Being named an executor is a profound responsibility, and it often arrives during a time of immense grief. For Texas families, understanding this role is the first step toward honoring a loved one’s final wishes. Your primary job is to locate the will, secure the deceased’s property, and begin the court process known as probate to legally manage and distribute the estate according to Texas law.

Think of it as being entrusted to respectfully close one chapter of a loved one’s life. This guide offers step-by-step guidance to help you navigate your duties with clarity and compassion.

Your First Steps as an Executor in Texas

Stepping into the role of an executor can feel overwhelming, especially while you are also mourning. The key is to take a breath and focus on the immediate, essential tasks first. You don’t need to know everything at once; this guide provides a clear, actionable roadmap for your initial duties.

Your first priority is to handle the practical necessities that arise immediately after a death. This is the foundation upon which all your other executor duties will be built.

Locating Critical Documents

Before any legal steps can happen, you must find the original, signed will. In plain English, a copy won’t be accepted by the Texas probate courts. Start by looking in common places like a home safe, a safe deposit box, or with the deceased’s attorney.

Alongside the will, you’ll need to obtain multiple copies of the official death certificate. You will need these for nearly every task ahead, from closing bank accounts to claiming life insurance policies. A good rule of thumb is to order at least 10 certified copies to avoid frustrating delays. Staying organized is your best friend here, and using a probate document checklist for executors can be a lifesaver.

Securing the Estate’s Property

One of your most important initial duties is to secure and protect the deceased’s assets. This means preventing any loss, theft, or damage from occurring while the estate is under your care.

As an executor, you have what’s called a fiduciary duty—a high-stakes legal obligation to act in the best interest of the estate. Securing property immediately is the first step in fulfilling that duty and protecting yourself from potential liability.

Your initial steps to secure assets should include:

- Real Estate: Change the locks on any homes or properties. Ensure maintenance continues (like lawn care) and verify that the homeowner’s insurance is current and paid.

- Valuables: Collect any valuable personal items—such as jewelry, art, or collectibles—and move them to a secure location.

- Vehicles: Find the keys and titles for all vehicles and ensure they are parked safely.

The Starting Line: Probating the Will

Once you have the will and the death certificate in hand, your next step is to begin the Texas Probate Process. This is the formal legal procedure where a court validates the will and officially appoints you as the executor. Think of it as getting the keys to the car; you cannot legally manage the estate without the court’s official permission.

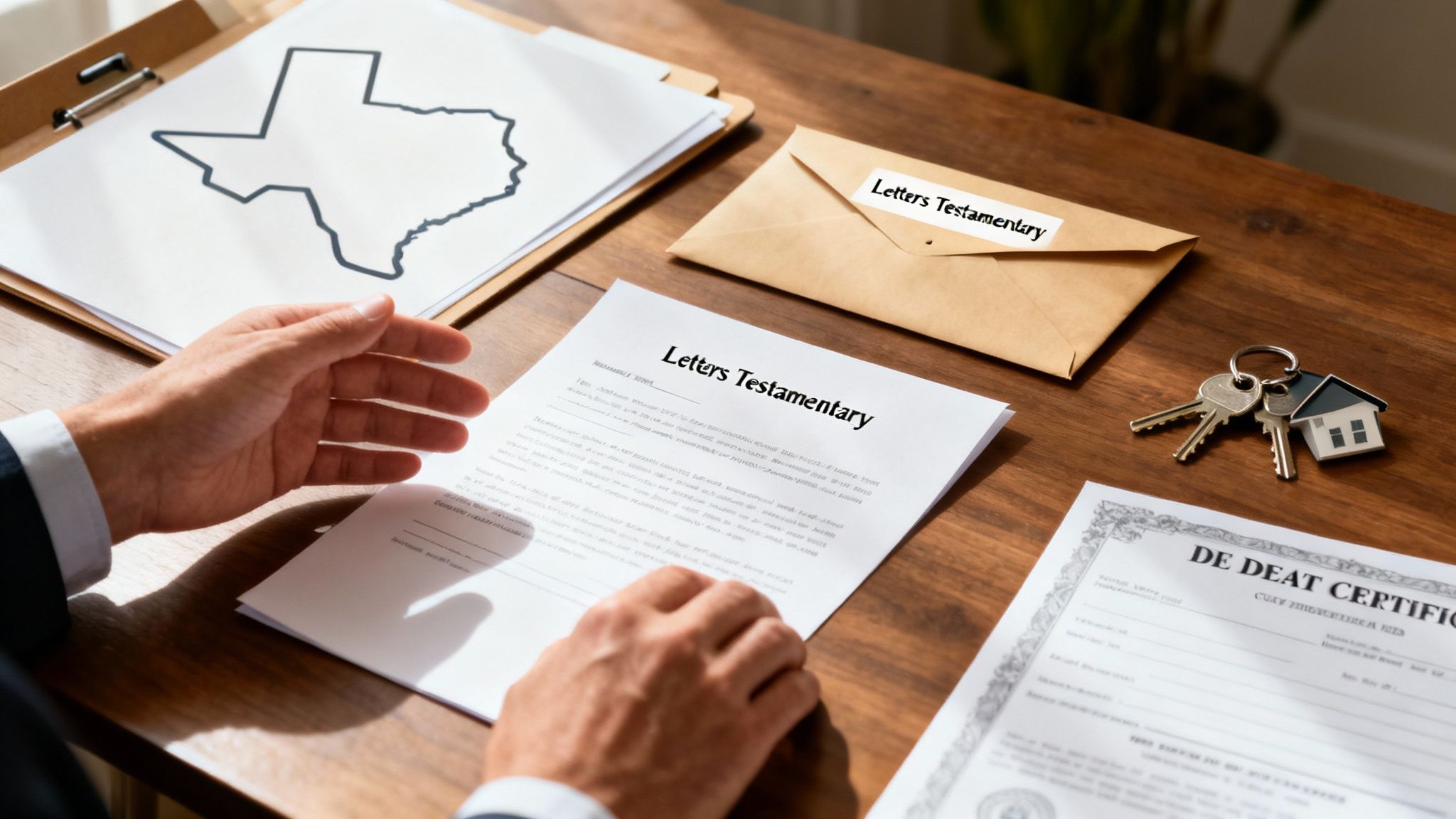

This process starts when you file an application with the proper Texas probate court. During a brief hearing, a judge will review the will and, if everything is in order, will sign an order appointing you. This leads to the single most important document you will receive: Letters Testamentary. This court-issued certificate is your official proof of authority, allowing you to manage bank accounts, sell property, and perform all other necessary duties on behalf of the estate.

What Does Going to Probate Court in Texas Actually Look Like?

The phrase “going to court” can sound intimidating, but the Texas probate process is usually a structured and straightforward administrative step. It’s the court’s way of giving its official stamp of approval on the will and granting you the legal authority needed to perform your duties as executor.

The probate court is where the will is legally recognized as valid, and you are formally appointed to carry out its instructions. This oversight ensures everything is handled fairly, transparently, and according to Texas law, providing reassurance to grieving families.

Independent vs. Dependent Administration: The Two Roads of Texas Probate

Texas law offers two main ways to manage an estate, and the difference comes down to the level of court supervision required.

- Independent Administration: This is the most common and efficient path in Texas. If the will specifically allows for it (as most modern wills do), or if all beneficiaries agree, an executor can handle nearly all of the estate’s business—paying debts, selling property, distributing assets—without needing a judge’s permission for each step. This approach saves significant time, money, and stress.

- Dependent Administration: This path requires the executor to get court approval for almost every action. It is slow, expensive, and paperwork-heavy, but it is sometimes necessary if the will is silent on the matter, beneficiaries are in conflict, or the estate is particularly complex.

Because of its clear advantages, virtually every well-drafted Texas will includes a provision for independent administration, as referenced in the Texas Estates Code, Title 2, Section 401.001.

A Realistic Scenario: An Executor in Travis County

Let’s illustrate this with a realistic scenario. Imagine a family in Austin. Their mother recently passed, leaving a will that names her eldest son, David, as the executor. Her will includes a clause for independent administration.

- Filing the Application: David’s attorney files an “Application to Probate Will and for Issuance of Letters Testamentary” with the Travis County Probate Court. This formal request includes the original will and a certified death certificate. It’s the official starting point.

- The Court Hearing: About two or three weeks later, the court schedules a brief hearing. This is not a contentious trial; often, it lasts only five to ten minutes. David will be asked a few simple questions to confirm the facts: the identity of his mother, that the will is hers, and that he is qualified and willing to serve as executor.

- Receiving Authority: Once the judge is satisfied, they will sign an order admitting the will to probate and officially appointing David as the independent executor. Shortly after, the court clerk issues a document called Letters Testamentary.

This one-page certificate is David’s golden ticket. It’s his official proof of authority, allowing him to access bank accounts, communicate with financial institutions, and begin the work of managing and distributing his mother’s assets. This formal court procedure provides a solid legal foundation for all the duties of an executor of an estate.

Managing the Estate’s Assets and Debts

Once the court provides your Letters Testamentary, your role shifts from preparation to active management. You are now legally empowered to handle the estate’s finances—a core duty that demands diligence, organization, and a clear understanding of your responsibilities. This is the phase where you gather everything the person owned, pay what they owed, and prepare to distribute what remains.

Think of yourself as the temporary manager of the estate. Your mission is to conduct a full inventory of all assets, responsibly settle all debts, and then distribute the remaining property to the beneficiaries.

Gathering and Inventorying All Estate Assets

Your first major financial task is to identify and take control of every estate asset. This requires you to be a detective, as missing an asset is a common and serious error.

The scope of this job is broad and covers:

- Financial Accounts: All checking, savings, and brokerage accounts. You’ll use your Letters Testamentary to close these and transfer the funds into a new bank account opened specifically for the estate.

- Real Estate: You must secure any property, ensure it is insured, and handle its upkeep until it can be sold or transferred to a beneficiary.

- Investments: Stocks, bonds, mutual funds, and retirement accounts. You will need to contact the financial institutions holding these assets to determine how to manage or transfer them.

- Personal Property: This includes everything from vehicles and furniture to jewelry, art, and family heirlooms.

Under Texas law, you have a strict deadline. Within 90 days of your appointment, you must file a detailed report with the court called an “Inventory, Appraisement, and List of Claims.” As required by the Texas Estates Code § 309.051, this document is a sworn, public record of every asset in the estate and its fair market value on the date of death.

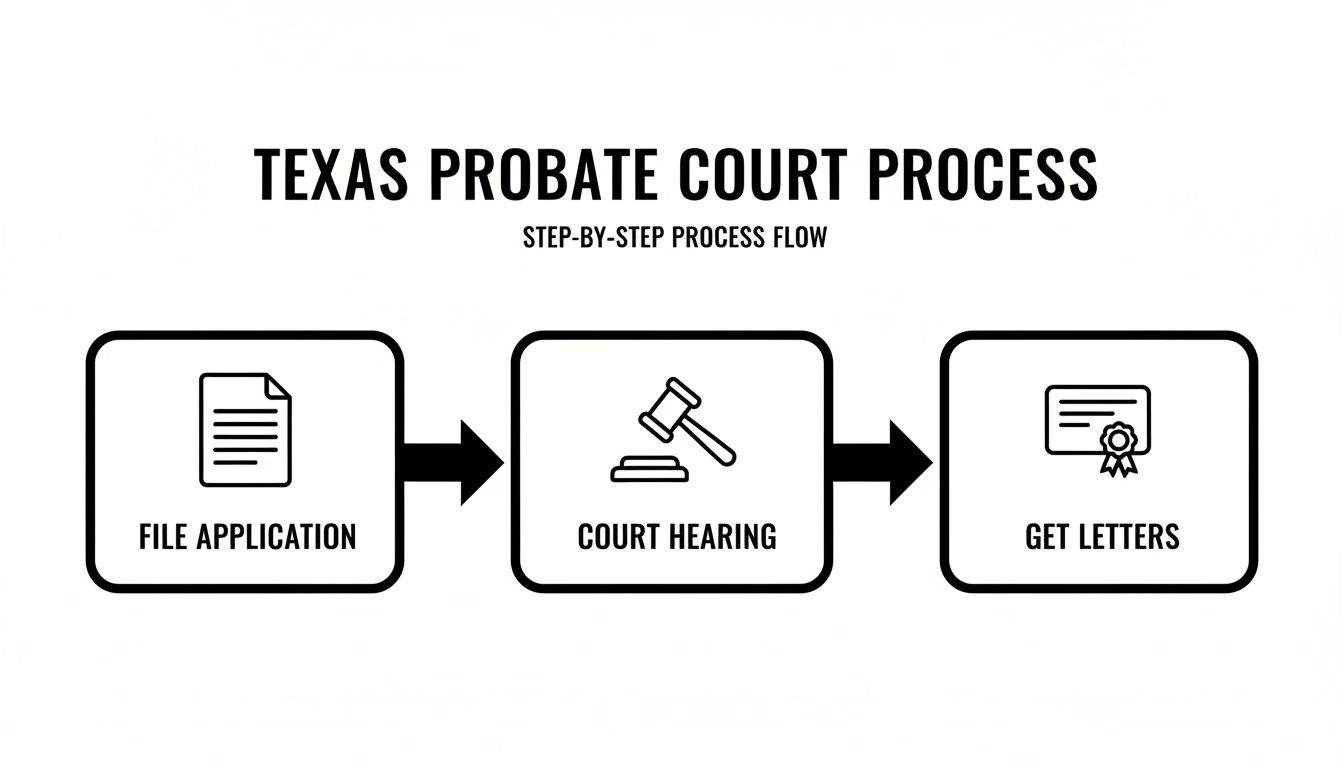

The flowchart below shows the simple court process that empowers you to manage these assets.

As you can see, getting those Letters Testamentary is the key that unlocks your legal authority to handle the estate’s finances.

Notifying Creditors and Handling Claims

Once you have a firm handle on the assets, your focus must turn to the debts. A critical part of an executor’s job is to formally notify potential creditors of the death. Under the Texas Estates Code, Title 2, this requires publishing a notice in a local newspaper. This acts as an official announcement, giving anyone owed money by the deceased a specific timeframe to present a claim against the estate.

When a claim is submitted, it’s your responsibility to review it and either accept it as valid or reject it. If you determine a debt is legitimate, you will pay it using estate funds. If you dispute a claim, you must formally reject it, which may lead to further legal action by the creditor.

Paying debts isn’t optional, and there’s a specific legal order for who gets paid first. If you don’t follow this hierarchy, you could become personally liable if the estate runs out of money before all legitimate creditors are satisfied.

Paying Final Bills, Taxes, and Expenses

After validating creditor claims, you must use estate funds to pay all legitimate debts and final expenses. Texas law creates a clear priority for payments, ensuring certain obligations are settled before others. For example, funeral expenses and the costs of administering the estate are typically paid before credit card bills or other unsecured debts.

To help you stay on track, we’ve put together a simple checklist of the key financial responsibilities you’ll need to manage.

Executor’s Financial Duties Checklist

| Task | Description | Texas Estates Code Reference (Example) |

|---|---|---|

| Open Estate Bank Account | Consolidate all liquid assets into a new, dedicated account under the estate’s name. | N/A (Best Practice) |

| File Inventory | Submit a detailed list of all assets and their values to the court within 90 days. | § 309.051 |

| Notify Creditors | Publish a notice in a local newspaper to alert potential creditors. | § 308.051 |

| Validate and Pay Debts | Review all claims, then pay valid debts according to the legal order of priority. | § 355.102 |

| File Final Tax Returns | File the deceased’s final personal income tax return and any required estate tax returns. | Varies (IRS Rules) |

| Maintain Records | Keep a meticulous ledger of all income, expenses, and transactions. | § 351.051 |

| Distribute Assets | Pay beneficiaries according to the will’s instructions after all debts and taxes are settled. | § 360.002 |

Properly managing the estate’s finances also means diligently tracking and organizing receipts for taxes to ensure your accounting is airtight. You are responsible for filing the deceased’s final personal income tax return and any estate income tax returns if the estate generates income.

Meticulous record-keeping is your best defense against future disputes. Every dollar that comes in and every dollar that goes out must be documented. For a deeper dive, learn more about managing estate assets and prioritizing debt repayment in our comprehensive guide.

Beyond court filings and financial spreadsheets, one of the most critical duties of an executor is communicating with heirs and beneficiaries. They are often grieving, anxious, and seeking information. How you communicate—with clarity, honesty, and empathy—can be the difference between a smooth process and a family dispute.

Establishing a Communication Rhythm

One of the best ways to manage expectations is to set up a regular schedule for updates. A simple monthly or quarterly email can work wonders by providing a straightforward summary of what’s been accomplished and what’s next.

Your updates should cover key areas:

- Milestones Reached: “We successfully filed the Inventory with the court this month.”

- Current Tasks: “We are now working through creditor claims to validate and pay them.”

- Upcoming Steps: “Once all debts are handled, the next step is to prepare the final accounting for everyone’s review.”

This proactive transparency demystifies the probate process for family members and reduces anxious phone calls.

Managing Difficult Conversations and Disagreements

It is almost inevitable that questions or disagreements will arise. Beneficiaries might ask about an asset’s valuation, the timeline for distribution, or a particular expense. Your job is to answer patiently and factually, always tying your responses back to the will’s instructions and Texas law.

Remember, your legal duty is to the estate as a whole, not to any single beneficiary. If a simple disagreement escalates into a serious dispute, seeking professional guidance on navigating Probate Litigation can protect both the estate and you from liability.

Key Takeaway

Transparency is a powerful risk management tool. Keeping meticulous records and sharing regular, clear updates with beneficiaries is your single best defense against accusations of mismanagement. It fosters trust and can prevent expensive legal fights before they begin, reinforcing that you are handling your duties with care and integrity.

Distributing Assets and Closing the Estate

You’ve reached the final leg of your journey as executor. After identifying assets, paying all creditors, and settling taxes, you are now at the most meaningful part of the role: carrying out your loved one’s final wishes. This is where your hard work culminates in distributing what’s left to the people named in the will.

This final phase brings a sense of closure, but it still demands the same precision as every other step.

The Mechanics of Transferring Property

Distributing an inheritance is more than just writing checks. Each type of asset has its own legal process for transferring ownership from the estate to the beneficiary. Your duty is to create a clear and undeniable legal chain of title for every item.

Here’s how it generally works for common assets:

- Real Estate: To transfer a house or land, you will sign and file a “Distribution Deed” with the county clerk. This official document moves the property’s title from the estate to the heir’s name.

- Vehicles: For a car or truck, you will sign the title over to the beneficiary in your capacity as executor, allowing them to register it in their own name.

- Financial Accounts: Cash is the simplest to distribute. You will typically write a check from the estate’s bank account or arrange a wire transfer directly to the beneficiaries.

Each transfer must be executed precisely according to Texas law to be legally binding and protect you from future claims. For more complex assets, such as a family business or property held in a trust, seeking help from a Wills & Trusts attorney is essential. A lawyer can also help if issues of Guardianship are involved for any minor beneficiaries.

Securing Receipts from Beneficiaries

Before you can close the estate, you need proof that you have fulfilled your duties. After each beneficiary receives their inheritance, it is critical that you have them sign a receipt or a release form. This simple document serves as your protection.

This signed acknowledgment confirms that you have met your obligations under both the will and the Texas Estates Code. File these signed receipts with all other estate records. They are your best defense if anyone ever questions whether the administration was handled correctly.

Filing the Final Paperwork to Close the Estate

With all property distributed and a signed receipt from every beneficiary, you’re on the home stretch. For an independent administration in Texas, wrapping things up is usually straightforward. You may file a document like a “Closing Affidavit” with the court to formally signal that the process is complete.

This final filing notifies the court and the public that you’ve fulfilled all your responsibilities. All known debts are paid, and all beneficiaries have received what is rightfully theirs. Once the court accepts this filing, the estate is officially closed, and your duties as executor are finally complete.

Understanding Executor Compensation and Liability in Texas

Serving as an executor is a demanding job that requires significant time and effort. Texas law acknowledges this important work and provides for compensation. This is not just a favor; it’s a role with legally defined responsibilities, and you are entitled to be paid for fulfilling them.

It’s also crucial to understand the topic of personal liability. This knowledge is not meant to intimidate but to empower you to perform your duties confidently and protect yourself.

How Executors Get Paid in Texas

In Texas, an executor is typically entitled to a commission based on the estate’s value. The standard fee, as outlined in the Texas Estates Code § 352.002, is 5% of all money the estate receives and 5% of all money it pays out in cash.

This calculation generally excludes cash that was already on hand (like money in a bank account at the time of death) or the final distributions made to beneficiaries. It’s a formula designed to fairly compensate you for the administrative work of managing the estate’s finances. For a closer look, learn more about how executors of estates get paid in Texas in our detailed guide.

The Weight of Fiduciary Duty and Personal Liability

With the authority of an executor comes a profound legal obligation known as a fiduciary duty. This is the highest standard of care recognized by law. In plain English, it means you must act solely in the best interests of the estate and its beneficiaries at all times. You must be loyal, careful, and impartial in every decision you make.

Violating this duty, even unintentionally, can have serious consequences. If your actions (or inaction) cause a financial loss to the estate, you could be held personally liable, meaning you might have to use your own money to correct the mistake.

Common errors that can lead to personal liability include:

- Paying Debts in the Wrong Order: Texas law sets a specific priority for paying creditors. If you pay a low-priority debt (like a credit card bill) before a high-priority one (like funeral expenses) and the estate runs out of money, you have breached your duty.

- Failing to Protect Assets: Allowing property to fall into disrepair, lose value from neglect, or go uninsured can expose you to liability.

- Self-Dealing: Using your position for personal gain, such as selling estate property to yourself for less than its market value, is strictly forbidden.

Key Insight

Think of your fiduciary duty as your legal and moral compass. The surest way to navigate these duties correctly, protect the estate’s assets, and shield yourself from personal financial risk is to partner with an experienced probate attorney from the very beginning. An attorney can provide step-by-step guidance, ensuring compliance with the Texas Estates Code and helping you honor your loved one’s wishes without fear of personal liability.

Wrapping It All Up: Your Role as a Texas Executor

Stepping into the role of an executor is a significant responsibility, but it doesn’t have to be an overwhelming burden. Think of it as a final act of service for someone you cared for. While the duties of an executor of an estate can seem complex, they are manageable with a clear plan and the right support.

Your job boils down to a handful of core tasks:

- Find and secure every asset—from the house to savings bonds.

- Settle all legitimate debts and taxes owed by the estate.

- Keep the beneficiaries informed with clear, honest communication.

- Once all obligations are met, distribute what remains according to the will.

Getting legal help is the smartest move a responsible executor can make. Working with a probate attorney shields you from personal liability, ensures you are honoring your loved one’s final wishes to the letter, and makes the entire Texas probate process far less stressful. It is an investment in doing the job with confidence and care.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.

Burning Questions: Your Executor Duties FAQ

When you’re named an executor, questions arise almost immediately. Here are some of the most common questions we hear from Texas families, with straight answers to help you see the path forward with reassurance.

How Long Is This Going to Take? The Timeline for Settling an Estate in Texas

Every family wants to know this, but the honest answer is: it depends. A very straightforward estate, where the will is clear and all beneficiaries are in agreement, can often be settled in about 9 to 12 months.

However, complications can extend the timeline. Factors that can slow the process include:

- Selling a house or a family business.

- Family disagreements or disputes between beneficiaries.

- Complex creditor claims or tax situations that need to be resolved.

In these more involved cases, it’s not unusual for the process to take 18 months or even longer. Patience and meticulous attention to detail are key.

Am I Personally on the Hook for the Estate’s Debts?

Generally, no—you will not have to use your own money to pay the estate’s bills. The estate’s assets are used to cover its liabilities.

However, you can be held personally liable if you mismanage the estate. For example, if you distribute inheritances to heirs before paying all known creditors, or if you pay debts out of the legally required order, you could be held responsible. This is why following the Texas Estates Code is not just a suggestion; it’s your protection.

What if a Beneficiary Starts Fighting with Me?

First, stay calm and rely on your records. Most disagreements arise from misunderstandings or a lack of information. Your best defense is transparent communication backed by the meticulous records you’ve been keeping. Often, simply showing someone the numbers or explaining the legal requirements can resolve the issue.

When clear communication doesn’t work and a disagreement escalates, you may be heading toward court intervention. Seeking guidance from a firm experienced in Probate Litigation is essential to protect the estate’s assets, yourself, and your role as executor.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.