When a loved one passes away without a will, the path forward for their property can feel incredibly confusing. We know you’re grieving, and the last thing you need is a complex legal battle. In Texas, one of the most practical tools for this situation is the affidavit of heirship. It’s a legal document designed to transfer property, especially real estate, to the rightful heirs without the time, cost, and stress of formal probate court.

Think of it as creating an official family history that the law can recognize, making a complicated process much simpler during a difficult time.

What an Affidavit of Heirship Means for Texas Families

Losing a family member is emotionally draining on its own. The last thing you want to deal with while grieving is a mountain of legal paperwork and court dates. The affidavit of heirship offers a more direct and compassionate alternative for many Texas families facing this exact scenario.

It’s essentially a way to tell the official story of your family to establish clear ownership of your loved one’s property. Instead of a judge making a formal ruling in a probate hearing, this document clearly lays out the deceased’s family life—marriages, children, and other relatives—to pinpoint who the legal heirs are under Texas law. This step-by-step guidance is meant to bring you clarity and reassurance.

The Core Purpose of the Affidavit

The main job of an affidavit of heirship in Texas is to create a clean and clear record of title for real property. When someone dies without a will (a term called dying “intestate”), their property doesn’t just automatically move to their family. A legal process is needed to document the ownership change.

Once filed in the county property records, this affidavit serves as solid evidence of that transfer. This is critically important for a few key reasons:

- Selling the Property: Title companies won’t insure a property sale without a clear chain of title. An affidavit of heirship provides that clarity, empowering heirs to sell the family home or land.

- Securing a Mortgage: If the heirs want to take out a loan against the property, lenders will demand proof of ownership. The affidavit delivers exactly that.

- Preventing Future Disputes: By formally and publicly documenting who the heirs are, the affidavit helps shut the door on future disagreements or claims against the property.

To give you a clearer picture, here’s a quick rundown of what an Affidavit of Heirship is all about.

Affidavit of Heirship at a Glance

| Concept | Plain-English Explanation |

|---|---|

| What it is | A sworn legal document that identifies the heirs of a deceased person who died without a will. |

| Primary Use | To transfer title of real property (like a house or land) from the deceased to their legal heirs. |

| Key Requirement | Must be signed by the heirs and two disinterested witnesses who knew the family but won’t inherit anything. |

| Main Benefit | Avoids the time and expense of a full probate court proceeding. |

| When it’s used | Primarily when the estate’s main asset is real estate and there is no will. |

This table shows just how this document simplifies an otherwise complicated legal situation, turning a potential court battle into a straightforward paperwork process.

How It Works in Plain English

The real beauty of this process is that it completely avoids the courtroom by relying on sworn statements. The affidavit must be signed by the heirs and—this is crucial—by two “disinterested witnesses.” These are people who knew the deceased and their family history but have absolutely no financial stake in the estate. They aren’t inheriting a dime.

Their job is to legally vouch for the accuracy of the family tree laid out in the document.

According to the Texas Estates Code, Title 2, Subtitle E, Chapter 203, a properly drafted and recorded Affidavit of Heirship becomes prima facie evidence of heirship after it has been on file for five years. In plain terms, this means the law presumes it to be correct unless someone comes forward with evidence to prove otherwise.

This legal standing gives title companies, county clerks, and potential buyers the confidence they need to recognize the heirs as the new, rightful owners. It empowers your family to manage your loved one’s assets with dignity and efficiency, helping you move forward during a difficult time. For countless Texas families navigating an estate without a will, it’s an invaluable first step.

When to Use a Texas Affidavit of Heirship

Deciding on the right legal path after a loved one’s death is a critical first step. An affidavit of heirship in Texas is a powerful and efficient tool, but it’s not a universal solution. It’s designed for very specific situations, and understanding when it fits can save your family a world of time, money, and emotional strain.

The absolute first requirement is that your loved one passed away without a will. In legal terms, this is known as dying intestate. When there’s no will to spell out who gets what, Texas law has a default plan for distributing property. The affidavit of heirship is essentially the formal document that puts this plan on paper, identifying the rightful heirs without forcing everyone through a full-blown court process.

But just because there’s no will doesn’t automatically mean an affidavit is the right move. Several other boxes need to be checked before this becomes a viable option for your family.

Core Requirements for Using the Affidavit

For an affidavit of heirship to actually work as intended, your family’s circumstances have to line up with the rules laid out in the Texas Estates Code, Chapter 203. Think of it as a checklist to see if this simplified path is open to you.

- No Valid Will Exists: This is the big one. The deceased must not have left a legally valid will. If a will turns up later, it will almost always trump the affidavit.

- All Heirs Must Agree: Everyone who is legally entitled to inherit must be on the same page about how the property should be divided. Even one dissenting voice can grind the process to a halt and push the estate into formal probate court.

- The Estate’s Main Asset is Real Property: The affidavit is purpose-built to transfer the title to real estate, like the family home or a piece of land. It’s far less effective for estates that are mostly cash, stocks, or other financial accounts.

- No Formal Administration is Needed: The estate shouldn’t need a court-appointed administrator to step in and manage things. This is usually the case when there aren’t significant debts to pay or complex assets to sort out.

If your situation ticks all these boxes, an affidavit of heirship can be a wonderfully streamlined and cost-effective way to handle things.

When an Affidavit Might Not Be the Best Choice

While it’s a fantastic tool in the right context, an affidavit of heirship is definitely not a one-size-fits-all fix. There are some clear red flags that signal it’s the wrong choice, and trying to force it could create even bigger headaches down the road.

For example, if the person who passed away had a lot of debt, those creditors have a right to be paid from the estate’s assets. An affidavit completely sidesteps the formal process of notifying and paying creditors, which is a cornerstone of the full Texas Probate Process. Trying to transfer a house with a pile of unpaid bills attached is just asking for legal challenges later on.

On top of that, financial institutions like banks and investment firms usually won’t accept an affidavit to release funds. They have their own strict protocols and typically demand official Letters Testamentary or Letters of Administration issued by a probate court. If the estate includes more than just a single piece of property, you’ll likely need to look at other probate methods. You can explore our guide for more details on transferring assets without probate.

The affidavit of heirship has become an essential tool in Texas, especially as property values have climbed and more people pass away without a will. Title companies and county clerks estimate that roughly 15-20% of real estate transactions involving an estate now rely on this document to clear up ownership. Given that statistics show about 60% of adults in Texas don’t have a will, it’s a scenario that plays out every single day.

Takeaway

An affidavit of heirship is a compassionate and efficient tool for transferring real estate in Texas when there is no will. However, it requires complete agreement from all heirs and is not suitable for estates with significant debts or complex financial assets. Its power lies in simplifying clear-cut situations, avoiding the time and expense of formal court proceedings.

Your Step-By-Step Guide to Filing the Affidavit

Navigating the legal steps after a loved one passes can feel overwhelming. But the good news is that filing an affidavit of heirship in Texas is much more straightforward than formal probate. We’ve broken down the entire process into simple, manageable steps to give you a clear roadmap.

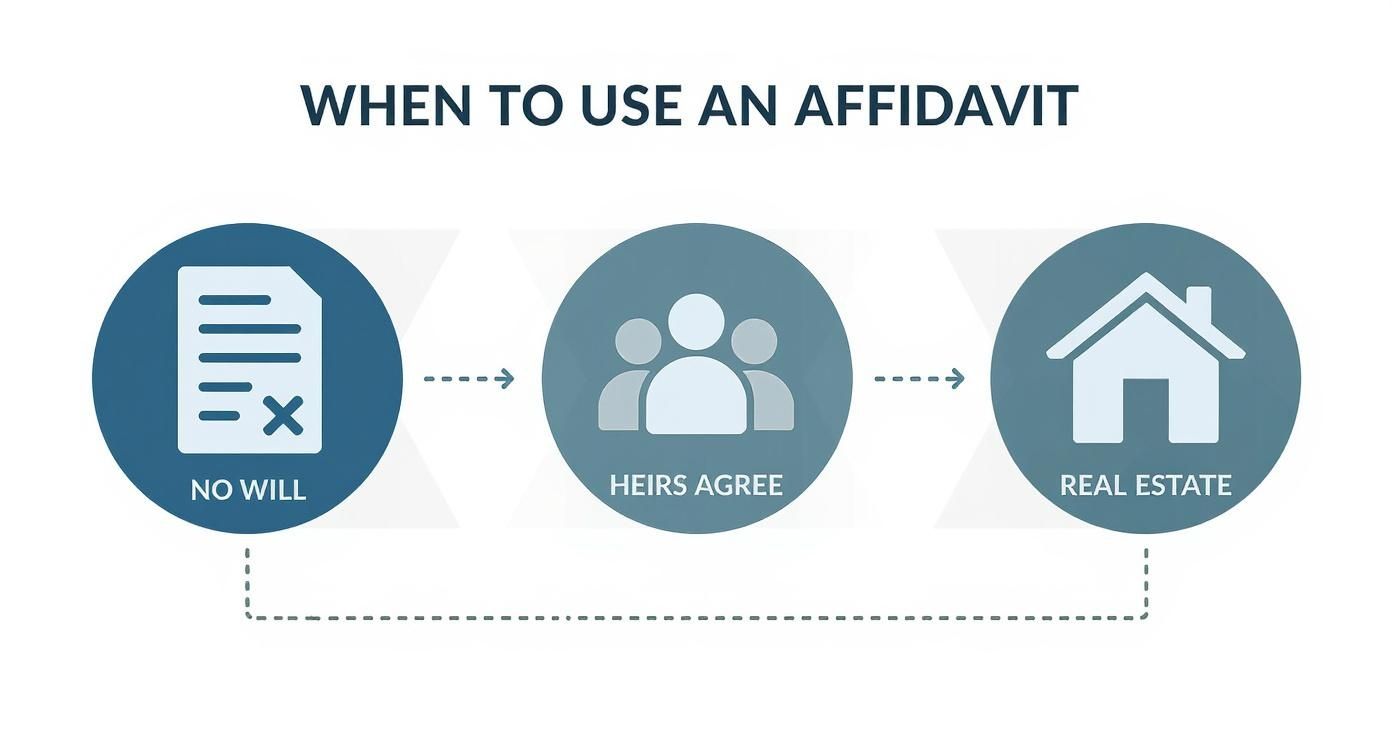

This visual guide shows you the ideal scenarios where an Affidavit of Heirship really shines.

As you can see, this path works best when there’s no will, all the heirs are on the same page, and the main asset you’re dealing with is real estate.

Step 1: Gather Essential Information and Documents

Before you even think about filling out a form, your first job is to play family historian. You’ll need to collect key details about the person who passed away (the “decedent”) and their entire family tree.

To do this right, you’ll need to gather a specific set of details about the decedent and their family history. The table below outlines exactly what you need to collect.

| Required Information for the Affidavit of Heirship | |

|---|---|

| Information Category | Specific Details Needed |

| Decedent’s Information | Full legal name, date and place of birth, date and place of death, and their address at the time of death. |

| Marital History | A complete list of all marriages, including the dates they began and ended (whether by death or divorce). |

| Family Details | A list of all children (born or adopted), their birthdates, and whether they are still living. You must also note any children who have passed away and list their own children (the decedent’s grandchildren). |

| Property Description | The full legal description of the real estate in question. You can find this on the property deed. |

Getting these details right from the start will save you a world of headaches later on.

Step 2: Identify and Secure Two Disinterested Witnesses

This next step is one of the most critical legal requirements under Texas law. You absolutely must find two disinterested witnesses.

What does that mean in plain English? These are people who knew the deceased and their family but will not inherit any property from the estate. They have no financial skin in the game.

Good candidates are often long-time family friends, neighbors, or colleagues who have personal knowledge of the decedent’s life. The witnesses must be willing to sign the affidavit under oath, confirming that the family history you’ve laid out is accurate. This requirement is what gives the document its legal weight and credibility.

Step 3: Draft the Affidavit of Heirship

Once you have all your information and your witnesses lined up, it’s time to draft the affidavit itself. The document needs to contain all the information you gathered in Step 1 and be structured to meet the strict requirements of the Texas Estates Code, Chapter 203.

For a detailed look at what the form requires, check out our guide on the affidavit of heirship Texas form.

Key Insight: The affidavit is not just a form; it’s a sworn statement of facts. Accuracy is everything. Any errors or forgotten details can lead to significant delays or even cause title companies to reject the document, forcing the estate into the very probate process you were trying to avoid.

The document will have specific sections for the heir(s) to sign and separate sections for the two disinterested witnesses. Every single signature must be notarized.

Step 4: Coordinate All Signatures and Notarization

Getting every signature can sometimes be a logistical puzzle, especially if heirs or witnesses live in different cities or even different states. Don’t worry, though.

Each heir and both witnesses must sign the affidavit in front of a notary public, but they don’t have to do it at the same time or in the same room. Each person can sign their part of the document with a local notary, and the separate signature pages can then be compiled into one final, complete document.

Step 5: File the Affidavit in the County Property Records

This is the final, official step that makes it all legal. You must file the completed and notarized affidavit with the county clerk’s office. Make sure you file it in the county where the real property is actually located.

Filing the document makes it part of the public property records. This creates an official chain of title that legally transfers ownership from the deceased to their heirs. It’s this crucial action that allows the heirs to finally sell, refinance, or otherwise manage the property as their own.

A Realistic Scenario Navigating the Process

Legal processes can feel abstract and cold, especially when you’re grieving. To bring things into focus, let’s walk through a realistic scenario with the Garcia family. Their story shows how an affidavit of heirship in Texas can help a family navigate the loss of a loved one with compassion and clarity.

The Garcia siblings—Maria, David, and Sarah—recently lost their father, Mr. Garcia, after a brief illness. He was a widower, and like so many people, he never got around to creating a will. His main asset was the beloved family home in Harris County, which he owned outright.

The siblings knew they needed to sort out the house’s title but were overwhelmed by the thought of a drawn-out probate court battle. After speaking with an attorney, they learned that since there was no will and the home was the only major asset, an affidavit of heirship was their best path forward.

Taking the First Steps Together

The first task for the Garcias was to gather all the necessary paperwork. Maria, who lived closest to their father, took the lead. She tracked down his death certificate, the original deed to the house, and the latest property tax records. While digging through old files, she also found her parents’ marriage certificate and her own birth certificate.

This initial step turned into a bittersweet family project. They shared memories while sifting through documents, piecing together a timeline of their father’s life—his marriage, the birth of each child, and other key milestones required for the affidavit.

One hurdle quickly became apparent: their younger sister, Sarah, lived all the way in Colorado. Getting everyone’s signature was going to require some coordination.

Finding the Right Witnesses

Texas law is very specific: the Garcias needed two disinterested witnesses to sign the affidavit. These couldn’t be family members or anyone who stood to inherit. They had to be people who knew Mr. Garcia for years and could swear to the family’s history.

David had the perfect candidates in mind:

- Mr. Henderson: A neighbor who had lived next door for over 30 years. He’d watched all the Garcia kids grow up.

- Mrs. Chen: A close friend from their father’s church who knew the family since before Sarah was even born.

Both were honored to help and readily agreed to attest to the family’s history. It was a perfect example of how a legal requirement can also be a moment of community support.

Facing the Logistical Hurdles

With their attorney’s guidance, drafting the affidavit was straightforward. The real challenge was logistics. How could they get everyone’s signature when they were spread across two states?

Maria, David, and the two witnesses signed their copies in front of a notary in Houston. But what about Sarah?

Key Insight: Heirs and witnesses don’t have to sign the affidavit in the same room or even on the same day. As long as each signature is individually notarized, the separate pages can be combined into a single, legally valid document.

Their attorney simply mailed the affidavit to Sarah in Colorado. She took it to a local notary in Denver, signed her portion, and mailed it right back to Houston. This simple, practical solution allowed the family to overcome the distance without adding any more stress to an already difficult time.

With all the notarized signatures collected, Maria filed the completed affidavit of heirship with the Harris County Clerk’s office. The document was officially recorded, becoming part of the public property record and establishing the three siblings as the new, undisputed owners of their father’s home. The Garcias successfully settled their father’s estate with clarity and cooperation, honoring his memory by working together.

Comparing Affidavits to Other Probate Options

When you’re dealing with the loss of a loved one, the legal jargon can feel overwhelming. The affidavit of heirship in Texas is one solution, but it’s just one tool in a much larger toolbox. Each probate option has its own purpose, costs, and timeline, and picking the right one depends entirely on your family’s unique situation.

Think of it this way: an affidavit is like a specialized wrench, perfect for the specific job of transferring real estate when there’s no will. But sometimes, you need a different tool to handle a more complicated repair. Let’s compare the affidavit of heirship to other common methods in Texas so you can see the full picture.

Affidavit of Heirship vs. Small Estate Affidavit

At first glance, these two sound almost identical. Both are designed to help families sidestep the time and expense of a full probate. But they serve very different primary purposes and operate under distinct rules in the Texas Estates Code, Chapter 205.

A Small Estate Affidavit (SEA) comes into play when the total value of the estate (not counting the homestead) is $75,000 or less. Where an Affidavit of Heirship is almost exclusively about real estate, an SEA is much broader and can be used to collect smaller assets, like bank accounts or a paid-off car.

- Affidavit of Heirship: Its main job is to transfer title to real property when there’s no will. It identifies the heirs but doesn’t handle debts or other types of assets.

- Small Estate Affidavit: This is for small estates (under $75,000) and covers all assets, not just real estate. A key difference is that it requires a judge’s approval, whereas an Affidavit of Heirship is simply filed in the property records.

For estates that might not qualify for an Affidavit of Heirship or need a simpler path for smaller assets, the law provides for the use of Texas Small Estate Affidavit forms.

Affidavit of Heirship vs. Muniment of Title

The biggest difference between these two processes boils down to one simple question: did the deceased leave a will? Creating Wills & Trusts is a foundational part of estate planning for this very reason.

A Muniment of Title is a streamlined probate process used only when there’s a valid will. Its sole purpose is to ask a court to legally recognize the will as the official document transferring title to the beneficiaries. Think of it as a shortcut for probating a will when there are no outstanding debts (other than a mortgage).

Key Insight: An Affidavit of Heirship is exclusively for situations with no will (intestacy). In contrast, a Muniment of Title is exclusively for situations with a will where no formal administration is needed. They are designed for opposite scenarios.

You can learn more about this specific process in our guide explaining what a Muniment of Title is. Choosing between them is straightforward—the existence of a will dictates which path you take.

Affidavit of Heirship vs. Formal Probate Administration

Formal probate administration is the most comprehensive—and often the most complex—option on the table. This is the traditional court-supervised process most people think of when they hear the word “probate.” A judge appoints an executor (if there’s a will) or an administrator (if there isn’t) to manage the entire estate from start to finish. A Guardianship may even be necessary if minor children are involved.

This process is necessary for more complicated situations, such as:

- Estates with significant debts that need to be paid off.

- Disagreements among heirs that require a judge’s ruling to resolve.

- Estates with diverse assets like stocks, bonds, and business interests.

- Situations where a will is being challenged, which often leads to Probate Litigation.

While an affidavit is just a declaration of family history filed in public records, a formal administration involves court hearings, strict deadlines, and judicial oversight every step of the way. It provides a level of finality and legal protection that an affidavit simply can’t offer, but it comes at a much higher cost in both time and money.

Common Questions About Affidavits of Heirship

When you’re sorting out an estate, it’s completely normal to have a lot of questions. You’re definitely not alone. Below, we’ve put together answers to some of the most common things Texas families ask about using an affidavit of heirship in Texas. Our goal is to give you simple, direct answers so you can move forward with confidence.

How Long Until the Affidavit Is Effective?

This is probably the most frequent question we get, and for good reason. An affidavit of heirship is legally effective the moment it’s properly signed, notarized, and filed with the county clerk where the property sits. Once it’s on the public record, it acts as proof of who the heirs are.

But here’s the inside track: its real power grows over time. Under the Texas Estates Code, Section 203.001, an affidavit that has been on file for five years or more without any legal challenges is considered prima facie evidence. That’s a fancy legal term meaning the facts in it are presumed to be true. This gives title companies and potential buyers maximum confidence in the transfer of ownership.

What If We Can’t Find Disinterested Witnesses?

Finding two disinterested witnesses—people who knew the deceased well but won’t inherit a single thing—is a non-negotiable legal requirement. If you’re hitting a wall, it’s time to think creatively about your loved one’s life and the people in it.

Who should you be thinking about?

- Long-time neighbors who watched the family come and go for years.

- Close family friends who were like family but aren’t named as heirs.

- Colleagues who worked alongside the deceased for a decade or more.

- Fellow members from a church, VFW post, or another community group.

The bottom line is that they need personal knowledge of the family’s history and absolutely no financial skin in the game.

Can an Affidavit of Heirship Be Contested?

Yes, it absolutely can be challenged. If an unknown heir suddenly appears or if a family member disputes the history laid out in the affidavit, they have the right to file a lawsuit to contest it.

For example, imagine a child from a previous marriage was accidentally left out. That child could file a legal challenge to the document. These situations almost always require a judge to step in, and they can get complicated fast. When an affidavit gets contested, the matter often turns into Probate Litigation, where the court will have the final say on who the rightful heirs are.

Does the Affidavit Settle the Deceased’s Debts?

This is a critical point to understand: an affidavit of heirship does nothing to handle or settle a deceased person’s debts. The document has one job and one job only: to transfer the title of real property from the deceased to their heirs. It’s all about creating a clear chain of ownership.

Creditors can still come after the estate’s assets, and that includes the property transferred by the affidavit. The property might have liens or other claims against it, and the heirs could find themselves responsible for dealing with those debts. This is a huge difference from a formal probate, which has a built-in process for notifying creditors and paying off debts before anything is distributed.

If you’re facing probate in Texas, our team can help guide you through every step — from filing to final distribution. Schedule your free consultation today.