When you're grieving a loved one, the last thing you want is to discover a will that feels wrong. Whether it seems unfair, suspicious, or completely out of character for the person you knew, this discovery can add a profound layer of distress to an already painful time. You might feel certain the document doesn’t reflect their true wishes, but in Texas, simply disagreeing with a will isn’t enough to challenge it in court.

We understand how sensitive and confusing this situation can be. The legal process of challenging a will's validity is called a will contest. In simple terms, it’s a lawsuit arguing that a will is legally invalid. To begin, you must have valid legal grounds and file your challenge within a strict two-year deadline after the will is admitted to probate—the official court process of validating a will. But before any of that, you have to clear the very first hurdle: proving you have the right to object in the first place.

Who Can Challenge a Will in Texas?

Texas law is very specific about who gets to step into a courtroom and question a will. This legal right is called “standing,” and it's the gatekeeper to the entire will contest process. Think of it as having a valid ticket to enter the arena. If you don't have standing, the court will dismiss your case without ever hearing your arguments, no matter how strong they are.

So, who qualifies?

The "Interested Person" Requirement

The Texas Estates Code, specifically Title 2, gives standing only to an “interested person.” This isn't a casual term; it's a legal definition with a very narrow focus. It doesn't include everyone who knew and loved the deceased, which can be a difficult concept to grasp during a time of loss.

To be an "interested person," you must have a direct financial stake in the estate. Your interest has to be pecuniary—meaning it’s about money or property, not just emotions or family ties.

This means you must be someone who stands to gain financially if the will is thrown out. You either would have inherited property if the will were declared invalid (because Texas law would name you an heir), or you would have received a larger share under a previous, valid will.

A good way to think about it is this: from the court's perspective, without a financial interest, you don't have legal skin in the game.

Who Is an 'Interested Person' Under Texas Law?

This table breaks down the common parties who have the legal standing required for contesting a will in Texas. It's crucial to understand where you might fit in before taking legal action.

| Party | Description of Interest | Example Scenario |

|---|---|---|

| Heirs-at-Law | Individuals who would inherit under Texas intestacy laws if no valid will existed (e.g., spouses, children, parents). | A son is completely left out of his mother's will. As her natural heir, he has standing to contest it because he would inherit if the will is invalidated. |

| Beneficiaries in a Previous Will | Someone named as a beneficiary in an earlier will who was removed or given a smaller share in the current one. | A niece was promised 50% of an estate in a 2015 will, but a 2023 will reduces her share to 10%. She has standing to challenge the newer will. |

| Certain Creditors | A creditor with a valid, legally recognized claim against the estate may have standing in specific situations. | A business partner is owed a significant debt from the deceased's estate, and the new will jeopardizes that payment. |

Understanding these roles is the first step. If you don't fall into one of these categories, your path to contesting a will is likely blocked from the start.

A Realistic Scenario: The Case of the Disinherited Children

Let's put this into a practical scenario. Imagine a father, Robert, who has two adult children, Sarah and Tom. His will, written ten years ago, splits his entire estate equally between them.

In the last year of his life, Robert grows frail and becomes heavily dependent on a new neighbor, David. Just weeks before Robert passes away, a new will is signed. This new document leaves Robert's entire estate to David, completely disinheriting Sarah and Tom.

In this situation, Sarah and Tom are unquestionably "interested persons."

They have standing for two clear reasons: they were the primary beneficiaries in the previous will, and as Robert's children, they are his legal heirs-at-law. If they successfully invalidate the second will, they stand to inherit the estate, either under the terms of the first will or through Texas intestacy laws.

David, as the sole beneficiary of the contested will, is also an interested party. But what about a concerned cousin who was never named in any will? Despite their family connection and genuine concern, they would almost certainly lack the standing to bring a challenge.

You can learn more about the legal loopholes your family might use in our detailed guide.

Valid Grounds for Contesting a Texas Will

Having legal standing is just the first hurdle. Once you've proven you're an "interested person," the real work begins: proving the will itself is invalid for a specific, legally recognized reason.

It’s a tough reality to accept, but in Texas, your personal feelings of unfairness or disappointment don't hold up in court. No matter how justified you feel, the judge needs to see concrete proof that something is legally wrong with the document, as defined by the Texas Estates Code.

This is almost always the hardest part of contesting a will in Texas. The burden of proof falls squarely on your shoulders. You, the contestant, must present clear and convincing evidence that the will doesn't reflect the true, uncoerced intentions of the person who passed away (the testator).

Lack of Testamentary Capacity

For a will to be valid, the person who signed it must have had testamentary capacity. This isn't a medical diagnosis; it's a legal standard. It means that at the exact moment they put pen to paper, they had to understand a few critical things:

- They were signing a will that would give away their property after they died.

- They had a general idea of what property they owned.

- They knew who their closest family members were (what the law calls the "natural objects of their affection," like a spouse and children).

- They understood how these pieces all fit together into a cohesive plan for their estate.

A diagnosis of dementia or Alzheimer's doesn't automatically mean a will is invalid. What matters is the person's mental state at the time of signing.

Here’s a realistic scenario: An elderly father with diagnosed Alzheimer's signs a new will just a few months before his death. His medical records show a steep cognitive decline, and his doctor's notes mention frequent confusion. If this new will completely upends a decades-old estate plan—say, by leaving everything to a brand-new acquaintance—his children have a strong argument that he lacked the mental clarity to understand what he was doing when he signed it.

Undue Influence

Undue influence is a subtle but powerful claim. It happens when someone in a position of trust—a caregiver, a new friend, or even a family member—uses their relationship to pressure or manipulate the testator into creating a will that benefits them.

This isn't just about gentle persuasion. It's about a level of control so complete that it overpowers the testator's own free will. The final document becomes a reflection of the influencer's desires, not the testator's.

Courts are on the lookout for red flags like:

- Isolating the testator from their family and friends.

- Taking control of their finances or mail.

- Threatening to stop providing care or affection.

- Being deeply involved in hiring the lawyer and creating the new will.

Picture this: An elderly woman is completely dependent on her live-in caregiver. The caregiver starts a campaign to poison her against her children, constantly telling her they never visit and don't care. Soon after, the caregiver finds a new lawyer and drives the woman to sign a new will that names the caregiver as the main beneficiary. In court, the children could argue that this will is the product of the caregiver’s undue influence, not their mother’s genuine wishes.

Improper Execution

The Texas Estates Code is incredibly strict about how a will must be signed and witnessed. This is called due execution. To be a valid, formal Texas will, it must be:

- In writing.

- Signed by the testator (or by someone else signing for them, in their presence and at their direction).

- Attested by two credible witnesses, both at least 14 years old, who sign the will in the testator's presence.

If these steps aren't followed to the letter, the will can be thrown out. We have seen contests succeed because only one witness signed, or because the witnesses added their signatures a week after the testator did. These seemingly small mistakes can invalidate the entire document. You can learn more about the specific factors that can invalidate a will in Texas in our detailed article on the topic.

Fraud or Forgery

Finally, a will can be challenged if it was born from fraud or outright forgery. These grounds might seem the most straightforward, but they often require significant evidence to prove.

- Forgery is simple: someone faked the testator's signature on the will.

- Fraud is more deceptive: the testator was tricked into signing the document. For instance, they were led to believe they were signing a routine financial document, like a power of attorney, when it was actually a will.

The Will Contest Process from Start to Finish

Facing a legal battle over a loved one's will can feel like navigating a maze during an already painful time. The process for contesting a will in Texas isn't a single event but a series of structured steps, each with its own purpose. Knowing the roadmap ahead can take some of the mystery out of the journey and give you a clearer sense of what to expect.

It all starts not with a family argument, but with a formal legal filing.

Step 1: Filing the Petition and Serving Notice

The first real step is filing a legal petition with the proper probate court. This isn't just a generic form; it's a detailed document drafted by your attorney that officially kicks off the will contest. It has to clearly state who you are, why you qualify as an "interested person," and lay out the specific legal grounds you're using to challenge the will's validity.

Once that petition is on file with the court, the next step is called "citation." This is a critical requirement under the Texas Estates Code. A citation is the formal legal notice that goes out to all the other interested parties—think the executor named in the will and every other beneficiary. This ensures everyone gets a fair heads-up that a lawsuit has been filed and has a chance to participate.

Step 2: The Discovery Phase: Uncovering the Facts

With the initial paperwork out of the way, the case moves into the discovery phase. This is often the longest and most important stage of the entire fight. It's where your legal team digs in and gathers the evidence needed to prove your case. You can think of it as a court-sanctioned investigation.

During discovery, your attorney has several powerful tools at their disposal:

- Depositions: These are formal, sworn interviews conducted outside of court. Your lawyer might depose the caregiver you suspect of undue influence, the witnesses who signed the will, or even the attorney who drafted it to ask tough questions under oath.

- Requests for Production: This is a legal demand that forces the other side to hand over relevant documents. We're talking about the testator's medical records, bank statements, personal emails, and any previous versions of their will.

- Interrogatories: These are written questions that the opposing party is required to answer in writing and under oath.

This entire phase is about methodically piecing together the story of how—and why—the will was created.

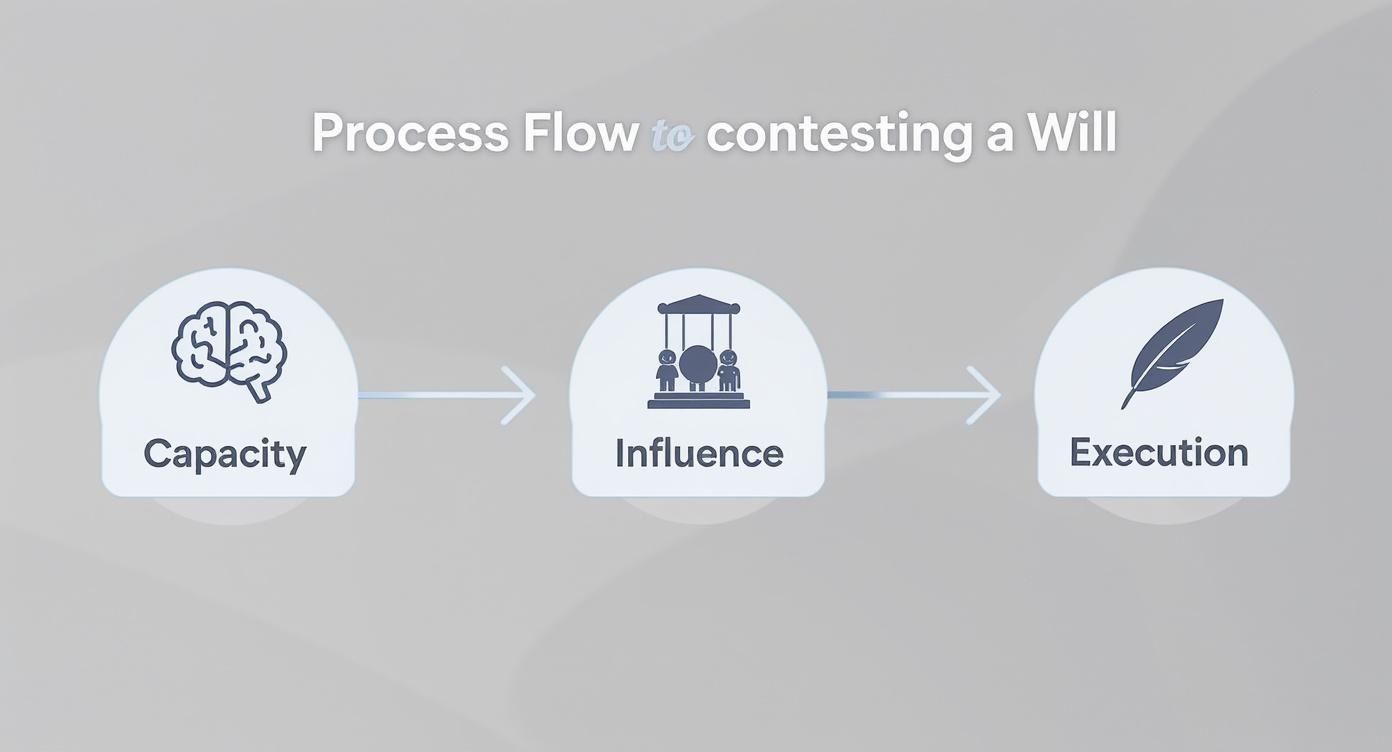

The infographic below highlights the core legal grounds that discovery often focuses on: lack of capacity, undue influence, and improper execution.

As you can see, a successful will contest hinges on proving a fundamental flaw in the will’s creation, whether it was an issue with the testator’s mental state, pressure from others, or a failure to follow legal formalities.

Step 3: Mediation: A Path to Resolution

Before a case ever sees the inside of a courtroom for trial, Texas courts almost always require the parties to try mediation. This is a confidential meeting where a neutral, third-party mediator steps in to help guide a settlement discussion. The whole point is to find a middle ground that everyone can live with, avoiding the time, expense, and emotional drain of a trial.

Mediation is a huge opportunity to resolve the fight on your own terms. A successful session results in a legally binding settlement agreement that ends the lawsuit for good and helps the family start to move on.

Step 4: What Happens at Trial

If mediation doesn't work out, the will contest moves on to trial. This is where both sides present their evidence, call witnesses to the stand, and make their legal arguments to a judge or jury. The contestant—that’s the person challenging the will—has the burden of proof. It's up to you to convince the court that the will is invalid.

After hearing everything, the court will issue a final ruling. If you win, the will is thrown out. If you lose, the will is upheld, and the probate process moves forward according to its original terms. The entire Texas will contest process is complex and demands a sharp legal strategy from the first filing to the final verdict.

Understanding the Strict Two-Year Deadline

When you’re thinking about contesting a will in Texas, the single most important factor is the clock. Texas law imposes a strict, non-negotiable timeline known as the statute of limitations. It’s an unforgiving legal deadline, and understanding it is absolutely critical to protecting your rights.

You have a very specific window of opportunity to file your challenge. In Texas, that window is exactly two years. This isn’t a suggestion or a loose guideline; it's a hard-and-fast rule that probate courts enforce with zero flexibility.

When Does the Two-Year Clock Start Ticking?

Here's where many people get tripped up. The two-year countdown doesn't begin on the day your loved one passes away or even when you first get a copy of the will. The clock officially starts ticking on the day the will is formally "admitted to probate."

This is a specific legal event where a judge officially recognizes the will as valid, which kicks off the entire Texas Probate Process.

Let's use a real-world example. If a will is admitted to probate on June 1, 2024, any legal contest has to be filed in court on or before June 1, 2026. Waiting until June 2nd is too late. The court would almost certainly dismiss your case, no matter how strong your evidence is.

This strict enforcement means that even if bombshell information comes to light after the deadline passes, the door to challenge the will is usually slammed shut forever. You can explore how some of these deadlines apply to Wills & Trusts in more detail on our site.

The Very Limited Exception for Fraud

While that two-year rule is nearly absolute, the law does carve out one extremely narrow exception: fraud or forgery that was impossible to discover within that two-year period. It sounds like a potential lifeline, but the legal standard for proving it is incredibly high.

To even have a chance at qualifying for this exception, you must prove two things:

- The will was the result of a deliberate fraud or forgery.

- You could not have possibly discovered this fraud through reasonable diligence before the two-year deadline expired.

Why You Cannot Afford to Wait

The reality of this deadline creates a genuine sense of urgency. Waiting around to see how the estate administration plays out or hoping for an amicable resolution can be a catastrophic mistake. Evidence gets lost, memories fade, and that two-year clock keeps ticking relentlessly.

This is exactly why you need to find out how long you have to contest a will and act fast. Seeking immediate legal advice from an experienced Probate Litigation attorney isn't just a good idea—it's essential for protecting your inheritance rights before it's too late.

What Happens After a Successful Will Contest

Winning a will contest is a huge legal victory, but it immediately begs the question: what now? When a court declares a will invalid, it's legally void—as if it never existed. But that doesn't mean the estate’s assets are suddenly up for grabs.

Instead, the court's decision kicks off a new process to figure out how the property should be distributed. The entire outcome hinges on one critical factor: whether there's an older, valid will waiting in the wings.

The Role of a Previous Will

If the deceased had a legally sound will from an earlier date, the court will almost always revert to that document. This is a common outcome in cases where a recent will was thrown out due to undue influence or the testator's lack of mental capacity. The court simply goes back to the last will that was considered valid.

Think of it this way: your father’s original 2010 will split his estate equally between you and your sister. But just before he passed away in 2023, a new will surfaced leaving everything to a caregiver. If you successfully contest that 2023 will, the court will likely probate the 2010 will, and the estate gets divided exactly as it originally intended.

When There Is No Other Will

But what if the will you just invalidated was the only one ever made? Or what if any previous wills were also invalid or had been formally revoked? In that case, the estate is considered "intestate."

It's a legal term that simply means the person died without a valid will. When that happens, the Texas Estates Code steps in with a default plan for dividing the property. These rules, known as the laws of intestate succession, distribute assets to the deceased’s closest living relatives in a specific, predetermined order. This is a crucial part of the overall Texas Probate Process.

How Intestacy Law Divides an Estate

Texas intestacy laws can get complicated, especially when distinguishing between community property (assets acquired during a marriage) and separate property (assets owned before marriage or received as a gift or inheritance). The distribution rules shift based on which family members survive the deceased.

Understanding these scenarios is vital before you even start a will contest. A victory could lead to a distribution that’s far from what you expected, and it can also impact related matters like Guardianship for any minor children.

The table below gives you a simplified look at how property is divided in a few common situations.

Texas Intestacy Rules: A Simplified Overview

This table breaks down how an estate is distributed if a will is invalidated and no prior valid will exists.

| Deceased's Surviving Relatives | How Community Property Is Divided | How Separate Property Is Divided |

|---|---|---|

| Spouse and Children (from that spouse) | 100% to the surviving spouse. | 1/3 to the surviving spouse; remaining 2/3 is split among the children. |

| Spouse and Children (from a prior relationship) | Deceased's 50% share goes to the children; the surviving spouse keeps their 50%. | 1/3 to the surviving spouse; remaining 2/3 is split among the children. |

| Children, No Spouse | Not applicable (no community property). | 100% is divided equally among the children. |

| Spouse, No Children, No Parents | 100% to the surviving spouse. | 100% to the surviving spouse. |

As you can see, the financial outcome of a successful will contest varies dramatically based on family structure and the type of assets involved. This really drives home why it's so important to have a clear legal strategy from day one—one that accounts for every possible result of the probate litigation.

Answering Your Top Questions About Texas Will Contests

Stepping into the probate process always stirs up a lot of questions, especially when you're thinking about taking the serious step of contesting a will. Let's tackle some of the most common concerns families have during this difficult time.

How Much Does It Cost to Contest a Will?

This is the million-dollar question, and the honest answer is: it depends entirely on the case's complexity. There's a world of difference between a straightforward dispute that's resolved quickly in mediation and a bitter family fight that ends up in a full-blown trial.

A few key factors will drive the cost up or down:

- The sheer amount of evidence that needs to be collected during the discovery phase.

- Whether we need to bring in expert witnesses, like doctors to testify about mental capacity or handwriting analysts to look at signatures.

- How aggressively the other side decides to fight back.

The good news is that many probate litigation attorneys handle these cases on a contingency fee basis. This means you don't pay them by the hour. Instead, they only get paid if you win, taking a percentage of the assets you recover.

Can a "No-Contest" Clause Stop Me from Filing?

You've probably heard of a "no-contest clause," sometimes called an in terrorem clause. It's a provision written into a will that says if a beneficiary challenges the will and loses, they forfeit whatever inheritance they were supposed to get. It’s a tool testators use to scare off frivolous lawsuits.

But here’s the critical part: under the Texas Estates Code, these clauses aren't ironclad. If you file a will contest in "good faith" and with "just cause," the court won't enforce that penalty clause against you, even if you don't win. This legal protection allows people with legitimate concerns to have their day in court without the fear of being automatically cut out.

What Happens If I Lose the Will Contest?

If you challenge the will and the court doesn't rule in your favor, the will is officially declared valid. From there, the probate process moves forward exactly as the will dictates. The executor will get back to the business of gathering assets, paying off any debts, and distributing the property to the beneficiaries listed in the document.

This is also where the no-contest clause can come back into play. If the will had one, and the court determined your challenge was not brought in good faith, you could lose your original inheritance. This is precisely why it's absolutely essential to build a strong, evidence-based case before you ever set foot in a courtroom for probate litigation.

Key Takeaway: Don't Go It Alone

The road to contesting a will in Texas is, without a doubt, a tough one. It's legally complex, emotionally draining, and not something you should ever attempt to navigate on your own. Your entire case rests on three non-negotiable pillars: legal standing, valid legal grounds, and a strict two-year deadline.

Trying to handle this alone is a recipe for disaster. The combination of unforgiving legal deadlines, a high burden of proof, and the emotional turmoil of family conflict makes experienced legal counsel essential. The single most critical step you can take right now is to speak with a seasoned probate litigation attorney who can help you understand your options, protect your rights, and guide you through this difficult process with compassion and expertise.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.