Losing a loved one is hard enough without the added stress of navigating the legal system and worrying about money. One of the first and most practical questions families face is, "What is the real cost to probate a will in Texas?" It's a critical concern, and we want to provide you with clear, reassuring answers.

The cost isn't a single, fixed number. It's best to think of it as a spectrum. A simple, well-organized estate will be on the lower end, while a complex estate with family disagreements or complicated assets will cost significantly more. Our goal is to demystify these expenses so your family can feel prepared and in control during a difficult time.

Understanding the True Cost to Probate a Will in Texas

When someone passes away, "probate" is the formal court process required to validate their will and settle their final affairs. For families in Texas, understanding the financial side of this process can feel overwhelming. The good news is that probate costs are made up of specific, identifiable fees that depend entirely on the unique circumstances of your loved one's estate.

A few key factors will determine the final bill:

- The Complexity of the Estate: An estate with a clear will, a few beneficiaries, a family home, and a bank account will be far less expensive to probate than one involving business partnerships, multiple properties, or out-of-state investments.

- The Type of Probate Administration: The Texas probate process is not one-size-fits-all. A straightforward "independent administration," where the executor can act without constant court supervision, costs much less than a "dependent administration," which requires a judge's approval for nearly every action.

- Potential for Disputes: This is the most significant variable. Unfortunately, disagreements among heirs can escalate into formal probate litigation. A contested will or a dispute over asset distribution can cause legal fees to rise dramatically.

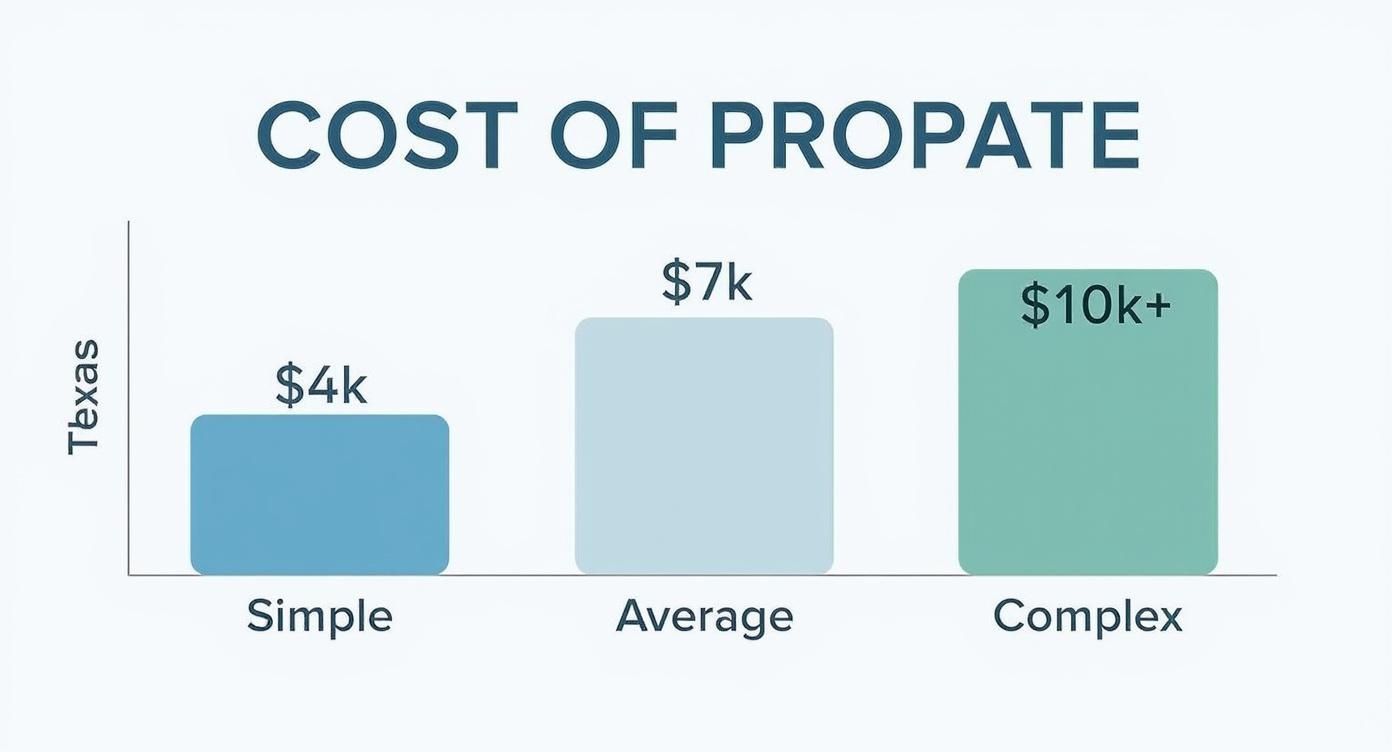

This infographic provides a general overview of what to expect.

As you can see, a simple probate might start around $4,000, but complex cases can easily push past $10,000. Historically, the average cost has landed somewhere in that $4,000 to $10,000 range, a wide gap that reflects just how much circumstances can vary.

To give you a clearer picture, let's look at a breakdown of where that money goes.

Estimated Breakdown of Texas Probate Expenses

This table provides a quick overview of the typical costs associated with probating a will in Texas, from simple to complex estates.

| Expense Category | Typical Cost for Simple Estate | Potential Cost for Complex Estate |

|---|---|---|

| Attorney's Fees | $2,500 – $4,000 | $5,000 – $15,000+ |

| Court Filing Fees | $300 – $500 | $400 – $600+ |

| Executor Compensation | Often waived or minimal | 5% of estate value or court-approved fee |

| Miscellaneous Costs | $200 – $500 | $1,000+ |

| Total Estimated Cost | $3,000 – $5,000 | $6,400 – $16,600+ |

Keep in mind these are just estimates. Every estate is different, and unexpected issues can always arise.

This guide will walk you through each of these cost components one by one. Our goal is to arm you with knowledge, explain the process in plain English, and help you make the best financial decisions for your family.

Breaking Down Probate Attorney Fees

When families start looking into the cost to probate a will in Texas, attorney fees often feel like the largest and most unpredictable piece of the puzzle. We believe in transparency and want to pull back the curtain on how lawyers charge for their services so you can make a confident, informed choice. Let's take the mystery out of legal billing and empower you to find the right support for your family.

In Texas, probate attorneys generally use one of three common billing structures. Each has its pros and cons, which depend heavily on the complexity of your loved one's estate.

Common Fee Structures Explained

Choosing the right payment model isn't just about the final number—it's about predictability and peace of mind during an already stressful time. Here’s a straightforward breakdown of what you're likely to encounter:

- Flat Fee: This is a single, all-inclusive price to handle the entire probate from start to finish. It’s an excellent option for simple, uncontested estates where an attorney can accurately predict the amount of work involved. This provides complete cost certainty.

- Hourly Rate: The attorney bills for their time, typically in small increments (e.g., tenths of an hour). This model is common for estates with potential complications, such as business assets, significant debts, or the possibility of family disagreements.

- Percentage Fee: While less common for probate today, some attorneys might charge a percentage of the estate's total value. The Texas Estates Code is very clear that all attorney fees must be "reasonable," and courts scrutinize percentage-based fees to ensure they are fair to the estate.

Real-World Scenarios

Let's illustrate this with a realistic example. Imagine the Miller family's situation. Their father left a clear, well-drafted will, and his assets consisted of a house, a car, and a retirement account with designated beneficiaries. His financial records were impeccable. Their attorney could confidently offer a flat fee because there were no red flags or foreseeable disputes. The family knew the exact cost upfront.

Now, consider an estate involving a family-owned restaurant and vague instructions in the will. The attorney couldn't possibly know how much time would be needed to get a business valuation or negotiate with beneficiaries who disagreed on the restaurant's future. In that case, an hourly rate was more appropriate, offering the flexibility to address complex issues as they arose. For a more detailed look at how these factors play out, check out our guide to probate attorney fees in Texas.

What to Expect for Legal Costs

It's helpful to approach this with a realistic budget in mind. Probate attorney fees in Texas have risen over the last decade. It's now common to see hourly rates between $400 and $900, depending on the lawyer's experience and location.

This means that even a relatively standard probate case, which might require 10 to 20 hours of legal work, could easily result in attorney fees of $4,000 to $8,000 or more.

The best path forward is always an open and honest conversation with any attorney you're considering. Discuss their fees, your estate’s specific situation, and what you can expect before signing any agreement.

Digging Into Court and Administrative Costs

Beyond legal guidance, every probate case involves court and administrative fees. While these costs are usually much smaller than attorney fees, they are a mandatory part of the total cost to probate a will in Texas. Understanding them early helps create a clear financial picture from the start.

Think of these as the required filing and processing expenses needed to settle the estate under the court's authority. The good news is they are predictable and essential for moving the case forward.

A Checklist of Common Expenses

To avoid surprises, it helps to see these costs broken down. While exact amounts can vary slightly by county, here’s what you can generally expect to pay during the probate process.

-

Court Filing Fees: This is the first fee you'll encounter. It's paid to the county clerk to officially open the probate case. In most Texas counties, this initial fee is between $300 and $500. It covers the administrative work of docketing the case and maintaining the court's official records.

-

Letters Testamentary Costs: Once a judge validates the will, the court issues a critical document called Letters Testamentary. This is the executor's official "permission slip"—it's the proof they need to act on the estate's behalf (like accessing bank accounts or selling property). The court charges a small fee, often just a few dollars, for each certified copy.

-

Notice to Creditors Fee: Texas law is specific on this point. The Texas Estates Code requires the executor to publish a notice in a local newspaper. This formally notifies potential creditors that the estate has been opened and gives them a deadline to submit claims. This cost typically falls between $100 and $200, depending on the newspaper’s rates.

Other Potential Administrative Costs

Some estates incur extra expenses, usually depending on the assets involved. For instance, if the estate includes real estate, valuable art, or a family business, you'll likely need a professional appraisal to determine its fair market value for the court and for tax purposes.

Additionally, some situations may require the executor to post a bond. A bond is an insurance policy that protects the estate’s assets from mismanagement or fraud. You can learn more about when a bond is required in Texas probate to see if this might apply to your situation. These costs are not universal, but they are important to factor into your budget if they become necessary.

Understanding Executor Fees and Other Expenses

Beyond attorney and court fees, a few other costs can arise during probate. Many families are surprised to learn that the person managing the estate—the executor—is legally entitled to be paid for their time and effort. This fee, along with other miscellaneous charges, is paid directly from the estate's assets before any inheritances are distributed.

An executor's role is significant. They are responsible for everything from inventorying assets and paying debts to communicating with beneficiaries and distributing property according to the will. It’s a role with serious legal duties, which you can learn more about in our guide on the executor's roadmap and duties under Texas probate law.

How Executor Compensation Works

To ensure fairness, the Texas Estates Code provides a standard method for calculating executor compensation. Understanding this is key for both the executor and the heirs.

Under Texas Estates Code § 352.002, an executor is generally entitled to a commission of five percent (5%) on all cash they actually receive and another five percent (5%) on all cash they pay out in the course of managing the estate.

This is often called the "five-on, five-off" rule. It sounds simple, but it's important to know that this fee is based only on cash transactions. It does not apply to non-cash assets like a house or stocks that are transferred directly to an heir. It also excludes cash that was already in a bank account at the time of death.

A Practical Example of Executor Fees

Let’s see how this works in a real-world scenario. Imagine an executor takes these steps to settle an estate:

- Sells the decedent's car for $20,000 (cash received).

- Sells stocks, generating $80,000 (cash received).

- Uses the funds to pay a $30,000 credit card bill (cash paid out).

- Pays a final $5,000 medical bill (cash paid out).

The total cash flow is $135,000 ($100,000 received + $35,000 paid out). The executor's statutory fee would be 5% of that total, which is $6,750.

For larger estates with many transactions, these fees can be substantial. An estate with $500,000 in cash transactions could result in a $25,000 executor fee.

Other Potential Estate Expenses

Finally, a few other costs might surface during the process, depending on the estate's assets and complexity.

- Bond Premiums: If the will doesn't waive the bond requirement, the court might order the executor to purchase one to protect the estate.

- Property Maintenance: Until a house is sold or transferred, someone has to pay for utilities, property taxes, insurance, and necessary repairs.

- Professional Fees: For complex estates, the executor may need outside help. This could mean hiring an accountant for final tax returns or an appraiser for unique assets like a business or art collection.

A well-drafted will often addresses these issues, providing clear instructions that help minimize costs and confusion.

What Makes Probate More Expensive

While many estates move through probate smoothly, certain factors can create complications that significantly drive up the cost to probate a will in Texas. Think of a simple probate as a straight path. Certain issues can twist that path into a difficult trail filled with unexpected and costly obstacles.

Knowing these potential roadblocks can help your family prepare for—and perhaps even prevent—needless expenses and delays. Nearly every complication increases the amount of an attorney's time required, which in turn increases the final cost.

Will Contests and Family Disputes

Without a doubt, the single biggest factor that inflates probate costs is conflict among family members. When a beneficiary or heir challenges the will's validity, it triggers a formal lawsuit known as probate litigation.

This isn't a simple disagreement; it's a legal battle within the probate case itself. These contests often arise from serious claims, such as undue influence (that someone manipulated the deceased), lack of testamentary capacity (that the deceased wasn't of sound mind), or even forgery.

The result is an emotionally draining and financially expensive process involving depositions, document discovery, and multiple court hearings—all of which generate significant legal fees.

Complex or Hard-to-Value Assets

The nature of the estate's assets can also complicate the process. Valuing a bank account is simple. But some assets are much harder to price, almost always requiring specialized professionals and adding another layer of expense.

Common examples of complex assets include:

- A Family-Owned Business: Determining a private company's fair market value requires hiring a business valuation expert.

- Commercial Real Estate or Farmland: Appraising unique properties is more involved than a standard residential appraisal and requires a specialist.

- Collections of Art, Antiques, or Intellectual Property: These unique assets require expert appraisers to determine their value for the estate.

For instance, if an estate includes a small construction company, the executor must hire a professional to analyze financial records, assess equipment, and evaluate the company's market position. That step alone can add thousands to the administrative costs.

Other problems that can drag out the timeline and increase costs include tracking down unknown heirs or dealing with substantial estate debt. An attorney may need to hire a genealogist to find a missing relative or spend hours negotiating with creditors. Each task adds billable hours, directly impacting the final cost.

Common Factors Affecting Probate Costs

| Factor | Impact on a Simple Estate | Impact on a Complex Estate |

|---|---|---|

| Family Harmony | Beneficiaries are cooperative; process moves quickly. | Frequent disputes or a formal will contest leads to litigation, significantly increasing fees and delays. |

| Asset Types | Assets like cash, stocks, and a primary home are easy to value and distribute. | Includes a family business, art collections, or commercial real estate requiring expert appraisals and more administrative time. |

| Will Clarity | The will is clear, valid, and self-proven, leaving no room for interpretation. | The will is ambiguous, outdated, or poorly drafted, inviting challenges and requiring court interpretation. |

| Heir Location | All heirs are known and easily reachable. | Heirs are missing, unknown, or located internationally, requiring extensive searches and legal notices. |

| Estate Debts | Minimal and straightforward debts are paid quickly. | Significant debts, tax issues, or creditor lawsuits require lengthy negotiations and potential litigation. |

When several of these complex factors are present, costs can escalate quickly, turning what could have been a simple process into a lengthy and expensive legal battle.

Actionable Steps to Manage Probate Costs

Navigating probate can feel overwhelming, but you have more control over the final cost than you might think. By taking a few proactive steps, your family can manage expenses, protect the estate’s value, and ensure your loved one’s legacy is handled with care and respect.

Knowledge and preparation are your strongest allies. This section provides practical strategies to keep the cost to probate a will in Texas as low as possible. Small actions at the beginning can prevent massive expenses down the road.

Proactive Strategies for Executors and Families

Being organized and communicative from day one is the single best thing an executor can do. These steps will help you sidestep common traps that drive up costs and cause frustrating delays.

-

Gather Documents Early: Before meeting with an attorney, collect the original will, the death certificate, and a basic list of known assets (bank accounts, property deeds) and debts (mortgages, credit cards). Being prepared saves your lawyer's time, which saves the estate money.

-

Foster Open Communication: Keep all beneficiaries informed about the process and major decisions. Transparency builds trust and can prevent a simple misunderstanding from escalating into expensive probate litigation. A quick phone call or email can often defuse tension before it starts.

-

Explore Simpler Alternatives: Not every estate requires a full, formal probate. Discuss options with your attorney, such as a "Muniment of Title," which can be a much faster and cheaper route if the estate has no debts. Another potential avenue is a Small Estate Affidavit for smaller estates.

Key Insight: The Power of Proactive Planning

The most effective tool for minimizing probate costs is proactive estate planning, completed long before it's needed. A well-constructed plan using legal tools like Wills & Trusts and proper beneficiary designations can simplify administration, clarify wishes, and even help your family avoid the court system entirely for many assets. This foresight is the greatest gift one can leave their family, ensuring a smoother transition during a difficult time.

By implementing these strategies, you can navigate the Texas probate process with confidence, honoring your loved one’s final wishes without unnecessary financial strain.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.

Your Top Questions About Texas Probate Costs, Answered

When families begin the probate journey, financial questions naturally arise. It's completely normal to feel uncertain. Here, we answer some of the most common concerns we hear from Texas families.

Can The Estate Pay for Probate Costs Directly?

Yes, absolutely. In fact, that's how the system is designed to work. All legitimate expenses related to the cost to probate a will in Texas—including court filing fees, attorney's fees, and any approved executor compensation—are paid directly from the estate's assets.

The estate settles its administrative bills first. Only after these costs are covered can the remaining property and funds be distributed to the beneficiaries named in the will. This ensures the process is properly funded from start to finish.

What Happens If The Estate Has No Money?

This is a challenging but important question. If an estate lacks sufficient cash to cover probate costs, other assets may need to be sold to generate the necessary funds. This could involve selling a vehicle, real estate, or other valuable property.

In some cases, an estate may be "insolvent," meaning its debts exceed its assets. When this occurs, a traditional probate may not be the right path, and different legal procedures under the Texas Estates Code are used to prioritize and pay creditors.

Is It Possible To Probate a Will Without a Lawyer?

While technically possible for the simplest procedures (like a Small Estate Affidavit), attempting to probate a will without legal counsel is almost always ill-advised. The Texas probate process is governed by strict legal requirements, deadlines, and procedures that are easy to miss.

Most Texas courts require an attorney to represent the executor in a formal probate. This is not just a formality; it's a critical safeguard. Having an experienced probate attorney ensures that all laws are followed correctly, protecting the executor from personal liability and shielding the beneficiaries and creditors from costly mistakes.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.