Yes, you absolutely can revoke a Power of Attorney (POA) in Texas. As long as you have the mental capacity to fully grasp your decision, you hold the power to cancel this important document. This legal “off switch” is a critical safeguard, ensuring you always remain in control of your own affairs.

Life changes, and the person you trusted to act on your behalf years ago may no longer be the right choice. Revoking a POA isn’t an admission of a mistake; it’s a responsible step to align your legal documents with your current reality.

Your Right to Reclaim Control in Texas

Granting someone Power of Attorney is an act of trust. But circumstances can shift—an agent may move away, a relationship may sour, or you may simply find someone better suited for the role. Texas law recognizes that the person who grants the power—known as the principal—must always have the right to take it back.

This guide will walk you through the process, providing step-by-step guidance based on the Texas Estates Code. We aim to give you clarity and reassurance, helping you navigate this decision with confidence.

The Importance of Mental Capacity

There is one critical requirement to revoke a POA: you must have the mental capacity to make the decision. In plain English, this means you must fully understand what you are doing.

You need to be able to grasp:

- What a revocation document is and what it accomplishes.

- The specific powers you are taking back from your agent.

- The real-world consequences of that person no longer acting for you.

This isn’t a legal hurdle; it’s a protection. It ensures that the choice to change your legal arrangements is made with a clear mind, free from confusion or outside pressure, especially during a vulnerable time.

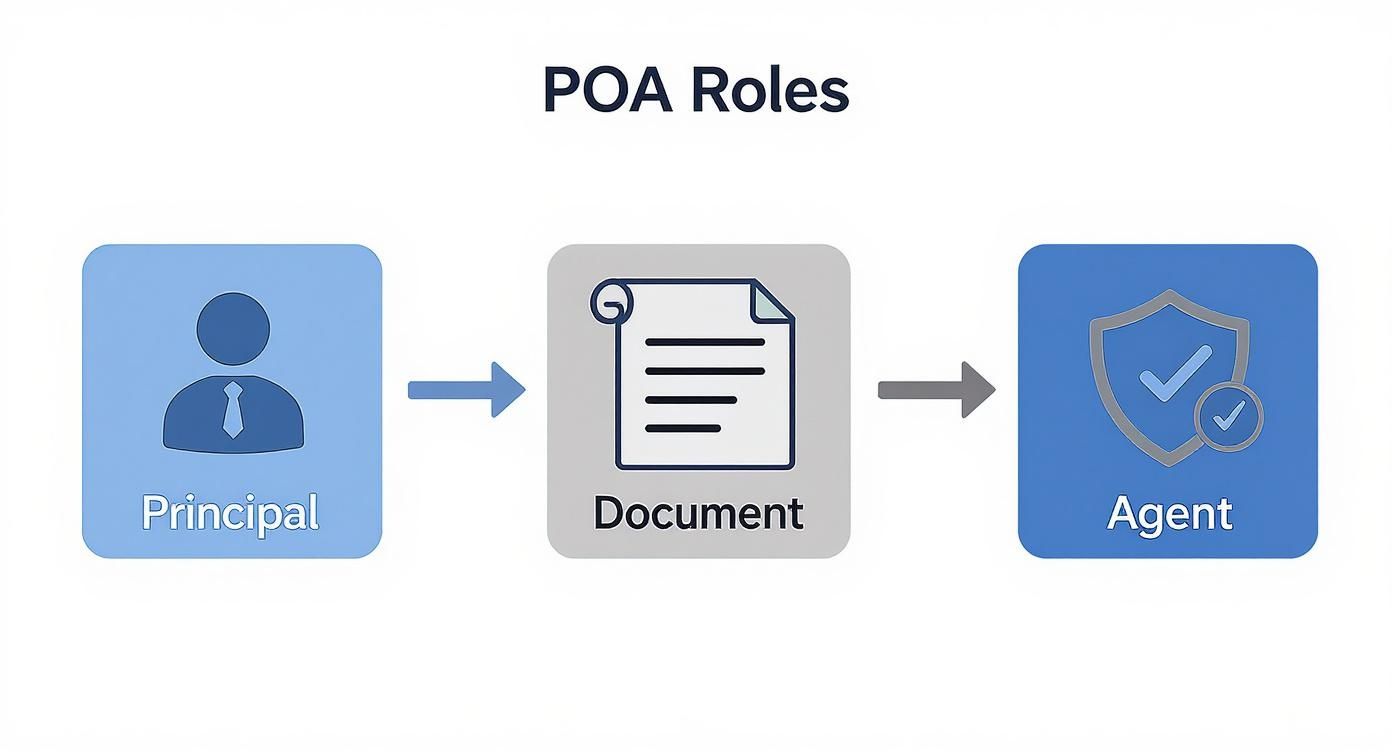

Understanding the Document You Want to Revoke

Before revoking a Power of Attorney, it’s important to understand what it does. A POA is a legal document where you, the principal, give another person, your agent, the authority to act on your behalf in certain matters. Think of it as officially authorizing a trusted individual to handle your affairs when you cannot.

The authority you grant can be broad, covering all financial decisions, or narrowly defined for a single task, like selling a specific property. You set the terms in the original document. For a deeper dive, you can learn more about what a Power of Attorney entails in our detailed guide.

Durable vs. General Power of Attorney

Understanding the type of POA you have is essential, as the distinction changes how it functions. The key difference lies in one word: durable.

- General Power of Attorney: This type of POA automatically ends if you, the principal, become incapacitated and can no longer make your own decisions.

- Durable Power of Attorney: This is the most common type used in estate planning. It is specifically designed to remain in effect even if you become incapacitated. Its primary purpose is to ensure someone you trust can manage your affairs when you are at your most vulnerable.

This distinction is precisely why your mental capacity is the key to revocation. Since a durable POA is built to function when you lack capacity, the Texas Estates Code, Title 2, Subtitle P, requires that you must be mentally competent to override it.

A Realistic Scenario: Why Revocation Becomes Necessary

Consider Sarah, who appointed her brother, Mark, as her agent under a durable POA ten years ago. They were close, and he lived nearby. However, Mark has since moved out of state and developed a gambling problem, falling into significant debt. Sarah, still mentally sharp, is now deeply concerned that Mark might misuse his authority over her finances.

In this situation, Sarah has every right to feel uneasy. The trust that formed the basis of the POA has been broken. For her peace of mind and financial security, she needs to take immediate steps to revoke Mark’s authority and appoint a new, more reliable agent. This scenario highlights how changing life circumstances can make revocation a necessary and prudent decision.

How to Legally Revoke a POA in Texas Step-by-Step

When you decide that an agent is no longer the right person to act for you, it’s time to take clear, methodical steps to legally revoke their authority. While the process in Texas is straightforward, every detail must be handled correctly to ensure the revocation is legally binding and fully protects you and your assets.

Following these steps will ensure your intentions are properly documented and legally sound.

Step 1: Draft a Formal Revocation Document

The first step is to create a new legal document called a Revocation of Power of Attorney. This document doesn’t need complex legal jargon, but it must be clear and direct.

It should include:

- Your full legal name (as the principal).

- The date the original Power of Attorney was signed.

- The full legal name of the agent whose authority you are revoking.

- A clear and unambiguous statement that you are revoking any and all authority previously granted to that agent.

This written declaration is the foundation of the revocation process. It serves as your official notice that the previous arrangement is now void.

Step 2: Sign and Notarize the Revocation

Once the revocation document is drafted, you must sign it in the presence of a notary public. This is a mandatory step in Texas. A notary’s seal verifies your identity and confirms that you signed the document willingly, giving it the legal weight required to be enforced.

A notarized signature transforms your written intention into a legally binding command. Without it, your revocation may not be considered valid by financial institutions or a court.

Step 3: Deliver Notice to Your Former Agent

Signing the document is not enough; you must formally notify the person whose authority you have revoked. You are required to provide a written copy of the signed and notarized revocation to your former agent. This step is critical because, until an agent receives notice, they might legally continue to act on your behalf.

The best way to handle this is to send the notice via certified mail with a return receipt requested. This creates a legal paper trail proving they were informed and on what date.

Step 4: Alert All Relevant Third Parties

Finally, you must inform every person and institution that has a copy of the old POA or has dealt with your former agent. This includes your bank, financial advisors, doctors, insurance companies, and anyone else who may have interacted with your agent on your behalf.

Providing them with a copy of the notarized revocation is crucial. It prevents them from unknowingly accepting your former agent’s instructions, protecting you from unauthorized transactions or decisions made after you have revoked their power.

The Critical Importance of Notifying Everyone Involved

Signing a revocation document is a powerful step, but its legal force doesn’t take full effect until you complete the most crucial part of the process: notifying everyone involved. A revocation that sits in a desk drawer offers no legal protection.

To be effective in Texas, your revocation must be communicated to the right people.

This isn’t just a suggestion; it’s a legal necessity. Your revocation is only binding on your former agent once they have received notice. This is why sending the notarized document via certified mail with a return receipt is the gold standard. It creates an undeniable record of when your agent was officially informed, leaving no room for them to claim ignorance.

Why Notifying Third Parties is a Non-Negotiable Step

Just as important is notifying every third party who has dealt with your former agent. Think of banks, investment firms, healthcare providers, and any other institution with the old POA on file.

Texas law protects these institutions if they act in “good faith” on instructions from an agent they believe still has authority. If they haven’t been informed of the revocation, they are legally permitted to follow that agent’s directions. This creates a dangerous risk, as an ex-agent could potentially act without your permission even after you’ve revoked their authority.

Key Takeaway: A revocation is only as good as its delivery. Notifying your former agent and all third parties is what transforms your private decision into a public, legally enforceable reality, safeguarding your assets and your wishes.

This entire notification process is a critical safeguard against potential abuse or mistakes. Taking the final step of notification closes all legal loopholes and ensures your decision to revoke a POA is final and fully protects your future. For more on this, explore these insights on revoking powers of attorney.

When You May Not Be Able to Revoke a POA

While the law strongly protects your right to revoke a POA, there is one major exception: the loss of mental capacity. This is often the most difficult and emotionally painful situation a family can face.

If the principal is no longer mentally competent—meaning they cannot understand the nature and consequences of their decisions—they legally cannot sign a new revocation document. This is the very scenario a Durable Power of Attorney was designed for. Its purpose is to remain in effect after you become incapacitated, ensuring someone you trusted can manage your affairs.

But what happens if that agent is no longer trustworthy or is not acting in your loved one’s best interests?

When Incapacity Prevents Revocation

If the principal can no longer act for themselves, the power to revoke a POA shifts from them to the courts. Concerned family members cannot simply tear up the old document; they must take formal legal action. This usually involves petitioning a Texas court to establish a Guardianship.

A guardianship proceeding is a legal process where a judge is asked to formally declare the principal incapacitated and appoint a guardian to oversee their personal and financial well-being. If the petition is successful, the judge can terminate the existing POA and transfer that authority to the new guardian. This is a significant legal step, but it is often the only way to protect a vulnerable person from harm or neglect. For more on this, you can learn about the role of a durable power of attorney for health care in similar situations.

Other Rare Exceptions

Beyond incapacity, a few other uncommon situations can complicate revocation.

- POA Coupled with an Interest: This is a rare type of POA where the agent has a personal financial stake in the matter. For example, if a business partner was given a POA to sell a shared property as part of a contract, it may not be unilaterally revocable.

- Court Orders: In some cases, a court may order a POA to remain in effect.

These exceptions are rare, and courts view the removal of an agent as a serious step that requires compelling evidence of misconduct or incapacity. For additional context, you can review some court-ordered POA revocations from this case summary.

Key Insights on Revoking a Power of Attorney

When navigating the complexities of a Power of Attorney, it’s easy to get lost in legal details. The most important principle is also the simplest: as the principal, you are in control. This document exists to serve your interests, and you have the final say. You can revoke a POA at any time, as long as you have the mental capacity to understand your decision.

To ensure your revocation is legally sound and fully protects you, remember these key points:

- Competency is Required: The power to revoke a POA belongs to a principal who is of sound mind and can grasp the consequences of their actions.

- Put It in Writing: A verbal revocation is not enough. The decision must be documented in a formal, written document.

- Notarization is Mandatory: Under Texas law, your signature on the revocation must be notarized to make it official.

- Notify Everyone: The revocation is not complete until your former agent and all relevant third parties—like your bank, doctor, or financial advisor—have received a copy.

A Word of Caution: If your agent resists the revocation, if you are concerned about a loved one’s capacity, or if you suspect financial mismanagement, seek legal advice immediately. These are serious red flags, and your priority must be protecting assets and ensuring your wishes are honored.

Understanding how different legal tools work together is also vital. Knowing the difference between a living will and power of attorney can bring more clarity to your overall estate plan.

Common Questions About Revoking a POA in Texas

Even with a clear process, families often have questions about specific challenges. Addressing these common concerns can provide the confidence needed to move forward.

What if My Agent Refuses to Acknowledge the Revocation?

If an agent ignores your written notice, the certified mail return receipt becomes your most powerful tool. It serves as legal proof that they were officially notified.

If they continue to act on your behalf after receiving notice, their actions could be considered fraudulent. At this point, you should contact an attorney immediately to enforce the revocation, which may require legal action to stop them.

Can I Revoke a POA for a Parent Who Now Has Dementia?

No, you cannot. Only the principal—the person who created the POA—can revoke it, and they must be mentally competent to do so. If your parent now lacks that capacity, you cannot revoke the document on their behalf.

In this challenging situation, your only legal path is to petition a court for a Guardianship. If a judge determines that your parent is incapacitated and the current agent is not acting in their best interest, the court can terminate the POA and appoint a guardian to protect them.

Do I Need a Lawyer to Revoke a POA?

For a simple revocation where the agent is cooperative, you may be able to handle the process yourself. However, legal guidance is essential when the situation is complex or contentious.

Consider seeking legal help if:

- You suspect financial abuse or exploitation.

- The agent is uncooperative or hostile.

- The principal’s mental capacity could be legally questioned.

- The POA involves complex business or real estate matters.

An experienced attorney can navigate these challenges, ensure the revocation is executed properly, and protect your or your loved one’s assets. This expertise is crucial for both effective estate planning with Wills & Trusts and resolving disputes through Probate Litigation.

At The Law Office of Bryan Fagan, PLLC, we understand the sensitive and personal nature of these decisions. Our compassionate attorneys are here to provide clear guidance through every step of the Texas Probate Process.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.