Key Considerations for Probate in Texas

Understanding the key considerations for probate in Texas is essential for individuals navigating the estate settlement process. Factors such as the type of assets, the presence of a will, and the relationships among heirs can significantly impact how probate is handled.

For instance, Texas is a community property state, which means that assets acquired during marriage are generally considered joint property. This can affect inheritance rights and the distribution of assets, making it crucial for individuals to be aware of these legal nuances when planning their estates.

Common Mistakes in Estate Planning

Many individuals make common mistakes in estate planning that can lead to complications during probate. Failing to update wills, not considering tax implications, and neglecting to communicate with heirs are frequent pitfalls that can create disputes and delays.

For example, if a will is not updated after a significant life event such as marriage or the birth of a child, it may not reflect the individual's true intentions. This oversight can lead to legal challenges and increased costs during the probate process, underscoring the importance of regular estate plan reviews.

Probate Alternatives in Texas

Exploring probate alternatives in Texas can provide individuals with more efficient ways to transfer assets without going through the lengthy probate process. Options such as living trusts, joint ownership, and beneficiary designations can simplify asset distribution and minimize court involvement.

For instance, establishing a living trust allows individuals to transfer their assets into the trust during their lifetime, enabling a smoother transition to beneficiaries upon death without the need for probate court. This method not only saves time but can also reduce legal fees associated with probate proceedings.

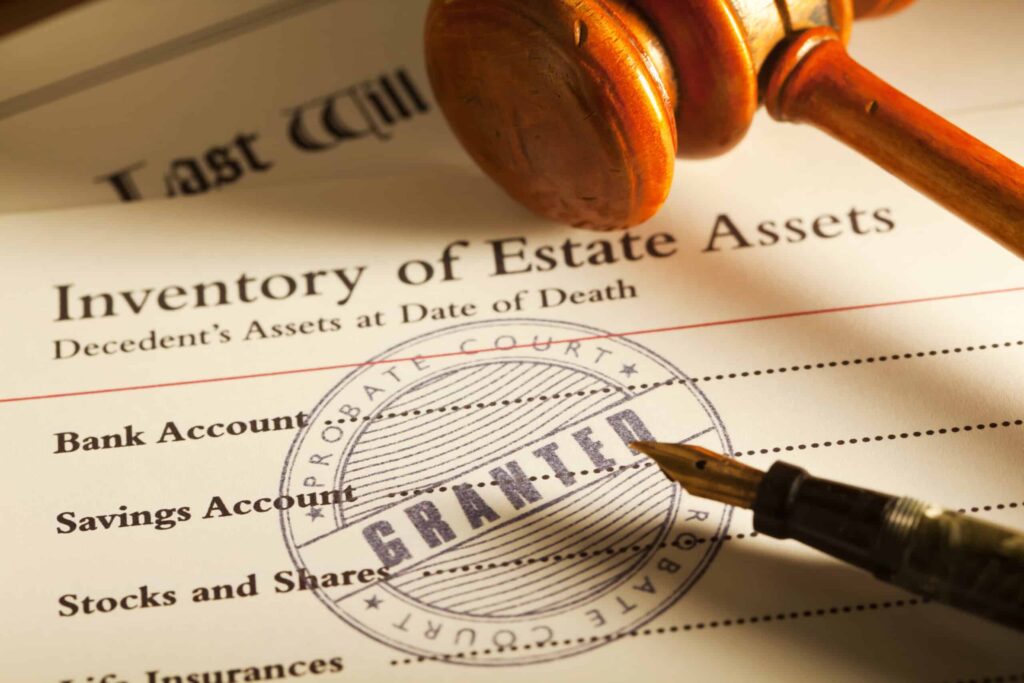

Understanding the Role of Executors in Probate

The role of executors in probate is critical, as they are responsible for managing the deceased's estate and ensuring that the probate process runs smoothly. Executors must gather assets, settle debts, and distribute the remaining property according to the will or state law.

Choosing the right executor is vital, as this individual should possess organizational skills and a good understanding of legal obligations. In Texas, executors can also face challenges such as disputes among heirs or complicated asset valuations, making it essential for them to be well-prepared for their responsibilities.

Key Considerations for Probate in Texas

Understanding the key considerations for probate in Texas is essential for individuals navigating the estate settlement process. Factors such as the type of assets, the presence of a will, and the relationships among heirs can significantly impact how probate is handled.

For instance, Texas is a community property state, which means that assets acquired during marriage are generally considered joint property. This can affect inheritance rights and the distribution of assets, making it crucial for individuals to be aware of these legal nuances when planning their estates.

Common Mistakes in Estate Planning

Many individuals make common mistakes in estate planning that can lead to complications during probate. Failing to update wills, not considering tax implications, and neglecting to communicate with heirs are frequent pitfalls that can create disputes and delays.

For example, if a will is not updated after a significant life event such as marriage or the birth of a child, it may not reflect the individual's true intentions. This oversight can lead to legal challenges and increased costs during the probate process, underscoring the importance of regular estate plan reviews.

Probate Alternatives in Texas

Exploring probate alternatives in Texas can provide individuals with more efficient ways to transfer assets without going through the lengthy probate process. Options such as living trusts, joint ownership, and beneficiary designations can simplify asset distribution and minimize court involvement.

For instance, establishing a living trust allows individuals to transfer their assets into the trust during their lifetime, enabling a smoother transition to beneficiaries upon death without the need for probate court. This method not only saves time but can also reduce legal fees associated with probate proceedings.

Understanding the Role of Executors in Probate

The role of executors in probate is critical, as they are responsible for managing the deceased's estate and ensuring that the probate process runs smoothly. Executors must gather assets, settle debts, and distribute the remaining property according to the will or state law.

Choosing the right executor is vital, as this individual should possess organizational skills and a good understanding of legal obligations. In Texas, executors can also face challenges such as disputes among heirs or complicated asset valuations, making it essential for them to be well-prepared for their responsibilities.