potential creditor—can look up the details of your assets, their value, and who inherited what.

- It Requires Court Supervision: The executor can't just act on their own. Every significant step, from selling a piece of property to distributing the final assets, often requires the court's permission or oversight, which translates to more time and more money.

This is exactly why for so many Texas families, a will is just the starting point, not the final destination. It solves the critical problem of "what happens after I'm gone" but leaves you and your family completely unprotected against the many "what ifs" of life. It’s this gap that highlights the sharp difference between just having a will and having a complete estate plan.

Digging Into the Toolbox: What’s Inside a Comprehensive Estate Plan?

While a will is all about what happens after you’re gone, a truly comprehensive estate plan is a complete toolbox designed to protect you and your family during your lifetime, too. Think of it as a proactive strategy—one that anticipates life’s curveballs and makes sure your wishes are followed and your loved ones are shielded from a legal mess. These tools work together to create a powerful safety net.

Let’s open this toolbox and take a look at the legal instruments that transform a simple will into a robust, life-proof plan. Each piece has a distinct, critical job to do, covering scenarios a will simply can’t touch.

Revocable Living Trusts: The Key to Bypassing Probate

One of the most powerful tools in any estate planner’s kit is the Revocable Living Trust. Imagine a trust as a private legal container you create to hold your assets—your home, bank accounts, investments, you name it. While you're alive, you’re the trustee, meaning you keep full control over everything inside it. Nothing really changes in your day-to-day life.

The real magic happens when you pass away. Because the trust—not you—technically owns the property, there is nothing for the probate court to get its hands on. Instead, your handpicked successor trustee steps in and distributes the assets to your beneficiaries according to your private instructions. This completely sidesteps the public, often lengthy, and expensive court process. For many Texas families, this is a cornerstone of a well-crafted estate plan.

Powers of Attorney: Your Voice When You Can't Speak for Yourself

Incapacity is a tough subject, but it’s a reality that solid estate planning confronts head-on. What happens if an accident or illness leaves you unable to manage your own affairs? A will is completely useless in this situation. A full estate plan, however, has you covered with two specific types of Power of Attorney.

Durable Power of Attorney (Financial): This document gives a person you trust—your "agent"—the authority to handle your financial life if you can’t. This includes everything from paying the mortgage and managing investments to filing your taxes. Without one, your family would be forced to seek a court-ordered Guardianship just to access your finances, a process that’s both costly and public.

Medical Power of Attorney: In the same way, this document appoints someone to make healthcare decisions for you if you’re unconscious or can't communicate. This person becomes your advocate, speaking with doctors to ensure you receive the care you would have wanted.

These documents are your voice when you don’t have one, providing clarity and legal authority right when your family needs it most.

Advance Directives: Making Your Final Wishes Crystal Clear

An Advance Directive to Physicians, which some people know as a Living Will, is another crucial component. This legal document, officially recognized under the Texas Health and Safety Code, spells out your specific wishes on end-of-life medical care. It answers the gut-wrenching questions about life-sustaining treatments ahead of time, so you’re the one making the call.

This simple piece of paper can lift an immense emotional burden from your family, preventing them from having to guess what you would have wanted during an already agonizing time.

Unfortunately, far too many families are left vulnerable without these protections. While about two-thirds of U.S. households aged 70 and older have a will, many lack the critical tools needed to handle incapacity. The risk is especially high for younger generations; an alarming 62% of millennials have no plan at all. This puts their "sandwich generation" parents in a terrible spot if they suddenly need to provide care without any legal authority. You can see more on these trends in LegalZoom's report on estate planning statistics.

By combining a trust with powers of attorney and an advance directive, you create a seamless plan that protects you during life and provides for your loved ones after you're gone.

Comparing the Aftermath: A Will in Probate vs. a Trust Administration

When you create a plan for your family, the real test isn’t just what the documents say—it’s what your loved ones will actually experience after you’re gone. The difference between settling an estate with only a will versus administering a trust-based plan is profound. One process is public and court-supervised; the other is private and efficient.

Understanding this contrast is key to appreciating why a comprehensive estate plan offers so much more than just a simple will. Let's walk through what each path looks like for a Texas family.

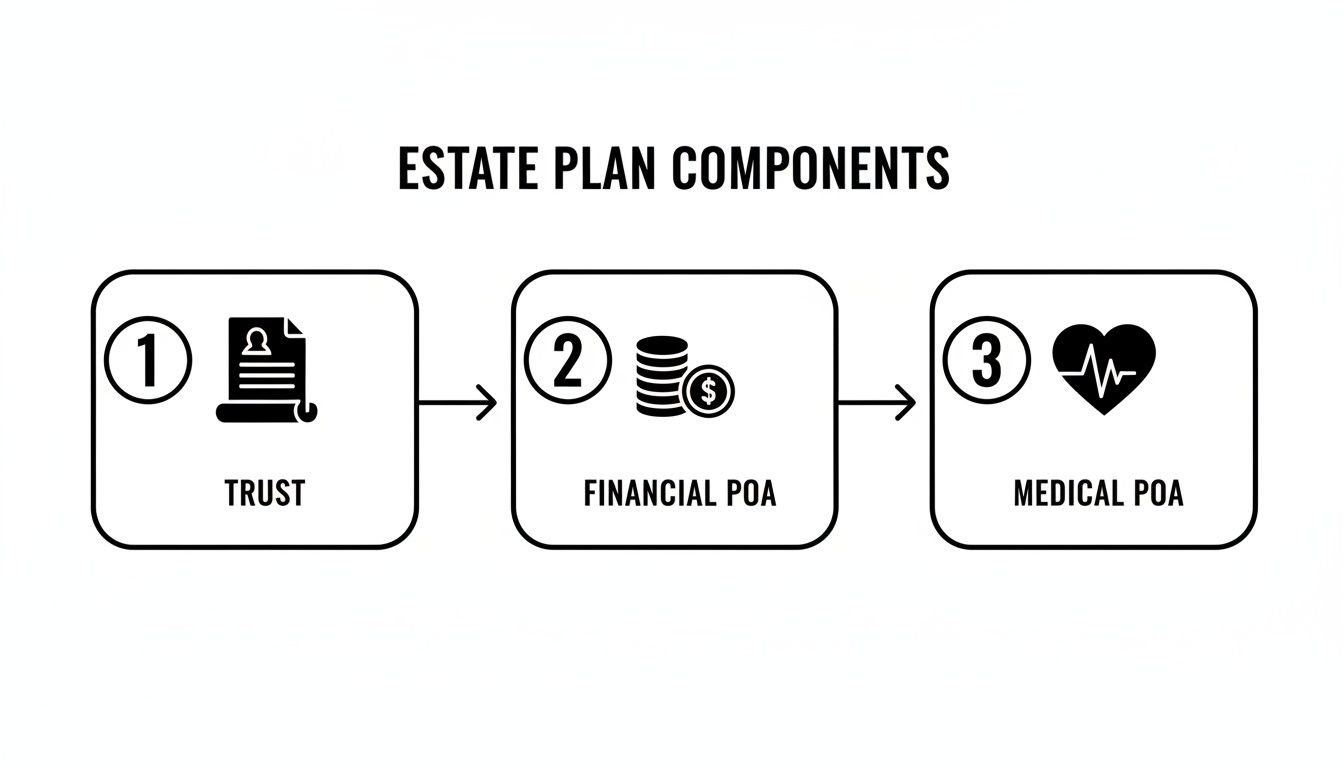

The diagram below shows how a trust and other key documents work together to create a complete protective shield, going far beyond a standalone will.

This structure—a trust, financial power of attorney, and medical power of attorney—provides layers of protection that a will alone simply can't.

The Path of a Will Through Texas Probate

When your plan hinges entirely on a Last Will and Testament, your executor has no choice but to navigate the formal Texas probate process. This is a court-supervised procedure designed to validate the will and oversee the settlement of your estate. It is, by its very nature, a public and often lengthy affair.

The journey usually involves these steps:

- Filing the Will: Your named executor must file your will with the proper Texas probate court, along with an application to kick off the process.

- Attending Court Hearings: A judge has to formally recognize the will as valid and legally appoint the executor. This appointment grants them what's known as Letters Testamentary, the official document giving them the authority to act.

- Inventorying Assets: The executor is required by Title 3 of the Texas Estates Code to create a detailed inventory of all your property. This document is filed with the court and becomes a public record for anyone to see.

- Notifying Creditors: A formal notice has to be published to alert potential creditors, who then get a specific timeframe to make claims against the estate.

- Awaiting Court Approval: Throughout this journey, the executor may need a judge's permission for big decisions, like selling a house. No one gets their inheritance until all debts are settled and the court gives the final green light.

This deliberate trip through the court system is designed for oversight, which also means it can be incredibly slow and stressful for a grieving family.

The Path of a Trust Administration

Now, let’s contrast that public court process with how a trust-based estate plan is handled. The experience for your family is drastically different from day one. A trust is a private agreement that doesn't require a judge's permission to function. It allows your chosen successor trustee to manage and distribute your assets according to your instructions, completely outside of the probate court system.

When the creator of the trust passes away, the successor trustee's role is activated immediately. There’s no court filing required to get started. Their duties are clear, private, and efficient:

- Step In Immediately: The successor trustee takes control of the trust assets right away. There's no waiting for a court appointment.

- Manage Assets Privately: They follow the trust’s instructions to pay final bills and handle the property held by the trust, all without public scrutiny.

- Distribute Assets Efficiently: Once all obligations are met, the trustee distributes the remaining assets directly to the beneficiaries exactly as you specified.

This entire process is handled privately, shielding your family’s financial affairs from public view and avoiding the delays baked into the court system. Even when disputes pop up, they are often handled through private mediation, not a public court battle. If you want to dive deeper, you can learn more about setting up a trust in our guide.

On average, the probate process for a will can drag on for 6-18 months, while a trust allows for a much faster—and often immediate—distribution of assets. This distinction is critical, especially when you consider that a staggering 52% of heirs don't even know where their loved one's will is located. That kind of uncertainty often leads to family disputes and delays that a well-structured trust is designed to prevent.

Which Strategy Is Right for Your Texas Family?

Knowing the technical difference between a will and an estate plan is one thing; figuring out which one your family actually needs is where the real work begins. There's no one-size-fits-all answer here. Every Texas family has its own story, its own assets, and its own unique dynamics. The right strategy for you won't be found in a template—it's found by looking at your life with compassion and foresight.

So, let's move past the legal definitions and into the real world. The best way to understand these concepts is to see how they play out for families in situations you might recognize.

For the Young Family with a New Home

Think about a young couple, maybe in their early 30s, with a toddler running around and a brand-new mortgage. Their biggest fear is simple and immediate: "If something happens to us, who will raise our child?" For them, a will is absolutely essential. The Texas Estates Code is clear that a will is the only place to legally nominate a guardian for your minor children.

But a will alone is a half-measure. It names a guardian for the child, but what about the house? The life insurance money? A will doesn't create a system for managing that inheritance. That’s where a full estate plan comes in. By adding a trust, they can appoint a trustee to manage those assets for their child's benefit until they’re old enough to handle it responsibly. This simple step avoids a court-supervised guardianship over the money and ensures it’s used for the child's health and education, just as they would have wanted.

For the Blended Family

Now, picture a couple in their second marriage. Each has children from a prior relationship. Their challenge is delicate: they want to provide for their current spouse but also make sure their own kids eventually inherit their share. This is a classic scenario where a simple will can spark conflict and lead to outcomes no one intended.

For blended families, an estate plan using a trust is often the best solution. They can set up a trust that allows the surviving spouse to live in the home and receive income for the rest of their life. Then, after the second spouse passes away, the trust’s remaining assets are distributed to the children from the first marriage. This structure provides security for everyone, eliminates ambiguity, and helps prevent bitter probate litigation between stepparents and stepchildren down the road.

For the Business Owner

A small business owner has a lot more on their plate than just personal assets. Their business is their legacy, and it supports their family and employees. A will can state who inherits the ownership shares, but it does nothing to keep the business running when they're gone.

An entrepreneur needs a comprehensive estate plan with a solid business succession component. This usually involves a trust to hold the business interests, paired with a detailed plan naming who will take over management. It can even include funding tools, like life insurance, to provide the cash needed to keep the doors open during the transition. It’s about protecting not just the family’s finances but the entire legacy they built from the ground up.

For the Retiree Seeking Simplicity and Privacy

Finally, consider a retired couple whose main goal is to make things as easy as possible for their adult children. They’ve spent a lifetime building their nest egg and want to pass it on without creating a mess.

In this case, a will guarantees the exact opposite of what they want: a public, often slow, and potentially expensive probate process. The perfect tool here is a revocable living trust. By transferring their home, bank accounts, and investments into the trust during their lifetime, they set the stage for a completely private and seamless transition. After they pass, their chosen successor trustee can distribute the assets directly to the beneficiaries without any court involvement. This saves the family time, money, and the emotional strain of navigating the formal legal system.

Wrapping Up: Your Next Steps Toward Peace of Mind

Navigating the difference between a will and a full estate plan is the first real step toward protecting your family’s future. If there’s one thing to take away, it’s this: a will is a good start, but a comprehensive estate plan offers a level of security for you and your loved ones that a will alone simply can’t match. Think of planning as an act of care—it provides security for you during your lifetime and lifts a massive burden from your family after you’re gone.

For most families, the biggest hurdle isn't confusion; it's procrastination. But taking action now is what prevents a crisis down the road. Let’s boil it down to what really matters.

Key Insight: Takeaway

Building an estate plan isn't just about handing out property. It’s about preserving family harmony, shielding your legacy from needless court interference, and giving your loved ones clarity during one of the most difficult times of their lives. A will is your instruction manual for the probate court. An estate plan, with tools like a trust and powers of attorney, is designed to protect you during life and keep your family out of court after you’re gone.

Don't wait for a crisis to force your hand. The most compassionate thing you can do for the people you love is to create a clear, legally sound plan that leaves nothing to chance.

Whether you need to draft your first will, set up a trust to protect your family, or update documents you made years ago, our team is here to give you straightforward guidance. And if you’re currently dealing with the probate process in Texas, we can walk you through every step—from the initial filing to the final distribution.

Schedule your free consultation today and take the first step toward peace of mind.

Common Questions About Texas Estate Planning

When you start digging into estate planning, a lot of practical questions pop up. It's only natural. Below, we’ll tackle some of the most common concerns we hear from Texas families trying to decide between a simple will and a full estate plan.

Can I Write My Own Will in Texas?

Yes, you absolutely can write your own will in Texas, but it’s a path filled with potential pitfalls. To be considered legally valid, a will has to follow the strict rules laid out in the Texas Estates Code. For instance, a handwritten will (also called a holographic will) must be entirely in your handwriting. A formal, typed will needs the signatures of two credible witnesses who sign in your presence.

It sounds simple, but a single mistake can derail everything. Having a potential heir sign as a witness or using the wrong legal phrasing could invalidate the entire document. If that happens, the court will likely ignore your wishes, and your property will be split up based on state law, not what you wanted.

Is an Estate Plan Really That Much More Expensive Than a Will?

A comprehensive estate plan does have a higher upfront cost than a basic will. However, looking at it as a one-time expense is the wrong way to think about it. It’s an investment. The costs of probate—court fees, attorney fees, and administrative headaches—can easily dwarf the initial price of setting up a trust.

Beyond that, a will offers zero protection if you become incapacitated and need a court-supervised guardianship. A full estate plan is specifically designed to avoid these expensive, public, and incredibly stressful court proceedings. In the long run, it often saves families thousands of dollars and an immense amount of emotional turmoil. The true cost isn't what you pay to create the plan; it's what your family might pay—in time, money, and stress—if you don't have the right protections in place.

What Happens If I Die Without Any Plan in Texas?

If you pass away without a will or trust, the law says you died "intestate." When that happens, the state of Texas has a default plan ready to go for you. Title 2 of the Texas Estates Code spells out exactly how your property gets divided among your relatives using a rigid formula. It looks at whether you have a surviving spouse, children, parents, or other family.

The court will appoint an administrator to manage everything, and your assets may end up with people you never would have chosen. The process is notoriously slow, completely public, and a common trigger for bitter family disputes.

How Often Should I Update My Estate Plan?

Life isn’t static, and your estate plan shouldn't be either. We generally recommend reviewing your plan every 3 to 5 years, or immediately after any major life event happens. Key triggers for an update include:

- Getting married, divorced, or remarried.

- The birth or adoption of a child or grandchild.

- A significant change in your finances (good or bad).

- The death of a spouse, beneficiary, or someone you named as an executor.

- Moving to a different state.

As you think about your estate plan, you may also run into questions about how documents are signed and executed in our modern world. For law firms and clients alike, understanding the electronic signature legal requirements is becoming more important. Keeping your documents up-to-date ensures they work the way you expect and fully comply with current laws.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.